- 349.00 KB

- 2022-04-22 11:45:56 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

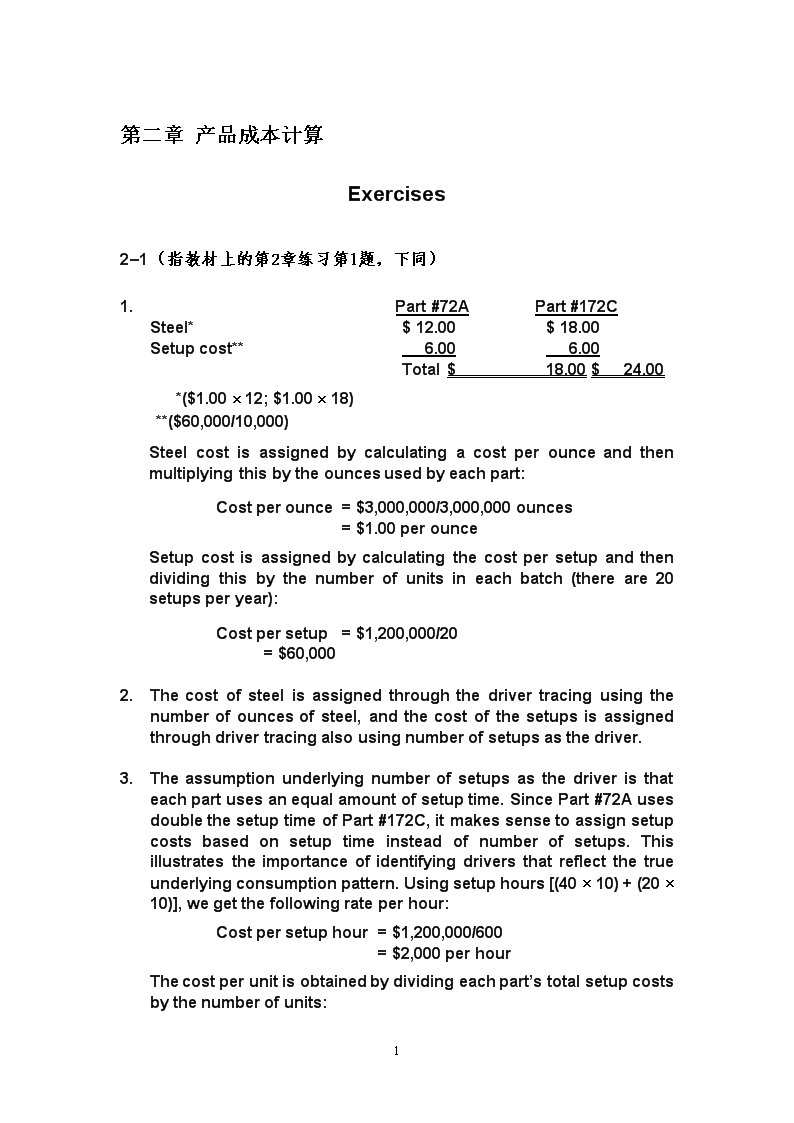

'第二章产品成本计算Exercises2–1(指教材上的第2章练习第1题,下同)1.Part#72APart#172CSteel*$12.00$18.00Setupcost**6.006.00Total$18.00$24.00*($1.00´12;$1.00´18)**($60,000/10,000)Steelcostisassignedbycalculatingacostperounceandthenmultiplyingthisbytheouncesusedbyeachpart:Costperounce=$3,000,000/3,000,000ounces=$1.00perounceSetupcostisassignedbycalculatingthecostpersetupandthendividingthisbythenumberofunitsineachbatch(thereare20setupsperyear):Costpersetup=$1,200,000/20=$60,0002.Thecostofsteelisassignedthroughthedrivertracingusingthenumberofouncesofsteel,andthecostofthesetupsisassignedthroughdrivertracingalsousingnumberofsetupsasthedriver.3.Theassumptionunderlyingnumberofsetupsasthedriveristhateachpartusesanequalamountofsetuptime.SincePart#72AusesdoublethesetuptimeofPart#172C,itmakessensetoassignsetupcostsbasedonsetuptimeinsteadofnumberofsetups.Thisillustratestheimportanceofidentifyingdriversthatreflectthetrueunderlyingconsumptionpattern.Usingsetuphours[(40´10)+(20´10)],wegetthefollowingrateperhour:Costpersetuphour=$1,200,000/600=$2,000perhourThecostperunitisobtainedbydividingeachpart’stotalsetupcostsbythenumberofunits:34

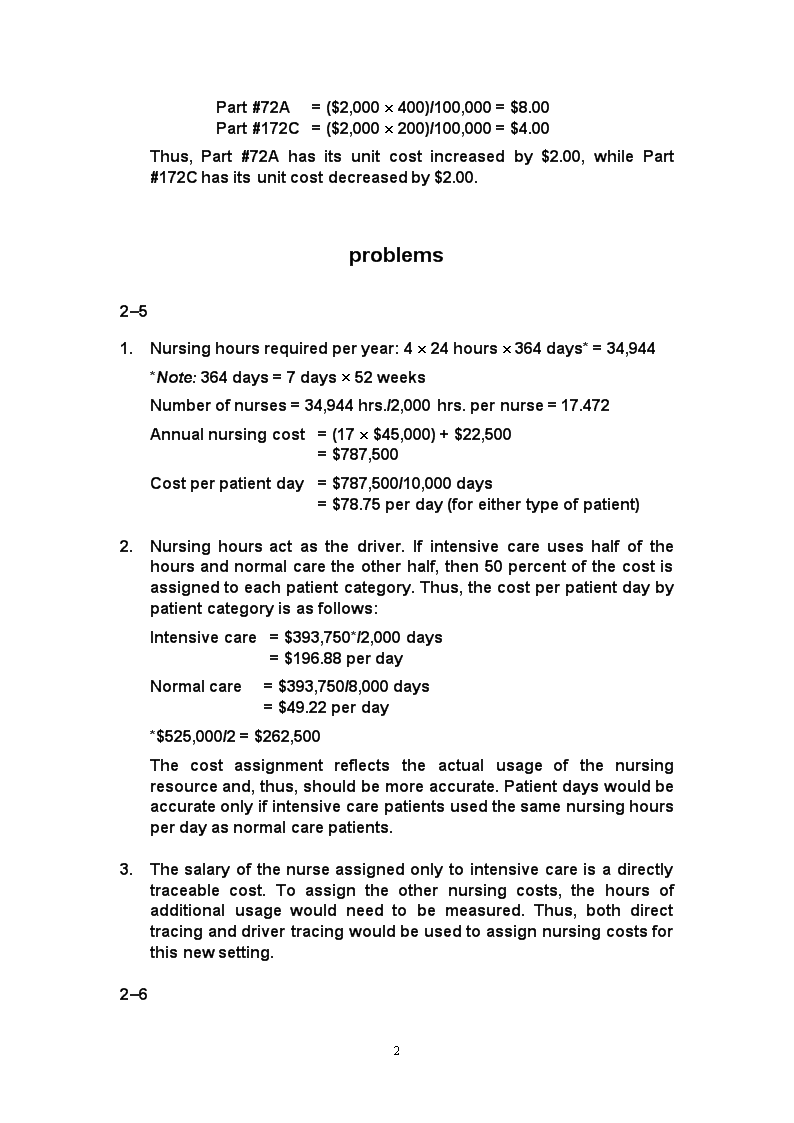

Part#72A=($2,000´400)/100,000=$8.00Part#172C=($2,000´200)/100,000=$4.00Thus,Part#72Ahasitsunitcostincreasedby$2.00,whilePart#172Chasitsunitcostdecreasedby$2.00.problems2–51.Nursinghoursrequiredperyear:4´24hours´364days*=34,944*Note:364days=7days´52weeksNumberofnurses=34,944hrs./2,000hrs.pernurse=17.472Annualnursingcost=(17´$45,000)+$22,500=$787,500Costperpatientday=$787,500/10,000days=$78.75perday(foreithertypeofpatient)2.Nursinghoursactasthedriver.Ifintensivecareuseshalfofthehoursandnormalcaretheotherhalf,then50percentofthecostisassignedtoeachpatientcategory.Thus,thecostperpatientdaybypatientcategoryisasfollows:Intensivecare=$393,750*/2,000days=$196.88perdayNormalcare=$393,750/8,000days=$49.22perday*$525,000/2=$262,500Thecostassignmentreflectstheactualusageofthenursingresourceand,thus,shouldbemoreaccurate.Patientdayswouldbeaccurateonlyifintensivecarepatientsusedthesamenursinghoursperdayasnormalcarepatients.3.Thesalaryofthenurseassignedonlytointensivecareisadirectlytraceablecost.Toassigntheothernursingcosts,thehoursofadditionalusagewouldneedtobemeasured.Thus,bothdirecttracinganddrivertracingwouldbeusedtoassignnursingcostsforthisnewsetting.2–634

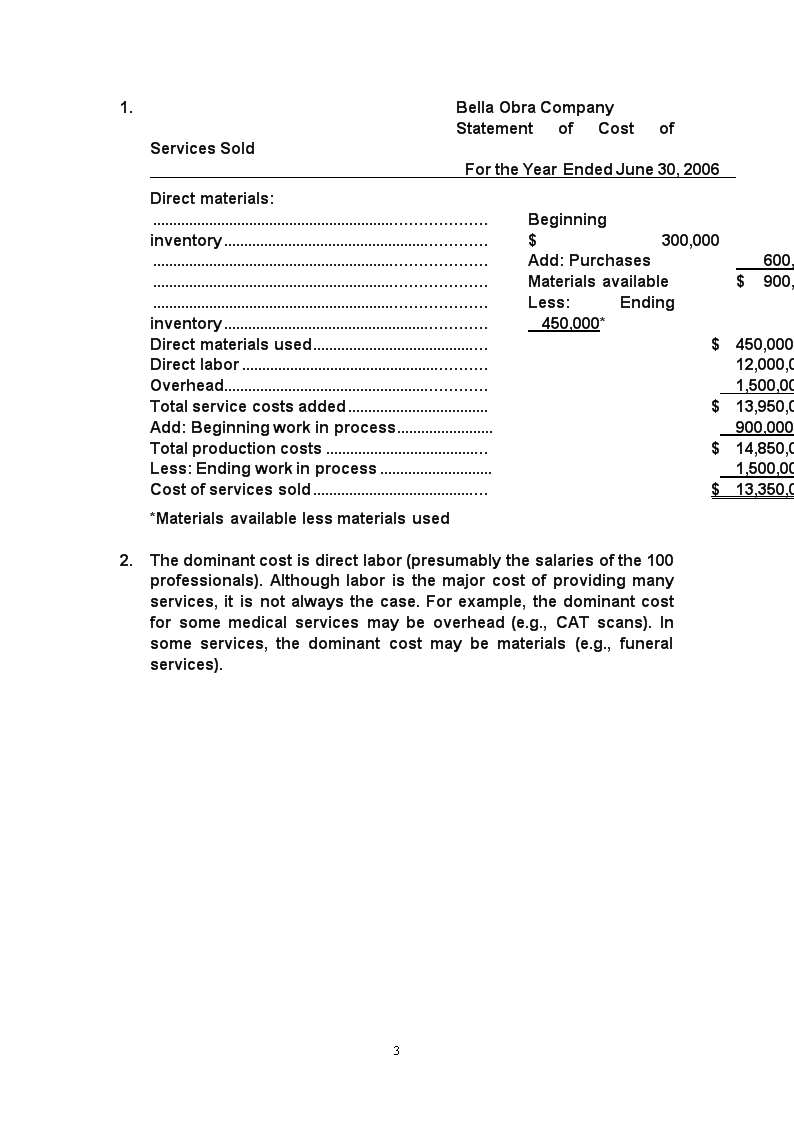

1.BellaObraCompanyStatementofCostofServicesSoldFortheYearEndedJune30,2006Directmaterials:Beginninginventory$300,000Add:Purchases600,000Materialsavailable$900,000Less:Endinginventory450,000*Directmaterialsused$450,000Directlabor12,000,000Overhead1,500,000Totalservicecostsadded$13,950,000Add:Beginningworkinprocess900,000Totalproductioncosts$14,850,000Less:Endingworkinprocess1,500,000Costofservicessold$13,350,000*Materialsavailablelessmaterialsused2.Thedominantcostisdirectlabor(presumablythesalariesofthe100professionals).Althoughlaboristhemajorcostofprovidingmanyservices,itisnotalwaysthecase.Forexample,thedominantcostforsomemedicalservicesmaybeoverhead(e.g.,CATscans).Insomeservices,thedominantcostmaybematerials(e.g.,funeralservices).34

3.BellaObraCompanyIncomeStatementFortheYearEndedJune30,2006Sales$21,000,000Costofservicessold13,350,000Grossmargin$7,650,000Lessoperatingexpenses:Sellingexpenses$900,000Administrativeexpenses750,0001,650,000Incomebeforeincometaxes$6,000,0004.Serviceshavefourattributesthatarenotpossessedbytangibleproducts:(1)intangibility,(2)perishability,(3)inseparability,and(4)heterogeneity.Intangibilitymeansthatthebuyersofservicescannotsee,feel,hear,ortasteaservicebeforeitisbought.Perishabilitymeansthatservicescannotbestored.ThispropertyaffectsthecomputationinRequirement1.Inabilitytostoreservicesmeansthattherewillneverbeanyfinishedgoodsinventories,thusmakingthecostofservicesproducedequivalenttocostofservicessold.Inseparabilitysimplymeansthatprovidersandbuyersofservicesmustbeindirectcontactforanexchangetotakeplace.Heterogeneityreferstothegreaterchanceforvariationintheperformanceofservicesthanintheproductionoftangibleproducts.2–71.Directmaterials:Magazine(5,000´$0.40)$2,000Brochure(10,000´$0.08)800$2,800Directlabor:Magazine[(5,000/20)´$10]$2,500Brochure[(10,000/100)´$10]1,0003,500Manufacturingoverhead:Rent$1,400Depreciation[($40,000/20,000)´350*]700Setups600Insurance140Power3503,190Costofgoodsmanufactured$9,49034

*Productionis20unitsperprintinghourformagazinesand100unitsperprintinghourforbrochures,yieldingmonthlymachinehoursof350[(5,000/20)+(10,000/100)].Thisisalsomonthlylaborhours,asmachinelaboronlyoperatesthepresses.2.Directmaterials$2,800Directlabor3,500Totalprimecosts$6,300Magazine:Directmaterials$2,000Directlabor2,500Totalprimecosts$4,500Brochure:Directmaterials$800Directlabor1,000Totalprimecosts$1,800Directtracingwasusedtoassignprimecoststothetwoproducts.3.Totalmonthlyconversioncost:Directlabor$3,500Overhead3,190Total$6,690Magazine:Directlabor$2,500Overhead:Power($1´250)$250Depreciation($2´250)500Setups(2/3´$600)400Rentandinsurance($4.40´250DLH)*1,1002,250Total$4,750Brochure:Directlabor$1,000Overhead:Power($1´100)$100Depreciation($2´100)200Setups(1/3´$600)200Rentandinsurance($4.40´100DLH)*440940Total$1,940*Rentandinsurancecannotbetracedtoeachproductsothecostsareassignedusingdirectlaborhours:$1,540/350DLH=$4.40perdirectlaborhour.Theotheroverheadcostsaretracedaccordingto34

theirusage.Depreciationandpowerareassignedbyusingmachinehours(250formagazinesand100forbrochures):$350/350=$1.00permachinehourforpowerand$40,000/20,000=$2.00permachinehourfordepreciation.Setupsareassignedaccordingtothetimerequired.Sincemagazinesusetwiceasmuchtime,theyreceivetwicethecost:LettingX=thepro portionofsetuptimeusedforbrochures,2X+X=1impliesacostassignmentratioof2/3formagazinesand1/3forbrochures.Exercises3–11.ResourceTotalCostUnitCostPlastic1$10,800$0.027Directlaborandvariableoverhead28,0000.020Moldsets320,0000.050Otherfacilitycosts410,0000.025Total$48,800$0.12210.90´$0.03´400,000=$10,800;$10,800/400,000=$0.0272$0.02´400,000=$8,000;$8,000/400,000=$0.023$5,000´4quarters=$20,000;$20,000/400,000=$0.054$10,000;$10,000/400,000=$0.0252.Plastic,directlabor,andvariableoverheadareflexibleresources;moldsandotherfacilitycostsarecommittedresources.Thecostofplastic,directlabor,andvariableoverheadarestrictlyvariable.Thecostofthemoldsisfixedfortheparticularactionfigurebeingproduced;itisastepcostfortheproductionofactionfiguresingeneral.Otherfacilitycostsarestrictlyfixed.3–3High(1,400,$7,950);Low(700,$5,150)V=($7,950–$5,150)/(1,400–700)34

=$2,800/700=$4peroilchangeF=$5,150–$4(700)=$5,150–$2,800=$2,350Cost=$2,350+$4(oilchanges)PredictedcostforJanuary=$2,350+$4(1,000)=$6,350problems3–61.High(1,700,$21,000);Low(700,$15,000)V=(Y2–Y1)/(X2–X1)=($21,000–$15,000)/(1,700–700)=$6perreceivingorderF=Y2–VX2=$21,000–($6)(1,700)=$10,800Y=$10,800+$6X2.Outputofspreadsheetregressionroutinewithnumberofreceivingordersastheindependentvariable:Constant4512.98701298698Std.Err.ofYEst.3456.24317476605RSquared0.633710482694768No.ofObservations10DegreesofFreedom8XCoefficient(s)13.3766233766234Std.Err.ofCoef.3.59557461331427V=$13.38perreceivingorder(rounded)F=$4,513(rounded)Y=$4,513+$13.38XR2=0.634,or63.4%Receivingordersexplainabout63.4percentofthevariabilityinreceivingcost,providingevidencethatTracy’schoiceofacostdriverisreasonable.However,otherdriversmayneedtobe34

consideredbecause63.4percentmaynotbestrongenoughtojustifytheuseofonlyreceivingorders.3.Regressionwithpoundsofmaterialastheindependentvariable:Constant5632.28109733183Std.Err.ofYEst.2390.10628259277RSquared0.824833789433823No.ofObservations10DegreesofFreedom8XCoefficient(s)0.0449642991356633Std.Err.ofCoef.0.0073259640055344V=$0.045perpoundofmaterialdelivered(rounded)F=$5,632(rounded)Y=$5,632+$0.045XR2=0.825,or82.5%Poundsofmaterialdeliveredexplainsabout82.5percentofthevariabilityinreceivingcost.ThisisabetterresultthanthatofthereceivingordersandshouldconvinceTracytotrymultipleregression.4.Regressionroutinewithpoundsofmaterialandnumberofreceivingordersastheindependentvariables:Constant752.104072925631Std.Err.ofYEst.1350.46286973443RSquared0.951068418023306No.ofObservations10DegreesofFreedom7XCoefficient(s)0.03338831510969157.14702865269395Std.Err.ofCoef.0.004955248411983681.68182916088492V1=$0.033perpoundofmaterialdelivered(rounded)34

V2=$7.147perreceivingorder(rounded)F=$752(rounded)Y=$752+$0.033a+$7.147bR2=0.95,or95%Multipleregressionwithbothvariablesexplains95percentofthevariabilityinreceivingcost.Thisisthebestresult.5–21.Job#57Job#58Job#59Balance,7/1$22,450$0$0Directmaterials12,9009,90035,350Directlabor20,0006,50013,000Appliedoverhead:Power7506003,600Materialhandling1,5003006,000Purchasing2501,000250Totalcost$57,850$18,300$58,2002.EndingbalanceinWorkinProcess=Job#58=$18,3003.EndingbalanceinFinishedGoods=Job#59=$58,2004.CostofGoodsSold=Job#57=$57,850problems5–31.Overheadrate=$180/$900=0.20or20%ofdirectlabordollars.(ThisratewascalculatedusinginformationfromtheLadanjob;however,theMyronandCoejobswouldgivethesameanswer.)2.LadanMyronCoeWalkerWillisBeginningWIP$1,730$1,180$2,500$0$0Directmaterials400150260800760Directlabor800900650350900Appliedoverhead16018013070180Total$3,090$2,410$3,540$1,220$1,840Note:Thisisjustonewayofsettingupthejob-ordercostsheets.Youmightprefertokeepthedetailonthematerials,labor,andoverheadinbeginninginventorycosts.34

3.SincetheLadanandMyronjobswerecompleted,theothersmuststillbeinprocess.Therefore,theendingbalanceinWorkinProcessisthesumofthecostsoftheCoe,Walker,andWillisjobs.Coe$3,540Walker1,220Willis1,840EndingWorkinProcess$6,600CostofGoodsSold=Ladanjob+Myronjob=$3,090+$2,410=$5,5004.NamanCompanyIncomeStatementFortheMonthEndedJune30,20XXSales(1.5´$5,500)$8,250Costofgoodssold5,500Grossmargin$2,750Marketingandadministrativeexpenses1,200Operatingincome$1,5505–201.Overheadrate=$470,000/50,000=$9.40perMHr2.DepartmentA:$250,000/40,000=$6.25perMHrDepartmentB:$220,000/10,000=$22.00perMHr3.Job#73Job#74Plantwide:70´$9.40=$65870´$9.40=$658Departmental:20´$6.25$125.0050´$6.25$312.5050´$221,100.0020´$22440.00$1,225.00$752.50DepartmentBappearstobemoreoverheadintensive,sojobsspendingmoretimeinDepartmentBoughttoreceivemoreoverhead.Thus,departmentalratesprovidemoreaccuracy.4.Plantwiderate:$250,000/40,000=$6.25DepartmentB:$62,500/10,000=$6.25Job#73Job#74Plantwide:70´$6.25=$437.5070´$6.25=$437.5034

Departmental:20´$6.25$125.0050´$6.25$312.5050´$6.25312.5020´$6.25125.00$437.50$437.50Assumingthatmachinehoursisagoodcostdriver,thedepartmentalratesrevealthatoverheadconsumptionisthesameineachdepartment.Inthiscase,thereisnoneedfordepartmentalrates,andaplantwiderateissufficient.5–41.Overheadrate=$470,000/50,000=$9.40perMHr2.DepartmentA:$250,000/40,000=$6.25perMHrDepartmentB:$220,000/10,000=$22.00perMHr3.Job#73Job#74Plantwide:70´$9.40=$65870´$9.40=$658Departmental:20´$6.25$125.0050´$6.25$312.5050´$221,100.0020´$22440.00$1,225.00$752.50DepartmentBappearstobemoreoverheadintensive,sojobsspendingmoretimeinDepartmentBoughttoreceivemoreoverhead.Thus,departmentalratesprovidemoreaccuracy.4.Plantwiderate:$250,000/40,000=$6.25DepartmentB:$62,500/10,000=$6.25Job#73Job#74Plantwide:70´$6.25=$437.5070´$6.25=$437.50Departmental:20´$6.25$125.0050´$6.25$312.5050´$6.25312.5020´$6.25125.00$437.50$437.50Assumingthatmachinehoursisagoodcostdriver,thedepartmentalratesrevealthatoverheadconsumptionisthesameineachdepartment.Inthiscase,thereisnoneedfordepartmentalrates,andaplantwiderateissufficient.34

5–51.Lastyear’sunit-basedoverheadrate=$50,000/10,000=$5Thisyear’sunit-basedoverheadrate=$100,000/10,000=$10LastYearThisYearBikecost:2´$20$40$403´$123636Overhead:5´$5255´$1050Total$101$126Pricelastyear=$101´1.40=$141.40/dayPricethisyear=$126´1.40=$176.40/dayThisisa$35increaseoverlastyear,nearlya25percentincrease.NodoubttheCarsonsarenotpleasedandwouldconsiderlookingaroundforotherrecreationalpossibilities.2.Purchasingrate=$30,000/10,000=$3perpurchaseorderPowerrate=$20,000/50,000=$0.40perkilowatthourMaintenancerate=$6,000/600=$10permaintenancehourOtherrate=$44,000/22,000=$2perDLHBikeRentalPicnicCateringPurchasing$3´7,000$21,000$3´3,000$9,000Power$0.40´5,0002,000$0.40´45,00018,000Maintenance$10´5005,000$10´1001,000Other$2´11,00022,00022,000Totaloverhead$50,000$50,0003.Thisyear’sbikerentaloverheadrate=$50,000/10,000=$5Carsonrentalcost=(2´$20)+(3´$12)+(5´$5)=$101Price=1.4´$101=$141.40/day4.Cateringrate=$50,000/11,000=$4.55*perDLHCostofEstesjob:34

Bikerentalrate(2´$7.50)$15.00Bikeconversioncost(2´$5.00)10.00Cateringmaterials12.00Cateringconversion(1´$4.55)4.55Totalcost$41.55*Rounded5.TheuseofABCgivesMountainViewRentalsabetterideaofthetypesandcostsofactivitiesthatareusedintheirbusiness.AddingLevel4bikeswillincreasetheuseofthemostexpensiveactivities,meaningthattherentalratewillnolongerbeanaverageof$5perrentalday.MountainViewRentalsmightneedtosetaLevel4pricebasedontheincreasedcostofboththebikeandconversioncost.分步成本法6–11.CuttingSewingPackagingDepartmentDepartmentDepartmentDirectmaterials$5,400$900$225Directlabor1501,800900Appliedoverhead7503,600900Transferred-incost:Fromcutting6,300Fromsewing12,600Totalmanufacturingcost$6,300$12,600$14,6252.a.WorkinProcess—Sewing6,300WorkinProcess—Cutting6,300b.WorkinProcess—Packaging12,600WorkinProcess—Sewing12,600c.FinishedGoods14,625WorkinProcess—Packaging14,6253.Unitcost=$14,625/600=$24.38*perpair6–21.Unitstransferredout:27,000+33,000–16,200=43,8002.Unitsstartedandcompleted:43,800–27,000=16,80034

3.Physicalflowschedule:Unitsinbeginningworkinprocess27,000Unitsstartedduringtheperiod33,000Totalunitstoaccountfor60,000Unitsstartedandcompleted16,800Unitscompletedfrombeginningworkinprocess27,000Unitsinendingworkinprocess16,200Totalunitsaccountedfor60,0004.Equivalentunitsofproduction:MaterialsConversionUnitscompleted43,80043,800Add:Unitsinendingworkinprocess:(16,200´100%)16,200(16,200´25%)4,050Equivalentunitsofoutput60,00047,8506–31.Physicalflowschedule:Unitstoaccountfor:Unitsinbeginningworkinprocess80,000Unitsstartedduringtheperiod160,000Totalunitstoaccountfor240,000Unitsaccountedfor:Unitscompletedandtransferredout:Startedandcompleted120,000Frombeginningworkinprocess80,000200,000Unitsinendingworkinprocess40,000Totalunitsaccountedfor240,0002.Unitscompleted200,000Add:UnitsinendingWIP´Fractioncomplete(40,000´20%)8,000Equivalentunitsofoutput208,0003.Unitcost=($374,400+$1,258,400)/208,000=$7.854.Costtransferredout=200,000´$7.85=$1,570,000CostofendingWIP=8,000´$7.85=$62,8005.Coststoaccountfor:Beginningworkinprocess$374,400IncurredduringJune1,258,400Totalcoststoaccountfor$1,632,800Costsaccountedfor:Goodstransferredout$1,570,00034

Goodsinendingworkinprocess62,800Totalcostsaccountedfor$1,632,8006–31、Unitst0accountfor:Unitsinbeginningworkinprocess(25%completed)10000Unitsstartedduringtheperiod70000Totalunitstoaccountfor80000UnitsaccountedforUnitscompletedandtransferredoutStartedandcompleted50000Frombeginningworkinprocess1000060000Unitsinendingworkinprocess(60%completed)20000Totalunitsaccountedfor800002、60000+20000×60%=72000(units)3、Unitcostformaterials:($/unit)Unitcostforconvension:($/unit)Totalunitcost:5+1.13=6.13($/unit)4、Thecostofunitsoftransferredout:60000×6.13=367800($)Thecostofunitsofendingworkinprocess:20000×5+20000×20%×1.13=113560($)34

作业成本法4–21.Predeterminedrates:DrillingDepartment:Rate=$600,000/280,000=$2.14*perMHrAssemblyDepartment:Rate=$392,000/200,000=$1.96perDLH*Rounded2.Appliedoverhead:DrillingDepartment:$2.14´288,000=$616,320AssemblyDepartment:$1.96´196,000=$384,160Overheadvariances:DrillingAssemblyTotalActualoverhead$602,000$412,000$1,014,000Appliedoverhead616,320384,1601,000,480Overheadvariance$(14,320)over$27,840under$13,5203.Unitoverheadcost=[($2.14´4,000)+($1.96´1,600)]/8,000=$11,696/8,000=$1.46**Rounded4–31.Yes.Sincedirectmaterialsanddirectlaboraredirectlytraceabletoeachproduct,theircostassignmentshouldbeaccurate.2.Elegant:(1.75´$9,000)/3,000=$5.25perbriefcaseFina:(1.75´$3,000)/3,000=$1.75perbriefcaseNote:Overheadrate=$21,000/$12,000=$1.75perdirectlabordollar(or175percentofdirectlaborcost).TherearemoremachineandsetupcostsassignedtoElegantthanFina.ThisisclearlyadistortionbecausetheproductionofFinaisautomatedandusesthemachineresourcesmuchmorethanthehandcraftedElegant.Infact,theconsumptionratioformachiningis0.10and0.90(usingmachinehoursasthemeasureofusage).Thus,FinausesninetimesthemachiningresourcesasElegant.Setupcostsaresimilarlydistorted.Theproductsuseanequalnumberofsetupshours.Yet,ifdirectlabordollarsareused,thentheElegantbriefcasereceivesthreetimesmoremachiningcoststhantheFinabriefcase.34

3.Overheadrate=$21,000/5,000=$4.20perMHrElegant:($4.20´500)/3,000=$0.70perbriefcaseFina:($4.20´4,500)/3,000=$6.30perbriefcaseThiscostassignmentappearsmorereasonablegiventherelativedemandseachproductplacesonmachineresources.However,onceafirmmovestoamultiproductsetting,usingonlyoneactivitydrivertoassigncostswilllikelyproduceproductcostdistortions.Productstendtomakedifferentdemandsonoverheadactivities,andthisshouldbereflectedinoverheadcostassignments.Usually,thismeanstheuseofbothunit-andnonunit-levelactivitydrivers.Inthisexample,thereisaunit-levelactivity(machining)andanonunit-levelactivity(settingupequipment).Theconsumptionratiosforeach(usingmachinehoursandsetuphoursastheactivitydrivers)areasfollows:ElegantFinaMachining0.100.90(500/5,000and4,500/5,000)Setups0.500.50(100/200and100/200)Setupcostsarenotassignedaccurately.Twoactivityratesareneeded—onebasedonmachinehoursandtheotheronsetuphours:Machinerate:$18,000/5,000=$3.60perMHrSetuprate:$3,000/200=$15persetuphourCostsassignedtoeachproduct:Machining:ElegantFina$3.60´500$1,800$3.60´4,500$16,200Setups:$15´1001,5001,500Total$3,300$17,700Units÷3,000÷3,000Unitoverheadcost$1.10$5.904:ElegantUnitoverheadcost:[9000+3000+18000*500/5000+3000/2]/3000=$5.1FinaUnitoverheadcost:[3000+3000+18000*4500/5000+3000/2]/3000=$7.94–51.DeluxePercentRegularPercentPrice$900100%$750100%Cost576646008034

Unitgrossprofit$32436%$15020%Totalgrossprofit:($324´100,000)$32,400,000($150´800,000)$120,000,0002.Calculationofunitoverheadcosts:DeluxegularUnit-level:Machining:$200´100,000$20,000,000$200´300,000$60,000,000Batch-level:Setups:$3,000´300900,000$3,000´200600,000Packing:$20´100,0002,000,000$20´400,0008,000,000Product-level:Engineering:$40´50,0002,000,000$40´100,0004,000,000Facility-level:Providingspace:$1´200,000200,000$1´800,000800,000Totaloverhead$25,100,000$73,400,000Units÷100,000÷800,000Overheadperunit$251$91.75DeluxePercentRegularPercentPrice$900100%$750.00100%Cost780*87***574.50**77***Unitgrossprofit$12013%***$175.5023%***Totalgrossprofit:($120´100,000)$12,000,000($175.50´800,000)$140,400,000*$529+$251**$482.75+$91.753.Usingactivity-basedcosting,amuchdifferentpictureofthedeluxeandregularproductsemerges.Theregularmodelappearstobemoreprofitable.Perhapsitshouldbeemphasized.34

4–61.JITNon-JITSalesa$12,500,000$12,500,000Allocationb750,000750,000a$125´100,000,where$125=$100+($100´0.25),and100,000istheaverageordersizetimesthenumberofordersb0.50´$1,500,0002.Activityrates:Orderingrate=$880,000/220=$4,000persalesorderSellingrate=$320,000/40=$8,000persalescallServicerate=$300,000/150=$2,000perservicecallJITNon-JITOrderingcosts:$4,000´200$800,000$4,000´20$80,000Sellingcosts:$8,000´20160,000$8,000´20160,000Servicecosts:$2,000´100200,000$2,000´50100,000Total$1,160,000$340,00Forthenon-JITcustomers,thecustomercostsamountto$750,000/20=$37,500perorderundertheoriginalallocation.Usingactivityassign ments,thisdropsto$340,000/20=$17,000perorder,adifferenceof$20,500perorder.Foranorderof5,000units,theorderpricecanbedecreasedby$4.10perunitwithoutaffectingcustomerprofitability.Overallprofitabilitywilldecrease,however,unlessthepriceforordersisincreasedtoJITcustomers.3.ItsoundsliketheJITbuyersareswitchingtheirinventorycarryingcoststoEmerywithoutanysignificantbenefittoEmery.Emeryneedstoincreasepricestoreflecttheadditionaldemandsoncustomer-supportactivities.Furthermore,additionalpriceincreasesmaybeneededtoreflecttheincreasednumberofsetups,purchases,andsoon,thatarelikelyoccurringinsidetheplant.EmeryshouldalsoimmediatelyinitiatediscussionswithitsJITcustomerstobeginnegotiationsforachievingsomeofthebenefitsthataJITsuppliershouldhave,suchaslong-termcontracts.Thebenefitsoflong-term34

contractingmayoffsetmostoralloftheincreasedcostsfromtheadditionaldemandsmadeonotheractivities.4–71.Suppliercost:First,calculatetheactivityratesforassigningcoststosuppliers:Inspectingcomponents:$240,000/2,000=$120persamplinghourReworkingproducts:$760,500/1,500=$507perreworkhourWarrantywork:$4,800/8,000=$600perwarrantyhourNext,calculatethecostpercomponentbysupplier:Suppliercost:VanceFoyPurchasecost:$23.50´400,000$9,400,000$21.50´1,600,000$34,400,000Inspectingcomponents:$120´404,800$120´1,960235,200Reworkingproducts:$507´9045,630$507´1,410714,870Warrantywork:$600´400240,000$600´7,6004,560,000Totalsuppliercost$9,690,430$39,910,070Unitssupplied÷400,000÷1,600,000Unitcost$24.23*$24.94**RoundedThedifferenceisinfavorofVance;however,whenthepriceconcessionisconsidered,thecostofVanceis$23.23,whichislessthanFoy’scomponent.LumusshouldacceptthecontractualoffermadebyVance.4–7Concluded2.Warrantyhourswouldactasthebestdriverofthethreechoices.Usingthisdriver,therateis$1,000,000/8,000=$125perwarrantyhour.Thecostassignedtoeachcomponentwouldbe:VanceFoyLostsales:34

$125´400$50,000$125´7,600$950,000$50,000$950,000Unitssupplied÷400,000÷1,600,000Increaseinunitcost$0.13*$0.59**Rounded$0.075perunitCategoryII:$45/1,000=$0.045perunitCategoryIII:$45/1,500=$0.03perunitCategoryI,whichhasthesmallestbatches,isthemostundercostedofthethreecategories.Furthermore,theunitorderingcostisquitehighrelativetoCategoryI’ssellingprice(9to15percentofthesellingprice).Thissuggeststhatsomethingshouldbedonetoreducetheorder-fillingcosts.3.Withthepricingincentivefeature,theaverageordersizehasbeenincreasedto2,000unitsforallthreeproductfamilies.Thenumberofordersnowprocessedcanbecalculatedasfollows:Orders=[(600´50,000)+(1,000´30,000)+(1,500´20,000)]/2,000=45,000Reductioninorders=100,000–45,000=55,000Stepsthatcanbereduced=55,000/2,000=27(roundingdowntonearestwholenumber)Therewereinitially50steps:100,000/2,000Reductioninresourcespending:Step-fixedcosts:$50,000´27=$1,350,000Variableactivitycosts:$20´55,000=1,100,000$2,450,000预算9-4Norton,Inc.SalesBudgetFortheComingYearModelUnitsPriceTotalSalesLB-150,400$29.00$1,461,600LB-219,80015.00297,000WE-625,20010.40262,080WE-717,82010.00178,20034

WE-89,60022.00211,200WE-94,00026.00104,000Total$2,514,080二、1.Raylene’sFlowersandGiftsProductionBudgetforGiftBasketsForSeptember,October,November,andDecemberSept.Oct.Nov.Dec.Sales200150180250Desiredendinginventory15182510Totalneeds215168205260Less:Beginninginventory20151825Unitsproduced1951531872352.Raylene’sFlowersandGiftsDirectMaterialsPurchasesBudgetForSeptember,October,andNovemberFruit:Sept.Oct.Nov.Production195153187´Amount/basket(lbs.)´1´1´1Neededforproduction195153187Desiredendinginventory8912Needed203162200Less:Beginninginventory1089Purchases193154190Smallgifts:Sept.Oct.Nov.Production195153187´Amount/basket(items)´5´5´5Neededforproduction975765935Desiredendinginventory383468588Needed1,3581,2331,523Less:Beginninginventory488383468Purchases8708501,055Cellophane:Sept.Oct.Nov.Production195153187´Amount/basket(feet)´3´3´3Neededforproduction585459561Desiredendinginventory230281353Needed81574091434

Less:Beginninginventory293230281Purchases522510633Basket:Sept.Oct.Nov.Production195153187´Amount/basket(item)´1´1´1Neededforproduction195153187Desiredendinginventory7794118Needed272247305Less:Beginninginventory987794Purchases1741702113.AdirectmaterialspurchasesbudgetforDecemberrequiresJanuaryproductionwhichcannotbecomputedwithoutaFebruarysalesforecast.8–31.CashBudgetFortheMonthofJune20XXBeginningcashbalance$1,345Collections:Cashsales20,000Creditsales:Currentmonth($90,000´50%)45,000Maycreditsales($85,000´30%)25,500Aprilcreditsales*8,060Totalcashavailable$99,905Lessdisbursements:Inventorypurchases:Currentmonth($110,000´80%´40%)$35,200Priormonth($100,000´80%´60%)48,000Salariesandwages10,300Rent2,200Taxes5,500Totalcashneeds101,200Excessofcashavailableoverneeds$(1,295)*PaymentsforAprilcreditsales=$50,000´16%=$8,000Latefeesremitted=($8,000/2)´0.015=$60TotalPaymentsforAprilcreditsalesandlatefees=$8,000+$60=$8,0602.Yes,thebusinessdoesshowanegativecashbalanceforthemonthofJune.Withoutthepossibilityofshort-termloans,theownershouldconsidertakinglesscashsalary.34

本量利分析第一题1.Units=Fixedcost/Contributionmargin=$10,350/($15–$12)=3,4502.Sales(3,450´$15)$51,750Variablecosts(3,450´$12)41,400Contributionmargin$10,350Fixedcosts10,350Operatingincome$03.Units=(Targetincome+Fixedcost)/Contributionmargin=($9,900+$10,350)/($15–$12)=$20,250/$3=6,75016–21.VariableUnitsinPackageProductPrice*–Cost=CM´Mix=CMScientific$25$12$131$13Business20911555Total$68*$500,000/20,000=$25$2,000,000/100,000=$20X=($1,080,000+$145,000)/$68X=$1,225,000/$68X=18,015packages18,015scientificcalculators(1´18,015)90,075businesscalculators(5´18,015)2.Revenue=$1,225,000/0.544*=$2,251,838*($1,360,000/$2,500,000)=0.54416–41.d2.c3.a4.d5.e6.b7.c34

16–51.Salesmix:Squares:$300,000/$30=10,000unitsCircles:$2,500,000/$50=50,000unitsSalesTotalProductP–V*=P–V´Mix=CMSquares$30$10$201$20Circles5010405200Package$220*$100,000/10,000=$10$500,000/50,000=$10Break-evenpackages=$1,628,000/$220=7,400packagesBreak-evensquares=7,400´1=7,400Break-evencircles=7,400´5=37,0002.Contributionmarginratio=$2,200,000/$2,800,000=0.78570.10Revenue=0.7857Revenue–$1,628,0000.6857Revenue=$1,628,000Revenue=$2,374,2163.Newmix:SalesTotalProductP–V=P–V´Mix=CMSquares$30$10$203$60Circles5010405200Package$260Break-evenpackages=$1,628,000/$260=6,262packagesBreak-evensquares=6,262´3=18,786Break-evencircles=6,262´5=31,310CMratio=$260/$340*=0.7647*(3)($30)+(5)($50)=$340revenueperpackage0.10Revenue=0.7647Revenue–$1,628,0000.6647Revenue=$1,628,000Revenue=$2,449,22516–71.Currently:Sales(830,000´$0.36)$298,80034

Variableexpenses224,100Contributionmargin$74,700Fixedexpenses54,000Operatingincome$20,700Newcontributionmargin=1.5´$74,700=$112,050$112,050–promotionalspending–$54,000=1.5´$20,700Promotionalspending=$27,0002.Herearetwowaystocalculatetheanswertothisquestion:a.Theper-unitcontributionmarginneedstobethesame:LetP*representthenewpriceandV*thenewvariablecost.(P–V)=(P*–V*)$0.36–$0.27=P*–$0.30$0.09=P*–$0.30P*=$0.39b.Oldbreak-evenpoint=$54,000/($0.36–$0.27)=600,000Newbreak-evenpoint=$54,000/(P*–$0.30)=600,000P*=$0.39Thesellingpriceshouldbeincreasedby$0.03.3.Projectedcontributionmargin(700,000´$0.13)$91,000Presentcontributionmargin74,700Increaseinoperatingincome$16,300Thedecisionwasgoodbecauseoperatingincomeincreasedby$16,300.(Newquantity´$0.13)–$54,000=$20,700Newquantity=574,615Selling574,615unitsatthenewpricewillmaintainprofitat$20,700.16–61.Break-evenunits=$300,000/$14*=21,429*$406,000/29,000=$14Break-evenindollars=21,429´$42**=$900,018or=$300,000/(1/3)=$900,000Thedifferenceisduetoroundingerror.**$1,218,000/29,000=$422.Marginofsafety=$1,218,000–$900,000=$318,00034

3.Sales$1,218,000Variablecosts(0.45´$1,218,000)548,100Contributionmargin$669,900Fixedcosts550,000Operatingincome$119,900Break-eveninunits=$550,000/$23.10*=23,810Break-eveninsalesdollars=$550,000/0.55**=$1,000,000*$669,900/29,000=$23.10**$669,900/$1,218,000=55%标准成本制度二、1.SH=0.8´95,000=76,000hours2.SQ=5´95,000=475,000components三、1.Materials:$60´20,000=$1,200,000Labor:$21´20,000=$420,0002.ActualCost*BudgetedCostVarianceMaterials$1,215,120$1,200,000$15,120ULabor390,000420,00030,000F*$122,000´$9.96;31,200´$12.503.MPV=(AP–SP)AQ=($9.96–$10)122,000=$4,880FMUV=(AQ–SQ)SP=(122,000–120,000)$10=$20,000UAP´AQSP´AQSP´SQ$9.96´122,000$10´122,000$10´120,000$4,880F$20,000UPriceUsage4.LRV=(AR–SR)AH=($12.50–$14)31,200=$46,800FLEV=(AH–SH)SR=(31,200–30,000)$14=$16,800UAR´AHSR´AHSR´SH$12.50´31,200$14´31,200$14´30,000$46,800F$16,800U34

RateEfficiency9–41.Fixedoverheadrate=$0.55/(1/2hr.perunit)=$1.10perDLHSH=1,180,000´1/2=590,000AppliedFOH=$1.10´590,000=$649,0002.Fixedoverheadanalysis:ActualFOHBudgetedFOHAppliedFOH$630,000$1.10´600,000$1.10´590,000$30,000F$11,000USpendingVolume(600,000expectedhours=1/2hour´1,200,000units)3.VariableOHrate=($1,350,000–$660,000)/600,000=$1.15perDLH4.Variableoverheadanalysis:ActualVOHBudgetedVOHAppliedVOH$705,000$1.15´595,000$1.15´590,000$20,750U$5,750USpendingEfficiency9–51.Casesneedinginvestigation:Week2:Exceedsthe10%rule.Week4:Exceedsthe$8,000ruleandthe10%rule.Week5:Exceedsthe10%rule.2.Thepurchasingagent.Correctiveactionwouldrequireareturntothepurchaseofthehigher-qualitymaterialnormallyused.六、Materials:AP´AQSP´AQSP´SQ$42,000$0.90´53,000$0.90´50,000$5,700F$2,700UPriceUsageLabor:AR´AHSR´AHSR´SH$102,000$7´14,900$7´15,00034

$2,300F$700FRateEfficiency变动成本法一.1.TotalCostPerUnitDirectmaterials$97,500$6.50Directlabor76,5005.10Variableoverhead17,4001.16Fixedoverhead51,0003.40Total$242,400$16.16Costofendinginventory=$16.76´300=$4,8482.TotalCostPerUnitDirectmaterials$97,500$6.50Directlabor76,5005.10Variableoverhead17,4001.16Total$191,400$12.76Costofendinginventory=$12.76´300=$3,8283.Sinceabsorptioncostingisrequiredforexternalreporting,theamountreportedwouldbe$4,848.15-31.FaiselCompanyVariable-CostingSegmentedIncomeStatement(inthousands)NortheastSouthTotalSales$15,000$12,000$27,000LessvariableCOGS*6,0208,38014,400Contributionmargin$8,980$3,620$12,600Lessdirectfixedexpenses:Fixedoverhead*(1,080)(720)(1,800)Sellingandadministrative**(1,000)(1,500)(2,500)Segmentmargin$6,900$1,400$8,300Lesscommonfixedexpenses:Fixedoverhead(1,800)Sellingandadministrative(2,000)Netincome$4,500*Fixedcosts=20%ofcostofgoodssold=$3,600DirectFOHcosts=50%of$3,600=$1,800CommonFOHcosts=50%of$3,600=$1,800Northeastdirectfixedcosts=0.30´$3,600=$1,08034

Southdirectfixedcosts=0.20´$3,600=$720Totalallocatedfixedcostsunderabsorptioncosting:Northeast=$1,080+0.5($1,800)=$1,980South=$720+0.5($1,800)=$1,620Variablecostofgoodssold:Northeast=$8,000–$1,980=$6,020South=$10,000–$1,620=$8,380**Commonsellingandadministrativeexpenses=$2,000Directsellingandadministrativeexpenses=$4,500–$2,000=$2,500Northeast=0.40´$2,500=$1,000South=0.60´$2,500=$1,500ThecompanyshouldnoteliminatetheSouthregion.Thesegmentmarginispositive.2.NortheastSouthContributionmargin59.9%*30.2%*Segmentmargin46.011.7*RoundedFaiselCompanyVariable-CostingSegmentedIncomeStatementNortheastSouthTotalSales$16,500$13,200$29,700Lessvariableexpenses:Costofgoodssold6,6229,21815,840Contributionmargin$9,878$3,982$13,860Lessdirectfixedexpenses:Fixedoverhead(1,080)(720)(1,800)Sellingandadministrative(1,000)(1,500)(2,500)Segmentmargin$7,798$1,762$9,560Lesscommonfixedexpenses:Fixedoverhead(1,800)Sellingandadministrative(2,000)Netincome$5,760NortheastSouthContributionmargin59.9%*30.2%*Segmentmargin47.3*13.3*Thecontributionmarginratioremainedconstantasapercentageofsales,butthesegmentmarginincreased.Bydefinition,wewouldexpectvariablecoststoincreaseinproportiontoincreasesinsales,thusleavingthecontributionmarginratiounchanged.However,we34

wouldexpectthesegmentmargintoincreaseasapercentageassalesincrease,simplybecausedirectfixedcostsdonotchangeasvolumechangeswithintherelevantrange.*Rounded四.1.d2.c3.c4.a5.e6.b15–61.AddProductC:ProductAProductBProductCTotalSales$250,000$375,000$100,000$725,000Lessvariableexpenses:Costofgoodssold(100,000)(250,000)(54,000)(404,000)Sellingandadmin.(20,000)(65,000)(12,000)(97,000)Contributionmargin$130,000$60,000$34,000$224,000Less:Directfixedexp.10,00055,00015,00080,000Productmargin$120,000$5,000$19,000$144,000Less:Commonfixedexp.75,000Netincome$69,000AddProductD:ProductAProductBProductDTotalSales$250,000$375,000$125,000$750,000Lessvariableexpenses:Costofgoodssold(100,000)(250,000)(81,250)(431,250)Sellingandadmin.(20,000)(65,000)(6,250)(91,250)Contributionmargin$130,000$60,000$37,500$227,500Less:Directfixedexp.10,00055,00011,25076,250Productmargin$120,000$5,000$26,250$151,250Less:Commonfixedexp.75,000Netincome$76,25034

TherecommendationwouldbetoaddProductD,sinceityieldsthegreatestincreaseinnetincome.2.ProductBshouldbedroppedtoaddProductsCandDbecauseBhasaproductmarginofonly$5,000andCandDhaveproductmarginsof$19,000and$26,250,respectively.15–71.PaperNapkinDiaperandTowelTotalSalesa$550,000$787,500$1,337,500Less:Variableexpensesb327,250483,000810,250Contributionmargin$222,750$304,500$527,250Less:Directfixedexpensesc215,000110,000325,000Segmentmargin$7,750$194,500$202,250Less:Commonfixedexpenses130,000Netincome$72,250aDiapersales:$500,000´1.10;Napkinsales:$750,000´1.05bDiaperDivision:$425,000/$500,000=85%.Underproposal,variablecostsarereducedby30%,or0.7´0.85=59.5%.cDiaperDivision:$85,000+$25,000+$105,000Theproposals,ifsound,willincreasethesegmentmarginoftheDiaperDivisionby$17,750andshouldbeimplemented.2.Fran’sproposalswithoutincreasedsales:PaperNapkinDiaperandTowelTotalSales$500,000$750,000$1,250,000Less:Variableexpenses297,500460,000757,500Contributionmargin$202,500$290,000$492,500Less:Directfixedexpenses215,000110,000325,000Segmentmargin$(12,500)$180,000$167,500Less:Commonfixedexpenses130,000Netincome$37,500Iftheincreaseinrevenuesdoesnottakeplace,theDiaperDivisionandcompanywouldloseanextra$2,500.Fran’sproposalswithoutincreasedsalesbutwitha40percentdecreaseinvariablecostsyieldconsiderablybetterresults.PaperNapkin34

DiaperandTowelTotalSales$500,000$750,000$1,250,000Less:Variableexpenses*255,000460,000715,000Contributionmargin$245,000$290,000$535,000Less:Directfixedexpenses215,000110,000325,000Segmentmargin$30,000$180,000$210,000Less:Commonfixedexpenses130,000Netincome$80,000*FortheDiaperDivision,variableexpensesarereducedby40percentandthereforerepresent51percentofsales(0.6´0.85).短期生产经营决策17-21.ThetwoalternativesaretomakethecomponentinhouseortobuyitfromCouples.2.AlternativesDifferentialMakeBuyCosttoMakeDirectmaterials$5.00—$5.00Directlabor2.38—2.38Variableoverhead1.90—1.90Purchasecost—$11.00(11.00)Totalrelevantcost$9.28$11.00$(1.72)Pierreshouldmakethecomponentinhousebecauseitwillsave$9,116($1.72´5,300)overpurchasingitfromCouples.17–31.Sales$293,000Costs264,000Operatingprofit$29,0002.SellProcessFurtherDifferenceRevenues$40,000$73,700$33,700Furtherprocessingcost023,90023,90034

Operatingincome$40,000$49,800$9,800ThecompanyshouldprocessDeltafurther,becauseoperatingprofitwouldincreaseby$9,800ifitwereprocessedfurther.(Note:Jointcostsareirrelevanttothisdecision,becausethecompanywillincurthemwhetherornotDeltaisprocessedfurther.)17–61.COGS+Markup(COGS)=Sales$144,300+Markup($144,300)=$206,349Markup($144,300)=$206,349–$144,300Markup=$62,049/$144,300Markup=0.43,or43%2.Directmaterials$800Directlabor1,600Overhead3,200Totalcost$5,600Add:Markup2,408Initialbid$8,00834'

您可能关注的文档

- 第四章习题与答案.doc

- 第四轮公修课《突发事件》练习题答案.doc

- 答案《审计学》习题.doc

- 简-201310补充财务管理复习题及答案.doc

- 管理会计(第二版)课后习题答案.docx

- 管理会计习题及答案.doc

- 管理会计习题集及答案(修改后).doc

- 管理会计总复习习题及答案解析.pdf

- 管理会计综合习题及答案.doc

- 管理信息系统单元练习及参考答案.pdf

- 管理学(第2版)习题答案(1-11章全).doc

- 管理学-习题及答案.docx

- 管理学原理 第2版课后习题答案.doc

- 管理学原理与方法课后习题答案(第五版)(周三多编写,复旦出版社).doc

- 管理学原理答案(臧有良、暴丽艳主编).doc

- 学周三多_著_高等教育出版社_课后答案.PDF.doc

- 管理学复习题及答案汇总(刑以群版教材).doc

- 管理学复习题及答案汇总(邢以群版教材).doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明