- 178.45 KB

- 2022-04-22 11:19:59 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

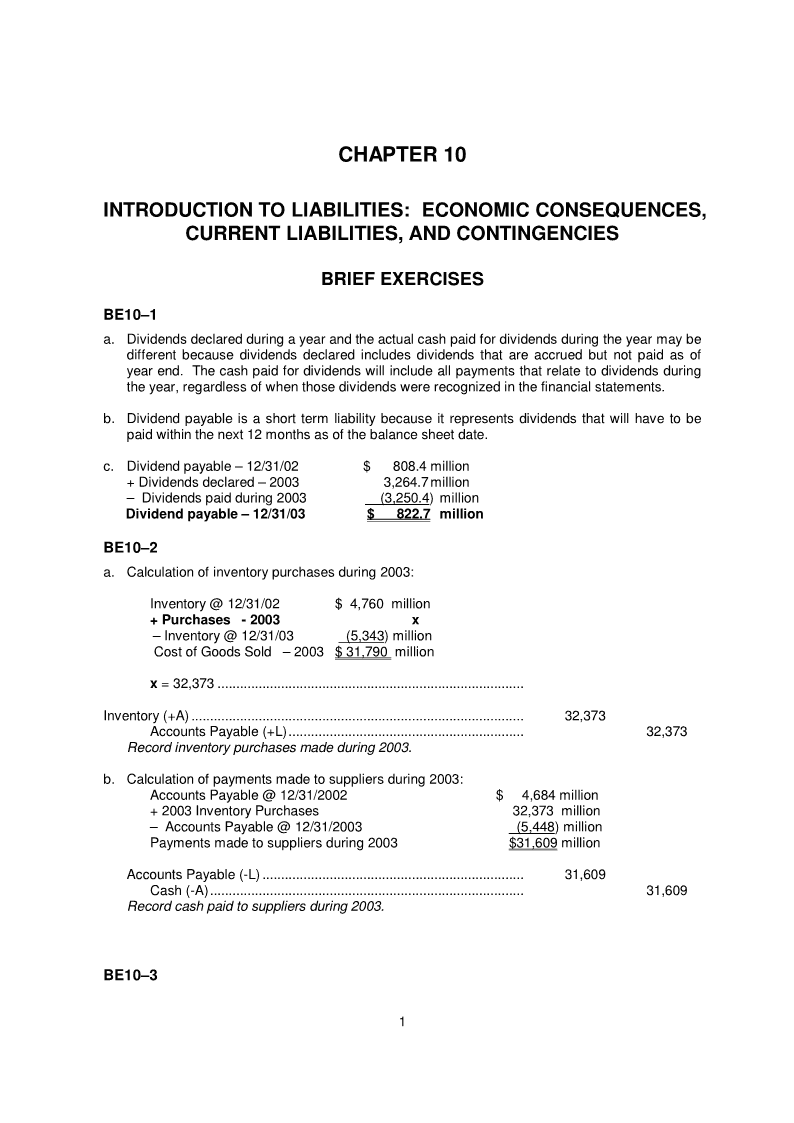

'CHAPTER10INTRODUCTIONTOLIABILITIES:ECONOMICCONSEQUENCES,CURRENTLIABILITIES,ANDCONTINGENCIESBRIEFEXERCISESBE10–1a.Dividendsdeclaredduringayearandtheactualcashpaidfordividendsduringtheyearmaybedifferentbecausedividendsdeclaredincludesdividendsthatareaccruedbutnotpaidasofyearend.Thecashpaidfordividendswillincludeallpaymentsthatrelatetodividendsduringtheyear,regardlessofwhenthosedividendswererecognizedinthefinancialstatements.b.Dividendpayableisashorttermliabilitybecauseitrepresentsdividendsthatwillhavetobepaidwithinthenext12monthsasofthebalancesheetdate.c.Dividendpayable–12/31/02$808.4million+Dividendsdeclared–20033,264.7million–Dividendspaidduring2003(3,250.4)millionDividendpayable–12/31/03$822.7millionBE10–2a.Calculationofinventorypurchasesduring2003:Inventory@12/31/02$4,760million+Purchases-2003x–Inventory@12/31/03(5,343)millionCostofGoodsSold–2003$31,790millionx=32,373..................................................................................Inventory(+A).........................................................................................32,373AccountsPayable(+L)...............................................................32,373Recordinventorypurchasesmadeduring2003.b.Calculationofpaymentsmadetosuppliersduring2003:AccountsPayable@12/31/2002$4,684million+2003InventoryPurchases32,373million–AccountsPayable@12/31/2003(5,448)millionPaymentsmadetosuppliersduring2003$31,609millionAccountsPayable(-L)......................................................................31,609Cash(-A)....................................................................................31,609Recordcashpaidtosuppliersduring2003.BE10–31

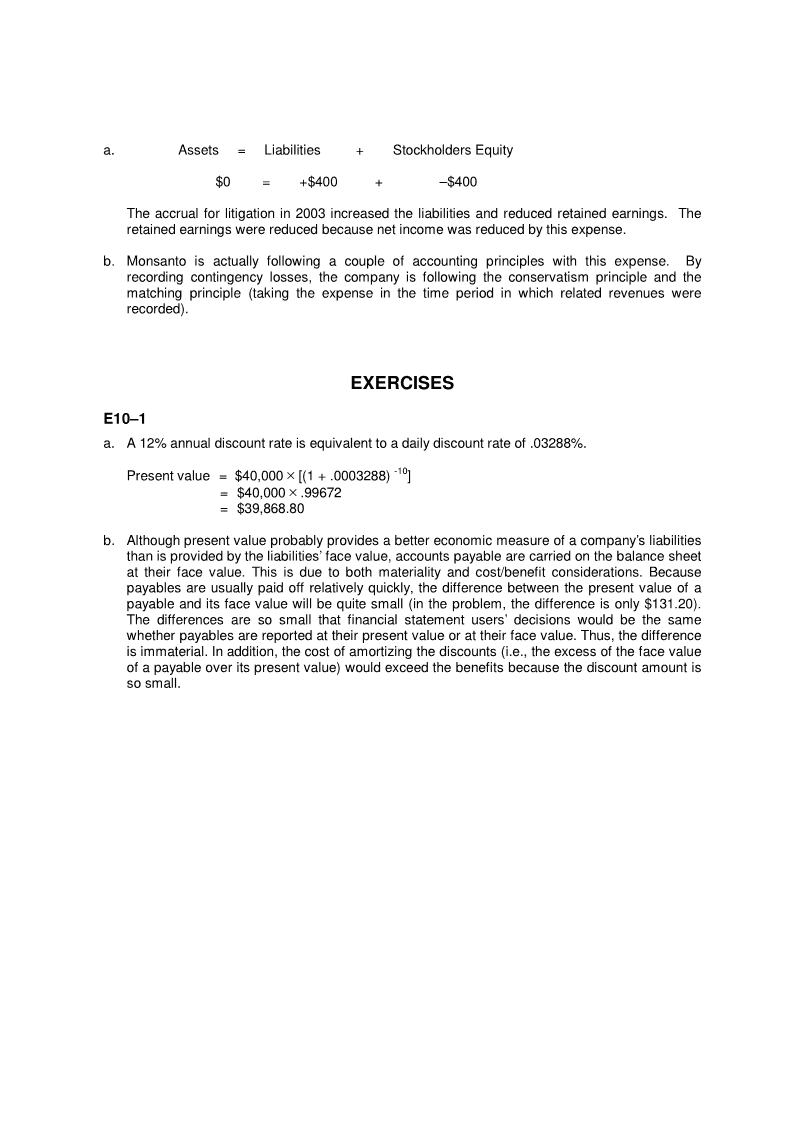

a.Assets=Liabilities+StockholdersEquity$0=+$400+–$400Theaccrualforlitigationin2003increasedtheliabilitiesandreducedretainedearnings.Theretainedearningswerereducedbecausenetincomewasreducedbythisexpense.b.Monsantoisactuallyfollowingacoupleofaccountingprincipleswiththisexpense.Byrecordingcontingencylosses,thecompanyisfollowingtheconservatismprincipleandthematchingprinciple(takingtheexpenseinthetimeperiodinwhichrelatedrevenueswererecorded).EXERCISESE10–1a.A12%annualdiscountrateisequivalenttoadailydiscountrateof.03288%.-10Presentvalue=$40,000×[(1+.0003288)]=$40,000×.99672=$39,868.80b.Althoughpresentvalueprobablyprovidesabettereconomicmeasureofacompany"sliabilitiesthanisprovidedbytheliabilities"facevalue,accountspayablearecarriedonthebalancesheetattheirfacevalue.Thisisduetobothmaterialityandcost/benefitconsiderations.Becausepayablesareusuallypaidoffrelativelyquickly,thedifferencebetweenthepresentvalueofapayableanditsfacevaluewillbequitesmall(intheproblem,thedifferenceisonly$131.20).Thedifferencesaresosmallthatfinancialstatementusers"decisionswouldbethesamewhetherpayablesarereportedattheirpresentvalueorattheirfacevalue.Thus,thedifferenceisimmaterial.Inaddition,thecostofamortizingthediscounts(i.e.,theexcessofthefacevalueofapayableoveritspresentvalue)wouldexceedthebenefitsbecausethediscountamountissosmall.

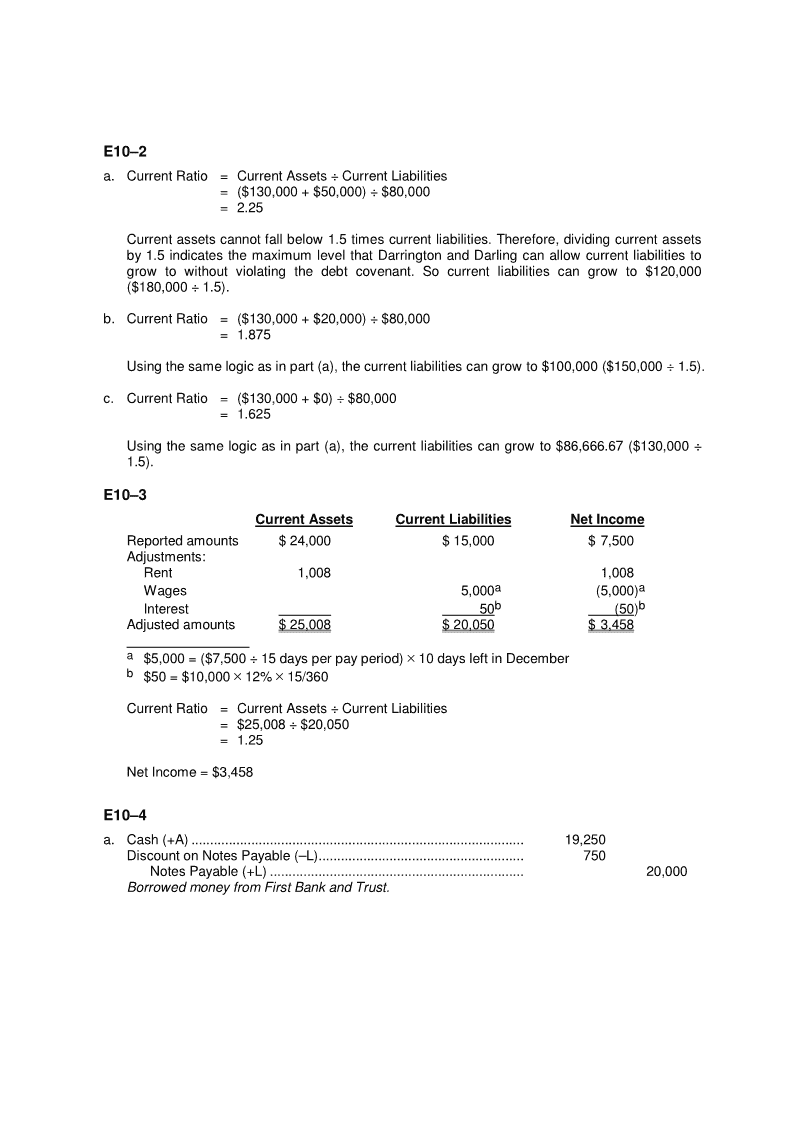

E10–2a.CurrentRatio=CurrentAssets÷CurrentLiabilities=($130,000+$50,000)÷$80,000=2.25Currentassetscannotfallbelow1.5timescurrentliabilities.Therefore,dividingcurrentassetsby1.5indicatesthemaximumlevelthatDarringtonandDarlingcanallowcurrentliabilitiestogrowtowithoutviolatingthedebtcovenant.Socurrentliabilitiescangrowto$120,000($180,000÷1.5).b.CurrentRatio=($130,000+$20,000)÷$80,000=1.875Usingthesamelogicasinpart(a),thecurrentliabilitiescangrowto$100,000($150,000÷1.5).c.CurrentRatio=($130,000+$0)÷$80,000=1.625Usingthesamelogicasinpart(a),thecurrentliabilitiescangrowto$86,666.67($130,000÷1.5).E10–3CurrentAssetsCurrentLiabilitiesNetIncomeReportedamounts$24,000$15,000$7,500Adjustments:Rent1,0081,008Wages5,000a(5,000)aInterest50b(50)bAdjustedamounts$25,008$20,050$3,458a$5,000=($7,500÷15daysperpayperiod)×10daysleftinDecemberb$50=$10,000×12%×15/360CurrentRatio=CurrentAssets÷CurrentLiabilities=$25,008÷$20,050=1.25NetIncome=$3,458E10–4a.Cash(+A).........................................................................................19,250DiscountonNotesPayable(–L).......................................................750NotesPayable(+L)....................................................................20,000BorrowedmoneyfromFirstBankandTrust.

E10–4Concludedb.InterestExpense(E,–SE)................................................................250*DiscountonNotesPayable(+L)................................................250Incurredinterestexpense.*$250=$750discount×30/90daysSpencerDepartmentStoreshoulddisclosethenotepayableonitsDecember31balancesheetasfollows:Notespayable...................................................................................$20,000Less:Discountonnotespayable.....................................................500$19,500c.Interest=Principal×Rate×Time$750=$19,250×Rate×90/360daysRate=15.58%(rounded)d.Theactual,oreffective,interestrateisdeterminedbycomparingthecashpaymentsforinteresttotheactualamountofcashreceived.Thecashpaymentforinterestequalstheinterestratestatedinthenotetimesthefacevalueofthenote.Thus,theonlywayforthestatedandeffectiveinterestratestobethesameisfortheamountofcashreceivedtobethesameasthenote"sfacevalue.Inthiscase,however,theactualamountofcashreceivedis$750lessthanthenote"sfacevalueof$20,000.The$750essentiallyrepresentsprepaidinterest.E10–5a.LaceyTreetoppershastomakeatotaloffifteenpaymentsof$20,000each.AsofDecember31,2005,thecompanyhasmadepaymentsfor2001,2002,2003,2004,and2005.Consequently,LaceyTreetoppershasatotaloftenpaymentsremaining.Theremainingliabilityof$200,000mustbeallocatedonthebalancesheetbetweentheamountsthatwillmaturewithinthetimeframeofcurrentliabilitiesandtheamountsthatwillnotmaturewithinthattime.AsofDecember31,2005,only$20,000willbecomeduewithinthenextyear.This$20,000shouldbeclassifiedonthebalancesheetundercurrentliabilitiesasCurrentMaturitiesofLong-TermDebt.Theremaining$180,000shouldbeclassifiedonthebalancesheetunderlong-termdebt.b.Currentliabilitiesaredefinedasthoseliabilitiesthatwillbesettledthroughtheuseofcurrentassetsorthroughthecreationofothercurrentliabilities.Ifaliabilityistobesettledthroughtheuseofnoncurrentassetsorthroughlong-termrefinancing,thentheliabilityshouldbeclassifiedaslong-termdebt.Inthiscase,LaceyTreetoppershasbasicallytwooptionsintryingtoavoidclassifyingtheupcoming$20,000installmentpaymentasacurrentliability.Thefirstoptionistonegotiatewiththecreditortorefinancethepaymentonalong-termbasis.Thesecondoptionistointendtopayoffthe$20,000usingnoncurrentassets.Forexample,thecompanycouldcreateasinkingfundtoservicetheentireobligation.Sincethesinkingfundwouldbeclassifiedasalong-terminvestment,thecorrespondingliabilitywouldalsobeclassifiedaslong-term.LaceyTreetoppersmayalsobeabletoavoidviolatingitsdebtcovenantsbyincreasingitscurrentassetstooffsettheincreaseincurrentliabilities.AssumethatLaceyTreetoppersintendstopayofftheupcominginstallmentpaymentbysellingoffinvestmentsinmarketablesecuritiesclassifiedaslong-term.Sincethesesecuritieswouldbesoldoffwithinoneyear,themarketablesecuritiesshouldbereclassifiedasacurrentasset.Consequently,currentassetswouldbeincreasedtooffsettheincreaseincurrentliabilities.

E10–6a.Cash(+A).........................................................................................88,000DeferredRevenue(+L)..............................................................88,000Soldgiftcertificates.b.DeferredRevenue(–L)....................................................................52,000Sales(R,+SE)...........................................................................52,000Madesales.CostofGoodsSold(E,–SE)............................................................32,000Inventory(–A).............................................................................32,000Costofinventorysold.c.2006Endingbalance=2006Beginningbalance+Giftcertificatessoldduring2006–Giftcertificatesredeemedduring2006=($88,000–$52,000)+$60,000–$80,000=$16,000E10–7a.Calculationofpaymentsmadetosuppliersduring2003:StepOne:Inventory–12/31/2002$753,972thousand+Purchases-2003x–COGS-2003(2,146,617)thousand=Inventory-12/31/2003$915,671thousandx=2,308,316StepTwo:AccountsPayable–12/31/2002$270,917thousand+Purchasesonacc2,308,316thousand–CashPaidtosuppliers-2003(x)thousand=AccountsPayable-12/31/2003$362,965thousandCashPaidtosuppliers–2003=$2,216,268b.IftheStatementofCashFlowsisstructuredinthedirectformat,theCashPaidtoSuppliersnumberwouldbedisclosedintheOperatingSection.IftheStatementisstructuredintheindirectformat,thisdollaramountwouldbedisclosedonthestatementofcashflows,butitisbrokenintothreedifferentareas.Netincome,whichincludesthecostofgoodssold,isthefirstlineitemonthestatementofcashflows.Theothertwoitemsonthestatementofcashflowsthatreflectthebalanceofthisamountarethechangeinaccountspayableandthechangeininventory.E10–8a.SinceZeusPowerbroughtthelawsuit,ZeusPowerisfacingagaincontingency.Gaincontingenciesareordinarilynotdisclosedinthefinancialstatementsorinthefootnotestothefinancialstatementsduetoconservatism.However,ifitisprobablethatZeusPowerwillrealizethegaincontingency,thenitmaybeacceptabletodisclosethecontingencyinthefootnotestothefinancialstatementstoavoidmisleadingfinancialstatementusers.

b.SinceRegionalSupplyisthedefendantinthelawsuit,RegionalSupplyisfacingalosscontingency.TheappropriateaccountingtreatmentforthislawsuitbyRegionalSupplydependsupon(1)whetheranadverseoutcometothelawsuit(fromRegionalSupply"sperspective)isremote,reasonablypossible,orprobableand(2)whethertheamountoftheloss,givenanadverseoutcome,canbereasonablyestimatedand(3)ifitismaterialtoRegionalSupply.Torecordaneconomicevent,acompanymustbeabletoquantifythedollaramountoftheevent.Ifthecompanycannotquantifythedollaramountoftheevent,itisimpossibleforthecompanytoprepareajournalentry.Thus,ifRegionalSupplycannotreasonablyestimatetheamountoftheloss,itcannotaccrueacontingentliability.Atbest,RegionalSupplycoulddisclosethelosscontingencyinthefootnotestoitsfinancialstatements.Alternatively,assumethatRegionalSupplycanreasonablyestimatehowmuchitwouldloseifitlostthelawsuit.Iftheprobabilitythatitwilllosethelawsuitisremote,RegionalSupplycanignorethelawsuitforfinancialreportingpurposes.IfitisreasonablypossiblethatRegionalSupplywilllosethelawsuit,itshoulddisclosethelawsuit,andtheamountofthepotentialloss,inthefootnotestoitsfinancialstatements.Finally,ifitisprobablethatRegionalSupplywilllosethelawsuit,thenitshouldaccrueacontingencyliability(i.e.,itshouldprepareajournalentryinwhichitrecognizesalossandrelatedliabilityforthelawsuit).Inthisparticularcase,itappearsthattheamountofthelosscanbereasonablyestimated.RegionalSupplymustdecidewhether"agreaterthat50%chance"oflosingthelawsuitmeansitisreasonablypossibleorprobablethatthecompanywilllosethelawsuit.c.ZeusPowerandRegionalSupplywouldaccountforthislawsuitdifferentlyduetoconservatism.Underconservatism,thebasicruleis"ifindoubtonhowtorecordorreportaneconomicevent,putyourworstfootforward."Thatis,recordorreporttheeventinthewaythatisleastfavorabletothecompany.Sincedoubtexistsastowhowillwinthelawsuit,thiseventqualifiesforconservatism.ForZeusPower,disclosingorrecordingthepotentialgainwouldputitinabetterpositionthannotdisclosingorrecordingit.Consequently,ZeusPowershouldprobablyignorethiseventforfinancialreportingpurposes.ForRegionalSupply,theoppositeistrue.Disclosingoraccruingthelawsuitpresentstheeventintheleastfavorableway.E10–9a.Theownersofacorporation(i.e.,thestockholders)usuallywantthemanagerstomakeoperating,investing,financing,andreportingdecisionsthatwillmaximizetheowners"wealth.However,managershavetheirowngoals,andthestockholdersofacompanytypicallyareunabletoobservetheday-to-dayactivitiesofthecompany"smanagers.Consequently,theownersareunsurethatthemanagersaretakingactionsinthebestinterestsoftheowners.Iftheownersandmanagershavesimilargoals,thenthemanagerswouldbeexpectedtotakeactionsthattheownerswouldapprove.Sincemaximizingnetincomeispositivelyassociatedwithmaximizingstockholders"wealth,onewaytohelpalignmanagers"goalswiththeowners"goalsistomakemaximizingnetincomedesirabletomanagers.Ifthemanagersweretoreceivebonuseslinkedtonetincome,thentheywouldbeexpectedtotrytoincreasenetincome.Soacompanywouldinstituteabonusplantotrytoalignthegoalsofmanagersandowners.IfJordanBrothersearnednetincomeof$300,000,thentheamountallocatedtothebonuspoolwouldbecomputedasfollows.($300,000–$200,000)×10%=$10,000Theappropriatejournalentrywouldbe:

BonusExpense(E,–SE)..................................................................10,000BonusLiability(+L)....................................................................10,000Incurred,butdidnotpay,managementbonuses.b.Themanagersofthecompanyarenoteligibleforabonusunlessnetincomeexceeds$200,000.Soifnetincomeisonly$180,000,nothingwouldbeallocatedtothebonuspool.AssumethatJordanBrotherswilleventuallylosethislawsuitandthatthecompanywillhavetopaytheentire$60,000.IfJordanBrothersaccruesthelossnow,netincomewillbereducedby$60,000,andnoadditionallosseswillhavetoberecordedwhenthelawsuitisactuallysettled.Sincenothingwillbeallocatedtothebonuspoolthisyearanyway,accruingthelossthisyeardoesnotaffectthisyear"sbonus.Sincenoadditionallosseswillhavetoberecordedinfutureyears,accruingthelossthisyearwillnotaffectfuturebonuses.If,however,JordanBrotherssimplydisclosesthelossnow,thecompanywillhavetorecordthe$60,000losswhenthelawsuitissettled.Sincenothingwillbeallocatedtothebonuspoolthisyearanyway,simplydisclosingthelossthisyeardoesnotaffectthisyear"sbonus.However,futureyears"bonusescouldbedecreased.Assumethatintheyearthelawsuitissettled,netincome,beforeconsideringtheloss,exceeds$200,000.Anyitemthatreducesnetincomealsoreducestheallocationtothebonuspool.Consequently,simplydisclosingthelawsuitcouldhaveeconomicconsequencestothemanagers.Byaccruingthelossthisyear,themanagersareincreasingtheprobabilitythattheywillreceiveabonusinafutureyear.E10–10a.(1)Cash(+A)..............................................................................50,000Sales(R,+SE).................................................................50,000Soldoutboardengines.(2)WarrantyExpense(E,–SE)..................................................4,000*ContingentWarrantyLiability(+L)..................................4,000Estimatedwarrantyexpense.*$4,000=200engines×$20estimatedwarrantycostperengine(3)2005ContingentWarrantyLiability(–L).........................................1,400Cash(–A)........................................................................1,400Maderepairsunderwarranty.2006ContingentWarrantyLiability(–L).........................................2,600Cash(–A)........................................................................2,600Maderepairsunderwarranty.b.ContingencyBasisCashBasis_2005_2006_2005__2006_Revenue$50,000$0$50,000$0Warrantyexpense(4,000)0(1,400)(2,600)Netincome(loss)$46,000$0$48,600$(2,600)

E10–11a.SouthwestAirlinesdoesnotrecognizerevenuewhenthecashisreceivedbecausetherevenuehasnotbeenearnedyet.Itisnotearneduntilthepassengertakestheflight.Thereisalwaysthepossibilitythatthepassengerwillnottaketheoriginallyscheduledflightandgetarefundoftheirmoney.b.Airtrafficliabilityisacurrentliability.Airlinesdonotsellticketsforflightsthatarescheduledformorethan12monthsinthefuture.Theliabilitesarethereforeshownascurrent.c.Calculationofcashreceiptsfrompassengersduring2003:Airtrafficliabilities@12/31/02$412million+cashreceipts–2003x–revenuerecognized–2003(5,900)millionAirtrafficliabilities@12/31/03$462millionx=$5,950million=cashreceipts–2003E10–12a.Year1PensionExpense(E,–SE)...............................................................16,000Cash(–A)...................................................................................16,000Madepensioncontribution.Year2PensionExpense(E,–SE)...............................................................16,000Cash(–A)...................................................................................16,000Madepensioncontribution.Year3PensionExpense(E,–SE)...............................................................16,000Cash(–A)...................................................................................16,000Madepensioncontribution.b.TheamountthatSeasawSeasonsshouldreportforitspensionliabilityequalsthedifferencebetweentheamountnecessarytofundthebenefitsandtheamountalreadypaidintothepensionplan.Inthiscase,theliabilitywouldbe$10,000($58,000–$48,000).E10–13a.IncomeTaxExpense(E,–SE).........................................................28,000aIncomeTaxLiability(+L)............................................................22,750bDeferredIncomeTaxes(+L)......................................................5,250Incurred,butdidnotpay,incometaxes.a$28,000=$80,000×35%b$22,750=$65,000×35%b.IncomeTaxExpense(E,–SE).........................................................24,000aIncomeTaxLiability(+L)............................................................19,500b

DeferredIncomeTaxes(+L)......................................................4,500Incurred,butdidnotpay,incometaxes.a$24,000=$80,000×30%b$19,500=$65,000×30%c.GenerallyacceptedaccountingprinciplesdifferfromtheInternalRevenueCode.Thetwosetsofaccountingprinciples/proceduresusuallyyielddifferentincomeamounts.However,overthelifeofacompany,totalnetincomeshould,forallpracticalpurposes,bethesameastotaltaxableincome.Sothetotaltaxexpenserecognizedoverthelifeoftheentityshouldequalthetotaltaxliabilityincurredoverthelifeoftheentity.Ifinaparticularyearthetaxexpenseexceedsthetaxliability,theninasubsequentyearthetaxliabilitymustexceedthetaxexpensetobalanceout.SothebalanceinDeferredIncomeTaxesrepresentstheamountthattheentitywillhavetopayinthefuturetobalancethetimingdifferencesbetweenitstaxexpenseanditstaxliability.ThebalanceinDeferredIncomeTaxesisdirectlylinkedtothetaxrate.Thelowertherate,thesmallerthedifferencebetweenthetaxexpenseandtaxliability.Consequently,thereisasmalleramountthatmustbebalancedoutoverthelifeoftheentity.E10–14a.ConservatismRatio=ReportedIncomeBeforeTaxes÷TaxableIncome=$68,000÷$50,000*=1.36IncomeTaxExpense........................................................................20,400DeferredIncomeTax($9,700–$8,300)....................................1,400IncomeTaxPayable(Plug)........................................................19,000*$19,000÷38%=$50,000Aconservatismratiogreaterthan1.0indicatestheextenttowhichreportedincomebeforetaxesexceedsthetaxableincome.ItseemsthatBusytownIndustriesdoesusesomeaggressiveaccountingpolicies.However,ameaningfulconclusioncanbedrawnonlywithanindustry-widecomparison.b.Theconservatismratioprovidesareasonablygoodmeasureoftheextenttowhichacompanyusesaggressiveversusconservativeaccountingpolicies.Thenumeratoroftheratioisincomereportedtothestockholders,whichmanagementismotivatedtoinflate.Thedenominatoristheincomeonwhichthecompanyactuallywouldpayincometaxes,whichmanagementnaturallyhasthemotivationtodeflate.Thus,aratioofthetwoprovidesameasureofthedivergencebetweenthereportedincomebeforetaxesandthetaxableincome.ThefollowingtablelistsafewaccountingpoliciesandtheireffectontheConservatismRatio.ConservatismRatioAccountingPolicyIncreaseDecrease1.Straight-linemethodofdepreciationX2.Double-decliningoranyaccelerateddepreciationmethodX3.Accountingestimates,i.e.,baddebts,warrantiesetc.XX

E10–15a.ConservatismRatio=ReportedIncomeBeforeTaxes÷TaxableIncome=$145,500÷$162,059*=.898IncomeTaxExpense........................................................................54,000DeferredIncomeTax($19,400–$18,300)......................................1,100IncomeTaxLiability(Plug).........................................................55,100*$55,100÷34%=$162,059Sincetheconservatismratioislessthan1,itappearsthatthecompanyisusingincome-deflatingpoliciesonitsincomestatement.b.Theconservatismratioprovidesareasonablygoodmeasureoftheextenttowhichacompanyusesaggressiveversusconservativeaccountingpolicies.Thenumeratoroftheratioisincomereportedtothestockholders,whichmanagementismotivatedtoinflate.Thedenominatoristheincomeonwhichthecompanyactuallywouldpayincometaxes,whichmanagementnaturallyhasthemotivationtodeflate.Thus,aratioofthetwoprovidesameasureofthedivergencebetweenthereportedincomebeforetaxesandthetaxableincome.ThefollowingtablelistsafewaccountingpoliciesandtheireffectontheConservatismRatio.ConservatismRatioAccountingPolicyIncreaseDecrease1.Straight-linemethodofdepreciationX2.Double-decliningoranyaccelerateddepreciationmethodX3.LIFOinventoryvaluationX4.FIFOinventoryvaluationX5.Accountingestimates,i.e.,baddebts,warrantiesetc.XXPROBLEMSP10–1a.,b.,andc.ClassificationAmountItemCurrentLong-TermCurrentLong-Term(1)X$170,000(2)X$60,000(3)XX75,000425,000(4)X8,000(5)X25,000(6)X15,000(7)X125,000(8)X50,000Total$343,000$610,000

P10–2ThebalancesheetofLintonimmediatelyafterthebankloanandpurchaseofequipmentwouldbe:AssetsLiabilitiesandStockholders"EquityCurrentassets$260,000aCurrentliabilities$125,000cNoncurrentassets1,860,000bLong-termliabilities775,000dCapitalstock1,000,000Retainedearnings220,000TotalliabilitiesandTotalassets$2,120,000stockholders"equity$2,120,000a$260,000=$120,000+$140,000incash.b$1,860,000=$1,500,000+$360,000inpurchasedequipment.c$125,000=$100,000+$25,000incurrentmaturitiesofthenewnote.d$775,000=$300,000+$475,000inlong-termmaturitiesofthenewnote.Thecurrentratioafterrecordingthebankloanandthepurchaseoftheequipmentwouldbe:CurrentRatio=CurrentAssets÷CurrentLiabilities=$260,000÷$125,000=2.08Declaringadividendwouldincreasecurrentliabilities.Currentassetscannotfallbelow2xcurrentliabilitiesifLintonistoavoidviolatingitsdebtcovenant.Sincecurrentassetsarecurrently$260,000,Lintoncoulddeclareandpayadividendof$5,000.Thisdividendwouldincreasecurrentliabilitiesto$130,000andreduceretainedearningsto$215,000.P10–3a.(1)BadDebtExpense(E,–SE)..................................................1,000*AllowanceforDoubtfulAccounts(–A)............................1,000Estimatedbaddebts.*$1,000=($50,000Accountsreceivablebalance×6%Estimateduncollectiblepercentage)–$2,000BalanceintheAllowanceaccount(2)WarrantyExpense(E,–SE)..................................................7,000WarrantyLiabilities(+L)..................................................7,000Estimatedwarrantyexpense.(3)UnearnedRevenues(–L)......................................................10,000Revenue(R,+SE)...........................................................10,000Earnedrevenuefromadvancecollections.(4)OtherCurrentLiabilities(–L).................................................5,000Long-TermLiabilities(+L)...............................................5,000Reclassifiedliabilities.

(5)IncomeTaxExpense(E,–SE)..............................................3,000IncomeTaxPayable(+L)................................................3,000Incurredincometaxexpense.(6)LossonLawsuit(Lo,–SE).....................................................10,000*Short-TermContingentLiability(+L)...............................10,000Incurredpotentiallossonalawsuit.*Assumesthat60%isconsideredprobable.If60%wasconsideredonlyreasonablypossible,the$10,000wouldnotbeaccrued,butwould,instead,bedisclosedinafootnote.b.Afterconsideringthejournalentriesinpart(a),exceptforentry(6),currentassetsandcurrentliabilitieswouldbeasfollows.CurrentAssets=$40,000+$50,000–$3,000+$52,000=$139,000CurrentLiabilities=$30,000+$15,000+$12,000+$5,000+$3,000=$65,000CurrentRatio=CurrentAssets÷CurrentLiabilities=$139,000÷$65,000=2.138

P10–3Continuedc.Afterconsideringthejournalentriesinpart(a),includingentry(6),currentassetsandcurrentliabilitieswouldbeasfollows.CurrentAssets=$40,000+$50,000–$3,000+$52,000=$139,000CurrentLiabilities=$30,000+$15,000+$12,000+$5,000+$3,000+$10,000=$75,000CurrentRatio=$139,000÷$75,000=1.853d.Thecompany"sauditorsmustfirstconsiderthedirectivesoftheFASB.SFASStatementNo.5,"AccountingforContingencies,"addressescontingentliabilities.Thispronouncementstatesthatifacontingentliabilityisbothreasonablyestimableandprobable,thentheliabilitymustbeaccrued.Butifthecontingentliabilityisreasonablyestimableandonlyreasonablypossible,orifitisnotreasonablyestimable,thentheliabilityonlyhastobedisclosedinafootnote.Finally,ifacontingencyisremotelylikely,thenthecontingentliabilitydoesnothavetobedisclosed.SinceSFASStatementNo.5doesnotprovideadefinitionofprobable,reasonablypossible,orremote,judgmentmustbeusedinconvertingaprobabilityestimatetooneofthesecategories.Onefactorthatmaygreatlyinfluencetheauditor"sjudgmentishisorherlegalliabilityregardingeachclassification.Assumethatthecompanylosesthelawsuit.Iftheliabilitywasconsideredremotelylikely,andhencenotdisclosed,theauditorwouldbelegallyliabletofinancialstatementusers.Iftheliabilitywasconsideredreasonablypossible,andhencedisclosedinthefootnotes,theauditorcouldpotentiallystillfacelegalactionfromthefinancialstatementusers.Theuserscouldarguethattheauditorshouldhaverequiredthelawsuittobeaccrued.Finally,iftheliabilitywasconsideredprobable,andhenceaccrued,thefinancialstatementuserswereprovidedwiththecorrectinformationandtheauditorwouldnotfaceanylegalliability.Assumethatthecompanywinsthelawsuit.Iftheliabilitywasconsideredremotelylikely,thefinancialstatementuserswereprovidedwiththecorrectinformation.Themanagersofthecompanywouldalsobehappybecausethecompanywasnotmadetoappearworseoffthanitactuallywas.Iftheliabilitywasconsideredreasonablypossibleandonlydisclosedinthefootnotes,itisdoubtfulthatmanyfinancialstatementusersincurredout-of-pocketlossesduetothedisclosure.Somepotentialinvestorsorcreditorsmighthaveforegonetransactingwiththecompany,butthesepeopleonlyincurredopportunitylosses.Peoplecannotsueforopportunitylosses.Themanagersmightbesomewhatupsetthatthepotentiallosswasdisclosedinthefootnotes.Thisdisclosuremightmakeitmoredifficulttoattractcapital.However,sincethecontingentliabilitywasonlydisclosedinthefootnotesandwasnotaccrued,theliabilitywouldnotaffectanyofthemanager"scontractssuchasdebtcovenantsorbonuscontracts.Finally,ifthecontingentliabilitywereaccrued,theauditorwouldprobablynotfaceanylegalliabilitybecausetheauditortookthemostconservativeaction.However,themanagerswouldprobablybeupset.Sincethecontingentliabilitywasaccrued,liabilitieswouldbeincreased,andthecompanywouldhavetoreportalossontheincomestatement.Accruingtheliabilitycoulddecreasethemanager"sbonusandcouldalsoplacethecompanyindefaultonitsdebtcovenants.

P10–3ConcludedTheauditorfacestwoconflictinginterests.Theauditormustconsiderhisorherlegalliabilitytofinancialstatementusers.Ontheotherhand,themanagerpaystheauditfees.Iftheauditordemandsthatthecontingentliabilitybeaccrued,themanagermayfiretheauditor.Theauditormusttradeoffthesetwoconflictinginterestsintryingtodecidewhetherornottoaccrueacontingentliability.Inmostcases,thecostoflegalliabilitywillprobablybegreaterthanlostauditfeesanddamagetotheauditor"sreputation.Inthisparticularcase,a60%probabilityoflosingthelawsuitwouldprobablybeconsideredeitherreasonablypossibleorprobable.Soattheminimum,theauditorshouldrequiredisclosureofthecontingentliabilityinthefootnotes.P10–4a.Fromanaccountingperspective,theFloorWaxShopmustconsidergenerallyacceptedaccountingprinciples.ThecompanywouldfindauthoritativeguidanceinSFASStatementNo.5,"AccountingforContingencies."Accordingtothisstatement,thetwofactorsthattheFloorWaxShopmustconsiderare(1)whethertheamountofthelosscanbereasonablyestimatedand(2)theprobabilitythattheFloorWaxShopwilleventuallyincurtheloss.Fromaneconomicperspective,theFloorWaxShopmustconsiderthecostsandbenefitsofthedifferentwaystoreportthislawsuit.Ifthelawsuitisnotdisclosedoraccruedandthecompanysubsequentlylosesthelawsuit,financialstatementuserscouldsuethecompanyforanylossestheyincurredfromrelyingonthecompany"sfinancialstatements.IftheFloorWaxShopdisclosesthelawsuitbutdoesnotaccruealoss,thenitislesslikelythatanyfinancialstatementuserswouldbeabletosuccessfullysuethecompany.Also,anycontractsinplace,suchasdebtcovenantsorbonuses,wouldprobablynotbeaffectedbyafootnotedisclosure.However,thefootnotedisclosuremaymakeitmoredifficultforthecompanytoattractnewcapital.Somesuppliersmayalsobewaryofextendingcredit,therebyforcingtheFloorWaxShoptopaycashforpurchasesorsigninterest-bearingnotes.Ineithercase,theFloorWaxShopcouldencountercashflowproblems.IftheFloorWaxShopaccruesthelawsuit,thecompanywouldreportalossonitsincomestatementandanassociatedliabilityonitsbalancesheet.InthiscaseitwouldbevirtuallyimpossibleforafinancialstatementusertosuccessfullysuetheFloorWaxShopforprovidingmisleadingorincorrectinformation.However,inadditiontotheproblemsdiscussedassociatedwithdisclosingthelawsuit,accruingalossforthelawsuitcouldaffectexistingcontracts.Accruingalossmightalsobeconsideredanadmissionofguilttothecourt,whichcouldcauseaccruingthelosstobecomeaself-fulfillingprophecy.

P10–4Concludedb.TheFloorWaxShopshouldaccruethelawsuitfortworeasons.First,thecontingentlossmeetstherequirementssetforthinSFASStatementNo.5,"AccountingforContingencies,"foraccruingacontingentloss.Thatis,itisbothprobablethattheFloorWaxShopwilllosethelawsuit,andtheamountofthelosscanbereasonablyestimated.Second,accruingalossminimizesmylegalexposureasthecompany"sauditor.c.TheFloorWaxShopwouldhavemadethefollowingentryonDecember31,2005toaccruethecontingentloss.ContingentLossonLawsuit(Lo,–SE).............................................742,000ContingentLiability(+L).............................................................742,000Accruedcontingentloss.TheamountrecordedforthecontingentlossandliabilityonDecember31,2005wassimplyanestimate.Thatis,$742,000wasthecompany"sbestestimateasofthatdateabouttheamountthecompanywouldeventuallylose.OnAugust12,2006,whenthelawsuitwassettled,theFloorWaxShopwasabletoreviseitsestimate.Sincechangesinestimatesareaccountedforprospectively,apriorperiodadjustmentisnotnecessary.Instead,theFloorWaxShopshouldmakethefollowingentryonAugust12,2006.ContingentLiability(–L)....................................................................742,000Cash(–A)...................................................................................690,000RecoveryofaContingentLoss(R,+SE)...................................52,000Settledlawsuit.P10–5a.Cash(+A).........................................................................................332,500Sales(R,+SE)...........................................................................332,500Soldcars.b.5/30ContingentWarrantyLiability(–L)....................................3,000Cash(–A)...................................................................1,200Parts(–A)...................................................................1,800Maderepairsunderwarranty.9/2ContingentWarrantyLiability(–L)....................................5,000Cash(–A)...................................................................2,000Parts(–A)...................................................................3,000Maderepairsunderwarranty.11/15ContingentWarrantyLiability(–L)....................................6,000Cash(–A)...................................................................2,400Parts(–A)...................................................................3,600Maderepairsunderwarranty.c.WarrantyExpense(E,–SE).............................................................26,600*ContingentWarrantyLiability(+L).............................................26,600Estimatedwarrantyexpense.*26,600=35carssold×$760estimatedwarrantycostpercar

P10–5Concludedd.EndingBalance=BeginningBalance+WarrantyExpensefortheYear–CostofRepairsUnderWarranty=$3,500+$26,600[frompart(c)]–($3,000+$5,000+$6,000)=$16,100e.Underthematchingprinciple,allcoststhatareincurredingeneratingrevenueshouldbematchedagainstthoserevenues.Thematchingprincipledoesnotdistinguishbetweencostsincurredbeforeorafterthepointofsale.Consequently,bothpresaleandpostsalecostsshouldbematchedagainsttheassociatedrevenue.Theproblemwithmatchingpostsalecostsagainsttheassociatedrevenueisthatthecostshavenotyetbeenincurredbythetimetherevenueisearned.Thus,theonlywaytobeabletomatchpostsalecostsagainsttheassociatedrevenueatthetimetherevenueisearnedistoestimatethevalueofthepostsalecosts.Sincepostsalecostsareanexampleofacontingency,thosepostsalecoststhatarebothreasonablyestimableandprobablearerecognizedatthetimetherevenueisrecognized.Inthecaseofwarranties,acompanycanusuallyusecompany-orindustry-specificdatatoestimatetheaveragecostthatwillsubsequentlybeincurredtomakerepairsunderwarranty.However,ifacompanyexpectstoincuramaterialamountofrepairsunderwarrantybutcannotreasonablyestimatetheamount,itisdebatablewhetherthecompanyshouldrecognizetherevenueinthecurrentperiod.Oneofthecriteriaforrecognizingrevenueundertherevenuerecognitionprincipleisthatpostsalecostscanbereasonablyestimated.Ifthiscriterioncannotbemetandtheamountismaterial,acompanyshouldprobablydelayrecognizingtherevenue.P10–6a.20052006Cash(+A)…………………………………40,00056,000Sales(R,+SE)………………………..40,00056,000Madesales.PromotionExpense(E,–SE)………………400a560bContingentPromotionLiability(+L)….400560Estimatedpromotioncost.a$400=20,000boxessoldduringtheyear×Expectedredemptionrateof10%÷5boxtopsperrefund×$1.00perrefundb$560=28,000boxes×10%÷5boxtopsperrefund×$1.00perrefund20052006ContingentPromotionLiability(–L)............300a400bCash(–A).............................................300400Paidpromotionalrefund.a$300=1,500boxtopsredeemed÷5boxtopsperrefund×$1.00perrefundb$400=2,000boxtopsredeemed÷5boxtopsperrefund×$1.00perrefund

P10–6Concludedb.Endingbalance=Beginningbalance+Promotionalexpense–Refundpayments2005:=$0+$400–$300=$1002006:=$100+$560–$400=$260P10–7a.ImpairmentandRestructuringExpense(E,–SE)............................147RestructuringLiability(+L).........................................................66Property,Plant,&Equipment(-A).............................................81Restructuringexpensesestimatedin2003.b.Theexpensewassubtractedfromearningstoproducenetincome,buttheexpensedidnotreducethecompany’scashbalances.Therefore,toconvertthenetincomefiguretothecashfromoperatingactivitiesnumber,thenon-cashexpensewasaddedback.c.Reductionintaxableearningsxtaxrate=taxsavings$147x.28=$41.2P10–8a.20012002PensionExpense(E,–SE).......................40,00040,000Cash(–A)...........................................32,00032,000PensionLiability(+L)..........................8,0008,000Fundedpension.20032004PensionExpense(E,–SE)........................40,00040,000Cash(–A)............................................36,00036,000PensionLiability(+L)...........................4,0004,000Fundedpension.2005PensionExpense(E,–SE).......................40,000Cash(–A)...........................................40,000Fundedpension.b.PensionExpenseAmountFundedPensionLiability2001$40,000$32,000$8,000200240,00032,0008,000200340,00036,0004,000200440,00036,0004,000200540,00040,0000$200,000$176,000$24,000Thus,thebalanceinthePensionLiabilityaccountasofDecember31,2005is$24,000.

P10–9a.2001IncomeTaxExpense(E,–SE).........................................................30,625aDeferredIncomeTaxes(+L)......................................................4,375IncomeTaxLiability(+L)............................................................26,250bIncurredincometaxes.a$30,625=($100,000–$12,500indepreciationexpense)×35%b$26,250=($100,000–$25,000indepreciationexpense)×35%2002IncomeTaxExpense(E,–SE).........................................................30,625*IncomeTaxLiability(+L)............................................................30,625Incurredincometaxes.*$30,625=($100,000–$12,500indepreciationexpense)×35%2003IncomeTaxExpense(E,–SE).........................................................30,625.00DeferredIncomeTaxes(–L)............................................................2,187.50IncomeTaxLiability(+L)............................................................32,812.50*Incurredincometaxes.*$32,812.50=($100,000–$6,250indepreciationexpense)×35%2004IncomeTaxExpense(E,–SE).........................................................30,625.00DeferredIncomeTaxes(–L)............................................................2,187.50IncomeTaxLiability(+L)............................................................32,812.50Incurredincometaxes.IncomeIncomeChangeinDeferredDeferredIncomeTaxExpenseTaxLiabilityIncomeTaxesTaxBalance2001$30,625$26,250.00$4,375.00$4,375.00200230,62530,625.0004,375.00200330,62532,812.50(2,187.50)2,187.50200430,62532,812.50(2,187.50)0b.ThebalanceinDeferredIncomeTaxesrepresentstheamountacompanywill,theoretically,havetopaythegovernmentinthefuture.Amountdifferences,suchasarisewhenacompanyusesdifferentdepreciationmethodsforfinancialreportingandtaxpurposes,betweenbookandtaxableincomereversethemselvesovertime.Ifthegovernmentlowersthetaxrate,thenthetaxliabilityinfutureperiodswhenthetimingdifferencesreversethemselveswillbelowerthantheassociatedtaxexpenserecordedonthebookswhentheoldertaxratewasstillineffect.Thus,theamountoftaxexpenserecordedinpriorperiodswas"incorrect"giventhenewtaxrates,andthecompanyshouldadjustitsbooksforthedecreaseintheexpense.Ifthemisstatementisconsideredanerror,thenapriorperiodadjustmentisnecessary.Butifthemisstatementisconsideredtobeachangeinestimate(whichisthemorelikelyview),thenthecorrectionwouldbeaccountedforprospectivelyandreportedasagaininthecurrentperiod.Inthisparticularcase,thegainfromthechangeinthetaxrateis$1,875.

P10–9Continued2001Sameasinpart(a)2002Sameasinpart(a)2003DeferredIncomeTaxes(–L)............................................................1,875*GainonDeferredIncomeTaxes(Ga,+SE)..............................1,875Adjustedforchangeinstatutorytaxrate.*$1,875=Excesstaxdepreciationof$12,500×Decreaseintaxrateof15%IncomeTaxExpense(E,–SE).........................................................17,500DeferredIncomeTaxes(–L)............................................................1,250IncomeTaxLiability(+L)............................................................18,750*Incurredincometaxes.*$18,750=($100,000–$6,250indepreciationexpense)×20%2004IncomeTaxExpense(E,–SE).........................................................17,500DeferredIncomeTaxes(–L)............................................................1,250IncomeTaxLiability(+L)............................................................18,750Incurredincometaxes.IncomeIncomeChangeinDeferredDeferredIncomeTaxExpenseTaxLiabilityIncomeTaxesTaxBalance2001$30,625$26,250$4,375$4,375200230,62530,62504,3752003(1,875)2,500200317,50018,750(1,250)1,250200417,50018,750(1,250)0c.2001Sameasinpart(a)2002IncomeTaxExpense(E,–SE).........................................................26,250aDeferredIncomeTaxes(+L)......................................................4,375IncomeTaxLiability(+L)............................................................21,875bIncurredincometaxes.a$26,250=($100,000–$25,000indepreciationexpense)×35%b$21,875=($100,000–$37,500indepreciationexpense)×35%2003IncomeTaxExpense(E,–SE).........................................................26,250.00DeferredIncomeTaxes(–L)............................................................2,187.50IncomeTaxLiability(+L)............................................................28,437.50*Incurredincometaxes.*$28,437.50=($100,000–$18,750indepreciationexpense)×35%

P10–9Concluded2004IncomeTaxExpense(E,–SE).........................................................21,875*IncomeTaxLiability(+L)............................................................21,875Incurredincometaxes.*$21,875=($100,000–$37,500indepreciationexpense)×35%IncomeIncomeChangeinDeferredDeferredIncomeTaxExpenseTaxLiabilityIncomeTaxesTaxBalance2001$30,625$26,250.00$4,375.00$4,375.00200226,25021,875.004,375.008,750.00200326,25028,437.50(2,187.50)6,562.50200421,87521,875.00(0)6,562.50Ifacompanyusesdifferentdepreciationmethodsforcalculatingbookandtaxableincome,itispossiblethattheDeferredIncomeTaxaccountwillremainonthecompany"sbooksindefinitely.Thiswouldhappenifacompanycontinuestoacquirefixedassetsbecausethedeferredtaxesarisingfromthenewassetswouldexceedthedeferredincometaxesbeingreversedfromprioraccountingperiods.Consequently,thebalanceinDeferredIncomeTaxeswouldcontinuetogrowovertime.P10–10Basedontheinformationprovidedinthisproblem,wecancomputetheconservatismratioofeachcompany:Thelowertheratio,thehighertheearningpowerofthecompany.ConservatismRatio=ReportedIncomeBeforeTaxes÷TaxableIncomeOwen-FoleyCompanyIncomeTaxExpense(I/S)................................................................52,000DeferredIncomeTax($18,400–$16,600)................................1,800IncomeTaxLiability(Plug).........................................................50,200TaxableIncome=$50,200÷36%=$139,444ConservatismRatio=$163,000÷$139,445=1.169AmertonIndustriesIncomeTaxExpense(I/S)................................................................53,500DeferredIncomeTax($19,800–$18,800)......................................1,000IncomeTaxLiability(Plug).........................................................54,500TaxableIncome=$54,500÷36%=$151,389ConservatismRatio=$158,500÷$151,389=1.047AmertonIndustries’conservatismratioislowerthanOwen-FoleyCompany’.Therefore,ithasstrongerearningpowerthanOwen-Foley.P10–11

Basedontheinformationprovidedinthisproblem,wecancomputetheconservatismratioofeachcompany:Thelowertheratio,themoreconservativethecompany.Thehigherconservatismratioindicatesthatmanagementismoreaggressivewithitstaxpoliciesandresultsinhigherfuturetaxliabilities.Thelowertheratio,thelessaggressivemanagementiswithtaxpolicies.ConservatismRatio=ReportedIncomeBeforeTaxes÷TaxableIncomeWalgreen’sTaxableIncome=$654÷38%=$1,721ConservatismRatio=$1,889÷$1,721=1.098TheLimitedTaxableIncome=$426÷39%=$1,092ConservatismRatio=$1,166÷$1,092=1.068ISSUESFORDISCUSSIONID10–1

a.Underthetermsofitsdebtcovenants,FedEx"scurrentassetsmustbeatleastasgreatasitscurrentliabilities.SinceFederalExpresshadcurrentassetsof$3,941asofDecember31,2003,themaximumamountofliabilitiesFederalExpresscouldhavewithoutviolatingitsdebtcovenantwouldalsobe$3,941.Therefore,FedExcouldreportadditionalcurrentliabilitiesof$606($3,941–$3,335)asofDecember31,2003.b.Therearemanycurrentliabilitieswhereeitherthecreationofortheamountreportedfortheliabilityisunderthecompany"scontrol.Forexample,acompany"sboardofdirectorsdecideswhentodeclareadividend(whichresultsinthecurrentliabilityDividendPayable),howmuchthedividendwillbeandwhentheliabilitywillbepaid.ManagementhasdiscretionovertheamountreportedforcontingentliabilitiessuchasContingentWarrantyLiabilityorContingentPromotionLiability.Byalteringtheirestimates,managementcandecreasetheamountreportedforsuchliabilities.ManagementcouldalsocontroltosomeextenttheamountreportedforUnearnedRevenues.Thatis,managementcouldsimplynottakeanyadvancesfromcustomers,ormanagementcouldcontrolwhenitprovidesthegoodsorservicesforwhichitcollectedtheadvancesfromcustomers.c.Violatingadebtcovenantresultsintheborrowerbeingintechnicaldefaultontheloan.Ifacompanyisindefaultonaloan,thecreditorcouldrequiretheborrowertoimmediatelyrepaytheoutstandingbalance.Alternatively,thecreditorcouldallowtheborrowertorenegotiatetheloan.However,insuchcasestheborrowerisusuallyforcedtoagreetolessfavorableloantermssuchasahigherinterestrate,providingmorecollateral,andsoforth.d.IfFedExpurchasedtheaircraftforcash,itsnoncurrentassetswouldincreaseby$800millionbutitscurrentassetswoulddecrease$800millionforthecashdisbursed.Withnochangeinitscurrentliabilities,fundingtheaircraftpurchasewithcashwoulddecreasethecompany’scurrentratiofrom1.18($3,941/$3,335)to0.94([$3,941-$800]/$3,335).FedExcouldnotfundthepurchasewithcashwithoutviolatingitsdebtcovenant.Alternatively,ifFedExpurchasedtheaircraftusinglong-termdebt,neithercurrentassetsnorcurrentliabilitieswouldbeaffected,leavingthecurrentratioat1.18(incompliancewiththedebtcovenant).ID10–2a.TheaccountCustomers"AdvancePaymentsrepresentscashcollectedfromcustomersinadvanceofprovidingdesiredgoodsorservicestothecustomers.WhenIngersoll-Randmakesthesecollections,itisimplicitlypromisingtoeitherprovidethedesiredgoodsorservicesorrefundthecustomer"smoney.Thus,thecashcollectedinadvanceforwhichIngersoll-RandhasnotyetprovidedthedesiredgoodsorservicesrepresentsaliabilitytoIngersoll-Rand,anditshouldbereportedintheliabilitysectionofthebalancesheetintheaccountCustomers"AdvancePayments.Inaddition,thecashcollectionsmadeduringtheyearshouldbereportedintheoperatingactivitiessectionofthestatementofcashflows.ID10–2Concludedb.Undertherevenuerecognitionprinciple,acompanyshouldnotrecognizerevenueuntil(1)thecompanyhasearnedtherevenue,(2)theamountofrevenueearnedcanbeobjectively

determined,(3)anypostsalecostscanbereasonablyestimated,and(4)cashcollectionisreasonablyassured.AlthoughthecashcollectionisreasonablyassuredwhenIngersoll-Randcollectscashinadvancefromitscustomers,itisnotreallyentitledtokeepthecashatthetimeitmakesthecollections.Thatis,thecompanyhastoprovidesomegoodsorservicesbeforeitisentitledtothecash(i.e.,beforeithasgeneratedsomerevenue).Thus,Ingersoll-Randdoesnotearnanyrevenuesimplyfrommakingcollectionsinadvancefromitscustomers.Itisnotuntilthecompanyprovidessomegoodsorservicesthatthecompanyshouldactuallyrecognizetherevenue.OnceIngersoll-Randprovidesthegoodsorservicesandrecognizestherevenue,thecompanyshouldthenmatchallcosts—bothpresaleandpostsalecosts—againsttherevenueinaccordancewiththematchingprinciple.c.Ingersoll-Randshouldnotrecognizerevenueforsimplycollectingcustomeradvances;instead,itgeneratesrevenuewhenitactuallyshipsthegoods.Thus,earningspersharewouldincreasewhenIngersoll-Randshipsgoods(assumingthatthecompanysellsitsinventoryataprofit),anditwouldnotbeaffectedbyreceivingadvancepayments.CollectingadvancepaymentswouldincreasebothIngersoll-Rand"scurrentassets(throughthecashcollected)andcurrentliabilities(throughtheobligationarisingfromtheadvances).Theactualeffectonthecompany"scurrentratiodependsonwhattheratiowasbeforethecompanymadetheadvancecollections.Ifthecurrentratiowaslessthan1,collectingadvancepaymentswouldincreaseIngersoll-Rand"scurrentratio.Alternatively,ifitscurrentratiowasgreaterthan1,collectingadvancepaymentswoulddecreaseIngersoll-Rand"scurrentratio.ShippingtherelatedgoodswoulddecreaseIngersoll-Rand"scurrentliabilities,whichmeansthatthecompany"scurrentratiowouldincrease.SincecollectingadvancepaymentswouldincreaseIngersoll-Rand"scurrentliabilities,itsdebt/equityratiowouldincrease.Shippingtherelatedgoodswouldbothdecreasethecompany"scurrentliabilitiesandincreaseitsstockholders"equity(throughtheincreasedincomethatwouldbeclosedintoRetainedEarnings).Thus,thecompany"sdebt/equityratiowoulddecreasewhenthegoodsareshipped.ID10–3a.In2003,19.1%($310/$1,624)ofthereservewasclassifiedascurrent;in2002,23.1%($358/$1,551)ofthereservewascurrent.b.Thejournalentriesappearbelow:2001:OtherOperatingExpense(E,-SE)252ProfessionalLiabilityReserve(+L)2522002:OtherOperatingExpense(E,-SE)315ProfessionalLiabilityReserve(+L)3152003:OtherOperatingExpense(E,-SE)380ProfessionalLiabilityReserve(+L)380ID10–3CONTINUEDc.ProfessionalLiabilityReserve–12/31/2002$1,551million

+ProfessionalLiabilityExpense-2003380million–CashPaymentsre:Liability-2003x=ProfessionalLiabilityReserve-12/31/2003$1,624millionx=$307milliond.Earningscouldbemanagedinthehealthcareindustrywithmanipulationtotheprofessionalliabilityreserve(aliabilityaccount)byadjustingtheannualchargetakenfortheexpense.Ifthecompanywerehavingaverysuccessfulyear,beatinganalystearningsestimates,managementcould“pad”thereservebytakinglarger-than-necessaryexpensessothatinfutureyears,whenearningsmightbebelowtargets,managementcouldthentakelower-than-necessaryexpenses(andthereforeshowhigherearnings).ID10–4ThenumerousfiledandpotentialcriminalandcivillawsuitsagainstPhilipMorrisareexamplesoflosscontingencies.SFASStatementNo.5,"AccountingforContingencies,"providesauthoritativeguidanceinaccountingforcontingencies.Accordingtothisstatement,thetwofactorsthatshouldbeconsideredindecidinghowtoaccountforalosscontingencyare(1)whethertheamountofthelosscanbereasonablyestimatedand(2)thelikelihoodthatthecompanywilleventuallyexperiencetheloss.Ifthelikelihoodthatthecompanywilleventuallyexperiencethelossisconsideredtoberemote,thenthecompanydoesnotneedtoprovideanyinformationaboutthelosscontingencyinitsfinancialstatementsorassociatedfootnotes.Acompanyshoulddisclosealosscontingencyinthefootnotestoitsfinancialstatementsundertwoconditions.Thefirstconditionisthatthelikelihoodthatthecompanywilleventuallyexperiencethelossisconsideredtobereasonablypossible.Thesecondconditionisthatthelikelihoodthatthecompanywilleventuallyexperiencethelossisconsideredtobeprobable,buttheamountofthelosscannotbereasonablyestimated.Finally,acompanyshouldaccruethelossifitisbothprobablethatthecompanywilleventuallyexperiencethelossandtheamountofthelosscanbereasonablyestimated.Accruingthelossmeansthatthecompanyreportsalossonitsincomestatementand,inthecaseofalawsuit,anassociatedliabilityonitsbalancesheet.ItisprobablethatPhilipMorriswouldloseanumberoflawsuitsassociatedwithsmoking,itwasprobablynotpossibletodeterminewhichlawsuitsitwouldwinandwhichonesitwouldlose.PhilipMorriswouldhavetoestimatetheprobabilityofwhichlawsuitsitwouldlose,thenPhilipMorrishastoreasonablyestimatetheamountofthecourtsettlementsbecauseofthemagnitudeofthedamagecausedbysmoking.PhilipMorristhenestimatedtheoverallliabilityandbookedthisasacontingentliability.Bydisclosingthelawsuitsinitsfootnotes,PhilipMorrishasprovideditsfinancialstatementuserswithrelevantinformationabouteventsthatcouldaffectthecompany"sfinancialhealth.Thus,thefinancialstatementuserswouldhaveaccesstoadiscussionaboutthevariouslawsuitsandmanagement’sestimateastothepotentialfinanciallosses.UserscanthenmaketheirownassessmentastothepotentialliabilitiesthatPhilipMorrismayface.ID10–5a.TherearetworeasonswhyLifschultz"sstockcouldbehighlyvaluedeventhoughthecompanyhasanegativebookvalue.First,thestockmarketexpectsLifschultztowinthelawsuitsandcollectalargesettlement.Theexpectedsettlement,however,iscurrentlynotreflectedinthecompany"sfinancialstatements.Thus,thepotentialsettlementessentiallyrepresentsanunreportedasset.IfLifschultzincludedtheamountitexpectedtowininthelawsuits,itsnet

bookvaluemaybepositive.Inaddition,generallyacceptedaccountingprinciplesdonotallowacompanytoreportanyself-generatedgoodwill(suchascustomerloyaltyornamerecognition).Goodwillisoftenacompany"slargestasset.Second,bookvalueandstockpricesarebasedontwodifferentmeasures.Thepriceofacompany"sstockshould,theoretically,equalthepresentvalueofthefuturecashflowsthestockmarketexpectsaninvestmentinthatcompanytogenerate.Alternatively,acompany"snetbookvalueisbasedlargelyonhistoricalcost.Acompanycouldhaveanegativebookvalue,butifthestockmarketthoughtthatthecompanycoulduseitsassetstogenerateenoughcashtobothserviceitsdebtanddisbursetoitsstockholders,thestockmarketwouldvaluethatcompany"sstockpositively.b.SFASStatementNo.5,"AccountingforContingencies,"providesauthoritativeguidanceinaccountingforcontingencies.Accordingtothisstatement,gaincontingenciesshouldusuallybeignoredforfinancialreportingpurposes.Ifitishighlyprobablethatthecompanywilleventuallyrealizethegain,thecompanycouldarguablydisclosethegaincontingencyinafootnote.Alternatively,therearethreepotentialwaystoaccountforalosscontingency.Thefirstwayistoignorethelosscontingency.Thisapproachwouldbeappropriateifthelikelihoodofthecompanyeventuallyexperiencingthelossisremote.Thesecondaccountingtreatmentistodisclosethelosscontingencyinafootnotetothefinancialstatements.Thisapproachisappropriate(1)ifthelikelihoodthatthecompanywilleventuallyexperiencethelossisconsideredtobereasonablypossibleor(2)ifthelikelihoodthatthecompanywilleventuallyexperiencethelossisconsideredtobeprobablebuttheamountofthelosscannotbereasonablyestimated.Thefinalpotentialaccountingtreatmentistoaccruealoss.Thatis,recordalossandassociatedliability.Thisapproachisappropriatewhenboththelikelihoodofthecompanyeventuallyexperiencingthelossisprobableandtheamountofthelosscanbereasonablyestimated.SinceLifschultzhasagaincontingency,itshouldnotdisclosethisinformationinitsfinancialstatementsorfootnotes.Alternatively,thethreetruckingcompanieshavelosscontingenciesassociatedwiththelawsuit.Thefactthatthethreecompaniesonlydisclosedthelawsuitintheirfootnotesindicatesthateitherthetruckingcompaniesthoughtitwasonlyreasonablypossiblethattheywouldlosethelawsuitorthattheycouldnotreasonablyestimatetheamountoftheloss.c.Thecostsofoverstatingandunderstatingacompany"sfinancialpositionandoperationsisverydifferent.Assumethatacompanyoverstatesitsfinancialpositionandoperationsinitsfinancialstatements.Iftheusersofthefinancialstatementsusetheinformationinthefinancialstatementstomakeinvestmentdecisionsandthenincuralossontheirinvestments,thefinancialstatementuserswouldprobablysuethecompanyanditsauditors.Thefinancialstatementuserscouldarguethattheywouldnothavemadetheinvestmentifthecompanyhadnotoverstateditsfinancialpositionandoperations.Thecostofdefendingoneselfagainstsuchlawsuits—boththemonetarycostandthelossofreputation—canbeverylarge.Alternatively,assumethatacompanyunderstatesitsfinancialpositionandoperationsinitsfinancialstatements.Peoplemayinvestinthecompanydespiteitsreportedfinancialpositionandoperations,butoncetheunderstatementbecomesknown,theinvestmentshouldincreaseinvalue.Thus,thepeoplewhoinvestedinthecompanyanywaywillprobablynotbeupsetandpursuelegalactionagainstthecompanyoritsauditors.Althoughsomepeoplemightarguethattheyincurredalossbecausetheywouldhaveinvestedinthecompanyifithadnotunder-reporteditsfinancialpositionandoperations,suchlossesrepresentopportunitycosts.Opportunitycostsgenerallydonotprovideasufficientbasisforpursuinglegalactionagainstacompanyoritsauditors.Thus,thecosttoacompanyanditsauditorsofoverstatingthecompany"sfinancialpositionandoperationsisgreaterthanthecostofunderstatingitsfinancialpositionandoperations.

Reportingoraccruingagaincontingencycouldresultinanoverstatementbutnotanunderstatementofacompany"sfinancialpositionandoperations.Sincereportingoraccruingalosscontingencycouldresultinanunderstatementbutnotanoverstatementofthecompany"sfinancialpositionandoperations,itmakessenseeconomicallythatplaintiffsanddefendantswouldaccountforunsettledlawsuitsdifferently.ID10–6a.A"technicaldefault"meansthattheborrowerhasviolatedsometermofadebtagreement,usuallyadebtcovenant.Inthisparticularcase,CitibankreactedtoCampeauCorporation"stechnicaldefaultbygivingCampeauafewdaystocorrecttheproblem.IfCampeauisunabletocorrecttheproblem,CitibankappearstointendtorequireCampeautoimmediatelyrepaytheentireoutstandingloanbalance.AnotheroptionCitibankcouldhavepursuedwouldhavebeentorenegotiatetheloanwithtermsmorefavorabletoCitibank.Forexample,CitibankcouldhaverequiredmorecollateralfromCampeauorincreasedtheinterestrateitwaschargingCampeau.b.Campeau"stechnicaldefaultandCitibank"sstatementthattheymaydemandimmediatefullrepaymentoftheloanindicatethatCampeaumaybeexperiencingseverecashflowproblems.Supplierswouldusuallybeunwillingtoshipmerchandisetoacustomerifthereisagoodchancethatthecustomerwillnotbeabletopayforthemerchandise.Ifthecustomerisindangerofdeclaringbankruptcy,thesuppliers"unwillingnesswouldbeevengreater.Thisisbecausesuppliersareusuallyunsecuredcreditorsinthatthegoodswerepurchasedonaccount,whichmeansthatthesuppliershaveonlythecustomer"spromiseofpayment;themerchandiseusuallydoesnotserveascollateral.Ifthecustomerweretodeclarebankruptcy,thesecuredcreditorswouldbepaidfirst,andonlyiftherewasanycashleft,wouldtheunsecuredcreditorsbepaid.Thesuppliers"unwillingnesstoshipmerchandiseonlyincreasesCampeau"scashflowproblems.Withoutthenewspringmerchandise,Campeau"sstoreswillbeunabletocompeteagainstotherstoreswhohavethenewfashions,anditsstoreswillprobablyrunlowonmerchandise.Thismeansthatthecompanywillbeabletogeneratelesscashfromitsoperations.ID10–7a.WarrantyLiability|72(2003BeginningBalance)||75(2003accruals*)(2003settlements)76_|_______________________|71(2003EndingBalance)*thejournalentrywouldhavebeenWarrantyExpense(E,-SE)75WarrantyLiability(+L)75RecognizinganexpenseforwarrantiesisanapplicationofthematchingprinciplebecausetherevenuesgeneratedinagivenperiodneedtobematchedagainstALLrelatedexpenses.Ifmanagementbelievesittobehighlyprobablethatwarrantyclaimswillbemade,thenitisonlyappropriatetotaketherelatedwarrantyexpensesinthetimeperiodinwhichtherevenue(fromthesaleoftheequipment,inAgilent’scase)isrecorded.Waitinguntilthewarrantyisactuallysubmittedwouldoverstatecurrentearningsandunderstatefutureearnings;matchingthewarrantyexpenseinthecurrenttimeperiodagainstcurrentrevenuesproducesamoreaccurateportrayalofAgilent’sperformance.

b.Earningscouldbemanagedwithmanipulationtothewarrantyliabilitybyadjustingtheannualchargetakenforthewarrantyexpense.Ifthecompanywerehavingaverysuccessfulyear,beatinganalystearningsestimates,managementcould“pad”thewarrantyliabilityreservebytakinglarger-than-necessarywarrantyexpensessothatinfutureyears,whenearningsmightbebelowtargets,managementcouldthentakelower-than-necessarywarrantyexpenses(andthereforeshowhigherearnings).ID10–8a.AsMicrosoftreceivespaymentsfromcustomers,forsoftwaretobeusedinthefuture,itdebitsCashandcreditsDeferredRevenue.Then,whenthesoftwareisprovidedtothecustomer,theDeferredRevenueliabilityisconvertedintoRevenue(debittoDeferredRevenue,credittoRevenue).b.Ifcustomersdiscontinuetheadvancepayments,Microsoftwillnolongerhavethecashpriortotherecognitionoftherevenue.The$1.1billioninDeferredRevenuewillconverttoRevenueasthesoftwareisprovided,butwiththecessationofadvancepaymentsfromcustomers,DeferredRevenuewillnotincreaseaftertheconversiontoRevenue.The“hole”isthefactthatcashwillnolongerbecomingintothecompany’scofferspriortosales.AssumingMicrosoftcontinuestoprovideasmanysoftwareprogramstocustomersasinthepast,revenuewillnotbeaffected.However,thepathofrevenuerecognitionwillchange.Nolongerwillcustomers“deposit”theircashwithMicrosoft,waitingforfuturesoftware;thecustomerswillsimplypurchasethesoftware(andtransfertheircash)whennewsoftwareupgradesarepurchased.c.Generally,thenewsisbad.Microsoftwononseverallevelswhencustomerspaidaheadoftime.Mostimportantly,Microsoftwasabletoinvestthecashandearnareturn(boostingitsprofitability)whencustomerspaidearly.Secondly,Microsofthadlocked-insalesandcustomerswhenthecashwasprepaidtothecompany.ThegoodnewsforMicrosoftwouldbetheminorfactthattheaccountingforthesaleswillnowbesimplifiedastheDeferredRevenueaccountwillnotbetheconduitforrevenuerecognition;thecompanywillrecognizerevenuedirectlywhenthesoftwareisshippedtothecustomer.ID10–9a.Short-termborrowings:thecompanyissueddebtsecuritiesthatareduewithin12monthsTradeaccountspayable:thecompanypurchasedinventoryonaccount,agreeingtopayinthenearfutureEmployeecompensation:thecompanyowesitsworkersforlaborthatwasperformedsincethelastpayday;theobligationwillbesatisfiedatthenextpaydayOtheraccruedliabilities:thecompanyhasmiscellaneousobligations,suchasutilitybills,thathavebeenexpensedontheincomestatementbuthaveyettobepaidincashDividendpayable:thecompanyhasdeclaredbutnotyetpaiddividendstoitsstockholdersIncometaxpayable:thecompanyhasexpenseditstaxobligationsbuthasyettosettlewithcashCurrentportionoflong-termdebt:thecompanyhaslong-termdebtwithsomeprincipalpaymentsdueinthenext12months;thatportionofthelong-termdebtdueafterthenext12monthsiscategorizedinthenoncurrentliabilitiessectionofthebalancesheetb.Iftheseobligationsarecategorizedascurrent,thentheywillbesatisfiedfromtheconversionofcurrentassets.Forexample,theaccountspayableobligationwillbepaidwhenthecompanysellsinventory(acurrentasset)andcollectscash.c.Thecompanymightbeconsideringconvertingtheshort-termborrowingstolong-term.Iflong-terminterestratesarelowandthecompanyrecognizesthatitwillbeaborrowerforsometime,itmightmakesensetorestructurethedebttolongterm.Lookingattheamountofshort-term

borrowingssuggeststhatthecompanyaddedsignificantlytothisdebtin2001and2002.The2000levelwasrelativelylowbutgrewtremendouslyin2001andremainedrelativelyhigh(whencomparedtothe2000levels)in2002.ThetotalforCurrentLiabilitiesmirrorsthistrend.Perhapsthecompanycouldaddresssomesolvencyissues(workingcapital,thecurrentratio)byrecastingsomeofitsshort-termdebttolong-term.d.Returnonequityistheratioofnetincometoshareholders’equity.Ifacompanycanresponsiblyusedebt,itcanimproveitsROE.Ifthedebtisusedtoaddassetsthatstronglycontributetoearnings,thenROEwillrise.IfAbbottcanuseitscurrentliabilitiestofundinventorythatcanbesoldforhighermargins,theincreasedprofitabilitywilltransfertoimprovedreturnsfortheshareholders.Ontheotherhand,ifcompaniesoverloadondebt(inanattempttodriveROE),interestchargescandragdownearnings;inaworst-casescenario,ifthedebtisincreasedtothepointthataninterruptiontoearningsandcashflowpreventprincipalrepayment,ROEcanbejeopardizedasthecompanymaybecomeinsolvent.Propermanagementofdebtallowscompaniestouseleveragetoimproveearningsavailabletoshareholderswhileadequatelyprovidingcushionsothatthedebtcanberepaid.ID10–10Aproxyisadevicewherebyasecurityholderauthorizesanotherpersonorgroupofpersonstoactforhimatameetingofsecurityholders—ineffectapowerofattorney.Wheneverthesolicitationismadeonbehalfofthemanagementoftheissuerandrelatestoanannualmeetingofsecurityholdersatwhichdirectorsaretobeelected,aproxystatementmustbefurnishedtothesecurityholderspursuanttotheSECrequirements.Inessence,proxystatementsaredisclosureinstrumentswithallkindsofinformation.Theyarefurnishedtothestockholdersatatimewhentheshareholdershavetomakecriticaldecisionsthroughaproxytothemanagement.ThenewSECrequireddisclosuresintheproxystatementsregardingtheexecutivecompensationcanbeveryinformativetothestockholders.Ifexecutivecompensationislinkedtotheshareholderreturnsorstockmarketperformance,thenitismostlikelythatmanagement’sactions,whilemaximizingtheirownwealth,willalsomaximizethewealthofthestockholders.Inaway,linkingexecutivecompensationtostockmarketreturnsorshareholderreturnspromotesgoalcongruence.Further,ifacompany’sexecutivesownalotofitsstock,stockholderscantakecomfortthatexecutiveswillmakedecisionsthatwouldreallymaximizetheeconomicwealthofthecompany.Theywouldtrytoincreasethemarketpriceofeachshareratherthanplaywithaccountingpoliciestodeclaremoreincomeontheincomestatement.Anyinformationthatindicatesthattherehasbeenachangeintheauditorscanalsoprovideusefulsignalstothestockholders.Suchachangecanindicatetheexistenceofseriousdisagreementbetweentheauditorandthemanagement.TheshareholderscanfurtherinvestigatethroughSECastowhatwerethereasonsleadingtosuchachangebeforeassigningtheirproxytothecurrentmanagement.ID10–11a.MedicalandLifeInsuranceExpense(E,–SE)..............2,260,000,000AccruedInsuranceLiability(+L)..............................2,260,000,000Accruedmedicalandlifeinsuranceexpense.b.AspartoftheChapter11reorganization,LTVnegotiatednewcreditagreements.Thesecreditagreementscontaineddebtcovenants,mostlikelyrelatedtotheamountofdebtLTVcouldhave.IfLTVhadwaiteduntilafteremergingfromChapter11,the$2.26billioninsuranceliabilitymighthavecausedthecompanytoviolatetheamountofallowabledebtasspecifiedinitsdebtagreements.SuchaviolationcouldhaveforcedthecompanybackintoChapter11or

torenegotiateitsdebtagreementsatlessfavorableterms.Byrecordingthe$2.26billionliabilitypriortonegotiatingitsnewdebtagreements,the$2.26billionliabilitywouldbeconsideredbycreditorsincreatingthedebtcovenants.Thus,thisliabilitywouldnotplaceLTVintoanautomaticviolationofitsdebtcovenants.c.ThereareprobablytworeasonswhyLTVchosetotakeseveralsignificantchargeswhileitwasunderbankruptcyproceedings.First,thesignificantchargeswouldadverselyaffectLTV"sreportedresultsofoperationsandfinancialposition,andLTVmayhavebeentryingtoextractmorefavorablesettlementtermsfromitscreditorsbydemonstratingweakenedperformanceandfinancialposition.Second,LTVmayhavebeenpositioningitselftoshowimprovedperformanceonceitemergedfromChapter11.Bytakingthe$2.26billionchargenow,notonlydoesLTVavoidhavingtoreduceitsearningsinthefuture,butitalsoreducesthecompany"searningssomuchthatitsearningscanonlyincreasenextyear.Thislatterstrategyisknownas"takingabath."ID10–12Theconservatismratioisanexcellentmeasureofacompany’saggressivenessinitstaxstrategy/Thelowertheratio,themoreconservativethecompany.Thehigherconservatismratioindicatesthatmanagementismoreaggressivewithitstaxpoliciesandresultsinhigherfuturetaxliabilities.Thelowertheratiothelessaggressivemanagementiswithtaxpolicies.ConservatismRatio=ReportedIncomeBeforeTaxes÷TaxableIncome2001TaxableIncome=$636÷.351=$1,812ConservatismRatio=$1,614÷$1,812=0.8912002TaxableIncome=$324÷.323=$1,003ConservatismRatio=$1,590÷$1,003=1.5852003TaxableIncome=$331÷.283=$1,170ConservatismRatio=$1,414÷$1,170=1.209ID10–12CONCLUDEDThetrendsindicatethatin2001thecompanywasveryconservativeinitstaxstrategy,withpreviouslydeferredtaxescomingdueatagreaterratethanthecompanywasabletodefercurrenttaxes.In2002,theratioclimbeddramatically,indicatingamoreaggressiveapproachtotaxes,whichdroppedsomewhatinthemore-conservative2003.ID10–13

a.WhatMr.HealyreallymeansisthatGMearned$200millionin1997notbysellingautosbutbyworkingthroughanaccountingadjustmentduetoachangeinthetaxratesinitsNorthAmericanoperations.b.Changeintheexpectedtaxratecanleadtoapositiveeffectonreportedearningsduetothefactthattaxliabilitywasaccruedatahighertaxrateandeventuallypaidatalowertaxrate.c.Notreally.ItseemsthatGMestimateditstaxliabilitytobehigher,andithadtopaymuchlesslowertaxesattheendoftheyear.Itisakintoachangeofanaccountingestimate.ID10–14a.Workingcapitalistheexcessofcurrentassetsovercurrentliabilities.Itisonemeasureofthesolvencyofacompany.HomeDepot’sworkingcapitalwas$3,882in2002(ending2/3/2003)and$3,774in2003,showingaslightdecline.b.In2002workingcapitalwas12.9%oftotalassets,droppingto11.0%in2003.c.HomeDepot’scurrentratiowas1.48in2002anddecreasedto1.40in2003.Thelargestincreaseinacurrentliability,causingthisdropinsolvency,wasinCurrentInstallmentsofLong-TermDebt.Evidently,HomeDepothasseveralpaymentsdueinthecomingyearforitsLongTermDebt.IncreasestoCashandMerchandiseInventorieswerenotenoughtocompensatefortheincreasesincurrentobligations.d.ThemostimportantcurrentliabilityreportedbyHomeDepotisaccountspayable($5,159).Accountspayableareusuallythebiggestcurrentliabilityforanyretailer.OtherimportantcurrentliabilitiesareDeferredRevenue(whichcouldrepresentgiftcardsandotherprepaymentsfromcustomers)andaccruedexpenses.e.Accountspayableturnover=COGS÷(Averageaccountspayable)2003X=$44,236÷(($5,159+$4,560)÷2)X=9.103**dividingturnoverinto365daysyields40daysonhandforaccountspayable20022001AccountsPayablenotprovided,soaveragecannotbecalculatedID10–14Concludedf.Perfootnote#8,HomeDepotdoeshavesomecontingenciesrelatedtolettersofcredit,buttheseprimarlilyareduetothenormalcourseofbusiness.Thecompanydoesnotdiscloseanycontingenciesforlitigationthatitconsiderstobematerialtothefinancialpositionoroperatingresultsofthecompany.g.Perfootnote#6,HomeDepotprovidesthreedefinedcontributionplans.HomeDepotcontributed$106million,$99million,and$97millioninthelastthreeyears,respectively.h.ConservatismRatio=ReportedIncomeBeforeTaxes÷TaxableIncome200320022001

Reportedincomebeforetax6,8435,8724,957÷Taxableincome5,2135,4124,972=Conservatismratio1.311.081.00Currentyeartaxliability1,9342,0351,919÷Effectivetaxrate*37.1%37.6%38.6%=TaxableIncome$5,213$5,412$4,972*footnote#3ThetaxstrategyofHomeDepotwasslightlymoreaggressivein2002thanithadbeenin2001,butthecompanywasveryaggressivein2003(asshownbythemuchhigherconservatismratioof1.31).'

您可能关注的文档

- book4 课内阅读参考译文及课后习题答案.doc

- C#习题参考答案 《c#面向对象程序设计》 郑宇军.doc

- C++第5章习题解答.doc

- chapter 1-4《单片机基础》练习题及答案.doc

- C语言程序设计教程(第三版)课后习题参考答案 张敏霞版.doc

- C语言课后习题答案.doc

- c语言课后答案.doc

- HR课后习题答案.doc

- Java基础入门习题答案.doc

- mba fa 《financial accounting》 习题答案2.pdf

- mba fa 《financial accounting》 习题答案7.pdf

- _fa_《financial_accounting》_习题答案7.pdf

- SQL Server 2008主教材第1~13章主教材习题答案.doc

- VB程序设计教程课后答案.doc

- VB程序设计课后习题答案.doc

- w-《大地测量学基础》复习题及参考答案.doc

- Zhujiao037_《电机学(高起专)》习题答案.doc

- ★《传播学教程》课后题答案.doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明