- 141.92 KB

- 2022-04-22 11:20:03 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

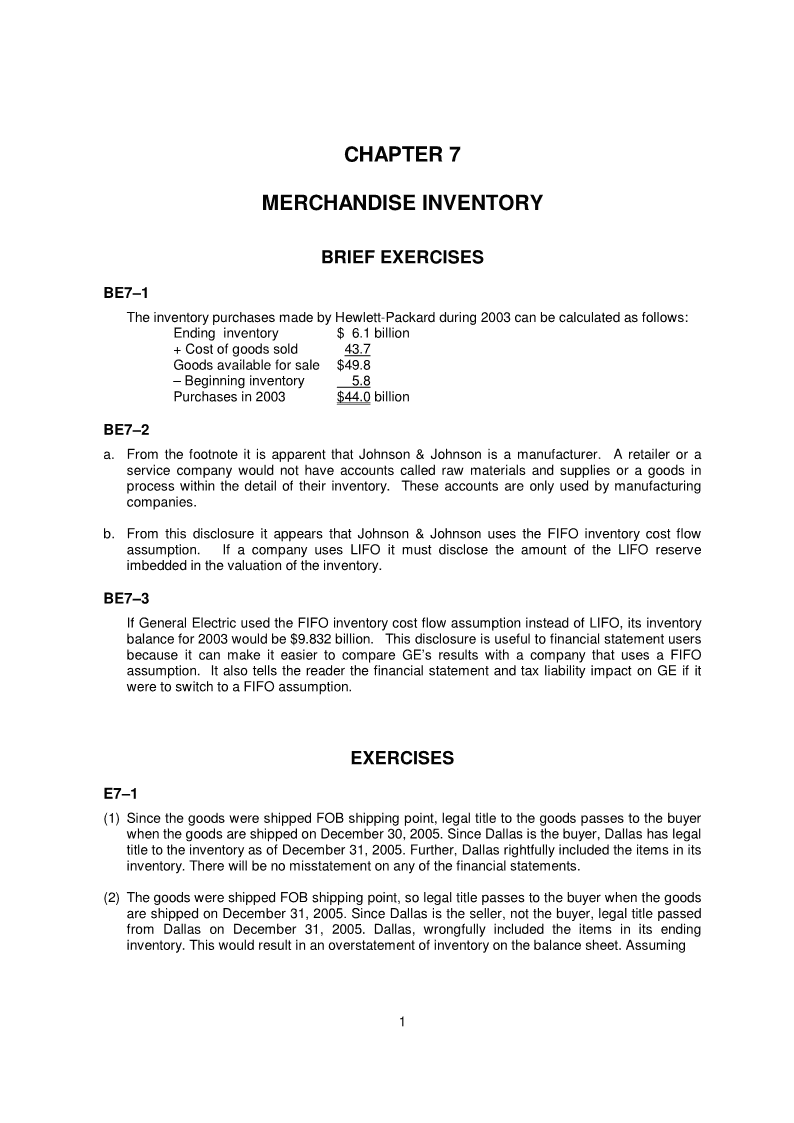

'CHAPTER7MERCHANDISEINVENTORYBRIEFEXERCISESBE7–1TheinventorypurchasesmadebyHewlett-Packardduring2003canbecalculatedasfollows:Endinginventory$6.1billion+Costofgoodssold43.7Goodsavailableforsale$49.8–Beginninginventory5.8Purchasesin2003$44.0billionBE7–2a.FromthefootnoteitisapparentthatJohnson&Johnsonisamanufacturer.Aretaileroraservicecompanywouldnothaveaccountscalledrawmaterialsandsuppliesoragoodsinprocesswithinthedetailoftheirinventory.Theseaccountsareonlyusedbymanufacturingcompanies.b.FromthisdisclosureitappearsthatJohnson&JohnsonusestheFIFOinventorycostflowassumption.IfacompanyusesLIFOitmustdisclosetheamountoftheLIFOreserveimbeddedinthevaluationoftheinventory.BE7–3IfGeneralElectricusedtheFIFOinventorycostflowassumptioninsteadofLIFO,itsinventorybalancefor2003wouldbe$9.832billion.ThisdisclosureisusefultofinancialstatementusersbecauseitcanmakeiteasiertocompareGE’sresultswithacompanythatusesaFIFOassumption.ItalsotellsthereaderthefinancialstatementandtaxliabilityimpactonGEifitweretoswitchtoaFIFOassumption.EXERCISESE7–1(1)SincethegoodswereshippedFOBshippingpoint,legaltitletothegoodspassestothebuyerwhenthegoodsareshippedonDecember30,2005.SinceDallasisthebuyer,DallashaslegaltitletotheinventoryasofDecember31,2005.Further,Dallasrightfullyincludedtheitemsinitsinventory.Therewillbenomisstatementonanyofthefinancialstatements.(2)ThegoodswereshippedFOBshippingpoint,solegaltitlepassestothebuyerwhenthegoodsareshippedonDecember31,2005.SinceDallasistheseller,notthebuyer,legaltitlepassedfromDallasonDecember31,2005.Dallas,wrongfullyincludedtheitemsinitsendinginventory.Thiswouldresultinanoverstatementofinventoryonthebalancesheet.Assuming1

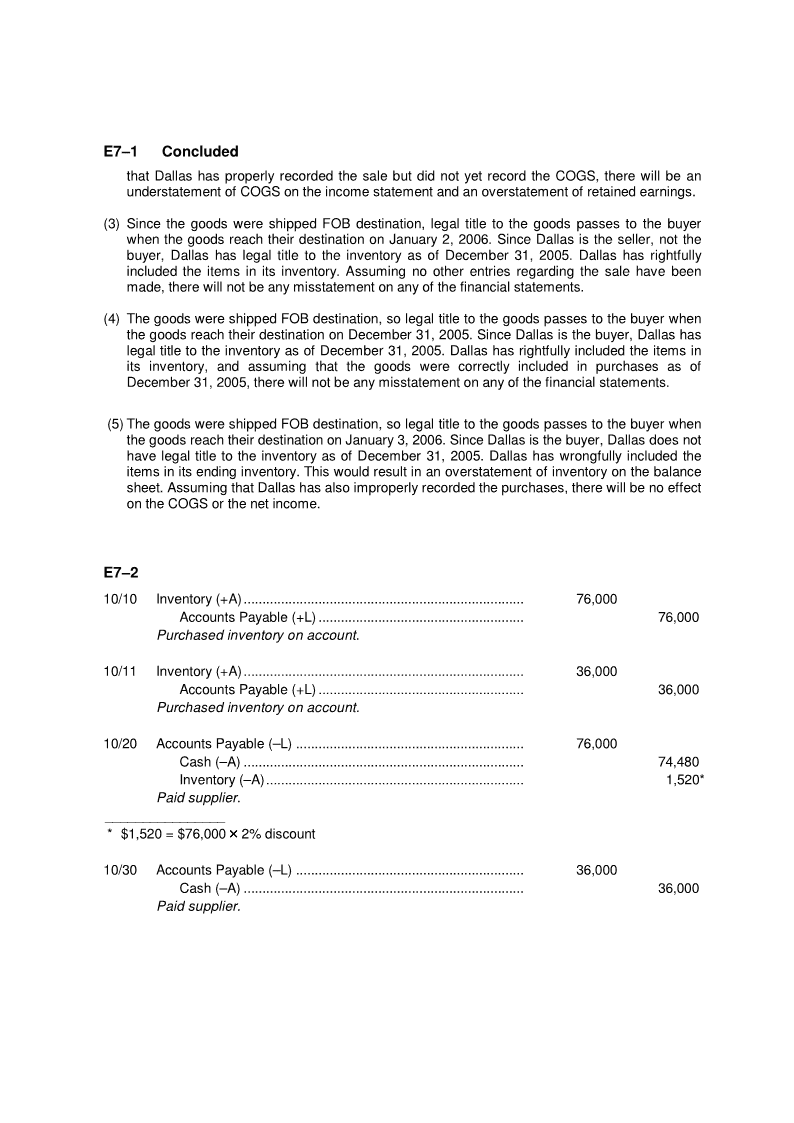

E7–1ConcludedthatDallashasproperlyrecordedthesalebutdidnotyetrecordtheCOGS,therewillbeanunderstatementofCOGSontheincomestatementandanoverstatementofretainedearnings.(3)SincethegoodswereshippedFOBdestination,legaltitletothegoodspassestothebuyerwhenthegoodsreachtheirdestinationonJanuary2,2006.SinceDallasistheseller,notthebuyer,DallashaslegaltitletotheinventoryasofDecember31,2005.Dallashasrightfullyincludedtheitemsinitsinventory.Assumingnootherentriesregardingthesalehavebeenmade,therewillnotbeanymisstatementonanyofthefinancialstatements.(4)ThegoodswereshippedFOBdestination,solegaltitletothegoodspassestothebuyerwhenthegoodsreachtheirdestinationonDecember31,2005.SinceDallasisthebuyer,DallashaslegaltitletotheinventoryasofDecember31,2005.Dallashasrightfullyincludedtheitemsinitsinventory,andassumingthatthegoodswerecorrectlyincludedinpurchasesasofDecember31,2005,therewillnotbeanymisstatementonanyofthefinancialstatements.(5)ThegoodswereshippedFOBdestination,solegaltitletothegoodspassestothebuyerwhenthegoodsreachtheirdestinationonJanuary3,2006.SinceDallasisthebuyer,DallasdoesnothavelegaltitletotheinventoryasofDecember31,2005.Dallashaswrongfullyincludedtheitemsinitsendinginventory.Thiswouldresultinanoverstatementofinventoryonthebalancesheet.AssumingthatDallashasalsoimproperlyrecordedthepurchases,therewillbenoeffectontheCOGSorthenetincome.E7–210/10Inventory(+A)...........................................................................76,000AccountsPayable(+L).......................................................76,000Purchasedinventoryonaccount.10/11Inventory(+A)...........................................................................36,000AccountsPayable(+L).......................................................36,000Purchasedinventoryonaccount.10/20AccountsPayable(–L).............................................................76,000Cash(–A)...........................................................................74,480Inventory(–A).....................................................................1,520*Paidsupplier.________________*$1,520=$76,000×××2%discount10/30AccountsPayable(–L).............................................................36,000Cash(–A)...........................................................................36,000Paidsupplier.

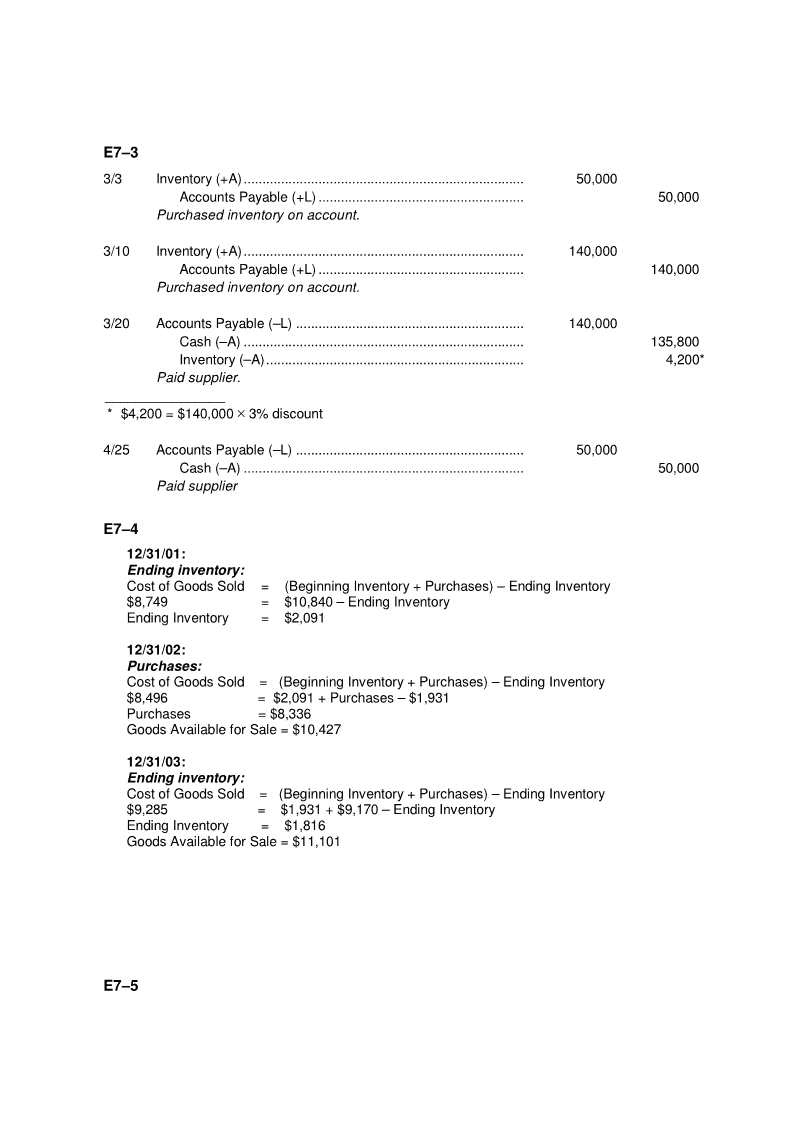

E7–33/3Inventory(+A)...........................................................................50,000AccountsPayable(+L).......................................................50,000Purchasedinventoryonaccount.3/10Inventory(+A)...........................................................................140,000AccountsPayable(+L).......................................................140,000Purchasedinventoryonaccount.3/20AccountsPayable(–L).............................................................140,000Cash(–A)...........................................................................135,800Inventory(–A).....................................................................4,200*Paidsupplier.________________*$4,200=$140,000×3%discount4/25AccountsPayable(–L).............................................................50,000Cash(–A)...........................................................................50,000PaidsupplierE7–412/31/01:Endinginventory:CostofGoodsSold=(BeginningInventory+Purchases)–EndingInventory$8,749=$10,840–EndingInventoryEndingInventory=$2,09112/31/02:Purchases:CostofGoodsSold=(BeginningInventory+Purchases)–EndingInventory$8,496=$2,091+Purchases–$1,931Purchases=$8,336GoodsAvailableforSale=$10,42712/31/03:Endinginventory:CostofGoodsSold=(BeginningInventory+Purchases)–EndingInventory$9,285=$1,931+$9,170–EndingInventoryEndingInventory=$1,816GoodsAvailableforSale=$11,101E7–5

Withtheperpetualmethod,thebalanceintheCostofGoodsSoldaccountisperpetuallyupdatedforsalesofinventory,asisthebalanceintheInventoryaccountforsalesandacquisitionsofinventory.ThisimpliesthatthebalanceinCostofGoodsSoldshouldcorrespondtoabalanceintheInventoryaccountof$52,000,andthatnoentryisnecessaryattheendoftheyeartorecordCostofGoodsSold.EndingInventory=BeginningInventory+NetPurchases–CostofGoodsSold$52,000=$32,000+($85,000+$4,300)–COGSCostofGoodsSold=$69,300However,sincethephysicalcountindicatesthatTelly"shas$2,000lessinventorythanisrecordedinitsInventoryaccount,thefollowingadjustingentryisnecessaryattheendoftheyear.InventoryShrinkage(E,–SE)...................................................2,000Inventory(–A).....................................................................2,000Incurredinventoryshrinkage.E7–6a.ErrorinEndingInventory=ErrorinBeginningInventory+ErrorinPurchases–ErrorinCostofGoodsSold$50=$0+$0–ErrorinCostofGoodsSoldErrorinCostofGoodsSold=$50OverstatementEndinginventoryisunderstatedby$50asofDecember31,2002,andcostofgoodssoldisoverstatedby$50fortheyearendedDecember31,2002.b.ErrorinEndingInventory=ErrorinBeginningInventory+ErrorinPurchases–ErrorinCostofGoodsSold$50=$50Understatement+$0–ErrorinCostofGoodsSoldErrorinCostofGoodsSold=$100understatementEndinginventoryisoverstatedby$50asofDecember31,2003,andcostofgoodssoldisunderstatedby$100fortheyearendedDecember31,2003.c.20022003TotalErrorinCOGS$50($100)($50)The$50understatementofendinginventoryin2002reversesitselfduring2003.Consequently,forthetwo-yearperiod,onlythe$50overstatementofinventoryonDecember31,2003affectsCOGS.Bytheendof2004,this$50errorwillalsohavereverseditself.E7–7a.IfMarianwantstomaximizeprofitsandendinginventory,sheshouldsellthecustomerthelowestpricedcoat(i.e.,Coat4).IfshesellsCoat4,Marianwouldreportthefollowinggrossprofitandendinginventory.E7–7Concluded

GrossProfitEndingInventoryRevenues$12,000Coat1$8,400COGSofCoat46,800Coat27,100Grossprofit$5,200Coat37,600Total$23,100Marianmayhaveseveralreasonstomaximizeprofitsandendinginventory.IfMarian"sFurshasborrowedmoneyandenteredintodebtcovenants,thedebtcovenantsmaycontainclausesstipulatingacertaincurrentratio,debt/equityratio,andsoforth.Bymaximizingprofitsandinventory,Mariancanalsominimizetheprobabilitythatshewillviolateoneoftheseratios,therebydecreasingthechancethatshewillviolateherdebtcovenants.Further,ifMarianhasabonuslinkedtoaccountingearnings,shecouldmaximizeherbonusbymaximizingprofits.b.IfMarianwantstominimizeprofitsandendinginventory,sheshouldsellthecustomerthehighestpricedcoat(i.e.,Coat1).IfshesellsCoat1,Marianwouldreportthefollowinggrossprofitandendinginventory.GrossProfitEndingInventoryRevenues$12,000Coat2$7,100COGSofCoat18,400Coat37,600Grossprofit$3,600Coat46,800Total$21,500ThemostlikelyreasonMarianwouldwanttominimizeprofitsandendinginventoryistominimizetaxes.Minimizingprofitswouldminimizecurrenttaxpayments,therebyminimizingthepresentvalueoftaxpayments.Further,somestateschargetaxesonacompany"sassets,therebyprovidinganincentivetominimizeassets.E7–8a.FIFOcostflowassumption:CostofGoodsSold=(75units×$450)+(50units×$500)+(5units×$600)=$33,750+$25,000+$3,000=$61,750GrossProfit=Sales–CostofGoodsSold=(130units×$1,000)–$61,750=$68,250EndingInventory=(60units×$600)=$36,000E7–8ConcludedAveragingcostflowassumption:CostperUnit=[(75units×$450)+(50units×$500)+(65units×$600)]÷(75units+50units+65units)($33,750+$25,000+$39,000)÷190units

=$514.47perunit(rounded)CostofGoodsSold=(130units×$514.47)=$66,881.10GrossProfit=Sales–CostofGoodsSold=(130units×$1,000)–$66,881.10=$63,118.90EndingInventory=60units×$514.47=$30,868.20LIFOcostflowassumption:CostofGoodsSold=(65units×$600)+(50units×$500)+(15units×$450)=$39,000+$25,000+$6,750=$70,750GrossProfit=Sales–CostofGoodsSold=(130units×$1,000)-$70,750=$59,250EndingInventory=(60units×$450)=$27,000b.Ifthemonitorsareidentical,customerswouldbeindifferentbetweenanytwomonitors.Hence,Vinniecouldsimplygiveacustomerthemonitorthatallowshimtoeitherminimizeormaximizecostofgoodssold,therebymaximizingorminimizinggrossprofit.IfVinniewantstomaximizenetincome,hewouldfirstselltocustomersthelowest-pricedmonitors,followedbythesecondlowest-pricedmonitors,andsoforth.Sincethecostofthemonitorsisincreasing,thisstrategyisidenticaltotheFIFOcostflowassumption.Therefore,thehighestgrossprofitVinniecouldreportis$68,250(frompart[a]).Vinniemaywanttomaximizenetincomeforseveralreasons.First,ifVinniereceivesanyincentivecompensation,suchasabonus,thatistiedtonetincome,thenhecanmaximizehiscompensationbymaximizingnetincome.Second,ifVinniehasanyexistingdebtcovenants,theymayspecifyamaximumdebt/equityratio.Byincreasingnetincome,Vinniewouldincreaseequity,therebydecreasinghisdebt/equityratio.Inthismanner,Vinniedecreasestheprobabilitythathewillviolatethedebtcovenant.Finally,ifVinnieisintheprocessoftryingtoobtaindebt,potentialcreditorsmayusenetincomeasafactorindeterminingwhetherornottoloanmoneytoVinnieorwhatinterestratetocharge.IfVinniewantstominimizenetincome,hewouldfirstselltocustomersthehighest-pricedmonitors,followedbythesecondhighest-pricedmonitors,andsoforth.Sincethecostofthemonitorsisincreasing,thisstrategyisidenticaltotheLIFOcostflowassumption.Therefore,thelowestgrossprofitVinniecouldreportis$59,250(frompart[a]).ThemostlikelyreasonVinniewouldwanttominimizenetincomeisfortaxpurposes.Ifheusesthesamesetofbooksfortaxandfinancialreportingpurposes,thenbyminimizingbookincome,Vinnieminimizestaxableincome.Minimizingtaxableincome,inturn,minimizesthepresentvalueofcashoutflowsfortaxes.E7–92004FIFOWeightedAverageLIFOCostofgoodssold160170180Grossprofit(Sales–COGS)290280270Endinginventory180170160

2005FIFOWeightedAverageLIFOCostofgoodssold245262.5290Grossprofit(Sales–COGS)455437.5410Endinginventory290262.5225Ifthebusinessisgrowing(inventorylevelsrising)andthecostofinventoryisincreasing,thenifLIFOischosen,thecompanywillloweritsnetincomewhichwillreduceitstaxliability.Thisincreasesthecashflowofthecompany.UsingFIFOwillincreaseitsreportednetincomeandtaxliabilitybutwillalsoincreaseitscurrentassets.Thischoiceimpactsthecompany’soperatingandliquidityratios.E7–10a.LIFOcostflowassumption:YearCalculationAmount20025,000units×$12$60,0002003(12,000units×$16)+(4,000units×$12)240,00020042,000units×$1836,000200510,000units×$21210,0002006(2,000units×$23)+(3,000units×$18)+(1,000units×$12)112,000Total$658,000FIFOcostflowassumption:YearCalculationAmount20025,000units×$12$60,0002003(5,000units×$12)+(11,000units×$16)236,0002004(1,000units×$16)+(1,000units×$18)34,0002005(4,000units×$18)+(6,000units×$21)198,0002006(4,000units×$21)+(2,000units×$23)130,000Total$658,000E7–10ConcludedAveragingcostflowassumption:YearCalculationAmount2002Cost/unit=$120,000÷10,000units=$12perunitCOGS=5,000units×$12$60,0002003Cost/unit=[(5,000×$12)+(12,000×$16)]÷17,000units

=$14.82perunitCOGS=16,000units×$14.82237,1202004Cost/unit=[(1,000×$14.82)+(5,000×$18)]÷6,000units=$17.47perunitCOGS=2,000units×$17.4734,9402005Cost/unit=[(4,000×$17.47)+(10,000×$21)]÷14,000units=$19.99perunitCOGS=10,000units×$19.99199,9002006Cost/unit=[(4,000×$19.99)+(2,000×$23)]÷6,000units=$20.99perunitCOGS=6,000units×$20.99125,940Total$657,900b.Overthelifeofacompany,CostofGoodsSoldwouldbethesameregardlessofthecostflowassumptionemployed.Overthelifeofabusiness,alltheunitsofinventorywillbesold.Consequently,allcostsassociatedwithinventorywillbeexpensed.Thechoiceofacostflowassumptionaffectsonlytheallocationofinventorycoststoparticularaccountingperiods;itdoesnotaffecttotalinventorycosts.c.Assumethataccountingearningsequalstaxearnings.Overthelifeofabusiness,acompany"stotalearningsarethesameregardlessofthecostflowassumptionemployed.Therefore,acompany"stotaltaxliabilityoverthecompany"slifeisthesame,regardlessofthecostflowassumptionemployed,aslongastaxratesareunchanged.Thechoiceofacostflowassumptiondoes,however,affecttheallocationofinventorycoststoparticularyears.Thesedifferentcostallocationsgiverisetodifferentearningsinparticularyears.Thedifferentearningsamountsunderdifferentcostflowassumptionsthengiverisetodifferenttaxliabilities(i.e.,cashoutflows)inparticularyears.Duetothetimevalueofmoney,thetimingofcashflowsaffectsthepresentvalueofthetotaltaxpayments.Inperiodsofinventorybuild-up,theLIFOcost-flowassumptionwillresultinlowerearningswhileFIFOwillresultinhigherearnings.Theoppositeistrueintimesofinventoryliquidation.Consequently,LIFOresultsinlowertaxpaymentswhenacompanybuildsupitsinventoriesandFIFOresultsinhighertaxpayments.ThetimingofthetaxpaymentsmeansthatthepresentvalueoftaxpaymentsunderLIFOislessthanthepresentvalueoftaxpaymentsunderFIFO.Intimesofdeflation,theoppositesituationarises.ThepresentvalueoftaxpaymentsunderFIFOislessthanthepresentvalueoftaxpaymentsunderLIFO.E7–11a.InventoriesonLIFObasis...................................................$3,047Add:AdjustmenttoLIFObasis...........................................1,863InventoriesonFIFObasis...................................................$4,910b.Accumulatedtaxsavingscanbecomputedbymultiplyingthetaxratebythetotaldecreaseinnetincomefortheyears2002and2003duetoLIFOadoption.AccumulatedTaxSavings=TaxRate×(2003LIFOReserve)

=.27×($1,863)=$503c.The2003reportednetincomeundertheFIFOcostflowassumptionwouldbe$2,963($1,100+$1,863)evenifCaterpillarhadchosentochangefromLIFOtoFIFOyearsearlier.d.Theinformationgeneratedinparts(a),(b),and(c)couldbeusefultotheusersfromseveralperspectives.First,userscouldusetheinformationtocompareCaterpillarwithothercompanieswithintheindustrythatuseFIFOcostflowassumption.Second,theuserscanreadilyseethetaxsavingsthatthecompanyhasgeneratedasaresultofitschoiceofLIFOcostflowassumption.Thirdly,alongwithotherinformation,userscanusethisinformationtoassessthequalityofearningsofCaterpillar.E7–12a.LossonInventoryWrite-down(Lo,–SE).........................................12Inventory(–A).............................................................................12Wroteinventorydowntomarketvalue.Cash(+A).....................................................................................50Sales(R,+SE)...........................................................................50SoldItem#1.CostofGoodsSold(E,–SE)............................................................28Inventory(–A).............................................................................28RecordedcostofgoodssoldforItem#1.Cash(+A).....................................................................................50Sales(R,+SE)...........................................................................50SoldItem#2.CostofGoodsSold(E,–SE)............................................................40Inventory(–A).............................................................................40RecordedcostofgoodssoldforItem#2.E7–12Concludedb.20052006TotalItem#1$12loss$22profit$10profitItem#2010profit10profitc.AsdemonstratedinPart(b)forItem#1,acompanycantradeoffalossinoneperiodforincreasedprofitsinalaterperiod.Thisimpliesthatifacompanyishavingagoodyear,itcanhidesomeofthoseprofitsbywritingdownitsinventoryandthenrecognizeincreasedprofitsinfutureperiodswhenthecompany"sprofitsmaybelower.

PROBLEMSP7–111/15Inventory(+A)...........................................................................8,000AccountsPayable(+L).......................................................8,000Purchasedinventoryonaccount.11/26Inventory(+A)...........................................................................12,000AccountsPayable(+L).......................................................12,000Purchasedinventoryonaccount.

12/2AccountsPayable(–L).............................................................8,000Cash(–A)...........................................................................8,000Paidsupplier.12/2AccountsPayable(–L).............................................................12,000Cash(–A)...........................................................................11,760Inventory(–A).....................................................................240Paidsupplier.P7–2a.3/5Inventory(+A).....................................................................30,000AccountsPayable(+L).................................................30,000Purchasedinventoryonaccount.3/10Inventory(+A).....................................................................60,000AccountsPayable(+L).................................................60,000Purchasedinventoryonaccount.3/13AccountsPayable(–L).......................................................30,000Cash(–A).....................................................................29,400Inventory(–A)...............................................................600Paidsupplier.7/18AccountsPayable(–L).......................................................60,000Cash(–A).....................................................................60,000Paidsupplier.P7–2Concludedb.3/10Inventory(+A).....................................................................60,000AccountsPayable(+L).................................................60,000Purchasedinventoryonaccount.3/19AccountsPayable(–L).......................................................40,000Cash(–A).....................................................................39,200Inventory(–A)...............................................................800*Paidsupplier._____________*$800=($60,000×2/3)×2%discount

8/7AccountsPayable(–L).......................................................20,000Cash(–A).....................................................................20,000Paidsupplier.P7–3ThecorrectamountthatshouldbereportedforCostofGoodsSoldiscalculatedusingthefollowingformula.ErrorinEndingInventory=ErrorinBeginningInventory+ErrorinPurchases–ErrorinCOGS2001:$500=$0+$0–ErrorinCOGSErrorinCOGS=($500).Therefore,COGSasreportedisunderstated$500.CorrectCOGS=$2,160+$500=$2,6602002:($150)=$500+$0–ErrorinCOGSErrorinCOGS=$650.Therefore,COGSasreportedisoverstated$650.CorrectCOGS=$2,177–$650=$1,5272003:$320=($150)+$0–ErrorinCOGSErrorinCOGS=($470).Therefore,COGSasreportedisunderstated$470.CorrectCOGS=$2,675+$470=$3,145Therestatedincomestatementsfollow.200320022001Sales$12,583$11,078$11,543Costofgoodssold3,1451,5272,660Grossprofit$9,438$9,551$8,883Expenses7,3476,1936,603Netincome$2,091$3,358$2,280P7–4a.CostofGoodsAvailableforSale=CostofGoodsinBeginningInventory+CostofGoodsPurchased=$15,000+(6,000units×$1.30)+(9,000units×$1.50)+(7,000units×$1.60)=$47,500NumberofUnitsAvailableforSale=NumberofUnitsinBeginningInventory+NumberofUnitsPurchased=15,000+22,000=37,000unitsFIFO:

EndingInventory=(7,000units×$1.60)+(4,000units×$1.50)=$17,200CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$47,500–$17,200=$30,300LIFO:EndingInventory=(11,000Units×$1.00)=$11,000CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$47,500–$11,000=$36,500Averaging:CostperUnit=CostofGoodsAvailableforSale÷NumberofUnitsAvailableforSale=$47,500÷37,000Units=$1.284perUnitEndingInventory=NumberofUnitsinEndingInventory×CostperUnit=11,000units×$1.284perunit=$14,124CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$47,500–$14,124=$33,376P7–4ContinuedLumbermansandAssociatesIncomeStatementsFortheYearEndedDecember31,20XXFIFOAveragingLIFOSales$55,000$55,000$55,000Costofgoodssold30,30033,37636,500Grossprofit$24,700$21,624$18,500Otherexpenses15,00015,00015,000Incomebeforetaxes$9,700$6,624$3,500Incometaxes2,9101,9871,050Netincome$6,790$4,637$2,450

b.ByusingLIFOratherthanFIFO,LumbermansandAssociateswouldsave$1,860($2,910–$1,050)intaxes.c.Endinginventoryatmarketvalue=11,000units×$1.35perunit=$14,850Lower-of-cost-or-marketvalue:FIFOAveragingLIFOCost$17,200$14,124$11,000Marketvalue14,85014,85014,850Excessofcostovermarketvalue(cannotbenegative)2,35000FIFOmethod:LossonInventoryWrite-down(Lo,–SE).............................................2,350Inventory(–A).................................................................................2,350AdjustedinventorytoLCM.Averagingmethod:Noentryisnecessary.LIFOmethod:Noentryisnecessary.d.CostofGoodsAvailableforSale=CostofGoodsinBeginningInventory+CostofGoodsPurchased=(15,000units×$1.60)+(6,000units×$1.40)+(9,000units×$1.30)+(7,000units×$1.20)=$52,500NumberofUnitsAvailableforSale=NumberofUnitsinBeginningInventory+NumberofUnitsPurchased=15,000+22,000=37,000unitsP7–4ConcludedFIFO:EndingInventory=(7,000units×$1.20)+(4,000units×$1.30)=$13,600CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$52,500–$13,600=$38,900LIFO:EndingInventory=11,000units×$1.60=$17,600CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$52,500–$17,600=$34,900

Averaging:CostperUnit=CostofGoodsAvailableforSale÷NumberofUnitsAvailableforSale=$52,500÷37,000units=$1.419perunitEndingInventory=NumberofUnitsinEndingInventory×CostperUnit=11,000units×$1.419perunit=$15,609CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$52,500–$15,609=$36,891LumbermansandAssociatesIncomeStatementsFortheYearEndedDecember31,20XXFIFOAveragingLIFOSales$55,000$55,000$55,000Costofgoodssold38,90036,89134,900Grossprofit$16,100$18,109$20,100Otherexpenses15,00015,00015,000Incomebeforetaxes$1,100$3,109$5,100Incometaxes3309331,530Netincome$770$2,176$3,570LIFOgivesrisetothehighestnetincomeinthiscase.UnderFIFO,theoldestcostsflowintoCOGSbeforethemostrecentcosts.UnderLIFO,themostrecentcostsflowintoCOGSbeforetheoldercosts.Undertheaveragingmethod,allthecostsareaveragedtodetermineCOGS.Inthiscase,thecostoftheinventoryisdecreasing,sotheLIFOcostflowassumptionuseslower,newercostsincomputingCOGSthantheothertwomethods.SincetheselowercostsflowintoCOGSunderLIFO,theolder,highercostsflowintoendinginventory.P7–5a.CostofGoodsAvailableforSale=CostofGoodsinBeginningInventory+CostofGoodsPurchased=$35,000+(1,000units×$75)+(3,000units×$80)+(4,000units×$82)=$678,000NumberofUnitsAvailableforSale=NumberofUnitsinBeginningInventory+NumberofUnitsPurchased=500+8,000=8,500unitsUnitsSold=6,000unitsUnitsremaininginInventory=2,500unitsFIFO:EndingInventory=2,500units×$82=$205,000CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory

=$678,000–$205,000=$473,000LIFO:EndingInventory=(500units×$70)+(1,000unitsx$75)+(1,000unitsx$80)=$190,000CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$678,000–$190,000=$488,000Averaging:CostperUnit=CostofGoodsAvailableforSale÷NumberofUnitsAvailableforSale=$678,000÷8,500Units=$79.76perUnitEndingInventory=NumberofUnitsinEndingInventory×CostperUnit=2,500units×$79.76perunit=$199,400CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$678,000–$199,400=$478,600P7–5ContinuedLaundryman’sCorporationIncomeStatementsFortheYearEndedDecember31,20XXFIFOAveragingLIFOSales$900,000$900,000$900,000Costofgoodssold473,000478,600488,000Grossprofit$427,000$421,400$412,000Otherexpenses125,000125,000125,000Incomebeforetaxes$302,000$296,400$287,000Incometaxes90,60088,92086,100Netincome$211,400$207,480$200,900b.ByusingLIFOratherthanFIFO,Laundryman’swouldsave$4,500($90,600–$86,100)intaxes.c.EndinginventoryFIFOAveragingLIFOCost2,500units@$822,500units@$79.76500units@$701,000units@$75

1,000units@$80Market/unit$78$78$78Writedown2,500x($82-$78)2,500x($79.76-$78)1,000x($80-$78)FIFOmethod:LossonInventoryWrite-down(Lo,–SE).............................................10,000Inventory(–A).................................................................................10,000AdjustedinventorytoLCM.Averagingmethod:LossonInventoryWrite-down(Lo,–SE).............................................4,400Inventory(–A).................................................................................4,400AdjustedinventorytoLCM.LIFOmethod:LossonInventoryWrite-down(Lo,–SE).............................................2,000Inventory(–A).................................................................................2,000AdjustedinventorytoLCM.P7–5Concludedd.CostofGoodsAvailableforSale=CostofGoodsinBeginningInventory+CostofGoodsPurchased=$40,000+(1,000units×$78)+(3,000units×$77)+(4,000units×$75)=$649,000NumberofUnitsAvailableforSale=NumberofUnitsinBeginningInventory+NumberofUnitsPurchased=500+8,000=8,500unitsUnitsSold=6,000unitsUnitsremaininginInventory=2,500unitsFIFO:EndingInventory=(2,500units×$75)=$187,500CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$649,000–$187,500=$461,500LIFO:

EndingInventory=(500units×$80)+(1,000unitsx$78)+(1,000unitsx$77)=$195,000CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$649,000–$195,000=$454,000Averaging:CostperUnit=CostofGoodsAvailableforSale÷NumberofUnitsAvailableforSale=$649,000÷8,500units=$76.35perunitEndingInventory=NumberofUnitsinEndingInventory×CostperUnit=2,500units×$76.35perunit=$190,875CostofGoodsSold=CostofGoodsAvailableforSale–EndingInventory=$649,000–$190,875=$458,125Laundryman’sCorporationIncomeStatementsFortheYearEndedDecember31,20XXFIFOAveragingLIFOSales$900,000$900,000$900,000Costofgoodssold461,500458,125454,000Grossprofit$438,500$441,875$446,000Otherexpenses125,000125,000125,000Incomebeforetaxes$313,500$316,875$321,000Incometaxes94,05095,06396,300NetIncome219,450221,812224,700BecauseCostofGoodsSoldisthelowestunderLIFOduetodeflation,LIFOyieldsthehighestnetincomeinthiscase.UnderFIFO,theoldestcostsflowintoCOGSbeforethemostrecentcosts.UnderLIFO,themostrecentcostsflowintoCOGSbeforetheoldercosts.Undertheaveragingmethod,allthecostsareaveragedtodetermineCOGS.Inthiscase,thecostoftheinventoryisdecreasing,sotheLIFOcostflowassumptionuseslower,newercostsincomputingCOGSthantheothertwomethods.SincetheselowercostsflowintoCOGSunderLIFO,theolder,highercostsflowintoendinginventory.P7–6a.LIFOcostflowassumption:

(1)1/3Purchases(+A)..............................................................140,000AccountsPayable(+L)............................................140,000Purchasedinventoryonaccount.(2)1/3Cash(+A)......................................................................100,000Sales(R,+SE).........................................................100,000Madecashsales.(3)1/9AccountsReceivable(+A).............................................200,000Sales(R,+SE).........................................................200,000Madesalesonaccount.(4)1/10AccountsPayable(–L)...................................................140,000Cash(–A)................................................................137,200PurchaseDiscount(–A)..........................................2,800*Madepaymenttosupplier._____________*$2,800=$140,000×2%discount(5)1/15Purchases(E,–SE).......................................................248,500Cash(–A)................................................................73,500AccountsPayable(+L)............................................175,000Purchasedinventory.(6)1/19Purchases(+A)..............................................................182,000AccountsPayable(+L)............................................182,000Purchasedinventory.(7)1/23AccountsPayable(–L)...................................................87,500Cash(–A)................................................................85,750PurchaseDiscount(–A)..........................................1,750*Madepaymenttosupplier._____________*$1,750=$87,500×2%discount(8)1/27Purchases(+A)..............................................................112,000Cash(–A)................................................................112,000Purchasedinventoryonaccount.(9)1/28AccountsPayable(–L)...................................................87,500Cash(–A)................................................................87,500Madepaymenttosupplier.

P7–6Continued(10)1/28AccountsPayable(–L)...................................................182,000Cash(–A)................................................................178,360PurchaseDiscount(–A)..........................................3,640*Madepaymenttosupplier._____________*$3,640=$182,000×2%discount(11)1/29Cash(+A)......................................................................360,000Sales(R,+SE).........................................................360,000Madecashsales.(12)1/30AccountsReceivable(+A).............................................300,000Sales(R,+SE).........................................................300,000Madesalesonaccount.(13)1/31Purchases(+A)..............................................................60,000Cash(–A)................................................................60,000Purchasedinventory.(14)1/31Freight-In(+A)...............................................................30,000AccountsPayable(+L)............................................30,000Incurredfreightcostsoninventory.Adjustingentry1/31Inventory(ending)..........................................................393,250*CostofGoodsSold........................................................466,060PurchaseDiscount.........................................................8,190Purchases................................................................742,500Freight-In.................................................................30,000Inventory(beginning)..............................................95,000RecordedCOGSandendinginventory._____________*$393,250=(5,000units×$19.00)+(7,000units×$20.60)+(6,000units×$25.675)Theunitcostsusedtocalculatethe$393,250weretakenfromthefollowingtable.DateNumberofUnitsUnitCostUnitFreightaUnitDiscountTotalUnitCostBeg.Inv.5,000$19.00$0.00$0.00$19.001/37,00020.001.000.4020.601/1510,00024.85b1.000.175c25.6751/197,00026.001.000.5226.481/274,00028.001.000.0029.001/312,00030.001.000.0031.00__________________a$1.00=$30,000freightbill÷30,000unitspurchasedb$24.85unitcost=[(3,000×$24.50)+(7,000×$25.00)]÷10,000unitsc$0.175unitdiscount=Totaldiscountof$1,750÷10,000units

P7–6Concludedb.FIFOcostflowassumption:AllentriesthroughoutJanuarywouldbeidenticalundertheFIFOandLIFOcostflowassumptionsusingtheperiodicmethod.TheonlydifferencewouldbeintheadjustingentrytorecordCOGSandendinginventory.Adjustingentry1/31Inventory(ending)........................................................491,735*CostofGoodsSold......................................................367,575PurchaseDiscount.......................................................8,190Purchases................................................................742,500Freight-In.................................................................30,000Inventory(beginning)..............................................95,000RecordedCOGSandendinginventory._________*Thecomputationsforendinginventoryarebaseduponthetableusedinpart(a)$491,735=(2,000units×$31.00)+(4,000units×$29.00)+(7,000units×$26.48)+(5,000units×$25.675)P7–7a.CurrentAssets÷CurrentLiabilities=CurrentRatioFIFO$8,965a÷$13,448=.67LIFO8,377b÷13,448=.62Decrease.05_____________a$5,458=$5,377incash+$3,588ininventoryb$4,863=$5,377incash+$3,000ininventoryb.FIFOLIFOSales$41,862$41,862Costofgoodssold:Beginninginventory$3,303$3,303Purchases12,46112,461Costofgoodsavailable$15,764$15,764Endinginventory3,5883,000Costofgoodssold12,17612,764Grossprofit$29,686$29,098Expenses19,37819,378Incomebeforetaxes$10,308$9,720Incometax3,1112,916Netincome$7,197$6,804Changeingrossprofit=$29,686–$29,098=$588Changeinnetincome=$7,197–$6,804=$393c.Taxdollarssaved=$3,111–$2,916=$195

P7–7Concludedd.UsingLIFOcanhaveseveraldisadvantages.First,LIFOrequiresacompanytomaintainrecordsforolderinventoryacquisitions.Thispracticeusuallyresultsinhigherbookkeepingcosts.Second,toavoid"eatinginto"aLIFOlayer,whichwouldresultinolder,lowerinventorycostsflowingintoCOGSandraisingthecompany"snetincomeandassociatedtaxliability,managersmaypurchaseinventoryatatimeoratacostthatisnotadvantageoustothecompany.Third,LIFOcanadverselyaffectacompany"sand/ormanager"scontracts.Acompany"sdebtcovenantsmaystipulateaminimumcurrentratio,orlevelofworkingcapital.ThesebothwouldbelowerunderLIFOthanunderFIFO(assuminginflation).Also,usingLIFOreducesnetincomeduringinflationaryperiods.Ifamanagerhasanincentivecontractlinkedtonetincome,themanager"scompensationwoulddecrease.Finally,thelowernetincomeachievedunderLIFOmaymisleadcurrentandpotentialinvestorsintobelievingthatthecompanyisperformingpoorly(althoughsomecurrentresearchindicatesthatthislastpointisnotlikely).P7–8a.EndingInventory,12/31/2005:LIFOlayers:19924,000unitsx$5perunit=$20,000b.RuheAutoSuppliesIncomeStatementFortheYearEndedDecember31,2005Revenue..............................................................................$3,000,000Costofgoodssold:Beginninginventory........................................................$112,500Purchases......................................................................902,500aCostofgoodsavailableforsale.....................................$1,015,000Endinginventory.............................................................20,000bCostofgoodssold.........................................................995,000Grossprofit..........................................................................$2,005,000Operatingexpenses............................................................800,000Incomebeforeincometaxes...............................................$1,205,000Incometaxes.......................................................................361,500Netincome..........................................................................$843,500___________a$902,500=9,500unitspurchasedduring2005×$95perunitb$20,000=4,000unitsfrom1989×$5perunitThecompany"sincometaxliabilityis$361,500,anditsnetincomeis$843,500.P7–8Concludedc.

Revenue..............................................................................$3,000,000Costofgoodssold:Beginninginventory........................................................$112,500Purchases......................................................................1,900,000aCostofgoodsavailableforsale.....................................$2,012,500Endinginventory.............................................................112,500bCostofgoodssold..........................................................1,900,000Grossprofit..........................................................................$1,100,000Operatingexpenses............................................................800,000Netincomebeforetaxes.....................................................$300,000Incometaxes.......................................................................90,000Netincome..........................................................................$210,000___________a$1,900,000=(9,500units+10,500units)×$95perunitb$112,500=(14,000units×$5)+(500units×$85)Purchasinganadditional10,500unitsofinventoryonDecember31,2005wouldcostRuheAutoSupplies$997,500.Byincurringthesecosts,thecompanywouldsaveonly$271,500intaxes(i.e.,$361,500frompart[b])–$90,000).Soonthefaceofit,itappearsthatitwouldnotbeawisedecisiontoacquiretheseadditionalunitsofinventory.However,ifRuheAutoSupplieswasplanningtoacquireadditionalinventoryearlyin2006anyway,thenitmightnotbeabaddecisiontoacquiretheinventoryattheendof2005tolowerthecompany"staxes.P7–9a.Brady’s2005reportedincomeunderLIFO......................................$42,700aLIFOLayerLiquidationduring2005(netofincometaxes)..............–5,200FIFOBasedNetIncomeAfterTaxes...............................................$37,500a=$8,000x(1-.35)=$5,200,aftertaximpactofnolifoliquidationduring2005.Bradyhasgonefromreportinghighernetincometohavinglowernetincome.b.RestatementofBrady’s2005reportedincome,ifithadalwaysbeenaFIFOuser,canbecomputedasfollows:Brady’s2005reportedincomeunderLIFO....................................$42,700aDecreaseinLIFOReserve(netofincometaxes)..........................–845bLIFOLayerLiquidationduring2005(netofincometaxes)............–5,200FIFOBasedNetIncomeAfterTaxes.............................................$36,655a=($4,800–$3,500)×1–.35)=$845b=$8,000×(1–.35)=$5,200Accordingtotheanalysisgivenabove,Brady’srestatedreportedincomeis$36,655whichislowerthanDanner’sreportednetincome.ThereasonBrady’sincomeunderFIFOislowerthanunderLIFOisduetothedeclineintheLIFOreserveandLIFOlayerliquidation.P7–9Concludedc.Asoftheendof2005BradyhadaLIFOreserveof$3,500.ALIFOreserveshowstheaccumulatedbenefitderivedfromtheLIFOmethod.DuetotheadoptionofLIFOBrady

reduceditscumulativepre-taxincomeby$3,500.Inotherwords,Bradysavedtaxesworth$3,500×.35=$1,225duetoitschoiceofLIFO.Asoftheendof2004,duetoLIFOadoption,Brady’scumulativenetincomedecreasedby$4,800onapre-taxbasis.Therelatedtaxsavingswere$4,800×.35=$1,680.TheimpactofaLIFOliquidationshowsthatadoptionofLIFOdoesnotnecessarilysavetaxesinallyears.LIFOhasadverseeffectswhenthelayerliquidationoccurs.d.FromanincometaxpointitisnotadvisableforBradytochangeitscostflowassumption.Ifitdidso,itwouldhavetopaytaxesonthe$3,500ofadditionalincomethatwouldbecreatedbyeliminatingtheLIFOreserve.However,ifthecompanywishestoreporthigherincome,thechangemaybedesirable.P7–10a.andb.IBTIncomeStatementsFortheYearEndedDecember31,2005Part(a)Part(b)Sales........................................................$67,500$67,500Costofsales............................................17,700a27,000bGrossprofit..............................................$49,800$40,500Otherexpenses.......................................20,00020,000Income(loss)beforetaxes......................$29,800$20,500Incometaxes...........................................8,9406,150Netincome(loss)....................................$20,860$14,350____________a$17,700=(350units×$30)+(200units×$15)+(350units×$12)b$27,000=(900units×$30)c.Theprimaryadvantageofpurchasingtheadditional550unitsonDecember20istheeffectonincometaxes.Underpart(a),IBTwouldhavetopay$8,940inincometaxes.However,underpart(b),IBTwouldhavetopayonly$6,150inincometaxes.Sothenetdifferencebetweentheincomestatementsofparts(a)and(b)is$2,790intaxessaved.Sinceincometaxesrepresentacashflow,thestrategyofacquiringtheadditional550unitswouldsaveIBT$2,790incashfromincometaxes.Thistaxsavingsisnotwithoutacosthowever.Toobtainthesavings,IBThadtopurchase550additionalunitsfor$16,500.IfIBTwasplanningonacquiringatleast550unitssometimeinthenearfuture,thenthecostofthetaxsavingsisnot$16,500,butisratherthereturnlostonanalternativeuseofthe$16,500.IfIBTwasnotplanningonacquiringadditionalinventory,thenthecostofobtainingthetaxsavingswouldbetheentire$16,500plustheopportunitycostofnotinvestingthe$16,500.ISSUESFORDISCUSSIONID7–1Ifinvestorsaresolelyinterestedinnetincome,thenthepartnerisprobablycorrect,andcompaniesshouldselectFIFOiftheywanttoraisecapital.However,thisviewisprobablynot

valid.Onemustrememberthatnetincomeissimplyameasurement;onemustnotlosesightofwhataccountantsaremeasuring.Netincomeisonlyvaluableifittrulyrepresentsanincreaseinthecompany"snetassets.FIFOwillresultinhigherreportedincome,butthehigherincomeisanillusion.Thatis,theincreasedincomeunderFIFOisduetothedifferencebetweentheinventory"scurrentmarketvalueandtheolder,"understated"inventorycostsmatchedagainstit.ThisiswhyFIFOresultsin"paperprofits."Alternatively,LIFOmatchesthemostrecent,higherinventorycostsagainstrevenue,whichprovidesahigherqualitymeasureofthecompany"sunderlyingeconomiccondition.Inaddition,thereducedincomeunderLIFOimplieslowertaxes.Thelowertaxes,inturn,providecashthatthecompanycanplowbackintothebusinesstoimproveoperations.Thus,althoughLIFOresultsinlowerreportedincome,LIFOprovidesahigherqualitymeasureofincomeandresultsinlowertaxes.ID7–2a.ThechoiceofLIFOorFIFOwillaffecttheamountsacompanyreportsbothinitsbalancesheetforinventoryandinitsincomestatementforcostofgoodssold(andconsequentlynetincome).Thus,inordertoevaluateacompany"sfinancialpositionandperformance,particularlyincomparisonwithothercompanies"performances,investorsandcreditorsneedtoknowwhichcost-flowassumptionthecompanyisusing.Inaddition,thechoiceofLIFOorFIFOcanhavealargeeffectonthecompany"scashflows.Ifinventorycostsarerising,acompanywillhavelowertaxableincome—andhencelowercashoutflowsfortaxes—ifitusesLIFOthanifitusesFIFO.Forsomecompaniesthedifferencecanbeseveralmilliondollarsayearintaxsavings.b.UnderLIFO,thecostoftheinventorysoldisassumedtobethecostoftheinventorypurchasedmostrecently.Thisimpliesthatthecostoftheinventorystillonhandisassumedtobethecostofinventorypurchasedlongago.Ifinventorycostsarerising,onewouldexpectthecostsassignedtotheinventorystillonhandtobeverylowrelativetothemostrecentinventorycosts.Ifacompanysellsmoreinventorythanitacquiresduringtheyear,thecompanywillhavetodipintothoseolderinventorycosts(i.e.,liquidateLIFOlayers)whencalculatingthecostofinventorysoldduringtheyear.Becausethoseoldercostsareless—insomecasesmuchless—thanthemostrecentinventorycosts,aLIFOliquidationwillresultinCostofGoodsSoldbeinglessthanitwouldhavebeenintheabsenceoftheLIFOliquidation.Thismeansthatthecompany"sincomewillbemuchgreaterwhich,inturn,implieshighertaxpayments.Thus,investorswouldbeinterestedinLIFOliquidationsbecausetheyhaveimplicationsfortheamountofcashthecompanywillhavetopayoutintaxes.c.Accordingtothefootnote,Deere’s2003endinginventoryunderFIFOwouldbe$950millionmorethanunderLIFO.Therefore,COGSunderFIFOwouldbelowerbythesameamountandnetincomebeforetaxhigherbythesameamount.Basedona35%taxrate,therefore,Deerewouldhavetopayanadditionalincometaxof$332.5($950×.35).ID7–3Intimesofrisinginventorycosts,LIFOallowscompaniesto"hide"thevalueoftheirinventory.Thatis,theinventoryvaluereportedonthebalancesheetisassumedtoconsistof"old"inventorycosts;themostrecentcostsofinventoryareallocatedtocostofgoodssold.However,theinventoryisreallyworthitscurrentmarketvalue.Thus,thedifferencebetweenthe"old"inventorycostsandthecurrentmarketvaluerepresentsa"hiddenreserve"ofprofits.By

manipulatingitsinventoryacquisition,acompanycandipintothisreserveandincreaseitsreportedincome.ID7–4a.LossonInventoryWrite–down(Lo,–SE)................................12,000,000Inventory(–A).....................................................................12,000,000Wrotedowninventorytomarketvalue.b.Period1LossonInventoryWrite–down(Lo,–SE)................................12,000,000Inventory(–A).....................................................................12,000,000Wrotedowninventorytomarketvalue.Period2AccountsReceivable(orCash)(+A).......................................48,000,000SalesRevenue(R,+SE)....................................................48,000,000Soldinventory.CostofGoodsSold(E,–SE)...................................................40,000,000Inventory(–A).....................................................................40,000,000Recordedcostofgoodssold.c.Becausethelower-of-cost-or-marketrulegivesdifferentialtreatmenttopricedecreasesandpriceincreases,andbecauseitforcestherecognitionoflossesbeforetheyarerealized,itmayprovideinconsistentmeasuresofnetincome.However,suchconservativeaccountingtreatmentsareemployedinresponsetotheliabilityfacedbythosewhoprovideandauditfinancialstatements.Thecostsassociatedwithunderstatinginventoriesandprofitsaretypicallylessthanthepotentialcostsofoverstatingthem.ID7–5a.Valeroisusingthelowerofcostormarketexceptiontothehistoricalcostprinciplethatisappliedtoinventory.Ifthemarketvalueofinventoryislowerthanthecostofthatinventory,itmustbewrittendowntothelowervalue.b.Thewrite-downwilllowerreportedincome,currentassetsandtheequityofValero.

c.Valero’scurrentratiowilldecreasebecauseinventorywillbecarriedatalowervalue,whichlowerscurrentassets,whilethereisnochangetocurrentliabilities.Valero’sinventoryturnoverratiowillincreasebecauseaverageinventoryfortheyearwillbelower.d.ByreducingthecarryingvalueofinventoryValeroisreducingearningsinthecurrentquarter.AsthisinventoryissoldinfutureperiodsValerowillreporthigherearningsthanitwouldhavewithnowrite-down.Valero’sreportingstrategycouldbetoeitherlowerthisquarter’searningsbecauseitproducedgreaterearningsthanitanticipated,orValerocouldbetryingtotakealargelossthisquarterinordertobeabletoreportbetterearningsinfuturequarters.ID7–6a.IfSherwinWilliamsreportedinventoriesattheendof2003basedonaFIFOsystem,theendinginventorybalancewouldhavebeen$734,828($638,237+$96,591).b.TheLIFOliquidationhadtheeffectofincreasingnetincomeforSherwinWilliamsin2002.Theamountoftheincreaseinnetincomeattributabletotheinventoryreductionwas$8,088.Thereasonthatyouhaveajumpinincomeisthat,fromanaccountingvaluationstandpoint,Sherwinhassoldsomeinventorythatwasactuallyacquiredinpreviousyearsatalowercost.Soineffectyouarematchingthisyear’ssalespriceforthoseproductsagainstthecostforthoseproductsfrompreviousyears.c.ThefollowingwerethetaxeffectstoSherwinWilliamsasaresultofusingLIFO.200120022003Increase/(decrease)innetincomeduetoLIFO(1,567)8,088(2,213)Pretaxeffectonnetincome(effect/(1-taxrate))(2,487)12,838(3,513)Increase/(decrease)intaxliability($920)$4,750($1,300)d.ALIFOinventorysystemoperatesonthepremisethatinventorythatissoldistheinventorythatwasmostrecentlypurchasedandthereforereflectsthemostcurrentpricesfortheinventory.Bytakingthisapproach,thisgivesthebestindicationastothefutureearningspotentialofthecompany.Thisisparticularlytrueduringperiodsofinflationwherethecostofinventorycouldincreasedramaticallyinshortperiodsoftime.ALIFOinventorymethodmostcloselyapproximatestheearningspowerofbuyinganewunitofinventorytodayandsellingitinthemarketplacetoday.Intimesofdeflation,LIFOstilldoesabetterjobofmatchingcurrentcostswithcurrentrevenues.ID7–7a.Theentrytorecordthediscardingorobsolescenceofinventorywouldbeasfollows:InventoryObsolescenceXXXXInventoryXXXX

Inventoryobsolescenceisanincomestatementaccountthatgoesintothecalculationofcostofgoodssold.Iftheamountismaterialthenitprobablyshouldbediscussedinthefootnotestothefinancialstatements.b.Aperpetualinventorysystemforcesthecompanytofocusoneveryitemthatexistsininventory.Onarealtimebasisthecompanywouldknowitsinventorylevelsforeachproductandhopefullythiswouldhelptopreventbuyingtoomuchofanyoneproduct.Inaperiodicsystemthecompanymayonlylookatsomeitemsininventoryonceayear,whenthephysicalinventoryistaken.Preventingoratleastmanagingtheproblemduringtheyearmayproduceabetterresultthanwaitinguntiltheendoftheyeartorecognizethatthereisaproblem.ID7–8Theentriesonthestatementofcashflowsareintendedtoshowtheimpactoncashofthechangesinthevariousbalancesheetaccounts.Achangeinanassetaccountimpactsthestatementofcashflowsbecauseiftheassetaccountincreaseditreducedtheamountofcash,andiftheassetaccountdecreasedthenitincreasedcash.Toincreasetheinventoryaccountthecompanyhastogooutandbuyinventory,whichreducescash.Ifthecompanysoldmoreinventorythanitpurchasedthenthiswouldincreasetheamountofcashinthecompany.Thisdatarevealsthatattheendof2001J.C.Penneyhad$348lessinventorythanitdidattheendof2000.Attheendof2002J.C.Penneyhad$43lessinventorythanithadattheendof2001andattheendof2003J.C.Penneyhad$100moreinventoryonhandthanattheendof2002.Sinceinventoryisanassetaccount,ifthenetchangeincreasedtheamountofcashinthecompanythentheassetaccountwasreduced,andifthenetchangedecreasestheamountofcashonhandthentheassetaccountroseduringtheyear.ID7–9a.SupervaluhasamuchlargerdifferencebetweenLIFOandFIFOinventoriesthandoesJ.C.Penney.Supervalu’sLIFOReserveof$135.8isover12%ofthevalueoftheinventory,whilePenney’sLIFOReserveisalittleof1%ofthetotal.b.Supervalu:LIFOInventory$1,078+$135.8=$1,213.8FIFOInventoryJ.C.Penney:LIFOInventory$3,156+$43=$3,199FIFOInventoryc.Assumingataxrateof30%,thebenefitwouldbe:Supervalu:.30x$135.8=$40.7J.C.Penney:.30x$43=$12.9d.AgrocerystoresuchasSupervaluemightadoptFIFOfor“highlyconsumable”itemssuchasmilkandproduceduetotheperishablenatureoftheinventory.Mostgrocerystoreswillsellthegallonsofmilkthatareclosesttotheexpirationdatebeforetheyputthemorerecentlypurchasedmilkontheshelf.TheadoptionofFIFO,inthiscase,morecloselymatchestheactualphysicalflowoftheinventory.

ID7–10a.Asof2/1/2004inventorywasthesecondlargestaccountforHomeDepot.Inventorywasover26%ofthetotalassetsofHomeDepot,versusnearly28%attheendof2003.Thereforetherewasanslightdecreasein2004,relativetootherassets.b.Wearenotprovidedbalancesheetinformationfor2002,sowecannotfigureoutaverageaccountspayablefor2003.However,usingtheaccountspayablebalances(withoutaveragingthem)indicatesthatHomeDepotispayingslightlyslowerin2004versustheprioryear.DaysonHandforAccountsPayablewas41daysin2002andincreasedto43daysin2003.c.Perfootnote#1HomeDepotstatesthatitusestheFIFOmethodprimarily.HomeDepotemploystheLIFOmethodforapproximately7%ofitsinventory,mainlyatsubsidiariesanddistributioncenters.Additionalinformationisnotprovidedduetothecompany’sselectionofFIFO.d.Additionalinformationrequiredtocalculatetheeffectontheincomestatementisnotprovidedduetothecompany’sselectionofFIFO.e.Intimesofinflation,employingtheFIFOmethodwillgiveacompanylowerinventoryexpensesandthereforehigherprofits.UsingtheLIFOmethod,inthesamecircumstances,wouldincreaseinventoryexpenses,lowerprofits,andthereforelowertaxes.IfHomeDepotismotivatedbyreducingitstaxes,andifthecompanyanticipatescontinuedinflationinthecostofitsinventories,switchingtoLIFOwouldbenefitthecompany.If,however,thecompanyismotivatedbyshowinghigherearnings,switchingtoLIFO(ininflationarytimes)wouldlowerprofits(althoughtaxsavingswouldsomewhatoffsetthisdrop).HomeDepothasbeenagrowthcompany,financingmuchofitsexpansionwithequityissuances.Stockpricescanbeinfluencedbyearnings,whichmightpointtothecompany’smotivation.Ifthecompanyanticipatesfundingfuturegrowthwithadditionalequityissuances,keepingearningshigh(throughtheFIFOmethod)mightcontributetoahigherstockpriceandthereforegreaterproceedsfromstocksales.'

您可能关注的文档

- C++第5章习题解答.doc

- chapter 1-4《单片机基础》练习题及答案.doc

- C语言程序设计教程(第三版)课后习题参考答案 张敏霞版.doc

- C语言课后习题答案.doc

- c语言课后答案.doc

- HR课后习题答案.doc

- Java基础入门习题答案.doc

- mba fa 《financial accounting》 习题答案10.pdf

- mba fa 《financial accounting》 习题答案2.pdf

- _fa_《financial_accounting》_习题答案7.pdf

- SQL Server 2008主教材第1~13章主教材习题答案.doc

- VB程序设计教程课后答案.doc

- VB程序设计课后习题答案.doc

- w-《大地测量学基础》复习题及参考答案.doc

- Zhujiao037_《电机学(高起专)》习题答案.doc

- ★《传播学教程》课后题答案.doc

- 《2007考研专业课管理学习题集及详细参考答案》.doc

- 《3G技术》复习习题有答案.doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明