- 124.88 KB

- 2022-04-22 11:20:01 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

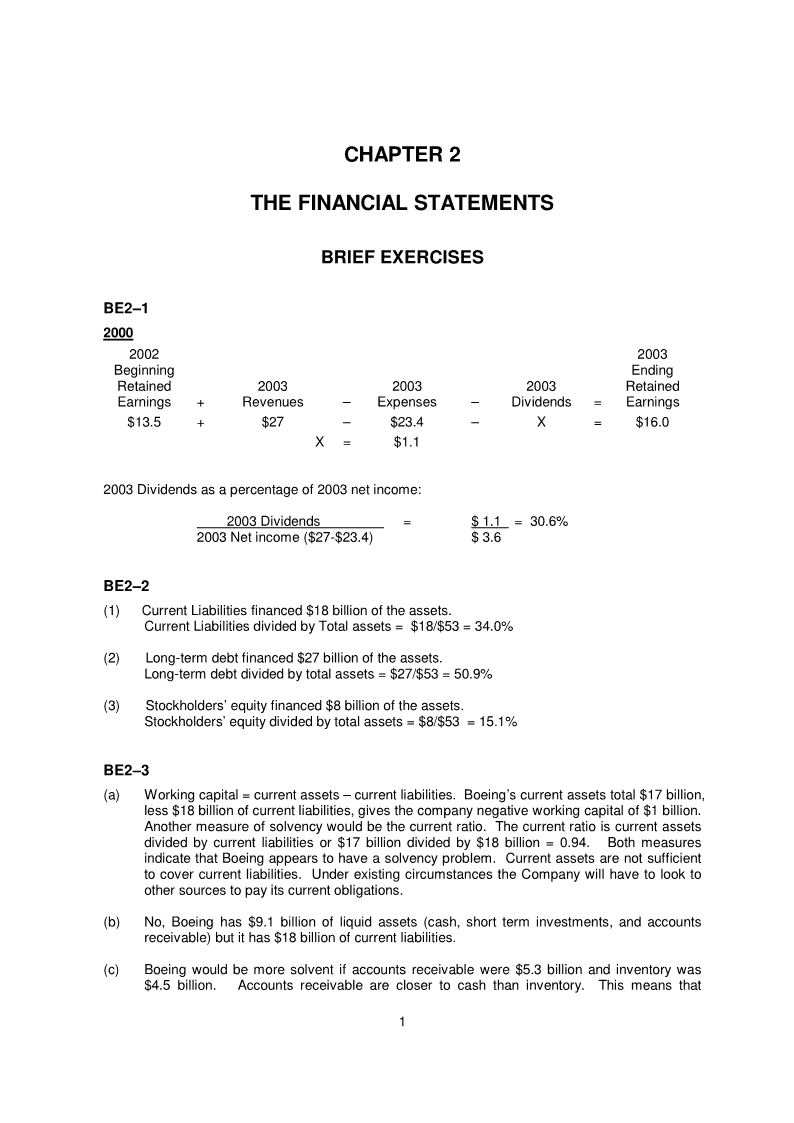

'CHAPTER2THEFINANCIALSTATEMENTSBRIEFEXERCISESBE2–1200020022003BeginningEndingRetained200320032003RetainedEarnings+Revenues–Expenses–Dividends=Earnings$13.5+$27–$23.4–X=$16.0X=$1.12003Dividendsasapercentageof2003netincome:2003Dividends=$1.1=30.6%2003Netincome($27-$23.4)$3.6BE2–2(1)CurrentLiabilitiesfinanced$18billionoftheassets.CurrentLiabilitiesdividedbyTotalassets=$18/$53=34.0%(2)Long-termdebtfinanced$27billionoftheassets.Long-termdebtdividedbytotalassets=$27/$53=50.9%(3)Stockholders’equityfinanced$8billionoftheassets.Stockholders’equitydividedbytotalassets=$8/$53=15.1%BE2–3(a)Workingcapital=currentassets–currentliabilities.Boeing’scurrentassetstotal$17billion,less$18billionofcurrentliabilities,givesthecompanynegativeworkingcapitalof$1billion.Anothermeasureofsolvencywouldbethecurrentratio.Thecurrentratioiscurrentassetsdividedbycurrentliabilitiesor$17billiondividedby$18billion=0.94.BothmeasuresindicatethatBoeingappearstohaveasolvencyproblem.Currentassetsarenotsufficienttocovercurrentliabilities.UnderexistingcircumstancestheCompanywillhavetolooktoothersourcestopayitscurrentobligations.(b)No,Boeinghas$9.1billionofliquidassets(cash,shortterminvestments,andaccountsreceivable)butithas$18billionofcurrentliabilities.(c)Boeingwouldbemoresolventifaccountsreceivablewere$5.3billionandinventorywas$4.5billion.Accountsreceivableareclosertocashthaninventory.Thismeansthat1

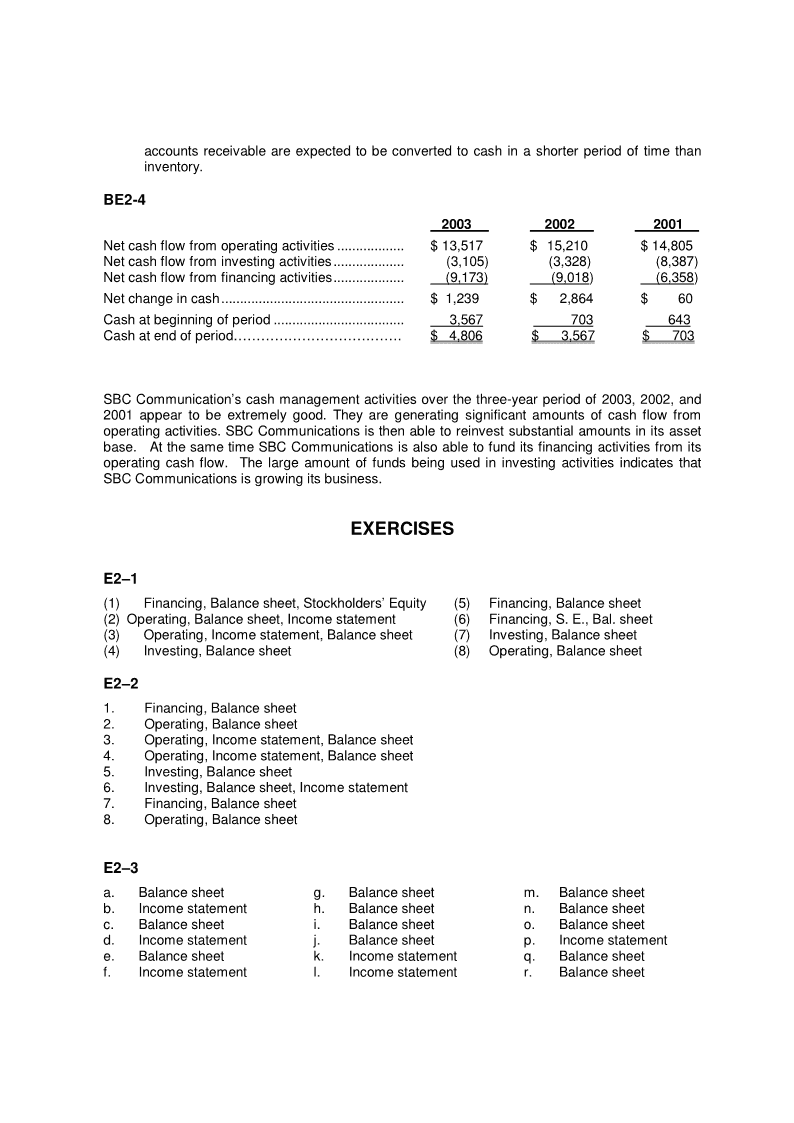

accountsreceivableareexpectedtobeconvertedtocashinashorterperiodoftimethaninventory.BE2-4200320022001Netcashflowfromoperatingactivities..................$13,517$15,210$14,805Netcashflowfrominvestingactivities...................(3,105)(3,328)(8,387)Netcashflowfromfinancingactivities...................(9,173)(9,018)(6,358)Netchangeincash.................................................$1,239$2,864$60Cashatbeginningofperiod...................................3,567703643Cashatendofperiod……………………………….$4,806$3,567$703SBCCommunication’scashmanagementactivitiesoverthethree-yearperiodof2003,2002,and2001appeartobeextremelygood.Theyaregeneratingsignificantamountsofcashflowfromoperatingactivities.SBCCommunicationsisthenabletoreinvestsubstantialamountsinitsassetbase.AtthesametimeSBCCommunicationsisalsoabletofunditsfinancingactivitiesfromitsoperatingcashflow.ThelargeamountoffundsbeingusedininvestingactivitiesindicatesthatSBCCommunicationsisgrowingitsbusiness.EXERCISESE2–1(1)Financing,Balancesheet,Stockholders’Equity(5)Financing,Balancesheet(2)Operating,Balancesheet,Incomestatement(6)Financing,S.E.,Bal.sheet(3)Operating,Incomestatement,Balancesheet(7)Investing,Balancesheet(4)Investing,Balancesheet(8)Operating,BalancesheetE2–21.Financing,Balancesheet2.Operating,Balancesheet3.Operating,Incomestatement,Balancesheet4.Operating,Incomestatement,Balancesheet5.Investing,Balancesheet6.Investing,Balancesheet,Incomestatement7.Financing,Balancesheet8.Operating,BalancesheetE2–3a.Balancesheetg.Balancesheetm.Balancesheetb.Incomestatementh.Balancesheetn.Balancesheetc.Balancesheeti.Balancesheeto.Balancesheetd.Incomestatementj.Balancesheetp.Incomestatemente.Balancesheetk.Incomestatementq.Balancesheetf.Incomestatementl.Incomestatementr.Balancesheet

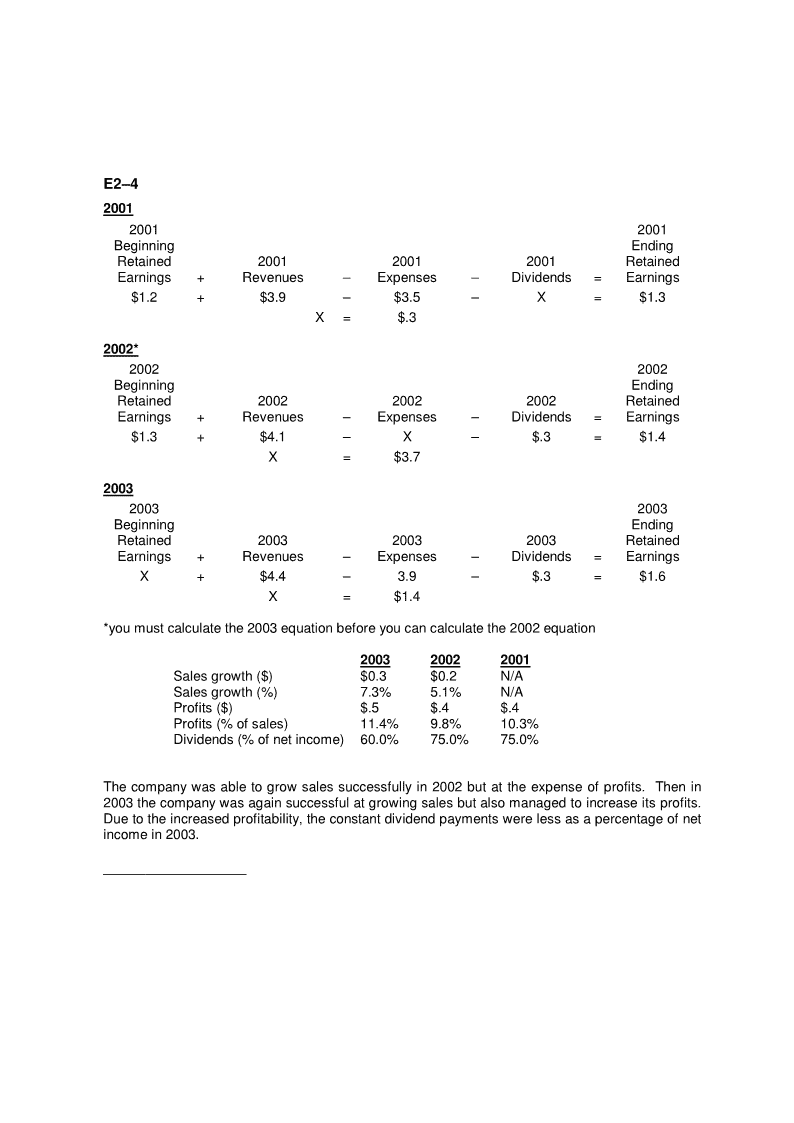

E2–4200120012001BeginningEndingRetained200120012001RetainedEarnings+Revenues–Expenses–Dividends=Earnings$1.2+$3.9–$3.5–X=$1.3X=$.32002*20022002BeginningEndingRetained200220022002RetainedEarnings+Revenues–Expenses–Dividends=Earnings$1.3+$4.1–X–$.3=$1.4X=$3.7200320032003BeginningEndingRetained200320032003RetainedEarnings+Revenues–Expenses–Dividends=EarningsX+$4.4–3.9–$.3=$1.6X=$1.4*youmustcalculatethe2003equationbeforeyoucancalculatethe2002equation200320022001Salesgrowth($)$0.3$0.2N/ASalesgrowth(%)7.3%5.1%N/AProfits($)$.5$.4$.4Profits(%ofsales)11.4%9.8%10.3%Dividends(%ofnetincome)60.0%75.0%75.0%Thecompanywasabletogrowsalessuccessfullyin2002butattheexpenseofprofits.Thenin2003thecompanywasagainsuccessfulatgrowingsalesbutalsomanagedtoincreaseitsprofits.Duetotheincreasedprofitability,theconstantdividendpaymentswerelessasapercentageofnetincomein2003._________________

E2–520012001EndingRetainedEarnings2001BeginningRetainedEarningsor=+Revenuesfor20012002BeginningRetainedEarnings–Expensesfor2001–Dividendsfor2001($523)=($499)+$1,383–X–$0X=$1,407Expensesfor2001are$1,407.2002($758)=($523)+$1,522–$1,608–XX=$149Dividendsdeclaredfor2002are$149.2003($596)=($758)+X–$1,550–$5X=$1,717Revenuefor2003is$1,717.200120022003Salesgrowth(%)...................................................N/A10.0%12.8%Profits.....................................................................($24)($86)$167Profitsasapercentageofsales.............................(1.7%)(5.7%)9.7%Dividends................................................................$0$149$5Dividendsasapercentageofnetincome..............N/AN/A3.0%Theadvertisingagencyhadmodestsalesgrowthfrom2001to2003.However,from2002to2003,theCompanywasabletogofromlossestoaprofit.EventhoughtheCompanyhadalossin2002theCompanypaidahealthydividend.Thenin2003,whentheCompanyshowedaprofit,itvirtuallyeliminatedthedividend.Thereisreasontobeoptimisticgoingforward.In2003theCompanywasabletoshowanicegrowthinitssaleswhileatthesametimeshowingareductioninitsexpenses.

E2–6Solvencyprimarilyindicatesacompany’sabilitytomeetitsdebtpaymentsastheycomedue.Currentliabilitiesareobligationsthatwillbesettledwithinoneyearorthecompany’soperatingcycle,whicheverislonger,throughtheuseofcurrentassetsorthecreationofnewcurrentliabilities.Currentassetsarethoseassetsthatwillbeconsumedorconvertedtocashwithinoneyearorthecompany’soperatingcycle,whicheverislonger.Consequently,comparingcurrentassetstocurrentliabilitiesprovidesanindicationofacompany’sabilitytomeetitsshort-termdebts.Inthiscase,currentassetswere3.16and2.96timesgreaterthancurrentliabilitiesasofDecember31,2003andDecember31,2002,respectively.Althoughcomparingcurrentassetstocurrentliabilitiesprovidesameasureofacompany’ssolvency,thismeasureisnotperfect.Atruetestofacompany’sshort-termsolvencywouldbetocomparethecashvalueofitscurrentassetstothecashvalueofitscurrentliabilities.Forcurrentliabilities,thebookvalueisusuallyagoodapproximationofthecashvalue,sinceacompanycannot,fromalegalviewpoint,unilaterallychangeitsdebts.Thesituationisdifferentforcurrentassetsthough.Thebookvaluemayormaynotbearanyrelationtothecashvalue.Consequently,comparingthebookvalueofcurrentassetstocurrentliabilitiesmaynotgiveanaccuratemeasureofacompany’ssolvency.E2–7Method1Method2Workingcapitalasof12/31/2003($680–$215)..........................................................$465$465Impactofmethodoncurrentassets.......................00Impactofmethodoncurrentliabilities...................(300)0NewworkingcapitalasofJanuary2004................$165$465Itseemsthatonlymethod2wouldbeacceptabletothecompanyintermsofmaintainingtheworkingcapitalcovenant.E2–8200320022001Beginningcashbalance.........................................$9,484$Y*$4,234Netcashflowfromoperatingactivities..................5,240X6,392Netcashflowfrominvestingactivities...................(5,436)(807)XNetcashflowfromfinancingactivities...................X(1,169)1,250Endingcashbalance..............................................$3,925$9,484$4,873Xequals.............................................................$(5,363)$6,587$(7,003)*Beginningcashbalancefor2002=Endingcashbalancefor2001.CiscoSystems’cashmanagementactivitiesoverthethree-yearperiodof2001,2002,and2003appeartobestrong.TheCompanyisgeneratingasignificantamountofnetcashflowfromoperationseachyearandthenisinvestinginitsbusiness.In2003Cisco’scashbalancesdecreasedduetoheavyinvestingandfinancingactivities.TheCompanyeitherrepaiddebtorreturnedcashtoitsshareholders.

E2–9200320022001Beginningcashbalance.........................................$Z**$2,280$XNetcashflowfromoperatingactivities..................1,3365201,485Netcashflowfrominvestingactivities...................X(603)(998)Netcashflowfromfinancingactivities...................(48)X1,270Endingcashbalance..............................................$1,865$1,815$Y*Xequals.............................................................$(1,238)$(382)$523*2002Beginningbalance=2001Endingbalance**2003Beginningbalance=2002Endingbalance.SouthwestAirlines’cashmanagementactivitiesappeartobeverygoodfortheyears2001,2002and2003.Thecompanyisconsistentlygeneratinganetcashinflowfromitsoperatingactivities.Alookatitsinvestingactivitiesrevealsthatthecompanyisexpandingitsassetbase,probablyforgrowth.During2002and2003,thecompanyapparentlyhadacashoutflowduetofinancingactivities,possiblyinpayingoffdebtorreturningcashtoshareholders.Overall,SouthwestAirlinesseemstobedoingreasonablywellinitscashmanagementactivities.E2–10Lana&SonStatementofCashFlowsFortheYearEndedCashflowsfromoperatingactivities:Cashcollectionfromservicesprovided.......................................$4,000Cashpaymentforexpenses........................................................(3,000)Netcashincrease(decrease)fromoperatingactivities........$1,000Cashflowsfrominvestingactivities:Purchaseofmachinery.................................................................$(3,000)Netcashincrease(decrease)frominvestingactivities.........(3,000)Cashflowsfromfinancingactivities:Proceedsfromstockholders’contributions..................................$7,000Paymentofdividends...................................................................(1,500)Netcashincrease(decrease)fromfinancingactivities.........5,500Increase(decrease)incashbalance.................................................$3,500Beginningcashbalance.....................................................................13,000Endingcashbalance..........................................................................$16,500Basedonjustoneyear’sstatementofcashflowsitisdifficulttocommentadequatelyonLana&Son’scashmanagementactivities.However,onecanobservethatmostofthecashduringtheyearwasgeneratedasaresultofissuingequity.Thecompanyseemstobeinvestinginitsassetbase.Thatwillcertainlyhelpitgrowinthefuture.Cashflowsfromoperationsispositive,whichcertainlyisagoodsign.E2–11EmoryInc.StatementofCashFlowsFortheYearEnded

Cashflowsfromoperatingactivities:Cashcollectionfromservicesprovided.......................................$40,000Cashpaymentforexpenses........................................................(23,000)Netcashincrease(decrease)fromoperatingactivities........$17,000Cashflowsfrominvestingactivities:Purchaseofequipment................................................................$(23,000)Netcashincrease(decrease)frominvestingactivities.........(23,000)Cashflowsfromfinancingactivities:Proceedsfromthebankloan.......................................................$30,000Paymentofdividends(24,000)Netcashincrease(decrease)fromfinancingactivities.........6,000Increase(decrease)incashbalance.................................................$0Beginningcashbalance.....................................................................25,000Endingcashbalance..........................................................................$25,000Basedonjustoneyear’sstatementofcashflows,itisdifficulttocommentadequatelyonEmory’scashmanagementactivities.However,itseemsthatthecompanyisgeneratingasubstantialportionofitscashflowsfromoperatingactivities.Thecompanyistakingsomeloanstofinanceitsassetbase,whichwouldbehelpfulinthefuture.Returnontotalassetsandreturnonequitywouldprobablyincrease.E2–12George’sBusinessIncomeStatementFortheYearEndedLeaserevenue........................................................................................$3,000Expenses................................................................................................2,500Netincome.............................................................................................$500George’sBusinessStatementofStockholders’EquityFortheYearEndedContributedRetainedCapitalEarningsBeginningBalance$0$0StockIssue6,000NetIncome500CashDividends_____(800)EndingBalance$6,000$(300)E2–12ConcludedGeorge’sBusinessBalanceSheetAsofAssetsCash......................................................................................................$2,700

Land......................................................................................................8,000Totalassets............................................................................................$10,700Liabilities&Stockholders’EquityNotepayable..........................................................................................$5,000Contributedcapital.................................................................................6,000Retainedearnings..................................................................................(300)Totalliabilities&stockholders’equity....................................................$10,700George’sBusinessStatementofCashFlowsFortheYearEndedCashflowsfromoperatingactivities:Cashcollectionsfromcustomers..........................................$3,000Cashpaymentsforexpenses................................................(2,500)Netcashflowfromoperatingactivities............................$500Cashflowsfrominvestingactivities:Purchaseofland....................................................................$(8,000)Netcashflowfrominvestingactivities.............................(8,000)Cashflowsfromfinancingactivities:Proceedsfromequityinvestor...............................................$6,000Proceedsfromborrowing......................................................5,000Cashpaymentsfordividends................................................(800)Netcashflowfromfinancingactivities.............................10,200Increaseincash.........................................................................$2,700Beginningcashbalance.............................................................0Endingcashbalance..................................................................$2,700UponexaminingGeorge’sfinancialstatementsthebankwouldcertainlybeconcernedbecauseGeorgepaidoutmoreindividendsthanthenetincomeherealizedduringtheyear.George’sstatementofretainedearningsshowsanegativebalance,whichmeansthatthepaymenttoequityinvestorswhichwasdisguisedasreturnoncapitalwasinfactareturnofcapital.Generally,dividendpaymentscannotexceedtheRetainedEarningsbalance.E2–13Mary’sBusinessIncomeStatementFortheYearEndedLeaserevenue........................................................................................$12,000Expenses................................................................................................14,000Netincome.............................................................................................$(2,000)

Mary’sBusinessStatementofStockholders’EquityFortheYearEndedContributedRetainedCapitalEarningsBeginningBalance$0$0StockIssue30,000NetIncome(Loss)(1,000)CashDividends______(2,000)EndingBalance$30,000$(3,000)Mary’sBusinessBalanceSheetAsofAssetsCash......................................................................................................$2,000Land......................................................................................................40,000Totalassets............................................................................................$42,000Liabilities&Stockholders’EquityNotepayable..........................................................................................$15,000Contributedcapital.................................................................................30,000Retainedearnings..................................................................................(3,000)Totalliabilities&stockholders’equity....................................................$42,000E2–13ConcludedMary’sBusinessStatementofCashFlowsFortheYearEndedCashflowsfromoperatingactivities:Cashcollectionsfromcustomers..........................................$12,000Cashpaymentsforexpenses................................................(14,000)Netcashflowfromoperatingactivities............................$(2,000)Cashflowsfrominvestingactivities:Purchaseofland....................................................................$(40,000)Netcashflowfrominvestingactivities.............................(40,000)

Cashflowsfromfinancingactivities:Proceedsfromequityinvestor...............................................$30,000Proceedsfromborrowing......................................................15,000Cashpaymentsfordividends................................................(1,000)Netcashflowfromfinancingactivities.............................44,000Increaseincash.........................................................................$2,000Beginningcashbalance.............................................................0Endingcashbalance..................................................................$2,000Maryshouldnothavepaidacashdividendof$1,000becauseofherdwindlingcashpositionandnegativeearningsduringtheyear.Thedividendwasareturnofcapitalratherthanareturnoncapital.

PROBLEMSP2–11.e9.a17.c2.e10.a18.a3.a11.c19.d4.a12.d20.b5.g13.c21.e6.c14.b22.e7.f15.e23.e8.c16.aXCompanyBalanceSheet(Date)AssetsCurrentassets:Cash...........................................................................$XXShort-terminvestments..............................................XXAccountsreceivable...................................................$XXLess:Allowanceforuncollectibleaccounts................XXXXInventory.....................................................................XXPrepaidrent................................................................XXTotalcurrentassets...............................................$XXLong-terminvestments:Landheldforinvestment............................................$XXInvestmentfundforplantexpansion..........................XXTotallong-terminvestments..................................XXProperty,plant,&equipment:Property......................................................................$XXBuilding.......................................................................$XXLess:Accumulateddepreciation(building)................XXNetbookvalueofbuilding..........................................XXMachineryandequipment..........................................$XXLess:Accumulateddepreciation(machinery&equipment).............................................................XXNetbookvalueofmachineryandequipment............XXTotalproperty,plant,&equipment........................XXIntangibleassets:Patents........................................................................$XXTrademarks................................................................XXTotalintangibleassets...........................................XXTotalassets.....................................................................$XX

P2–1ConcludedLiabilitiesandStockholders"EquityCurrentliabilities:Accountspayable.......................................................$XXWagespayable...........................................................XXDividendpayable........................................................XXShort-termnotespayable...........................................XXCurrentportiondueoflong-termdebt.......................XXPaymentsreceivedinadvance..................................XXTotalcurrentliabilities............................................$XXLong-termliabilities:Bondspayable............................................................$XXTotallong-termliabilities........................................XXStockholders"equity:Capitalstock...............................................................$XXRetainedearnings......................................................XXTotalstockholders"equity......................................XXTotalliabilitiesandstockholders"equity..........................$XXP2–21.e6.e11.e2.b7.e12.f3.e8.f13.f4.a9.c14.d5.e10.c15.cP2–2Concluded

XCompanyIncomeStatementForthePeriodEndedRevenues:Sales...........................................................................$XXFeesearned................................................................XXInterestincome...........................................................XXDividendincome.........................................................XXGainonsaleofshort-terminvestments.....................XXTotalrevenues.......................................................$XXExpenses:Costofgoodssold......................................................$XXOperatingexpenses:Officesalaryexpense............................................$XXInsuranceexpense................................................XXSalesmencommissionexpense............................XXDepreciationexpense............................................XXOfficesuppliesexpense........................................XXAdvertisingexpense..............................................XXTotaloperatingexpenses..................................XXOtherexpenses:Interestexpense....................................................$XXLossonsaleofequipment.....................................XXLossonsaleofbuilding.........................................XXTotalotherexpenses.........................................XXTotalexpenses...........................................................XXNetincome......................................................................$XX

P2–3JohnsonCompanyBalanceSheetDecember31,2005AssetsCurrentassets:Cash.......................................................................................$8,000Short-terminvestments..........................................................40,000Accountsreceivable...............................................................$125,000Less:Allowanceforuncollectibleaccounts...........................2,400Netaccountsreceivable...................................................122,600Inventory.................................................................................161,000aTotalcurrentassets..........................................................$331,600Property,plant,&equipment:Buildings.................................................................................$35,000Less:Accumulateddepreciation............................................8,000Totalproperty,plant,&equipment...................................27,000Totalassets...................................................................................$358,600Liabilities&Stockholders"EquityCurrentliabilities:Accountspayable...................................................................$110,000Taxespayable........................................................................29,400Totalcurrentliabilities......................................................$139,400Long-termnotespayable..............................................................79,100Stockholders"equity:Contributedcapital.................................................................$100,000bRetainedearnings..................................................................40,100cTotalstockholders"equity.................................................140,100Totalliabilities&stockholders"equity...........................................$358,600________________aInventoryisreportedatthelowerofitscostoritsmarketvalue.b$100,000=$12,500shares×$8pershare.c$40,100=$65,000cumulativeearnings–$24,900cumulativedeclareddividends.Basedononlyoneyear’sbalancesheetitisaverydifficultquestiontoanswer.Thisfactprovesthepointthat(1)allthefinancialstatementsmustbeinterpretedasawhole,and(2)thattheinformationshouldbeanalyzedoveranumberofyearstodrawanymeaningfulconclusions.However,basedonwhatwehave,Iwouldnotinvestinthiscompany.Thecurrentratiois2.379butdebt/equityratiois1.560,whichisacauseforconcerninthelongterm.Further,thecompanyseemstobepayingapproximately38%ofitsretainedearningsbeginningbalanceindividends,whichisgoodfortheinvestorswhoarelookingforshort-termreturnontheircapital.

P2–42002ContributedCapital:Totalassets=Totalliabilities+Totalstockholders"equity($300+$200+$500+$100+$700)=($200+$500)+(Contributedcap.+$400)Contributedcapital=$700NetIncome:Netincome=Sales–Expenses=$1,000–$400=$600Dividends:Endingretainedearnings=Beginningretainedearnings+Netincome–Dividends$400=$0+$600–DividendsDividends=$2002003Inventory:Totalassets=Totalliabilities+Totalstockholders"equity($300+$300+Inventory+$200+$600)=($300+$600)+($400+$800)Inventory=$700Expenses:Netincome=Sales–Expenses$400=$1,100–ExpensesExpenses=$700Dividends:Endingretainedearnings=Beginningretainedearnings+Netincome–Dividends$800=$400+$400–DividendsDividends=$02004AccountsReceivable:Totalassets=Totalliab.+Totalstockholders"equity($200+Accts.rec.+$400+$400+$700)=($500+$800)+($600+$300)Accountsreceivable=$500Expenses:Netincome=Sales–Expenses($100)=$700–ExpensesExpenses=$800Dividends:Endingretainedearnings=Beginningretainedearnings+Netincome–Dividends$300=$800+($100)–DividendsDividends=$400

P2–4Concluded2005AccountsPayable:Totalassets=Totalliabilities+Totalstockholders"equity($500+$700+$400+$400+$800)=(Accts.pay.+$700)+($600+$600)Accountspayable=$900Netincome:Endingretainedearnings=Beginningretainedearnings+Netincome–Dividends$600=$300+Netincome–$200Netincome=$500Sales:Netincome=Sales–Expenses$500=Sales–$600Sales=$1,100Inordertoassessthefinancialperformanceofthiscompany,weneedtocalculatethemeasuresofsolvencyandearningpower.Respectivemeasuresarecomputedasfollows:MeasuresofSolvency2002200320042005CurrentRatio:54.332.201.78WorkingCapital:$800$1,000$600$700Debt/EquityRatio:.64.751.441.33TheonlymeasureofearningpowerthatwecancomputeforthiscompanyisReturnonEquity.Theothermeasures,suchasEPSandP/ERatio,cannotbecomputedsincetherelevantinformationisnotavailable.MeasuresofEarningPower2002200320042005ReturnonEquity:.55.33—*.42*Noreturnonstockholder’sequityduring2004sincethecompanysufferedalossof$100.Overall,lookingatthemeasuresofsolvencyandearningpower,onecansafelyconcludethatthefinancialperformanceandpositionofthecompanyhasdeterioratedsinceitsinceptionin2002.Thecurrentratiohascontinuedtodeclineandworkingcapitalhasalsogonedown.Whilethecompanyhastakenmoredebt,ithasbeenunabletoleverageagainsttheinterestofthestockholders,sincethereturnonequityhasdeclinedconsiderably.Inoneyear,2004,thecompanyevensufferedaloss.Thecompanypaiddividendsevenduringtheyearofloss,indicatingapoorlydeviseddividendpolicy.

P2–5SupervaluBalanceSheetDecember31,2003,200220032002AssetsCash.....................................................................................$292$29Accountsreceivable.............................................................448477Inventory...............................................................................1,0781,049Property,plant,andequipment(net)....................................2,1342,221Otherassets.........................................................................2,2012,120Totalassets...........................................................................$6,153$5,896LiabilitiesandStockholders’EquityAccountspayable.................................................................$1,118$1,082Othershort-termdebts.........................................................754422Longtermdebt.....................................................................2,0712,383Stockholders’Equity.............................................................2,2102,009Totalliabilitiesandstockholders’equity...............................$6,153$5,896SupervaluIncomeStatementFortheYearsEndedDecember31,2003,200220032002Sales.....................................................................................$20,210$19,160Expenses..............................................................................19,93018,903Netincome............................................................................$280$257Solvencyreferstoacompany’sabilitytopayitsobligationsastheycomedue.Thecurrentratioprovidesameasureofsolvencybycomparingthoseobligationsthatarecomingdueinthenearfutureagainstthoseassetsthatthecompanyexpectstoconvertintocashorconsumeinthenearfuture.Basedonitscurrentratio,Supervaludoesnothavesufficientcurrentassetstocoveritsexistingcurrentliabilitiesin2003,althoughitdidin2002.In2003thecurrentratiowas0.97,whileitwas1.03in2002.TheCompany’ssolvencyhasdeterioratedinthetimeperiodshown.Earningpowerreferstoacompany’sabilitytogeneratenetassetsthroughoperations.Incomehasbeenfairlyconstant,asmeasuredintermsofdollarsandasapercentageofsales.Marginsarethininthecompany’sindustry,butSupervaluhasshownconsistentearningsinthetimeperiod.P2–6a.Assetsare,forthemostpart,recordedatoriginalcost.Overaperiodoftime,thevalueofanitemwillchange.Forinstance,thevalueofEatandRun"sproperty,plant,andequipmentwillmostlikelychangeastheitemsbecomeolder.Consequently,overtimethecostofanitemmayhavenorelationtotheitem"smarketvalue.Sincethecashreceivedfromsellinganassetisbasedontheasset"smarketvalue,theasset"sbookvalueisnotanaccurateindicatorofacompany"svalue.b.Thevalueofthefirmwouldequalthesumofthefairmarketvalueoftheassetslessthesumofliabilities.ThevalueofEatandRunwould,therefore,beasfollows:

MarketValueCash...........................................................................$25,000Short-terminvestments..............................................19,000Accountsreceivable...................................................25,000Inventory.....................................................................33,000Prepaidinsurance......................................................0Property,plant,&equipment.....................................100,000Otherassets...............................................................0Totalmarketvalueofassets......................................$202,000Less:Totalliabilities..................................................196,000ValueofEatandRun.................................................$6,000c.IfEatandRunweretogobankrupt,thestockholderswouldreceiveanythingleftafteralltheassetsweresoldandthecreditorswerepaid.Inthiscasethefairmarketvalueoftheassetsexceedsthetotalliabilities,sothestockholderswouldreceivetheresidual,whichwouldbe$6,000.Asapracticalmatter,EatandRunmighthavetohirelawyersandaccountantsforthebankruptcyproceedings.Ifthiswerethecase,thelawyersandaccountantswouldhavetobepaidbeforethestockholdersreceivedanything.Sointhisparticularcase,theremaybenothingleftforthestockholdersoncethecreditors,lawyers,andaccountantsarepaid.P2–7First,letuscomputesomerelevantratiosthatwouldhelptoevaluatethefinancialstatementssubmittedbyRomneyHeightsinsupportofitsloanapplicationtoAcmeBank.Ratios20052004LiquidityCurrentRatio2.002.00(CurrentAssets÷CurrentLiabilities)WorkingCapital$7,000$6,000(CurrentAssets–CurrentLiabilities)Long-TermDebtPayingAbilityDebt/EquityRatio1.060.96(TotalLiabilities÷Stockholders’Equity)OperatingCashFlowtoTotalDebt0.450.33(OperatingCashFlow÷TotalDebt)Ratios20052004ProfitabilityNetProfitMargin0.340.19(NetIncome÷Sales)TotalAssetTurnover0.550.58(Sales÷TotalAssets)ReturnonAssets0.190.11(NetIncome÷TotalAssets)ReturnonAssets0.187.110(NetProfitMargin×TotalAssetTurnover)ReturnonEquity0.390.21

(NetIncome÷Stockholders’Equity)AthoroughreviewofthevariousratiosrevealsthatRomneyHeightsisworththerisk.Thebankshouldconsideritsloanapplication,atleastforashort-termloan.Theshort-termsolvencypositionisreasonablygood.Workingcapitalispositiveandthecurrentassetsaretwicethecurrentliabilities.Regardinglong-termdebtpayingabilitythecompanyseemstobeheavilyleveraged.Thedebttoequityratioismorethan1andhasincreasedfrom2004to2005.However,theconcernissomewhatmitigatedbyasubstantialincreaseintheproportionofoperatingcashflowstothetotaldebtheldbythecompany.Theoverallprofitabilityofthecompanyisontherise,buttheassetutilizationispoorandflat.Sincethereturnonequityhasalmostdoubled,thecompanyseemstobeabletoeffectivelyleveragetheincrementinitsdebttotheadvantageofitsstockholders.Regardingthestatementofcashflows,thecompanyseemstobedoingfine.Netcashflowfromoperatingactivitiesispositive.Thecompanyisinvestinginitsassetbase,probablyintendingtoexpandinthefuturebysupplementingitscashflowfromoperatingactivitieswithfinancingeitherfrombankloansorfromequity.

P2–8First,letuscomputesomerelevantratiosthatwouldhelpusevaluatethefinancialstatementsofTedTooney.Ratios20052004LiquidityCurrentRatio1.292.00(CurrentAssets÷CurrentLiabilities)WorkingCapital$2,000$4,000(CurrentAssets–CurrentLiabilities)Long-TermDebtPayingAbilityDebt/EquityRatio1.450.92(TotalLiabilities÷Stockholders’Equity)OperatingCashFlowtoTotalDebt0.751.36(OperatingCashFlow÷TotalDebt)ProfitabilityNetProfitMargin0.150.19(NetIncome÷Sales)TotalAssetTurnover3.413.87(Sales÷TotalAssets)ReturnonAssets0.520.74(NetIncome÷TotalAssets)ReturnonAssets0.510.74(NetProfitMargin×TotalAssetTurnover)ReturnonEquity1.271.42(NetIncome÷Stockholders’Equity)Lookingatthedecliningtrendsofallfinancialindicators,itwouldbesafetodeclineTed’srequestforanequityinvestmentinhiscompany.Theshort-termliquidityofthecompanyisgoingdown.Theworkingcapitalaswellasthecurrentratiohasdeclined.Thecompanyisbecominghighlyleveragedandtheamountofoperatingcashflowasapercentageoftotaldebthasconsiderablydeclined.Thisallindicatesaworseningposition.Theprofitabilityandreturnonassetsaremediocreanddeclining.Thereturnonequityhasalsodeclinedasthecompanyisnotabletoleverageitsdebttotheadvantageofitsstockholders.Eventhoughtheoverallliquiditypositionisnotthatserious,thetrendistowardsthedecline.Insummary,aloanpositionmaybetakenwiththecompany,butcertainlynotanequityposition.

P2–9a.Asof12/31/05thecurrentassetbalanceofEllingtonIndustriesis1.33timesthecurrentliabilitybalance.Sincethedebtcovenantrequiresthisbalancetobe2timesthecurrentliabilitybalance,EllingtonIndustriesmusthavecurrentassetsofatleast$18,000.Since,italreadyhas$12,000investedincurrentassets,itwillneedtoinvestanadditional$6,000outofthelong-termborrowingof$40,000tocomplywiththedebtcovenant.Thatwouldleave$34,000($40,000–$6,000)foradditionalinvestmentintheland.b.EllingtonIndustriesBalanceSheetJanuary1,2006AssetsCurrentassets.................................................................$18,000Landinvestment..............................................................89,000Totalassets.....................................................................$107,000Liabilities&Stockholders’EquityAccountspayable............................................................$9,000Long-termliabilities.........................................................70,000Stockholders’equity........................................................28,000Totalliabilitiesandstockholders’equity..........................$107,000RatiosCurrentassets/Currentliabilities=$18,000/$9,000=2Totalliabilities/Totalassets=$79,000/$107,000=.74c.EllingtonIndustriesBalanceSheetDecember31,2005AssetsCurrentassets.................................................................$36,000Landinvestment..............................................................89,000Totalassets.....................................................................$125,000Liabilities&Stockholders’EquityAccountspayable............................................................$7,000Long-termliabilities.........................................................70,000Stockholders’equity........................................................48,000Totalliabilitiesandstockholders’equity..........................$125,000Sincethedividendhastobepaidincash,itwillcomeoutofthecurrentassets.Accordingtotherestrictionsimposedbythedebtcovenant,thecurrentassetsmustbetwicethecurrentliabilities,i.e.,atleast$14,000.Thiswouldresultinanexcessof$22,000($36,000–$14,000)inthecurrentassets.Therefore,thecompanycanpayamaximumof$22,000individendswithoutviolatingthedebtcovenant.Ifthecompanydeclaresandpays$22,000individends,thentotalliabilities/totalassetswouldbeequalto.75($77,000/$103,000).

ISSUESFORDISCUSSIONID2–1a.Netincomerepresentsthechangeinnetassets(i.e.,assetslessliabilities)generatedduringtheyearfromoperatingactivities.Alternatively,cashflowsfromoperatingactivitiesistheamountofcashthecompanygeneratedduringtheyearfromoperatingactivities.Sincecashissimplyoneofmanyassetsacompanyhas,itisobviousthatnetincomeandcashflowsfromoperatingactivitiesarenotthesame.Thus,itisquitepossibleforacompanytohaveanincreaseinnetassetsfromoperatingactivities(i.e.,netincome)andatthesametimehavenegativecashflowsfromoperatingactivities.Theabilityofacompanytopaydividendsisafunctionofhowmuchcashthecompanyhasavailable.Acompanycouldgeneratenegativecashflowsfromoperatingactivitiesbuthavelargecashreservesfromgeneratingcashfromoperatingactivitiesinprioryears.Alternatively,acompanymayhaveobtainedenoughcashtopayadividendbyborrowingthemoneyorbysellingassets.Remember,companiescangeneratecashfrominvestingactivitiesandfinancingactivitiesinadditiontocashfromoperatingactivities.b.Acompanycouldnotcontinuegeneratingnegativecashflowsfromoperatingactivitiesandexpecttocontinueinbusiness.Acompanycannotborrowmoneyorissuestockindefinitely.Atsomepointthecreditorswilldemandtoberepaidandtheownerswilldemandsomereturnontheirinvestment.Soonerorlaterthecompanywillhavetogeneratecashfromitsoperationstorepaythecreditors.Payingoutdividendswhilegeneratingnegativecashflowsfromoperatingactivitieswillonlyincreasethecompany"scashproblems.ID2–2Therewillbenoimpactonthenetprofitreportedbye-companies.Therewillbeanimpactonthegrossprofitreportedbythesee-companies.Grossprofitisrevenuesminuscostofgoodssold.Previouslyshippingandhandlingcostswereincludedinthesellingandadministrativecategory,whichisnotpartofthecalculationofgrossprofit.Nowthesecostswillbepartofthecostofgoodssoldsectionandthereforewillreducethereportedgrossprofit.Yes,shippingandhandlingcostsaremoresignificantfore-tailersthanfortraditionalretailers.Atraditionalretailerwillnormallyhavenoshippingcoststogettheproducttothecustomerbecausethecustomerisbuyingitattheretailers’store.Thesupposedadvantageofe-tailersisthattheydonothavethecostsassociatedwithstores.Asaresultofthisstructuree-tailershavetoshipeveryproducttothecustomer.Thesetendtobesmallshipmentsandthereforethecostofshippingisasignificantpercentageofthesalesprice.Theoreticallythereshouldbenopreferenceastowherethesecostsarerecordedontheincomestatement.Thenetincomeandcashflowofthecompanyisnotimpacted.Therealityisthatmanyinvestorsandanalystshavefocusedongrossprofittoevaluatecompanies.Thisisacarryoverfromatimewhenmostmajorcompaniesweremanufacturingcompanies.Forthesecompaniesthemajorityoftheircostswerethecostsofmanufacturingaproduct.Shippingandhandlingwerenotasignificantpercentageofthesalesprice.Ifthischangehasasignificantimpactonthestockpricesofe-tailersthenthiswouldshowthatanalystsandinvestorsweredoingapoorjobofevaluatingthetruecoststructureofe-tailers.

ID2–3a.TheexcerptindicatesthattheCumminsEngineCompany"screditorshaveimposedrestrictionsonCumminsaspartoftheborrowingagreement.ThecovenantsrestrictCummins"abilitiestopaydividendsandborrowmoneyandtherelativeamountofitscurrentassetsandcurrentliabilities.IfCumminsfailstocomplywiththecovenants,itscreditorscouldrequireCumminstorepaytheloansimmediately.b.Abankorothercreditorwouldimposesuchrestrictionstoprotectitselffromaloandefault.Thatis,creditorsimposerestrictionsonborrowers,suchastheamountofcashthatcanbepaidoutfordividends,thatincreasetheprobabilitythattheborrowerwillhavesufficientresourcestobeabletomaketheinterestandprincipalpaymentsrequiredundertheborrowingagreement.c.Debtcovenantsareoftenexplicitlybasedonfinancialaccountingnumbers.Forexample,thecurrentratioisbasedontheamountofcurrentassetsandcurrentliabilitiesreportedonCummins"balancesheet.Similarly,compliancewiththedividendrestrictioncanbeassessedbyexaminingtheamountofdividendsdeclaredreportedinthestatementofretainedearnings.ID2–4Bed,Bath&Beyond–BB&Bisabletogeneratestrongcashflowfromitscurrentoperations($419)andisinvestingasignificantportionofthiscashintonewinvestmentsinthecompany.Managementhasalsogonetothecapitalmarketsandraisedmoney($24ofdebtandequity).Totalcashbalanceshaveincreasedasthecompany’soperationsandcapital-raisingactivitiesarecurrentlymorethanthecompanyhasre-investedintoitsbusiness.U.S.Airways–Theairlineisnotgeneratingcashfromitsoperations,whichisalwayssomethingthatisacauseforconcern.USAirwaysisinvestinglotsofmoneyinitsbusiness($511)butsincethecompanyisnotgeneratingcashfromitsoperationsthenthefundingforbothoperationsandinvestmentactivitieshadtocomefromfinancingactivities.Thisisanothercauseforconcernbecauseitisnotalwaysadvantageousforcompaniestoraisemoneyinthecapitalmarkets.Sincethecompany’scashfromoperationsisnegativethecompanyisdependentuponfundingthecompanythroughfinancingactivities.Ifthecapitalmarketsnolongerwanttoinvestmoneyintheairlineindustrythenitcouldfinditselfinacashcrunch.Coca-Cola–CocaColaisgeneratingasignificantamountofcashfromitsoperations($5,456)andisusingthismoneytoinvestinitsbusiness.Itisalsousingsomeofthiscashtopaydowndebtand/orbuybackstock.Thiswouldindicatethatmanagementfeelsthattherearesomegoodopportunitiestoinvestinitsbusinessbutitdoesnothaveenoughopportunitiesforinvestmenttouseallofitscash.Thereforeitiseitherreturningcashtoshareholdersorpayingdowndebt.Thiswouldindicatethatitscurrentbusinessisinprettygoodshapebutmayindicatethatfuturegrowthforitsbusinessmaybeslowing.ID2–5FromthedatagivenabouttheCendantCorporationitcanbesurmisedthatCendanthasdoneaverygoodjobatimprovingitsoperatingcashflow.Itdecreasedin2002butthenjumpedseven-foldin2003.Duringthefirsttwoyearsshown,Cendantreinvestedallofitscashflowfromoperationsintoitsbusinessthroughinvestingactivities.Investingactivitiesaretheuseofcashtopurchaseequipmentthatwillbeusedintheoperationsofthebusiness.Inthethirdyearshown,Cendant’soperationsthrewoffsuchsignificantcashthatthecompanywasabletocontinueitsinvestmentinitsbusinessesbutitwasalsoabletoreturncashtoshareholdersand/orpaydowndebt.

ID2–6AU.S.GAAPbalancesheetshowsassetsononesideandliabilitiesandequityontheother.Thisbalancesheetshowsassetsminusliabilitiesononesideandequityontheother.Theotherprimarydifferenceisinthesequencingoftheaccountsastheyarepresented.AU.S.GAAPbalancesheetshowsthemostliquidaccountsfirstandthenlistsaccountsintheorderthattheyareconvertibletocash.Thoseaccountsbeingclosesttocasharelistedfirst.GlaxoWellcomeConsolidatedBalanceSheetAsof12/31/200320032002ASSETS:Cash9621,052Shortterminvestments2,4931,256Accountsreceivable6,8976,200Inventory2,1092,080Otherassets164161Currentassets12,62510,749FixedAssetsTangibleassets6,4416,649Investments3,0693,121Fixedassets9,5109,770Goodwill&Other1,8401,808TotalAssets23,97522,327LIABILITIESLoans1,4521,551Accountspayable7,1457,257Currentliabilities8,5978,808Long-termliabilitiesLoans3,6513,092Longtermpayables3,2623,039Longtermliabilities6,9136,131Shareholders’EquityCommonstock1,4871,506Paidincapital264224MinorityInterest745807Retainedearnings5,9694,851Totalshareholder’sequity8,4657,388TotalLiabilitiesandShareholders’Equity23,97522,327

ID2–7EarningsaccordingtoGAAPareaccrualnumbers,meaningthattheydon’trepresentcash.Forexample,netincomeisderivedbysubtractingexpensesfromrevenue,butrevenuecanberecognizedevenifthecompanyhasyettoreceivethecash(accountsreceivablearebooked).Iftheaccountsreceivable,whichrepresentapromisefromacustomertopaycash,neverconvertintocash,theaccrualnetincomefigureisanoverstatementofthecompany’searningspower.Investors,therefore,lookatnetincomeinconjunctionwithoperatingcashflowtodetermineifthevariouscomponentsofaccrualnetincomearesupportedbycashflows.ID2–8ManagementofLeviStrausswouldhavebeenconcernedthatthe$2billionindebtwasputtingthecompanyatrisk,asthedebtmustberepaidatsomepoint;inaddition,thecompanywouldhavefocusedontheinterestpaymentswhichmustbemadeuntilthedebtisrepaid.Byretiringthedebt,thecompany’scashflowwouldbefreedfornewuses,includinginvestingactivitiessuchasmodernizingitsmanufacturingplantsandimprovingitsproductiontechnology.Levi’sdeterminedthatitsDockersbrandwouldfetchastrongpricewhensoldandwouldbethesourceofcashtorepaythedebtsothecompanycouldfocusonitsotherbusinesses.SellingtheDockersbrandwouldhaveremovedlong-termassets(andinventory)fromthebalancesheetandwouldhavegeneratedthe$2billionincash.Payingoffthedebtwouldhaveremovedthecashandreducedtheliabilities.ThestatementofcashflowwouldhaveshownacashinflowfrominvestingactivitieswhentheDockersbrandwassoldandthenwouldhaveshownacashoutflowinfinancingactivitieswhenthedebtwasretired.ID2–9a.200420032002.Sales$64,816$58,247$53,553CostofmerchandiseSold44,23668.2%40,13968.9%37,40669.8%Operatingexpenses13,73421.2%12,27821.1%11,21520.9%Interestexpense62.0%37.0%28.0%Taxes2,5393.9%2,2083.8%1,9133.6%Netincome$4,3046.6%$3,6646.3%$3,0445.7%From2002to2004salesincreasedramatically(21%)andnetincomeincreasedby41%.DuringeachoftheseyearsthecoststructureofHomeDepotchangedverylittle.Thebiggestcomponentofcosts(costofmerchandisesold)fluctuatedbyonly.3%.Thiswouldindicatethattheincreaseinnetincomefrom2002to2004wasdrivenbytheincreaseinsales.Therewasnoimprovementinthecostsasapercentageofsales.b.20042003.Currentassets$13,32838.7%$11,91739.7%Noncurrentassets21,10961.3%18,09460.3%Totalassets$34,437$30,011From2003to2004therehasbeenasignificantincreaseinnoncurrentassets,$3billion.Theratioofcurrentvs.noncurrentassetsthoughchangedonlyminimally.Thisindicatesthat

managementisdoingagoodjobofmanagingitsassetsandnotbecomingimbalancedbetweencurrentandnoncurrentassets.c.20042003.Currentliabilities$9,55427.7%$8,03526.8%Long-termliabilities2,4767.2%2,1747.2%Totalassets$34,437$30,011From2003to2004HomeDepotincreaseditscurrentliabilitiesby$1.5billionanditslong-termliabilitiesby$300million.However,theratiooflong-termliabilitiestototalassetsremainedconstant.Theratioofcurrentliabilitiestototalassetsincreasedbyarelativelysmallpercentage(.9%).Thisshowsthattheincreaseintotalassets($4.4billion)wasgeneratedbytheincreaseincurrentliabilitiesandnetincome.d.HomeDepotiscontinuingtogrowitsbusinessbyinvestingheavilyinp,p&e.During2004and2003HomeDepotspentapproximately$6.2billioninp,p&eadditions.Thiswasfinancedbycashflowfromoperations($11.3billion).During2004and2003thecompanyusedexcesscashtorepurchaseitsownstock($3.5billion).e.200420032002.Netincome$4,304$3,664$3,044Dividendspaid$595$492$396Dividendsasapercentageofnetincome13.8%13.4%13.0%'

您可能关注的文档

- C#习题参考答案 《c#面向对象程序设计》 郑宇军.doc

- C++第5章习题解答.doc

- chapter 1-4《单片机基础》练习题及答案.doc

- C语言程序设计教程(第三版)课后习题参考答案 张敏霞版.doc

- C语言课后习题答案.doc

- c语言课后答案.doc

- HR课后习题答案.doc

- Java基础入门习题答案.doc

- mba fa 《financial accounting》 习题答案10.pdf

- mba fa 《financial accounting》 习题答案7.pdf

- _fa_《financial_accounting》_习题答案7.pdf

- SQL Server 2008主教材第1~13章主教材习题答案.doc

- VB程序设计教程课后答案.doc

- VB程序设计课后习题答案.doc

- w-《大地测量学基础》复习题及参考答案.doc

- Zhujiao037_《电机学(高起专)》习题答案.doc

- ★《传播学教程》课后题答案.doc

- 《2007考研专业课管理学习题集及详细参考答案》.doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明