- 2.96 MB

- 2022-04-22 11:18:42 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

'23章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes:1.Grossdomesticproductmeasurestwothingsatonce:(1)thetotalincomeofeveryoneintheeconomy;and(2)thetotalexpenditureontheeconomy’soutputofgoodsandservices.Itcanmeasurebothofthesethingsatoncebecauseincomemustequalexpenditurefortheeconomyasawhole.2.TheproductionofapoundofcaviarcontributesmoretoGDPthantheproductionofapoundofhamburgerbecausethecontributiontoGDPismeasuredbymarketvalueandthepriceofapoundofcaviarismuchhigherthanthepriceofapoundofhamburger.3.Thefourcomponentsofexpenditureare:(1)consumption;(2)investment;(3)governmentpurchases;and(4)netexports.Thelargestcomponentisconsumption,whichaccountsformorethantwo-thirdsoftotalexpenditure.4.NominalGDPistheproductionofgoodsandservicesvaluedatcurrentprices.RealGDPistheproductionofgoodsandservicesvaluedatconstantprices.RealGDPisabettermeasureofeconomicwell-beingbecauseitreflectstheeconomy’sabilitytosatisfypeople’sneedsanddesires.ThusariseinrealGDPmeanspeoplehaveproducedmoregoodsandservices,butariseinnominalGDPcouldoccureitherbecauseofincreasedproductionorbecauseofhigherprices.5.AlthoughGDPisnotaperfectmeasureofwell-being,policymakersshouldcareaboutitbecausealargerGDPmeansthatanationcanaffordbetterhealthcare,bettereducationalsystems,andmoreofthematerialnecessitiesoflife.QuestionsforReview:1.Aneconomy"sincomemustequalitsexpenditure,sinceeverytransactionhasabuyerandaseller.Thus,expenditurebybuyersmustequalincomebysellers.2.TheproductionofaluxurycarcontributesmoretoGDPthantheproductionofaneconomycarbecausetheluxurycarhasahighermarketvalue.3.ThecontributiontoGDPis$3,themarketvalueofthebread,whichisthefinalgoodthatissold.4.ThesaleofusedrecordsdoesnotaffectGDPatallbecauseitinvolvesnocurrent

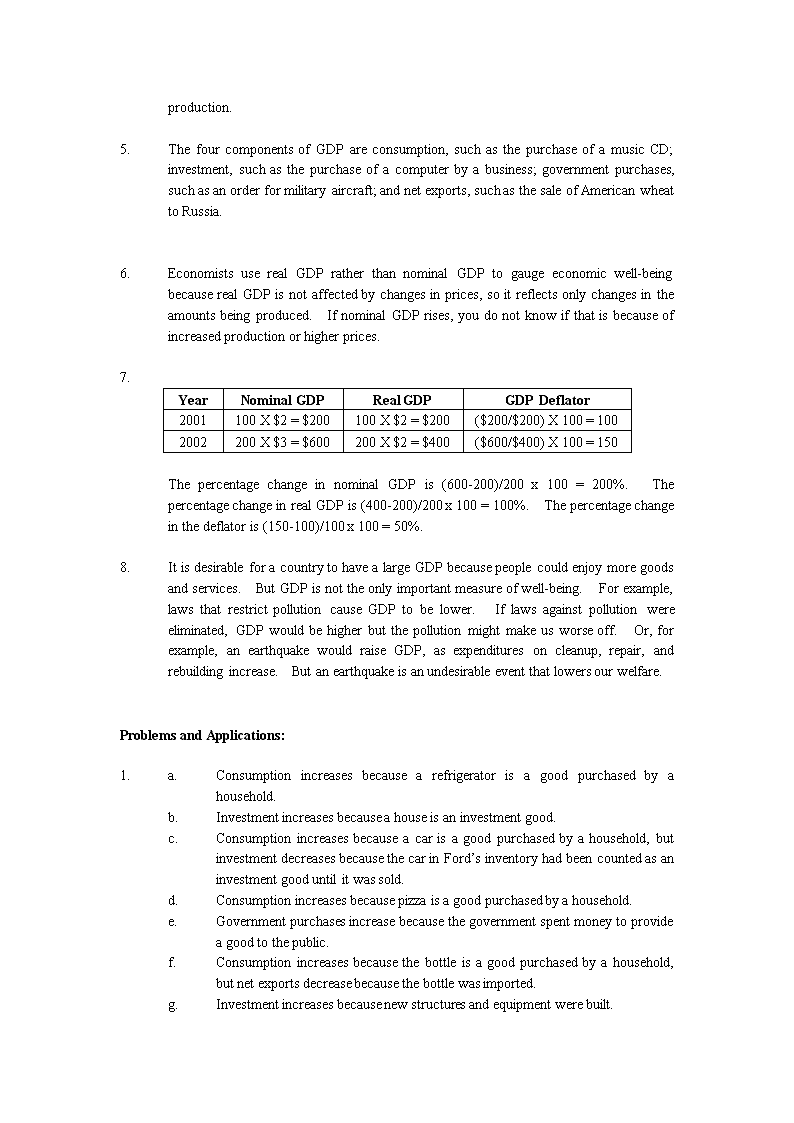

production.5.ThefourcomponentsofGDPareconsumption,suchasthepurchaseofamusicCD;investment,suchasthepurchaseofacomputerbyabusiness;governmentpurchases,suchasanorderformilitaryaircraft;andnetexports,suchasthesaleofAmericanwheattoRussia.6.EconomistsuserealGDPratherthannominalGDPtogaugeeconomicwell-beingbecauserealGDPisnotaffectedbychangesinprices,soitreflectsonlychangesintheamountsbeingproduced.IfnominalGDPrises,youdonotknowifthatisbecauseofincreasedproductionorhigherprices.7.YearNominalGDPRealGDPGDPDeflator2001100X$2=$200100X$2=$200($200/$200)X100=1002002200X$3=$600200X$2=$400($600/$400)X100=150ThepercentagechangeinnominalGDPis(600-200)/200x100=200%.ThepercentagechangeinrealGDPis(400-200)/200x100=100%.Thepercentagechangeinthedeflatoris(150-100)/100x100=50%.8.ItisdesirableforacountrytohavealargeGDPbecausepeoplecouldenjoymoregoodsandservices.ButGDPisnottheonlyimportantmeasureofwell-being.Forexample,lawsthatrestrictpollutioncauseGDPtobelower.Iflawsagainstpollutionwereeliminated,GDPwouldbehigherbutthepollutionmightmakeusworseoff.Or,forexample,anearthquakewouldraiseGDP,asexpendituresoncleanup,repair,andrebuildingincrease.Butanearthquakeisanundesirableeventthatlowersourwelfare.ProblemsandApplications:1.a.Consumptionincreasesbecausearefrigeratorisagoodpurchasedbyahousehold.b.Investmentincreasesbecauseahouseisaninvestmentgood.c.Consumptionincreasesbecauseacarisagoodpurchasedbyahousehold,butinvestmentdecreasesbecausethecarinFord’sinventoryhadbeencountedasaninvestmentgooduntilitwassold.d.Consumptionincreasesbecausepizzaisagoodpurchasedbyahousehold.e.Governmentpurchasesincreasebecausethegovernmentspentmoneytoprovideagoodtothepublic.f.Consumptionincreasesbecausethebottleisagoodpurchasedbyahousehold,butnetexportsdecreasebecausethebottlewasimported.g.Investmentincreasesbecausenewstructuresandequipmentwerebuilt.

2.Withtransferpayments,nothingisproduced,sothereisnocontributiontoGDP.3.PurchasesofnewhousingareincludedintheinvestmentportionofGDPbecausehousingprovidesservicesforalongtime.Forthesamereason,purchasesofnewcarscouldbethoughtofasinvestment,butbyconvention,theyarenot.Thelogiccouldapplytoanydurablegood,suchashouseholdappliances.4.IfGDPincludedgoodsthatareresold,itwouldbecountingoutputofthatparticularyear,plussalesofgoodsproducedinapreviousyear.Itwoulddouble-countgoodsthatweresoldmorethanonceandwouldcountgoodsinGDPforseveralyearsiftheywereproducedinoneyearandresoldinanother.5.a.CalculatingnominalGDP:2001:($1perqt.ofmilk´100qts.milk)+($2perqt.ofhoney´50qts.honey)=$2002002:($1perqt.ofmilk´200qts.milk)+($2perqt.ofhoney´100qts.honey)=$4002003:($2perqt.ofmilk´200qts.milk)+($4perqt.ofhoney´100qts.honey)=$800CalculatingrealGDP(baseyear2001):2001:($1perqt.ofmilk´100qts.milk)+($2perqt.ofhoney´50qts.honey)=$2002002:($1perqt.ofmilk´200qts.milk)+($2perqt.ofhoney´100qts.honey)=$4002003:($1perqt.ofmilk´200qts.milk)+($2perqt.ofhoney´100qts.honey)=$400CalculatingtheGDPdeflator:2001:($200/$200)´100=1002002:($400/$400)´100=1002003:($800/$400)´100=200b.CalculatingthepercentagechangeinnominalGDP:PercentagechangeinnominalGDPin2002=[($400-$200)/$200]´100=100%.PercentagechangeinnominalGDPin2003=[($800-$400)/$400]´100=100%.

CalculatingthepercentagechangeinrealGDP:PercentagechangeinrealGDPin2002=[($400-$200)/$200]´100=100%.PercentagechangeinrealGDPin2003=[($400-$400)/$400]´100=0%.CalculatingthepercentagechangeinGDPdeflator:PercentagechangeintheGDPdeflatorin2002=[(100-100)/100]´100=0%.PercentagechangeintheGDPdeflatorin2003=[(200-100)/100]´100=100%.Pricesdidnotchangefrom2001to2002.Thus,thepercentagechangeintheGDPdeflatoriszero.Likewise,outputlevelsdidnotchangefrom2002to2003.ThismeansthatthepercentagechangeinrealGDPiszero.c.Economicwell-beingrosemorein2002thanin2003,sincerealGDProsein2002butnotin2003.In2002,realGDProseandpricesdidn’t.In2003,realGDPdidn’triseandpricesdid.6.YearNominalGDP(billions)GDPDeflator(baseyear:1996)2000$9,8731181999$9,269113a.ThegrowthrateofnominalGDPis($9,873-$9,269)/$9,269´100%=6.5%.b.Thegrowthrateofthedeflatoris(118-113)/113´100%=4.4%.c.RealGDPin1999(in1996dollars)is$9,269/(113/100)=$8,203.d.RealGDPin2000(in1996dollars)is$9,873/(118/100)=$8,367.e.ThegrowthrateofrealGDPis($8,367-$8,203)/$8,203´100%=2.0%.f.ThegrowthrateofnominalGDPishigherthanthegrowthrateofrealGDPbecauseofinflation.7.Economistsignoretheriseinpeople"sincomesthatiscausedbyhigherpricesbecausealthoughincomesarehigher,thepricesofthegoodsandservicesthatpeoplebuyarealsohigher.Therefore,theywillnotnecessarilybeabletopurchasemoregoodsandservices.Forthisreason,economistsprefertolookatrealGDPinsteadofnominalGDP.8.Manyanswersarepossible.

9.a.GDPequalsthedollaramountBarrycollects,whichis$400.b.NNP=GDP–depreciation=$400-$50=$350.c.Nationalincome=NNP-salestaxes=$350-$30=$320.d.Personalincome=nationalincome-retainedearnings=$320-$100=$220.e.Disposablepersonalincome=personalincome-personalincometax=$220-$70=$150.10.IncountrieslikeIndia,peopleproduceandconsumeafairamountoffoodathomethatisnotincludedinGDP.SoGDPperpersoninIndiaandtheUnitedStateswilldifferbymorethantheircomparativeeconomicwell-being.11.IfthegovernmentcaresaboutthetotalincomeofAmericans,itwillemphasizeGNP,sincethatmeasureincludestheincomeofAmericansthatisearnedabroadandexcludestheincomeofforeigners.IfthegovernmentcaresaboutthetotalamountofeconomicactivityoccurringintheUnitedStates,itwillemphasizeGDP,whichmeasuresthelevelofproductioninthecountry,whetherproducedbydomesticcitizensorforeigners.12.a.Theincreasedlabor-forceparticipationofwomenhasincreasedGDPintheUnitedStates,sinceitmeansmorepeopleareworkingandproductionhasincreased.b.Ifourmeasureofwell-beingincludedtimespentworkinginthehomeandtakingleisure,itwouldn"triseasmuchasGDP,sincetheriseinwomen"slabor-forceparticipationhasreducedtimespentworkinginthehomeandtakingleisure.c.Otheraspectsofwell-beingthatareassociatedwiththeriseinwomen"sincreasedlabor-forceparticipationincludeincreasedself-esteemandprestigeforwomenintheworkforce,especiallyatmanageriallevels,butdecreasedqualitytimespentwithchildren,whoseparentshavelesstimetospendwiththem.Suchaspectswouldbequitedifficulttomeasure.24章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Theconsumerpriceindextriestomeasuretheoverallcostofthegoodsandservicesboughtbyatypicalconsumer.Itisconstructedbysurveyingconsumerstofixabasket

ofgoodsandservicesthatthetypicalconsumerbuys,findingthepricesofthegoodsandservicesovertime,computingthecostofthebasketatdifferenttimes,andthenchoosingabaseyear.Tocomputetheindex,wedividethecostofthemarketbasketinthecurrentyearbythecostofthemarketbasketinthebaseyearandmultiplyby100.2.SinceHenryFordpaidhisworkers$5adayin1914andtheconsumerpriceindexwas10in1914and177in2001,thentheFordpaycheckwasworth$5´177/10=$88.50adayin2001dollars.QuestionsforReview1.A10percentincreaseinthepriceofchickenhasagreatereffectontheconsumerpriceindexthana10percentincreaseinthepriceofcaviarbecausechickenisabiggerpartoftheaverageconsumer"smarketbasket.2.Thethreeproblemsintheconsumerpriceindexasameasureofthecostoflivingare:(1)substitutionbias,whicharisesbecausepeoplesubstitutetowardgoodsthathavebecomerelativelylessexpensive;(2)theintroductionofnewgoods,whicharenotreflectedquicklyintheCPI;and(3)unmeasuredqualitychange.3.IfthepriceofaNavysubmarinerises,thereisnoeffectontheconsumerpriceindex,sinceNavysubmarinesarenotconsumergoods.ButtheGDPpriceindexisaffected,sinceNavysubmarinesareincludedinGDPasapartofgovernmentpurchases.4.Sincetheoverallpriceleveldoubled,butthepriceofthecandybarrosesixfold,therealprice(thepriceadjustedforinflation)ofthecandybartripled.5.Thenominalinterestrateistherateofinterestpaidonaloanindollarterms.Therealinterestrateistherateofinterestcorrectedforinflation.Therealinterestrateisthenominalinterestrateminustherateofinflation.ProblemsandApplications1.a.Thepriceoftennisballsincreases0percent;thepriceoftennisracquetsincreases50percent[=($60-$40)/$40x100%];thepriceofGatoradeincreases100percent[=($2-$1)/$1x100%].Tofindthepercentagechangeintheoverallpricelevel,followthesesteps:1)Determinethefixedbasketofgoods:100balls,10racquets,200Gatorades

2)Findthepriceofeachgoodineachyear:YearBallsRacquetsGatorade2001$2$40$12002$2$60$23)Computethecostofthebasketofgoodsineachyear:2001:(100x$2)+(10x$40)+(200x$1)=$8002002:(100x$2)+(10x$60)+(200x$2)=$1,2004)Chooseoneyearasabaseyear(2001)andcomputetheCPIineachyear:2001:$800/$800x100=1002002:$1,200/$800x100=1505)UsetheCPItocomputetheinflationratefromthepreviousyear:2002:(150-100)/100x100%=50%b.TennisracquetsarelessexpensiverelativetoGatorade,sincetheirpricerose50percentwhilethepriceofGatoraderose100percent.Thewell-beingofsomepeoplechangesrelativetothewell-beingofothers.ThosewhopurchasealotofGatoradebecomeworseoffrelativetothosewhopurchasealotoftennisracquetsortennisballs.2.Tofindthepercentagechangeintheoverallpricelevel,followthesesteps:a.Determinethefixedbasketofgoods:100headsofcauliflower,50bunchesofbroccoli,500carrots.b.Findthepriceofeachgoodineachyear:YearCauliflowerBroccoliCarrots2001$2$1.50$0.102002$3$1.50$0.20c.Computethecostofthebasketofgoodsineachyear:2001:(100x$2)+(50x$1.50)+(500x$.10)=$3252002:(100x$3)+(50x$1.50)+(500x$.20)=$475d.Chooseoneyearasabaseyear(2001)andcomputetheCPIineachyear:2001:$325/$325x100=1002002:$475/$325x100=146

e.UsetheCPItocomputetheinflationratefromthepreviousyear:2002:(146-100)/100x100%=46%3.Manyanswersarepossible.4.a.Sincetheincreaseincostwasconsideredaqualityimprovement,therewasnoincreaseregisteredintheCPI.b.Theargumentinfavorofthisisthatconsumersaregettingabettergoodthanbefore,sothepriceincreaseequalstheimprovementinquality.Theproblemisthattheincreasedcostmightexceedthevalueoftheimprovementinairquality,soconsumersareworseoff.Inthiscase,itwouldbebetterfortheCPItoatleastpartiallyreflectthehighercost.5.a.introductionofnewgoods;b.unmeasuredqualitychange;c.substitutionbias;d.unmeasuredqualitychange;e.substitutionbias6.a.($0.75-$0.15)/$0.15x100%=400%.b.($14.26-$3.36)/$3.36x100%=324%.c.In1970:$.15/($3.36/60)=2.7minutes.In2000:$.75/($14.26/60)=3.2minutes.d.Workers"purchasingpowerfellintermsofnewspapers.7.a.Iftheelderlyconsumethesamemarketbasketasotherpeople,SocialSecuritywouldprovidetheelderlywithanimprovementintheirstandardoflivingeachyearbecausetheCPIoverstatesinflationandSocialSecuritypaymentsaretiedtotheCPI.b.Sincetheelderlyconsumemorehealthcarethanyoungerpeople,andsincehealthcarecostshaverisenfasterthanoverallinflation,itispossiblethattheelderlyareworseoff.Toinvestigatethis,youwouldneedtoputtogetheramarketbasketfortheelderly,whichwouldhaveahigherweightonhealthcare.Youwouldthencomparetheriseinthecostofthe"elderly"basketwiththatofthegeneralbasketforCPI.8.Manyanswersarepossible.Acommonanswermaybethatasstudents,theyspendagreaterproportionoftheirincomeontuitionandbooksthanthetypicalhousehold.Ifthepricesoftuitionandbookshaverisenfasterthanaverageprices,studentsfaceahigherinflationratethanthetypicalhousehold.9.Whenbracketcreepoccurred,inflationincreasedpeople"snominalincomes,pushing

themintohighertaxbrackets,sotheyhadtopayahigherproportionoftheirincomesintaxes,eventhoughtheywerenotgettinghigherrealincomes.Asaresult,realtaxrevenuerose.10.Indecidinghowmuchincometosaveforretirement,workersshouldconsidertherealinterestrate,sincetheycareabouttheirpurchasingpowerinthefuture,notthenumberofdollarstheywillhave.11.a.Wheninflationishigherthanwasexpected,therealinterestrateislowerthanexpected.Forexample,supposethemarketequilibriumhasanexpectedrealinterestrateof3percentandpeopleexpectinflationtobe4percent,sothenominalinterestrateis7percent.Ifinflationturnsouttobe5percent,therealinterestrateis7percentminus5percentequals2percent,whichislessthanthe3percentthatwasexpected.b.Sincetherealinterestrateislowerthanwasexpected,thelenderlosesandtheborrowergains.Theborrowerisrepayingtheloanwithdollarsthatareworthlessthanwasexpected.c.Homeownersinthe1970swhohadfixed-ratemortgagesfromthe1960sbenefitedfromtheunexpectedinflation,whilethebanksthatmadethemortgageloanswereharmed.25章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.TheapproximategrowthrateofrealGDPperpersonintheUnitedStatesis1.81percent(basedonTable1)from1870to2000.CountriesthathavehadfastergrowthincludeJapan,Brazil,Mexico,Canada,Germany,China,andArgentina;countriesthathavehadslowergrowthincludeIndia,Indonesia,UnitedKingdom,Pakistan,andBangladesh.2.Thefourdeterminantsofacountry’sproductivityare:(1)physicalcapital,whichisthestockofequipmentandstructuresthatareusedtoproducegoodsandservices;(2)humancapital,whichistheknowledgeandskillsthatworkersacquirethrougheducation,training,andexperience;(3)naturalresources,whichareinputsintoproductionthatareprovidedbynature,suchasland,rivers,andmineraldeposits;and(4)technologicalknowledge,whichissociety’sunderstandingofthebestwaystoproducegoodsand

services.3.Waysinwhichagovernmentpolicymakercantrytoraisethegrowthinlivingstandardsinasocietyinclude:(1)investingmorecurrentresourcesintheproductionofcapital,whichhasthedrawbackofreducingtheresourcesusedforproducingcurrentconsumption;(2)encouraginginvestmentfromabroad,whichhasthedrawbackthatsomeofthebenefitsofinvestmentflowtoforeigners;(3)increasingeducation,whichhasanopportunitycostinthatstudentsarenotengagedincurrentproduction;(4)protectingpropertyrightsandpromotingpoliticalstability,forwhichnodrawbacksareobvious;(5)pursuingoutward-orientedpoliciestoencouragefreetrade,whichmayhavethedrawbackofmakingacountrymoredependentonitstradingpartners;(6)reducingtherateofpopulationgrowth,whichmayhavethedrawbackofreducingindividualfreedomandloweringtherateoftechnologicalprogress;and(7)encouragingresearchanddevelopment,which(likeinvestment)mayhavethedrawbackofreducingcurrentconsumption.QuestionsforReview1.Thelevelofanation’sGDPmeasuresboththetotalincomeearnedintheeconomyandthetotalexpenditureontheeconomy’soutputofgoodsandservices.ThelevelofrealGDPisagoodgaugeofeconomicprosperity,andthegrowthofrealGDPisagoodgaugeofeconomicprogress.YouwouldratherliveinanationwithahighlevelofGDP,eventhoughithadalowgrowthrate,thaninanationwithalowlevelofGDPandahighgrowthrate,sincethelevelofGDPisameasureofprosperity.2.Thefourdeterminantsofproductivityare:(1)physicalcapital,whichisthestockofequipmentandstructuresthatareusedtoproducegoodsandservices;(2)humancapital,whichconsistsoftheknowledgeandskillsthatworkersacquirethrougheducation,training,andexperience;(3)naturalresources,whichareinputsintoproductionthatareprovidedbynature;and(4)technologicalknowledge,whichissociety’sunderstandingofthebestwaystoproducegoodsandservices.3.Acollegedegreeisaformofhumancapital.Theskillslearnedinearningacollegedegreeincreaseaworker"sproductivity.4.Highersavingmeansfewerresourcesaredevotedtoconsumptionandmoretoproducingcapitalgoods.TheriseinthecapitalstockleadstorisingproductivityandmorerapidgrowthinGDPforawhile.Inthelongrun,thehighersavingrateleadstoahigherstandardofliving.Apolicymakermightbedeterredfromtryingtoraisetherateofsavingbecausedoingsorequiresthatpeoplereducetheirconsumptiontodayanditcantakealongtimetogettoahigherstandardofliving.5.Ahigherrateofsavingleadstoahighergrowthratetemporarily,notpermanently.In

theshortrun,increasedsavingleadstoalargercapitalstockandfastergrowth.Butasgrowthcontinues,diminishingreturnstocapitalmeangrowthslowsdownandeventuallysettlesdowntoitsinitialrate,thoughthismaytakeseveraldecades.6.Removingatraderestriction,suchasatariff,wouldleadtomorerapideconomicgrowthbecausetheremovalofthetraderestrictionactslikeanimprovementintechnology.Freetradeallowsallcountriestoconsumemoregoodsandservices.7.Thehighertherateofpopulationgrowth,theloweristhelevelofGDPperperson,becausethere"slesscapitalperperson,hencelowerproductivity.8.TheU.S.governmenttriestoencourageadvancesintechnologicalknowledgebyprovidingresearchgrantsthroughtheNationalScienceFoundationandtheNationalInstituteofHealth,withtaxbreaksforfirmsengaginginresearchanddevelopment,andthroughthepatentsystem.ProblemsandApplications1.Thefactsthatcountriesimportmanygoodsandservicesyetmustproducealargequantityofgoodsandservicesthemselvestoenjoyahighstandardoflivingarereconciledbynotingthattherearesubstantialgainsfromtrade.Inordertobeabletoaffordtopurchasegoodsfromothercountries,aneconomymustgenerateincome.Byproducingmanygoodsandservices,thentradingthemforgoodsandservicesproducedinothercountries,anationmaximizesitsstandardofliving.2.a.Producingcarsrequiresafactorywithmachines,robots,andanassemblyline,aswellashumancapitalthatcomesfromtrainingworkers.b.Producingahigh-schooleducationrequiresbooksandbuildingsaswellashumancapitalfromtheteachers.c.Producingplanetravelrequiresplanesandairportsaswellashumancapitalintermsofpilots"knowledge.d.Producingfruitsandvegetablesrequiresirrigationsystems,harvestingmachinery,andtruckstotransportthegoodstothemarket,aswellashumancapitalintheformofagriculturalknowledge.3.Today"sstandardoflivingdiffersfromthoseofourgreat-grandparentsbecauseofimprovedtransportation,communications,entertainment,machineryforhouseholdwork,andcomputers,amongotherthings.4.Inthemanufacturingsector,employmenthasfallensharplywhileoutputremainsabout

thesamepercentageofGDPasbefore.Thisisgoodforoureconomybecauseitistheresultofincreasedproductivity.Manymanufacturedgoodsaremuchcheaperthantheyusedtobe.5.a.Moreinvestmentwouldleadtofastereconomicgrowthintheshortrun.b.Thechangewouldbenefitmanypeopleinsocietywhowouldhavehigherincomesastheresultoffastereconomicgrowth.However,theremightbeatransitionperiodinwhichworkersandownersinconsumption-goodindustrieswouldgetlowerincomes,andworkersandownersininvestment-goodindustrieswouldgethigherincomes.Inaddition,someonewouldhavetoreducetheirspendingforsometimesothatinvestmentcouldrise.6.a.Privateconsumptionspendingincludesbuyingfoodandbuyingclothes;privateinvestmentspendingincludespeoplebuyinghousesandfirmsbuyingcomputers.Manyotherexamplesarepossible.b.Governmentconsumptionspendingincludespayingworkerstoadministergovernmentprograms;governmentinvestmentspendingincludesbuyingmilitaryequipmentandbuildingroads.Manyotherexamplesarepossible.7.Theopportunitycostofinvestingincapitalisthelossofconsumptionthatresultsfromredirectingresourcestowardsinvestment.Over-investmentincapitalispossiblebecauseofdiminishingmarginalreturns.Acountrycan"over-invest"incapitalifpeoplewouldprefertohavehigherconsumptionspendingandlessfuturegrowth.Theopportunitycostofinvestinginhumancapitalisalsothelossofconsumptionthatisneededtoprovidetheresourcesforinvestment.Acountrycould"over-invest"inhumancapitalifpeopleweretoohighlyeducatedforthejobstheycouldget¾forexample,ifthebestjobaPh.D.inphilosophycouldfindismanagingarestaurant.8.a.WhenaGermanfirmopensafactoryinSouthCarolina,itrepresentsforeigndirectinvestment.b.TheinvestmentincreasesU.S.GDPsinceitincreasesproductionintheUnitedStates.TheeffectonU.S.GNPwouldbesmallersincetheownerswouldgetpaidareturnontheirinvestmentthatwouldbepartofGermanGNPratherthanU.S.GNP.9.a.TheUnitedStatesbenefitedfromtheJapaneseinvestmentsinceitmadeourcapitalstocklarger,increasingoureconomicgrowth.b.ItwouldhavebeenbetterfortheUnitedStatestomaketheinvestmentsitselfsincethenitwouldhavereceivedthereturnsontheinvestmentitself,insteadofthereturnsgoingtoJapan.

10.GreatereducationalopportunitiesforwomencouldleadtofastereconomicgrowthinthecountriesofSouthAsiabecauseincreasedhumancapitalwouldincreaseproductivityandtherewouldbeexternaleffectsfromgreaterknowledgeinthecountry.Second,increasededucationalopportunitiesforyoungwomenmaylowerthepopulationgrowthratebecausesuchopportunitiesraisetheopportunitycostofhavingachild.11.a.Politicalstabilitycouldleadtostrongeconomicgrowthbymakingthecountryattractivetoinvestors.Theincreasedinvestmentwouldraiseeconomicgrowth.b.Strongeconomicgrowthcouldleadtopoliticalstabilitybecausewhenpeoplehavehighincomestheytendtobesatisfiedwiththepoliticalsystemandarelesslikelytooverthroworchangethegovernment.26章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Astockisaclaimtopartialownershipinafirm.Abondisacertificateofindebtedness.Theyaredifferentinnumerousways:(1)abondpaysinterest(afixedpaymentdeterminedwhenthebondisissued),whileastockpaysdividends(ashareofthefirm’sprofitsthatcanincreaseifthefirmismoreprofitable);(2)abondhasafixedtimetomaturity,whileastocknevermatures;and(3)ifacompanythathasissuedbothstockandbondsgoesbankrupt,thebondholdersgetpaidoffbeforethestockholders,sostockshavegreaterriskandpotentiallygreaterreturnthanbonds.Stockandbondsaresimilarinthatbotharefinancialinstrumentsthatareusedbycompaniestoraisemoneyforinvestment,botharetradedonexchanges,botharesubjecttocreditrisk,andthereturnstobotharetaxed(usually).2.Privatesavingistheamountofincomethathouseholdshaveleftafterpayingtheirtaxesandpayingfortheirconsumption.Publicsavingistheamountoftaxrevenuethatthegovernmenthasleftafterpayingforitsspending.Nationalsavingisequaltothetotalincomeintheeconomythatremainsafterpayingforconsumptionandgovernmentpurchases.Investmentisthepurchaseofnewcapital,suchasequipmentorbuildings.Thesetermsarerelatedintwoways:(1)Nationalsavingisthesumofpublicsavingandprivatesaving,bydefinition.(2)Nationalsavingequalsinvestment.

3.IfmoreAmericansadopteda“livefortoday”approachtolife,theywouldspendmoreandsaveless.Thiswouldshiftthesupplycurvetotheleftinthemarketforloanablefunds,causingtheinterestratetorise.Inequilibrium,therewouldbelesssavingandinvestment,andahigherinterestrate.QuestionsforReview1.Thefinancialsystem"sroleistohelpmatchoneperson"ssavingwithanotherperson"sinvestment.Twomarketsthatarepartofthefinancialsystemarethebondmarket,throughwhichlargecorporations,thefederalgovernment,orstateandlocalgovernmentsborrow,andthestockmarket,throughwhichcorporationssellownershipshares.Twofinancialintermediariesarebanks,whichtakeindepositsandusethedepositstomakeloans,andmutualfunds,whichsellsharestothepublicandusetheproceedstobuyaportfoliooffinancialassets.2.Itisimportantforpeoplewhoownstocksandbondstodiversifytheirholdingsbecausethentheywillhaveonlyasmallstakeineachasset,whichreducesrisk.Mutualfundsmakesuchdiversificationeasybyallowingasmallinvestortopurchasepartsofhundredsofdifferentstocksandbonds.3.Nationalsavingistheamountofanation"sincomethatisnotspentonconsumptionorgovernmentpurchases.Privatesavingistheamountofincomethathouseholdshaveleftafterpayingtheirtaxesandpayingfortheirconsumption.Publicsavingistheamountoftaxrevenuethatthegovernmenthasleftafterpayingforitsspending.Thethreevariablesarerelatedbecausenationalsavingequalsprivatesavingpluspublicsaving.4.Investmentreferstothepurchaseofnewcapital,suchasequipmentorbuildings.Itisequaltonationalsaving.5.Achangeinthetaxcodethatmightincreaseprivatesavingistheintroductionofaconsumptiontaxtoreplacetheincometax.Sinceaconsumptiontaxwouldnottaxthereturnstosaving,itwouldincreasethesupplyofloanablefunds,thusloweringinterestratesandincreasinginvestment.6.Agovernmentbudgetdeficitariseswhenthegovernmentspendsmorethanitreceivesintaxrevenue.Sinceagovernmentbudgetdeficitreducesnationalsaving,itraisesinterestrates,reducesprivateinvestment,andthusreduceseconomicgrowth.ProblemsandApplications1.a.ThebondofaneasternEuropeangovernmentwouldpayahigherinterestratethanthebondoftheU.S.governmentbecausetherewouldbeagreaterriskof

default.b.Abondthatrepaystheprincipalin2025wouldpayahigherinterestratethanabondthatrepaystheprincipalin2005becauseithasalongertermtomaturity,sothereismorerisktotheprincipal.c.AbondfromasoftwarecompanyyouruninyourgaragewouldpayahigherinterestratethanabondfromCoca-Colabecauseyoursoftwarecompanyhasmorecreditrisk.d.AbondissuedbythefederalgovernmentwouldpayahigherinterestratethanabondissuedbyNewYorkstatebecauseaninvestordoesnothavetopayfederalincometaxonthebondfromNewYorkstate.2.Manyanswersarepossible.Price-earningsratiosvary.Ahighprice-earningsratiomightindicateeitherthatpeopleexpectearningstoriseinthefutureorthatthestockisovervalued.Alowprice-earningsratiomightindicateeitherthatpeopleexpectearningstofallorthatthestockisundervalued.3.Thestockmarketdoeshaveasocialpurpose.Firmsobtainfundsforinvestmentbyissuingnewstock.Peoplearemorelikelytobuythatstockbecausethereareorganizedstockmarkets,sopeopleknowthattheycanselltheirstockiftheywantto.4.StockpricesareviewedasharbingersoffuturedeclinesinrealGDPbecausepeoplevaluestocksbasedontheexpectedfutureprofitabilityofthefirm.Ifstockpricesfall,thismustmeanthatinvestorsexpectalowerfutureprofitabilityforthefirms.Thismeansthatwemightexpectoutputinthesefirmstodeclineaswell.5.WhentheRussiangovernmentdefaultedonitsdebt,investorsperceivedahigherchanceofdefault(thantheyhadbefore)onsimilarbondssoldbyotherdevelopingcountries.Thusthesupplyofloanablefundsshiftedtotheleft,asshowninFigure1.Theresultwasanincreaseintheinterestrate.

Figure16.Companiesencouragetheiremployeestoholdstockinthecompanybecauseitgivestheemployeestheincentivetocareaboutthefirm’sprofits,notjusttheirownsalary.Then,ifemployeesseewasteorseeareasinwhichthefirmcanimprove,theywilltakeactionsthatbenefitthecompanybecausetheyknowthevalueoftheirstockwillriseasaresult.Anditalsogivesemployeesanadditionalincentivetoworkhard,knowingthatifthefirmdoeswell,theywillprofit.Butfromanemployee’spointofview,owningstockinthecompanyforwhichsheorheworkscanberisky.Theemployee’swagesorsalaryisalreadytiedtohowwellthefirmperforms.Ifthefirmhastrouble,theemployeecouldbelaidofforhaveherorhissalaryreduced.Iftheemployeeownsstockinthefirm,thenthereisadoublewhammy¾theemployeeisunemployedorgetsalowersalaryandthevalueofthestockfallsaswell.Soowningstockinyourowncompanyisaveryriskyproposition.Mostemployeeswouldbebetteroffdiversifying¾owningstockorbondsinothercompanies¾sotheirfortuneswouldn’tdependsomuchonthefirmforwhichtheywork.7.Toamacroeconomist,savingoccurswhenaperson’sincomeexceedshisconsumption,whileinvestmentoccurswhenapersonorfirmpurchasesnewcapital,suchasahouseorbusinessequipment.a.Whenyourfamilytakesoutamortgageandbuysanewhouse,thatisinvestment,becauseitisapurchaseofnewcapital.

b.Whenyouuseyour$200paychecktobuystockinAT&T,thatissaving,becauseyourincomeof$200isnotbeingspentonconsumptiongoods.c.Whenyourroommateearns$100anddepositsitinheraccountatabank,thatissaving,becausethemoneyisnotspentonconsumptiongoods.d.Whenyouborrow$1,000fromabanktobuyacartouseinyourpizza-deliverybusiness,thatisinvestment,becausethecarisacapitalgood.8.GiventhatY=8,T=1.5,Sprivate=0.5=Y-T-C,Spublic=0.2=T-G.SinceSprivate=Y-T-C,thenrearranginggivesC=Y-T-Sprivate=8-1.5-0.5=6.SinceSpublic=T-G,thenrearranginggivesG=T-Spublic=1.5-0.2=1.3.SinceS=nationalsaving=Sprivate+Spublic=0.5+0.2=0.7.Finally,sinceI=investment=S,I=0.7.9.a.Ifinterestratesincrease,thecostsofborrowingmoneytobuildthefactorybecomehigher,sothereturnsfrombuildingthenewplantmaynotbesufficienttocoverthecosts.Thus,higherinterestratesmakeitlesslikelythatIntelwillbuildthenewfactory.b.EvenifIntelusesitsownfundstofinancethefactory,theriseininterestratesstillmatters.Thereisanopportunitycostontheuseofthefunds.Insteadofinvestinginthefactory,Intelcouldinvestthemoneyinthebondmarkettoearnthehigherinterestrateavailablethere.Intelwillcompareitspotentialreturnsfrombuildingthefactorytothepotentialreturnsfromthebondmarket.Soifinterestratesrise,sothatbondmarketreturnsrise,Intelisagainlesslikelytoinvestinthefactory.Figure2

10.a.Figure2illustratestheeffectofthe$20billionincreaseingovernmentborrowing.Initially,thesupplyofloanablefundsiscurveS1,theequilibriumrealinterestrateisi1,andthequantityofloanablefundsisL1.Theincreaseingovernmentborrowingby$20billionreducesthesupplyofloanablefundsateachinterestrateby$20billion,sothenewsupplycurve,S2,isshownbyashifttotheleftofS1byexactly$20billion.Asaresultoftheshift,thenewequilibriumrealinterestrateisi2.Theinterestratehasincreasedasaresultoftheincreaseingovernmentborrowing.b.Sincetheinterestratehasincreased,investmentandnationalsavingdeclineandprivatesavingincreases.Theincreaseingovernmentborrowingreducespublicsaving.Fromthefigureyoucanseethattotalloanablefunds(andthusbothinvestmentandnationalsaving)declinebylessthan$20billion,whilepublicsavingdeclinesby$20billionandprivatesavingrisesbylessthan$20billion.c.Themoreelasticisthesupplyofloanablefunds,theflatterthesupplycurvewouldbe,sotheinterestratewouldrisebylessandthusnationalsavingwouldfallbyless,asFigure3shows.Figure3d.Themoreelasticthedemandforloanablefunds,theflatterthedemandcurvewouldbe,sotheinterestratewouldrisebylessandthusnationalsavingwouldfallbymore,asFigure4shows.

Figure4e.Ifhouseholdsbelievethatgreatergovernmentborrowingtodayimplieshighertaxestopayoffthegovernmentdebtinthefuture,thenpeoplewillsavemoresotheycanpaythehigherfuturetaxes,soprivatesavingwillincrease,aswillthesupplyofloanablefunds.Thiswilloffsetthereductioninpublicsaving,thusreducingtheamountbywhichtheequilibriumquantityofinvestmentandnationalsavingdecline,andreducingtheamountthattheinterestraterises.Iftheriseinprivatesavingwasexactlyequaltotheincreaseingovernmentborrowing,therewouldbenoshiftinthenationalsavingcurve,soinvestment,nationalsaving,andtheinterestratewouldallbeunchanged.ThisisthecaseofRicardianequivalence.11.Sincenewcomputertechnologyenablesfirmstoreduceinventoryinvestment,thedemandcurveforloanablefundsshiftstotheleft,asshowninFigure5.Asaresult,theequilibriumquantityofloanablefundsdeclines,asdoestheinterestrate.Thedeclineintheinterestratethenincreasesinvestmentinfactoriesandequipment,butoverallinvestmentstilldeclines.

Figure5Figure612.Ifworldsavingsdeclinesatthesametimeworldinvestmentrises,thesupplycurveofloanablefundsshiftstotheleftandthedemandcurveshiftstotheright.Figure6illustratestheresultthattheworldinterestratewillrise,whiletheoveralleffectontheequilibriumquantityofloanablefundsisambiguous¾itdependsonhowbigtheshiftsofthetwocurvesarerelativetoeachother,andontheirelasticities.13.a.Investmentcanbeincreasedbyreducingtaxesonprivatesavingorbyreducingthegovernmentbudgetdeficit.Butreducingtaxesonprivatesavinghastheeffectofincreasingthegovernmentbudgetdeficit,unlesssomeothertaxesareincreasedorgovernmentspendingisreduced.Soitisdifficulttoengageinbothpoliciesatthesametime.

b.Toknowwhichofthesepolicieswouldbeamoreeffectivewaytoraiseinvestment,youwouldneedtoknow:(1)whattheelasticityofprivatesavingiswithrespecttotheafter-taxrealinterestrate,sincethatwoulddeterminehowmuchprivatesavingwouldincreaseifyoureducedtaxesonsaving;(2)howprivatesavingrespondstochangesinthegovernmentbudgetdeficit,since,forexample,ifRicardianequivalenceholds,thedeclineinthegovernmentbudgetdeficitwouldbematchedbyanequaldeclineinprivatesaving,sonationalsavingwouldnotincreaseatall;and(3)howelasticinvestmentiswithrespecttotheinterestrate,sinceifinvestmentisquiteinelastic,neitherpolicywillhavemuchofanimpactoninvestment.27章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Thepresentvalueof$150tobereceivedin10yearsiftheinterestrateis7percentis$150/(1.07)10=$76.25.2.Therearethreewaysinwhicharisk-aversepersonmayreducetheriskhefaces:(1)purchaseinsurance,(2)diversifyhisportfolio,or(3)choosesaferalternativesbyacceptingalowerrateofreturn.3.No.Accordingtotheefficientmarketshypothesis,thepriceofashareofstockshouldreflectallavailableinformationaboutitsvalue.Thus,thestocksinthislistshoulddonobetteronaveragethananyotherstocklistedonthestockexchange.QuestionsforReview1.Iftheinterestrateis7percent,thepresentvalueof$200tobereceivedin10yearsis$200/(1.07)10=$101.67.Iftheinterestrateis7percent,thepresentvalueof$300tobereceived20yearsfromnowis$300/(1.07)20=$77.53.2.Purchasinginsuranceallowsanindividualtoreducethelevelofriskhefaces.Twoproblemsthatimpedetheinsuranceindustryfromworkingcorrectlyareadverseselectionandmoralhazard.Adverseselectionoccursbecauseahigh-riskpersonismorelikelytoapplyforinsurancethanalow-riskpersonis.Moralhazardoccursbecausepeoplehavelessincentivetobecarefulabouttheirriskybehavioraftertheypurchaseinsurance.3.Diversificationisthereductionofriskachievedbyreplacingasingleriskwithalargenumberofsmallerunrelatedrisks.Astockholderwillgetmorediversificationgoingfrom1to10stocksthanfrom100to120stocks.4.Stockshavemoreriskbecausetheirvaluedependsonthefuturevalueofthefirm.Becauseofitshigherrisk,shareholderswilldemandahigherreturn.Thereisapositiverelationshipbetweenriskandreturn.

5.Astockanalystwillconsiderthefutureprofitabilityofafirmwhendeterminingthevalueofthestock.6.Theefficientmarketshypothesissuggeststhatstockpricesreflectallavailableinformation.Thismeansthatwecannotusecurrentinformationtopredictfuturechangesinstockprices.Onepieceofevidencethatsupportsthistheoryisthefactthatmanyindexfundsoutperformmutualfundsthatareactivelymanagedbyaprofessionalportfoliomanager.7.Economistswhoareskepticaloftheefficientmarketshypothesisbelievethatfluctuationsinstockpricesarepartlypsychological.Peoplemayinfactbewillingtopurchaseastockthatisovervaluediftheybelievethatsomeonewillbewillingtopayevenmoreinthefuture.Thismeansthatthestockpricemaynotbearationalvaluationofthefirm.ProblemsandApplications1.Thefuturevalueof$24investedfor400yearsataninterestrateof7percentis(1.07)400´$24=$13,600,000,000,000=$13.6trillion.2.a.Thepresentvalueof$15milliontobereceivedinfouryearsataninterestrateof11percentis$15million/(1.11)4=$9.88million.Sincethepresentvalueofthepayoffislessthanthecost,theprojectshouldnotbeundertaken.Thepresentvalueof$15milliontobereceivedinfouryearsataninterestrateof10percentis$15million/(1.10)4=$10.25million.Sincethepresentvalueofthepayoffisgreaterthanthecost,theprojectshouldbeundertaken.Thepresentvalueof$15milliontobereceivedinfouryearsataninterestrateof9percentis$15million/(1.09)4=$10.63million.Sincethepresentvalueofthepayoffisgreaterthanthecost,theprojectshouldbeundertaken.Thepresentvalueof$15milliontobereceivedinfouryearsataninterestrateof8percentis$15million/(1.08)4=$11.03million.Sincethepresentvalueofthepayoffisgreaterthanthecost,theprojectshouldbeundertaken.b.Theexactcutofffortheinterestratebetweenprofitabilityandnonprofitabilityistheinterestratethatwillequatethepresentvalueofreceiving$15millioninfouryearswiththecurrentcostoftheproject($10million):$10=15/(1+x)410(1+x)4=15(1+x)4=1.51+x=(1.5)0.251+x=1.1067x=0.1067Therefore,aninterestrateof10.67percentwouldbethecutoffbetweenprofitabilityandnonprofitability.3.a.Asickpersonismorelikelytoapplyforhealthinsurancethanisawellperson.Thisisadverseselection.Onceapersonhashealthinsurance,hemaybelesslikelytotakegoodcareofhimself.Thisismoralhazard.b.Ariskydriverismorelikelythanasafedrivertoapplyforcarinsurance.Thisisadverseselection.Onceadriverhasinsurance,hemaydrivemorerecklessly.Thisisadverseselection.4.Toreducetheriskassociatedwiththeportfolio,itisbettertodiversify.Thismeansthatthe

stocksshouldbeofcompaniesfromdifferentindustriesaswellaslocatedindifferentcountries.5.Astockthatisverysensitivetoeconomicconditionswillhavemoreriskassociatedwithit.Thus,wewouldexpectforthatstocktopayahigherreturn.Togetstockholderstobewillingtoaccepttherisk,theexpectedreturnmustbelargerthanaverage.6.Shareholderswilllikelydemandahigherreturnduetothestock’sidiosyncraticrisk.Idiosyncraticriskisriskthataffectsonlythatparticularstock.Allstocksintheeconomyaresubjecttoaggregaterisk.7.a.Ifaroommateisbuyingstocksincompaniesthateveryonebelieveswillexperiencebigprofitsinthefuture,theprice-earningsratioislikelytobehigh.Thepriceishighbecauseitreflectseveryone’sexpectationsaboutthefirm’sfutureearnings.Thelargestdisadvantageinbuyingthesestocksisthattheyarecurrentlyovervaluedandmaynotpayoffinthefuture.b.Firmswithlowprice-earningsratioswilllikelyhavelowerfutureearnings.Thereasonwhythesestocksarecheapisthateveryonehaslowerexpectationsaboutthefutureprofitabilityofthesefirms.Thelargestdisadvantagetobuyingthisstockisthatthemarketmaybecorrectandthefirm"sstockmayprovidealowreturn.8.a.Answerswillvary,butmayincludethingslikeinformationonnewproductsunderdevelopmentorinformationconcerningfuturegovernmentregulationsthatwillaffecttheprofitabilityofthefirm.b.Thefactthatthosewhotradestocksbasedoninsideinformationearnveryhighratesofreturndoesnotviolatetheefficientmarketshypothesis.Theefficientmarkethypothesissuggeststhatthepriceofastockreflectsallavailableinformationconcerningthefutureprofitabilityofthefirm.Insideinformationisnotreadilyavailabletothepublicandthusisnotreflectedinthestock’sprice.c.Insidertradingisillegalbecauseitgivessomebuyersorsellersanunfairadvantageinthestockmarket.28章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Theunemploymentrateismeasuredthroughasurveyof60,000householdstofindoutthepercentageofthelaborforcethatisunemployed.Theunemploymentrateoverstatestheamountofjoblessnessbecausesomeofthosewhoreportbeingunemployedmaynot,infact,betryinghardtofindajob.Buttheunemploymentrateunderstatestheamountofjoblessnessbecausediscouragedworkersreportbeingoutofthelaborforceeventhoughtheywantjobs.

2.Anincreaseintheworldpriceofoilincreasestheamountoffrictionalunemploymentasoil-producingfirmsincreaseoutputandemployment,butotherfirms,suchasthoseintheautoindustry,reduceoutputandemployment.Thesectoralshiftfromtheautoindustrytooilfirmscauseshigherfrictionalunemploymentforatimeuntilworkershaveshiftedfromtheautoindustrytotheoilindustry.Althoughnoincreaseinunemploymentisreallydesirable,thistypeoffrictionalunemploymentisnecessarytoreallocateresourcesbetweendifferentsectors.Publicpoliciesthatmightaffecttheunemploymentcausedbythischangeinthepriceofoilincludeemploymentagencies,whichcanhelpautoworkersmoveintotheoilindustry,job-trainingprogramstohelpworkersadapttoanewindustry,andunemploymentinsurance,whichkeepsworkersfromsufferingeconomichardshipwhilechangingfromoneindustrytoanother.3.Figure1showsthesupplycurve(S)andthedemandcurve(D)forlabor.Thewage(W)isabovetheequilibriumwage(WE).Theresultisunemployment,equaltotheamountbywhichlaborsupply(LS)exceedslabordemand(LD).Figure14.AunionintheautoindustryraisesthewagesofworkersemployedbyGeneralMotorsandFordbythreateningtostrike.Topreventthecostsofastrike,thefirmsgenerallypayhigherwagesthantheywouldiftherewasnounion.However,thehigherwagesreduceemploymentatGeneralMotorsandFord.Wagesandemploymentinotherindustriesareaffected,sinceunemployedautoworkersseekjobselsewhere,reducingwagesandincreasingemployment.5.Therearefourreasonsthatfirmsmightfinditprofitabletopaywagesabovethelevelthatbalancesthequantityoflaborsuppliedandthequantityoflabordemanded:(1)toensurethatworkersareingoodhealthsotheywillbemoreproductive;(2)toreduce

workerturnoverbecauseitiscostlytohirenewworkers;(3)tomakeworkerseagertokeeptheirjobs,thusdiscouragingthemfromshirking;and(4)toattractabetterpoolofworkers.QuestionsforReview1.TheBLScategorizeseachadult(16yearsofageandolder)aseitheremployed,unemployed,ornotinthelaborforce.Thelaborforceconsistsofthesumoftheemployedandtheunemployed.Theunemploymentrateisthepercentageofthelaborforcethatisunemployed.Thelabor-forceparticipationrateisthepercentageofthetotaladultpopulationthatisinthelaborforce.2.Unemploymentistypicallyshortterm.Mostpeoplewhobecomeunemployedareabletofindnewjobsfairlyquickly.Butsomeunemploymentisattributabletotherelativelyfewworkerswhoarejoblessforlongperiodsoftime.3.Frictionalunemploymentisinevitablebecausetheeconomyisalwayschanging.Somefirmsareshrinkingwhileothersareexpanding.Someregionsareexperiencingfastergrowththanotherregions.Transitionsofworkersbetweenfirmsandbetweenregionsareaccompaniedbytemporaryunemployment.Thegovernmentcouldhelptoreducetheamountoffrictionalunemploymentbypublicpoliciesthatprovideinformationaboutjobvacanciesinordertomatchworkersandjobsmorequickly,andthroughpublictrainingprogramsthathelpeasethetransitionofworkersfromdecliningtoexpandingindustriesandhelpdisadvantagedgroupsescapepoverty.4.Minimum-wagelawsareabetterexplanationforunemploymentamongteenagersthanamongcollegegraduates.Teenagershavefewerjob-relatedskillsthancollegegraduatesdo,sotheirwagesarelowenoughtobeaffectedbytheminimumwage.Collegegraduates"wagesgenerallyexceedtheminimumwage.5.Unionsmayaffectthenaturalrateofunemploymentviatheeffectoninsidersandoutsiders.Sinceunionsraisethewageabovetheequilibriumlevel,thequantityoflabordemandeddeclineswhilethequantitysuppliedoflaborrises,sothereisunemployment.Insidersarethosewhokeeptheirjobs.Outsiders,workerswhobecomeunemployed,havetwochoices:eithergetajobinafirmthatisnotunionizedorremainunemployedandwaitforajobtoopenupintheunionsector.Asaresult,thenaturalrateofunemploymentishigherthanitwouldbewithoutunions.6.Advocatesofunionsclaimthatunionsaregoodfortheeconomybecausetheyareanantidotetothemarketpowerofthefirmsthathireworkersandtheyareimportantforhelpingfirmsrespondefficientlytoworkers"concerns.

7.Fourreasonswhyafirm"sprofitsmightincreasewhenitraiseswagesare:(1)betterpaidworkersarehealthierandmoreproductive;(2)workerturnoverisreduced;(3)workereffortisincreased;and(4)thefirmcanattracthigherqualityworkers.ProblemsandApplications1.Thelaborforceconsistsofthenumberofemployed(138,547,000)plusthenumberofunemployed(6,021,000),whichequals144,568,000.Tofindthelabor-forceparticipationrate,weneedtoknowthesizeoftheadultpopulation.Addingthelaborforce(144,568,000)tothenumberofpeoplenotinthelaborforce(67,723,000)givestheadultpopulationof212,291,000.Thelabor-forceparticipationrateisthelaborforce(144,568,000)dividedbytheadultpopulation(212,291,000)times100percent,whichequals68percent.Theunemploymentrateisthenumberofunemployed(6,021,000)dividedbythelaborforce(144,568,000)times100percent,whichequals4.2percent.2.Manyanswersarepossible.3.Menaged55andoverexperiencedthegreatestdeclineinlaborforceparticipation.ThiswasbecauseofincreasedSocialSecuritybenefitsandretirementincomethanbefore,encouragingretirementatanearlierage.4.Youngerwomenexperiencedabiggerincreaseinlaborforceparticipationthanolderwomenbecausemoreofthemhaveenteredthelaborforce(inpartbecauseofsocialchanges),sotherearemoretwo-careerfamilies.Inaddition,womenhavedelayedhavingchildrenuntillaterinlifeandhavereducedthenumberofchildrentheyhave,sotheyareinthelaborforceforagreaterproportionoftheirlivesthanwasthecasepreviously.5.Thefactthatemploymentincreased2.1millionwhileunemploymentdeclined0.5millionisconsistentwithgrowthinthelaborforceof1.6millionworkers.Thelaborforceconstantlyincreasesasthepopulationgrowsandaslabor-forceparticipationincreases,sotheincreaseinthenumberofpeopleemployedmayalwaysexceedthereductioninthenumberunemployed.6.a.Aconstructionworkerwhoislaidoffbecauseofbadweatherislikelytoexperienceshort-termunemployment,sincetheworkerwillbebacktoworkassoonastheweatherclearsup.

b.Amanufacturingworkerwholosesherjobataplantinanisolatedareaislikelytoexperiencelong-termunemployment,sincethereareprobablyfewotheremploymentopportunitiesinthearea.Shemayneedtomovesomewhereelsetofindasuitablejob,whichmeansshewillbeoutofworkforsometime.c.Aworkerinthestagecoachindustrywhowaslaidoffbecauseofthegrowthofrailroadsislikelytobeunemployedforalongtime.Theworkerwillhavealotoftroublefindinganotherjobwhenhisentireindustryisshrinking.Hewillprobablyneedtogainadditionaltrainingorskillstogetajobinadifferentindustry.d.Ashort-ordercookwholoseshisjobwhenanewrestaurantopensislikelytofindanotherjobfairlyquickly,perhapsevenatthenewrestaurant,andthushewillprobablyhaveonlyashortspellofunemployment.e.Anexpertwelderwithlittleeducationwholosesherjobwhenthecompanyinstallsautomaticweldingmachineryislikelytobewithoutajobforalongtime,sinceshelacksthetechnologicalskillstokeepupwiththelatestequipment.Toremainintheweldingindustry,shemayneedtogobacktoschoolandlearnthenewesttechniques.Figure27.Figure2showsadiagramofthelabormarketwithabindingminimumwage.Theinitialequilibriumwithminimumwagem1hasquantityoflaborsupplyL1SgreaterthanthequantityoflabordemandedL1D,withunemploymentequaltoL1S-L1D.Anincreaseintheminimumwagetom2leadstoanincreaseinthequantityoflaborsuppliedtoL2SandadecreaseinthequantityoflabordemandedtoL2D.Asaresult,unemploymentincreasesastheminimumwagerises.

8.Firmsinsmalltownshavemoremarketpowerinhiringbecausetherearefeweropportunitiesforworkerstofindjobselsewhere.Firmsgenerallyhavelessmarketpowernowthantheyusedto,sinceitisnoweasierforemployeestotravelfarthertogotowork.Thischangeinthemarketpoweroffirmshasreducedtheneedforunions,sincecompetitionfromotherfirmskeepsworkers"wagesandbenefitshighandreducestheneedforcollectivebargaining.9.a.Figure3illustratestheeffectofaunionbeingestablishedinonelabormarket.Whenonelabormarketisunionized,showninthefigureontheleft,thewagerisesfromw1Utow2UandthequantityoflabordemandeddeclinesfromU1toU2D.Sincethewageishigher,thequantitysuppliedoflaborincreasestoU2S,sothereareU2S-U2Dunemployedworkersintheunionizedsector.Thequantityoflaboremployedinthismarketisinefficient,sincemoreworkerswouldliketohavejobsattheexistingwage.b.Whenthoseworkerswhobecomeunemployedintheunionsectorseekemploymentinthenonunionizedmarket,showninthefigureontheright,thesupplyoflaborshiftstotherightfromS1toS2.Theresultisadeclineinthewageinthenonunionizedsectorfromw1Ntow2NandanincreaseinemploymentinthenonunionizedsectorfromN1toN2.310.a.WhentheJapanesedevelopedastrongautoindustry,U.S.autodemandbecamemoreelasticasaresultofincreasedcompetition.Withmoreelasticdemandforautos,theelasticityofdemandforAmericanautoworkersincreased.b.Sincetheriseinautoimportsmadethedemandforautoworkersmoreelastic,to

maintainahigher-than-competitivewageraterequiresagreaterreductioninthequantityoflabordemanded.Sotheunionhadtochoosebetweenallowingtheunionwagetodeclineorfacingthelossofmanyjobs.c.Giventhetradeofffacedbytheunion,thegrowthoftheJapaneseautoindustryforcedtheunionwagetomoveclosertothecompetitivewage.11.Workersneedtobemonitorediftheyearnaflatsalarybutlittlemonitoringisneededunderacommissionstructure.Underasystemwithflatsalaries,thewageneedstoexceedtheequilibriumwagetoencouragegreatereffortbyworkers.Thewageneednotexceedtheequilibriumwageunderasystemwithcommissions,sinceworkerscanchoosetheirlevelofeffortandgetpaidinproportiontotheireffort.Thefactorsthatdeterminethetypeofcompensationschemeincludethecostofmonitoring,thewillingnessofworkerstobearriskunderthecommissionscheme,andtheinterdependenceoftasks.12.a.Ifafirmwasnotprovidingsuchbenefitspriortothelegislation,thecurveshowingthedemandforlaborwouldshiftdownbyexactly$4ateachquantityoflabor,becausethefirmwouldnotbewillingtopayashighawagegiventheincreasedcostofthebenefits.Figure4b.Ifemployeesvaluethebenefitbyexactly$4perhour,theywouldbewillingtoworkthesameamountforawagethat"s$4lessperhour,sothesupplycurveoflaborshiftsdownbyexactly$4.c.Figure4showstheequilibriuminthelabormarket.Sincethedemandandsupplycurvesoflaborbothshiftdownby$4,theequilibriumquantityoflaborisunchangedandthewageratedeclinesby$4.Bothemployeesandemployersarejustaswelloffasbefore.

d.Iftheminimumwagepreventsthewagefromfalling,theresultwillbeincreasedunemployment,asFigure5shows.Initially,laborsupplyisL1SandlabordemandisL1D,sounemploymentisgivenbyL1S-L1D.ThedownwardshiftofboththedemandandsupplycurvesgivesanewequilibriumwithlaborsupplyL2S,labordemandL2D,andunemploymentL2S-L2D.Thewageisunchanged,thelevelofemploymentdeclines,andthelevelofunemploymentrises.Employersareworseoffbecausetheyhirelesslaboratahigherwage(includingbenefits).Theworkerswhobecomeunemployedareworseoffbecauseofthepolicy,whileworkerswhoremainemployedarebetteroff,sincetheirwagesplusbenefitshaveincreased.Figure5

Figure6e.Iftheworkersdonotvaluethemandatedbenefitatall,thesupplycurveoflabordoesnotshiftdown.Asaresult,inpartc,thewageratewilldeclinebylessthan$4andtheequilibriumquantityoflaborwilldecline,asshowninFigure6.Thenewwage,w2,willbelessthanw1,butgreaterthanw1-$4.Employersareworseoff,sincetheynowpayagreatertotalwageplusbenefitsforfewerworkers.Employeesareworseoff,sincetheygetalowerwageandworkless.Withaminimumwageineffect,asinpartd,theimpactonunemploymentisnotasbadaswhentheworkersvaluedthebenefits.LookingbackatFigure5,theonlydifferenceisthatthelabor-supplycurvedoesnotshift,sotheequilibriumquantityoflaborsuppliedstaysthesameatL1S.Sothewagestaysthesame,labordemanddeclines,laborsupplyisunchanged,andunemploymentrises.Asbefore,employersareworseoffsincetheygetlesslaboratahigherwageplusbenefits.Employeesareworseoff,too,sincethereislessemploymentatthesamewage.29章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Thethreefunctionsofmoneyare:(1)mediumofexchange;(2)unitofaccount;and(3)

storeofvalue.Moneyisusedasamediumofexchangebecausemoneyistheitempeopleusetopurchasegoodsandservices.Moneyisusedasaunitofaccountbecauseitistheyardstickpeopleusetopostpricesandrecorddebts.Moneyisusedasastoreofvaluebecauseitisanitempeopleusetotransferpurchasingpowerfromthepresenttothefuture.2.TheprimaryresponsibilitiesoftheFederalReservearetoregulatebanks,ensuringthehealthofthebankingsystem,andtocontrolthequantityofmoneythatismadeavailableintheeconomy.IftheFedwantstoincreasethesupplyofmoney,itusuallydoessobycreatingdollarsandusingthemtopurchasegovernmentbondsfromthepublicinthenation’sbondmarkets.3.Bankscreatemoneywhentheymakeloansandholdafractionoftheamountoftheloansinreserves,resultinginanexpansionofbothmoneyandcreditintheeconomy.IftheFedwantedtouseallthreeofitstoolstodecreasethemoneysupply,itwould:(1)sellgovernmentbondsfromitsportfoliointheopenmarkettoreducethenumberofdollarsincirculation;(2)increasereserverequirementstoreducethemoneycreatedbybanks;and(3)increasethediscountratetodiscouragebanksfromborrowingreservesfromtheFed.QuestionsforReview1.Moneyisdifferentfromotherassetsintheeconomybecauseitisthemostliquidassetavailable.Otherassetsvarywidelyintheirliquidity.2.Commoditymoneyismoneywithintrinsicvalue,likegold,whichcanbeusedforpurposesotherthanasamediumofexchange.Fiatmoneyismoneywithoutintrinsicvalue;ithasnovalueotherthanitsuseasamediumofexchange.Oureconomytodayusesfiatmoney.3.Demanddepositsarebalancesinbankaccountsthatdepositorscanaccessondemandsimplybywritingacheck.Theyshouldbeincludedinthestockofmoneybecausetheycanbeasamediumofexchange.4.TheFederalOpenMarketCommittee(FOMC)isresponsibleforsettingmonetarypolicyintheUnitedStates.TheFOMCconsistsofthesevenmembersoftheFederalReserveBoardofGovernorsandfiveofthe12presidentsofFederalReserveBanks.MembersoftheBoardofGovernorsareappointedbythepresidentoftheUnitedStatesandconfirmedbytheU.S.Senate.ThepresidentsoftheFederalReserveBanksarechosenbyeachbank’sboardofdirectors.5.IftheFedwantstoincreasethesupplyofmoneywithopen-marketoperations,itpurchasesU.S.governmentbondsfromthepublicontheopenmarket.Thepurchaseincreasesthenumberofdollarsinthehandsofthepublic,thusraisingthemoneysupply.

6.Banksdonothold100percentreservesbecauseitismoreprofitabletousethereservestomakeloans,whichearninterest,insteadofleavingthemoneyasreserves,whichearnnointerest.Theamountofreservesbanksholdisrelatedtotheamountofmoneythebankingsystemcreatesthroughthemoneymultiplier.Thesmallerthefractionofreservesbankshold,thelargerthemoneymultiplier,sinceeachdollarofreservesisusedtocreatemoremoney.7.ThediscountrateistheinterestrateonloansthattheFederalReservemakestobanks.IftheFedraisesthediscountrate,fewerbankswillborrowfromtheFed,sobanks"reserveswillbelower,andthusthemoneysupplywillbelower.8.Reserverequirementsareregulationsontheminimumamountofreservesthatbanksmustholdagainstdeposits.Anincreaseinreserverequirementsraisesthereserveratio,lowersthemoneymultiplier,anddecreasesthemoneysupply.9.TheFedcannotcontrolthemoneysupplyperfectlybecause:(1)theFeddoesnotcontroltheamountofmoneythathouseholdschoosetoholdasdepositsinbanks;and(2)theFeddoesnotcontroltheamountthatbankerschoosetolend.TheactionsofhouseholdsandbanksaffectthemoneysupplyinwaystheFedcannotperfectlycontrolorpredict.ProblemsandApplications1.a.AU.S.pennyismoneyintheU.S.economybecauseitisusedasamediumofexchangetobuygoodsorservices,itservesasaunitofaccountbecausepricesinstoresarelistedintermsofdollarsandcents,anditservesasastoreofvalueforanyonewhoholdsitovertime.b.AMexicanpesoisnotmoneyintheU.S.economy,becauseitisnotusedasamediumofexchange,andpricesarenotgivenintermsofpesos,soitisnotaunitofaccount.Itcouldserveasastoreofvalue,though.c.APicassopaintingisnotmoney,becauseyoucannotexchangeitforgoodsorservices,andpricesarenotgivenintermsofPicassopaintings.Itdoes,however,serveasastoreofvalue.d.Aplasticcreditcardissimilartomoney,butrepresentsdeferredpayment,ratherthatimmediatepayment.Socreditcardsdonotfullyrepresentthemediumofexchangefunctionofmoney,noraretheyreallystoresofvalue,sincetheyrepresentshort-termloansratherthanbeinganassetlikecurrency.2.a.Itwouldbedifficulttoruntheeconomyusingthe"Swopper"sColumn"instead

ofmoneybecauseitrequiresfindingadoublecoincidenceofwants.Moneyworksefficientlybecauseitrequiressatisfyingpeople"sneedsonjustonesideofeachtransaction;youbuysomethingformoneyandsellsomethingelseformoney.Withmoney,youdonothavetobuysomethingfromsomeonewhowantsanitemyou"reselling.b.The"Swopper"sColumn"probablyexistssothatpeoplecanavoidpayingtaxesonthingstheybuyandsell.3.Foranassettobeusefulasamediumofexchange,itmustbewidelyaccepted(soalltransactionscanbemadeintermsofit),recognizedeasilyasmoney(sopeoplecanperformtransactionseasilyandquickly),divisible(sopeoplecanprovidechange),anddifficulttocounterfeit(sopeoplewillnotprinttheirownmoney).Thatiswhynearlyallcountriesusepapermoneywithfancydesignsforlargerdenominationsandcoinsforsmallerdenominations.Foranassettobeusefulasastoreofvalue,itmustbesomethingthatmaintainsitsvalueovertimeandsomethingthatcanbeuseddirectlytobuygoodsandservicesorsoldwhenmoneyisneeded.Inadditiontocurrency,financialassets(likestocksandbonds)andphysicalassets(likerealestateandart)makegoodstoresofvalue.4.a.Iftherewereaneasywaytomakelimestonewheels,thepeopleonYapwouldmakeadditionalwheelsaslongasthemonetaryvalueofthewheelswasgreaterthanthecostofproducingthewheels.Theresultwouldbethatpeoplewouldmaketheirownmoney,sotherewouldbetoomuchmoneyproduced.Mostlikely,peoplewouldstopacceptingthewheelsasmoneyandswitchtosomeotherassetasamediumofexchange.b.IfsomeoneintheUnitedStatesdiscoveredaneasywaytocounterfeithundred-dollarbills,theycouldfloodthecountrywithcounterfeitcurrency,thusreducingitsvalue.Theresultmightbeaswitchtoadifferenttypeofcurrency.5.Manyanswersarepossible.6.Whenyourunclerepaysa$100loanfromTenthNationalBank(TNB)bywritingacheckfromhisTNBcheckingaccount,theresultisachangeintheassetsandliabilitiesofbothyouruncleandTNB,asshownintheseT-accounts:

YourUncleAssetsLiabilitiesBefore:CheckingAccount$100Loans$100After:CheckingAccount$0Loans$0TenthNationalBankAssetsLiabilitiesBefore:Loans$100Deposits$100After:Loans$0Deposits$0Bypayingofftheloan,yourunclesimplyeliminatedtheoutstandingloanusingtheassetsinhischeckingaccount.Youruncle"swealthhasnotchanged;hesimplyhasfewerassetsandfewerliabilities.7.a.HereisBSB"sT-account:BeleagueredStateBankAssetsLiabilitiesReserves$25millionDeposits$250millionLoans$225millionb.WhenBSB"slargestdepositorwithdraws$10millionincashandBSBreducesitsloansoutstandingtomaintainthesamereserveratio,itsT-accountisnow:BeleagueredStateBankAssetsLiabilitiesReserves$24millionDeposits$240millionLoans$216millionc.SinceBSBiscuttingbackonitsloans,otherbankswillfindthemselvesshortofreservesandtheymayalsocutbackontheirloansaswell.d.BSBmayfinditdifficulttocutbackonitsloansimmediately,sinceitcannotforcepeopletopayoffloans.Instead,itcanstopmakingnewloans.Butforatimeitmightfinditselfwithmoreloansthanitwants.Itcouldtrytoattractadditionaldepositstogetadditionalreserves,orborrowfromanotherbankorfromtheFed.

8.Ifyoutake$100thatyouheldascurrencyandputitintothebankingsystem,thenthetotalamountofdepositsinthebankingsystemincreasesby$1,000,sinceareserveratioof10percentmeansthemoneymultiplieris1/.10=10.Thusthemoneysupplyincreasesby$900,sincedepositsincreaseby$1,000butcurrencydeclinesby$100.9.Witharequiredreserveratioof10percent,themoneymultipliercouldbeashighas1/.10=10,ifbanksholdnoexcessreservesandpeopledonotkeepsomeadditionalcurrency.Sothemaximumincreaseinthemoneysupplyfroma$10millionopen-marketpurchaseis$100million.Thesmallestpossibleincreaseis$10millionifallofthemoneyisheldbybanksasexcessreserves.10.a.Iftherequiredreserveratiois5percent,thenFirstNationalBank"srequiredreservesare$500,000x.05=$25,000.Sincethebank’stotalreservesare$100,000,ithasexcessreservesof$75,000.b.Witharequiredreserveratioof5percent,themoneymultiplieris1/.05=20.IfFirstNationallendsoutitsexcessreservesof$75,000,themoneysupplywilleventuallyincreaseby$75,000x20=$1,500,000.11.a.Witharequiredreserveratioof10percentandnoexcessreserves,themoneymultiplieris1/.10=10.IftheFedsells$1millionofbonds,reserveswilldeclineby$1millionandthemoneysupplywillcontractby10x$1million=$10million.b.Banksmightwishtoholdexcessreservesiftheyneedtoholdthereservesfortheirday-to-dayoperations,suchaspayingotherbanksforcustomers"transactions,makingchange,cashingpaychecks,andsoon.Ifbanksincreaseexcessreservessuchthatthereisnooverallchangeinthetotalreserveratio,thenthemoneymultiplierdoesnotchangeandthereisnoeffectonthemoneystock.12.a.Withbanksholdingonlyrequiredreservesof10percent,themoneymultiplieris1/.10=10.Sincereservesare$100billion,themoneystockis10x$100billion=$1,000billion.b.Iftherequiredreserveratioisraisedto20percent,themoneymultiplierdeclinesto1/.20=5.Withreservesof$100billion,themoneystockwoulddeclineto$500billion,adeclineof$500billion.Reserveswouldbeunchanged.13.a.Ifpeopleholdallmoneyascurrency,thequantityofmoneyis$2,000.b.Ifpeopleholdallmoneyasdemanddepositsatbankswith100percentreserves,thequantityofmoneyis$2,000.

c.Ifpeoplehave$1,000incurrencyand$1,000indemanddeposits,thequantityofmoneyis$2,000.d.Ifbankshaveareserveratioof10percent,themoneymultiplieris1/.10=10.Soifpeopleholdallmoneyasdemanddeposits,thequantityofmoneyis10x$2,000=$20,000.e.Ifpeopleholdequalamountsofcurrency(C)anddemanddeposits(D)andthemoneymultiplierforreservesis10,thentwoequationsmustbesatisfied:(1)C=D,sothatpeoplehaveequalamountsofcurrencyanddemanddeposits;and(2)10x($2,000-C)=D,sothatthemoneymultiplier(10)timesthenumberofdollarbillsthatarenotbeingheldbypeople($2,000-C)equalstheamountofdemanddeposits(D).Usingthefirstequationinthesecondgives10x($2,000-D)=D,or$20,000-10D=D,or$20,000=11D,soD=$1,818.18.ThenC=$1,818.18.ThequantityofmoneyisC+D=$3,636.36.30章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Whenthegovernmentofacountryincreasesthegrowthrateofthemoneysupplyfrom5percentperyearto50percentperyear,pricesandnominalinterestrateswillincreasedramatically.Thegovernmentmaybeincreasingthemoneysupplytofinanceitsexpenditures.2.Sixcostsofinflationare:(1)shoeleathercosts;(2)menucosts;(3)relative-pricevariabilityandthemisallocationofresources;(4)inflation-inducedtaxdistortions;(5)confusionandinconvenience;and(6)arbitraryredistributionsofwealth.Shoeleathercostsarisebecauseinflationcausespeopletospendresourcesgoingtothebankmoreoften.Menucostsoccurwhenpeoplespendresourceschangingtheirpostedprices.Relative-pricevariabilityoccursbecauseasgeneralpricesrise,afixeddollarpricetranslatesintoadecliningrelativeprice,sotherelativepricesofgoodsareconstantlychangingasaresultofinflation;thiscausesamisallocationofresources.Thecombinationofinflationandtaxationcausesdistortionsbecausepeoplearetaxedontheirnominalcapitalgainsandinterestincome,insteadoftheirrealincome.Inflationcausesconfusionandinconveniencebecauseitreducesmoney’sabilitytofunctionasaunitofaccount.Unexpectedinflationredistributeswealthbetweenborrowersandlenders.

QuestionsforReview1.Anincreaseinthepricelevelreducestherealvalueofmoneybecauseeachdollarinyourwalletnowbuysasmallerquantityofgoodsandservices.2.Accordingtothequantitytheoryofmoney,anincreaseinthequantityofmoneycausesaproportionalincreaseinthepricelevel.3.Nominalvariablesarethosemeasuredinmonetaryunits,whilerealvariablesarethosemeasuredinphysicalunits.Examplesofnominalvariablesincludethepricesofgoods,wages,andthedollarvalueofGDP.Examplesofrealvariablesincluderelativeprices(thepriceofonegoodintermsofanother),realwages,andrealGDP.Accordingtotheprincipleofmonetaryneutrality,onlynominalvariablesareaffectedbychangesinthequantityofmoney.4.Inflationislikeataxbecauseeveryonewhoholdsmoneylosespurchasingpower.Inahyperinflation,thegovernmentincreasesthemoneysupplyrapidly,whichleadstoahighrateofinflation.Thusthegovernmentusestheinflationtax,insteadoftaxesonincome,tofinanceitsspending.5.AccordingtotheFishereffect,anincreaseintheinflationrateraisesthenominalinterestratebythesameamountthattheinflationrateincreases,withnoeffectontherealinterestrate.6.Thecostsofinflationincludeshoeleathercostsassociatedwithreducedmoneyholdings,menucostsassociatedwithmorefrequentadjustmentofprices,increasedvariabilityofrelativeprices,unintendedchangesintaxliabilitiesduetonon-indexationofthetaxcode,confusionandinconvenienceresultingfromachangingunitofaccount,andarbitraryredistributionsofwealthbetweendebtorsandcreditors.WithalowandstablerateofinflationlikethatintheUnitedStates,noneofthesecostsareveryhigh.Perhapsthemostimportantoneistheinteractionbetweeninflationandthetaxcode,whichmayreducesavingandinvestmenteventhoughtheinflationrateislow.7.Ifinflationislessthanexpected,creditorsbenefitanddebtorslose.Creditorsreceivedollarpaymentsfromdebtorsthathaveahigherrealvaluethanwasexpected.ProblemsandApplications1.Inthisproblem,allamountsareshowninbillions.a.NominalGDP=PxY=$10,000andY=realGDP=$5,000,soP=(PxY)/Y=$10,000/$5,000=2.

SinceMxV=PxY,thenV=(PxY)/M=$10,000/$500=20.b.IfMandVareunchangedandYrisesby5percent,thensinceMxV=PxY,Pmustfallby5percent.Asaresult,nominalGDPisunchanged.c.Tokeepthepricelevelstable,theFedmustincreasethemoneysupplyby5percent,matchingtheincreaseinrealGDP.Then,sincevelocityisunchanged,thepricelevelwillbestable.d.IftheFedwantsinflationtobe10percent,itwillneedtoincreasethemoneysupply15percent.ThusMxVwillrise15percent,causingPxYtorise15percent,witha10percentincreaseinpricesanda5percentriseinrealGDP.2.a.Ifpeopleneedtoholdlesscash,thedemandformoneyshiftstotheleft,sincetherewillbelessmoneydemandedatanypricelevel.b.IftheFeddoesnotrespondtothisevent,theshifttotheleftofthedemandformoneycombinedwithnochangeinthesupplyofmoneyleadstoadeclineinthevalueofmoney(1/P),whichmeansthepricelevelrises,asshowninFigure1.Figure1c.IftheFedwantstokeepthepricelevelstable,itshouldreducethemoneysupplyfromS1toS2inFigure2.Thiswouldcausethesupplyofmoneytoshifttotheleftbythesameamountthatthedemandformoneyshifted,resultinginnochangeinthevalueofmoneyandthepricelevel.

Figure23.Withconstantvelocity,reducingtheinflationratetozerowouldrequirethemoneygrowthratetoequalthegrowthrateofoutput,accordingtothequantitytheoryofmoney(MxV=PxY).4.Leninisrightthatgovernmentscanconfiscatethewealthofcitizenswithinflation.Inflationactslikeataxonpeoplewhoholdmoney,byreducingitsvalue.Thegovernmentcanfinanceitsexpendituresbyprintingmoneyandusingittobuythings,whichresultsinahighermoneysupplyandinflation.Theresultisatransferofwealthfrommoney-holderstothegovernment.5.Ifacountry"sinflationrateincreasessharply,theinflationtaxonholdersofmoneyincreasessignificantly.Wealthinsavingsaccountsisnotsubjecttoachangeintheinflationtaxbecausethenominalinterestratewillincreasewiththeriseininflation.Butholdersofsavingsaccountsarehurtbytheincreaseintheinflationratebecausetheyaretaxedontheirnominalinterestincome,sotheirrealreturnsarelower.6.Hyperinflationsusuallyarisewhengovernmentstrytofinancemuchoftheirexpendituresbyprintingmoney.Thisisunlikelytooccurifthecentralbank(whichisresponsibleforcontrollingthelevelofthemoneysupply)isindependentofthegovernment.7.a.Whenthepriceofbothgoodsdoublesinayear,inflationis100percent.Thetotalcostofpurchasingequalamountsofbeansandriceequalsthequantityofeachgoodtimesitsprice,addedtogetherforallgoods.Thatis,ifxisthequantityofbeans,whichalsoequalsthequantityofrice,thenthecostofbeansandricefortheyearisx(PB+PR).Inthesecondyear,thecostisx(PB"+PR"),wherethe"markreferstothepriceinthesecondyear.Thenwecandefineapriceindexwithavalueofoneinthefirstyear.Inthesecondyear,thepriceindexhasthevalueofthecostofgoodsinthesecondyeardividedbythecostof

goodsinthefirstyear.Thusthepriceindexinthesecondyearisx(PB"+PR")/x(PB+PR)=(PB"+PR")/(PB+PR)=($2+$6)/($1+$3)=$8/$4=2.Theinflationrateisthen(2-1)/1x100%=100%.Sincethepricesofallgoodsriseby100percent,thefarmersgeta100percentincreaseintheirincomestogoalongwiththe100percentincreaseinprices,soneitherisaffectedbythechangeinprices.b.Ifthepriceofbeansrisesto$2andthepriceofricerisesto$4,thenthepriceindexinthesecondyearis(PB"+PR")/(PB+PR)=($2+$4)/($1+$3)=$6/$4=1.5,sotheinflationrateis(1.5-1)/1x100%=50%.Bobisbetteroffbecausehisdollarrevenuesdoubled(increased100percent)whileinflationwasonly50percent.Ritaisworseoffbecauseinflationwas50percent,sothepricesofthegoodsshebuysrosefasterthanthepriceofthegoods(rice)shesells,whichroseonly33percent.c.Ifthepriceofbeansrisesto$2andthepriceofricefallsto$1.50,thenthepriceindexinthesecondyearis(PB"+PR")/(PB+PR)=($2+$1.50)/($1+$3)=$3.50/$4=0.875,sotheinflationrateis(0.875-1)/1x100%=-12.5%.Bobisbetteroffbecausehisdollarrevenuesdoubled(increased100percent)whilepricesoverallfell12.5percent.Ritaisworseoffbecauseinflationwas-12.5percent,sothepricesofthegoodsshebuysdidn"tfallasfastasthepriceofthegoods(rice)shesells,whichfell50percent.d.TherelativepriceofriceandbeansmattersmoretoBobandRitathantheoverallinflationrate.Ifthepriceofthegoodthatapersonproducesrisesmorethaninflation,heorshewillbebetteroff.Ifthepriceofthegoodapersonproducesriseslessthaninflation,heorshewillbeworseoff.8.Thefollowingtableshowstherelevantcalculations:(a)(b)(c)(1)Nominalinterestrate10.06.04.0(2)Inflationrate5.02.01.0(3)Before-taxrealinterestrate5.04.03.0(4)Reductioninnominalinterestratedueto40%tax4.02.41.6(5)After-taxnominalinterestrate6.03.62.4(6)After-taxrealinterestrate1.01.61.4Row(3)isrow(1)minusrow(2).Row(4)is.40xrow(1).Row(5)is(1-.40)xrow(1),whichequalsrow(1)minusrow(4).Row(6)isrow(5)minusrow(2).Notethateventhoughpart(a)hasthehighestbefore-taxrealinterestrate,ithasthelowestafter-taxrealinterestrate.Notealsothattheafter-taxrealinterestrateismuchlessthanthebefore-taxrealinterestrate.

9.Theshoeleathercostsofgoingtothebankincludethevalueofyourtime,gasforyourcarthatisusedasyoudrivetothebank,andtheinconvenienceofnothavingmoremoneyonhand.Thesecostscouldbemeasuredbyvaluingyourtimeatyourwagerateandvaluingthegasforyourcaratitscost.Valuingtheinconvenienceofbeingshortofcashishardertomeasure,butmightdependonthevalueoftheshoppingopportunitiesyougiveupbynothavingenoughmoneytobuythingsyouwant.Yourcollegepresidentdiffersfromyoumainlyinhavingahigherwage,thushavingahighercostoftime.10.Thefunctionsofmoneyaretoserveasamediumofexchange,aunitofaccount,andastoreofvalue.Inflationmainlyaffectstheabilityofmoneytoserveasastoreofvalue,sinceinflationerodesmoney"spurchasingpower,makingitlessattractiveasastoreofvalue.Moneyalsoisnotasusefulasaunitofaccountwhenthere’sinflation,becausestoreshavetochangepricesmoreoftenandbecausepeopleareconfusedandinconveniencedbythechangesinthevalueofmoney.Insomecountrieswithhyperinflation,storespostpricesintermsofamorestablecurrency,suchastheU.S.dollar,evenwhenthelocalcurrencyisstillusedasthemediumofexchange.Andsometimescountriesevenstopusingtheirlocalcurrencyaltogether,usingaforeigncurrencyasthemediumofexchangeaswell.11.a.Unexpectedlyhighinflationhelpsthegovernmentbyprovidinghigherinflationtaxrevenueandreducingtherealvalueofoutstandinggovernmentdebt.b.Unexpectedlyhighinflationhelpsahomeownerwithafixed-ratemortgagebecausehepaysafixednominalinterestratethatwasbasedonexpectedinflation,andthuspaysalowerrealinterestratethanwasexpected.c.Unexpectedlyhighinflationhurtsaunionworkerinthesecondyearofalaborcontractbecausethecontractprobablybasedtheworker"snominalwageontheexpectedinflationrate.Asaresult,theworkerreceivesalower-than-expectedrealwage.d.Unexpectedlyhighinflationhurtsacollegethathasinvestedsomeofitsendowmentingovernmentbondsbecausethehigherinflationratemeansthecollegeisreceivingalowerrealinterestratethanithadplanned.12.Theredistributionfromcreditorstodebtorsissomethingthathappenswheninflationisunexpected,notwhenitisexpected.Theproblemsthatoccurwithbothexpectedandunexpectedinflationincludeshoeleathercostsassociatedwithreducedmoneyholdings,menucostsassociatedwithmorefrequentadjustmentofprices,increasedvariabilityofrelativeprices,unintendedchangesintaxliabilitiesduetonon-indexationofthetaxcode,andtheconfusionandinconvenienceresultingfromachangingunitofaccount.13.a.Thestatementthat"Inflationhurtsborrowersandhelpslenders,because

borrowersmustpayahigherrateofinterest,"isfalse.Higherexpectedinflationmeansborrowerspayahighernominalrateofinterest,butitisthesamerealrateofinterest,soborrowersarenotworseoffandlendersarenotbetteroff.Higherunexpectedinflation,ontheotherhand,makesborrowersbetteroffandlendersworseoff.b.Thestatementthat"Ifpriceschangeinawaythatleavestheoverallpricelevelunchanged,thennooneismadebetterorworseoff,"isfalse.Changesinrelativepricescanmakesomepeoplebetteroffandothersworseoff,eventhoughtheoverallpriceleveldoesnotchange.Seeproblem7foranillustrationofthis.c.Thestatementthat"Inflationdoesnotreducethepurchasingpowerofmostworkers"istrue.Mostworkers"incomeskeepupwithinflationreasonablywell.31章SOLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Netexportsarethevalueofanation’sexportsminusthevalueofitsimports,alsocalledthetradebalance.Netcapitaloutflowisthepurchaseofforeignassetsbydomesticresidentsminusthepurchaseofdomesticassetsbyforeigners.Netexportsequalnetcapitaloutflow.2.Thenominalexchangerateistherateatwhichapersoncantradethecurrencyofonecountryforthecurrencyofanother.Therealexchangerateistherateatwhichapersoncantradethegoodsandservicesofonecountryforthegoodsandservicesofanother.Theyarerelatedthroughtheexpression:realexchangerateequalsnominalexchangeratetimesdomesticpricedividedbyforeignprice.Ifthenominalexchangerategoesfrom100to120yenperdollar,thedollarhasappreciatedbecauseadollarnowbuysmoreyen.3.SinceSpainhashadhighinflationandJapanhashadlowinflation,thenumberofSpanishpesetasapersoncanbuywithJapaneseyenhasincreased.QuestionsforReview

1.Thenetexportsofacountryarethevalueofitsexportsminusthevalueofitsimports.Netcapitaloutflowreferstothepurchaseofforeignassetsbydomesticresidentsminusthepurchaseofdomesticassetsbyforeigners.Netexportsareequaltonetcapitaloutflowbyanaccountingidentity,sinceexportsfromonecountrytoanotherarematchedbypaymentsofsomeassetfromthesecondcountrytothefirst.2.Savingequalsdomesticinvestmentplusnetcapitaloutflow,sinceanydollarsavedcanbeusedtofinanceaccumulationofdomesticcapitaloritcanbeusedtofinancethepurchaseofcapitalabroad.3.Ifadollarcanbuy100yen,thenominalexchangerateis100yenperdollar.Therealexchangerateequalsthenominalexchangeratetimesthedomesticpricedividedbytheforeignprice,whichequals100yenperdollartimes$10,000perAmericancardividedby500,000yenperJapanesecar,whichequals2JapanesecarsperAmericancar.4.Theeconomiclogicbehindthetheoryofpurchasing-powerparityisthatagoodmustsellforthesamepriceinalllocations.Otherwise,peoplewouldprofitbyengaginginarbitrage.5.IftheFedstartedprintinglargequantitiesofU.S.dollars,theU.S.pricelevelwouldincrease,andadollarwouldbuyfewerJapaneseyen.ProblemsandApplications1.a.WhenanAmericanartprofessorspendsthesummertouringmuseumsinEurope,hespendsmoneybuyingforeigngoodsandservices,soU.S.exportsareunchanged,importsincrease,andnetexportsdecrease.b.WhenstudentsinParisflocktoseethelatestArnoldSchwarzeneggermovie,foreignersarebuyingaU.S.good,soU.S.exportsrise,importsareunchanged,andnetexportsincrease.c.WhenyourunclebuysanewVolvo,anAmericanisbuyingaforeigngood,soU.S.exportsareunchanged,importsrise,andnetexportsdecline.d.WhenthestudentbookstoreatOxfordUniversitysellsapairofLevi"s501jeans,foreignersarebuyingU.S.goods,soU.S.exportsincrease,importsareunchanged,andnetexportsincrease.e.WhenaCanadianshopsinnorthernVermonttoavoidCanadiansalestaxes,a

foreignerisbuyingU.S.goods,soU.S.exportsincrease,importsareunchanged,andnetexportsincrease.2.a.Wheatistradedmoreinternationallythaninthepastbecauseshippingcostshavedeclined,ashavetraderestrictions.b.Bankingservicesaretradedmoreinternationallythaninthepastbecausecommunicationscostshavedeclined,ashavetraderestrictions.c.Computersoftwareistradedmoreinternationallythaninthepastbecausethecomputerindustryhasgrownandthesoftwareiseasiertotransport(sinceitcannowbedownloadedelectronically).d.Automobilesaretradedmoreinternationallythaninthepastbecausetransportationcostshavedeclined,ashavetariffsandquotas.3.Foreigndirectinvestmentrequiresactivelymanaginganinvestment,forexample,byopeningaretailstoreinaforeigncountry.Foreignportfolioinvestmentispassive,forexample,buyingcorporatestockinaretailchaininaforeigncountry.Asaresult,acorporationismorelikelytoengageinforeigndirectinvestment,whileanindividualinvestorismorelikelytoengageinforeignportfolioinvestment.4.a.WhenanAmericancellularphonecompanyestablishesanofficeintheCzechRepublic,U.S.netcapitaloutflowincreases,becausetheU.S.companymakesadirectinvestmentincapitalintheforeigncountry.b.WhenHarrod"sofLondonsellsstocktotheGeneralElectricpensionfund,U.S.netcapitaloutflowincreases,becausetheU.S.companymakesaportfolioinvestmentintheforeigncountry.c.WhenHondaexpandsitsfactoryinMarysville,Ohio,U.S.netcapitaloutflowdeclines,becausetheforeigncompanymakesadirectinvestmentincapitalintheUnitedStates.d.WhenaFidelitymutualfundsellsitsVolkswagenstocktoaFrenchinvestor,U.S.netcapitaloutflowdeclines(iftheFrenchinvestorpaysinU.S.dollars),becausetheU.S.companyisreducingitsportfolioinvestmentinaforeigncountry.5.Ifnationalsavingisconstantandnetcapitaloutflowincreases,domesticinvestmentmustdecrease,sincenationalsavingequalsdomesticinvestmentplusnetcapitaloutflow.Ifdomesticinvestmentdeclines,thecountry"saccumulationofdomesticcapitaldeclines.6.a.Thenewspapershowsnominalexchangerates,sinceitshowsthenumberofunits

ofonecurrencythatcanbeexchangedforanothercurrency.b.Manyanswersarepossible.c.IfU.S.inflationexceedsJapaneseinflationoverthenextyear,youwouldexpectthedollartodepreciaterelativetotheJapaneseyenbecauseadollarwoulddeclineinvalue(intermsofthegoodsandservicesitcanbuy)morethantheyenwould.7.a.DutchpensionfundsholdingU.S.governmentbondswouldbehappyiftheU.S.dollarappreciated.TheywouldthengetmoreDutchguildersforeachdollartheyearnedontheirU.S.investment.Ingeneral,ifyouhaveaninvestmentinaforeigncountry,youarebetteroffifthatcountry"scurrencyappreciates.b.U.S.manufacturingindustrieswouldbeunhappyiftheU.S.dollarappreciatedbecausetheirpriceswouldbehigherintermsofforeigncurrencies,whichwillreducetheirsales.c.AustraliantouristsplanningatriptotheUnitedStateswouldbeunhappyiftheU.S.dollarappreciatedbecausetheywouldgetfewerU.S.dollarsforeachAustraliandollar,sotheirvacationwillbemoreexpensive.d.AnAmericanfirmtryingtopurchasepropertyoverseaswouldbehappyiftheU.S.dollarappreciatedbecauseitwouldgetmoreunitsoftheforeigncurrencyandcouldthusbuymoreproperty.8.Allthepartsofthisquestioncanbeansweredbykeepinginmindthedefinitionoftherealexchangerate.Therealexchangerateequalsthenominalexchangeratetimesthedomesticpriceleveldividedbytheforeignpricelevel.a.IftheU.S.nominalexchangerateisunchanged,butpricesrisefasterintheUnitedStatesthanabroad,therealexchangeraterises.b.IftheU.S.nominalexchangerateisunchanged,butpricesrisefasterabroadthanintheUnitedStates,therealexchangeratedeclines.c.IftheU.S.nominalexchangeratedeclines,andpricesareunchangedintheUnitedStatesandabroad,therealexchangeratedeclines.d.IftheU.S.nominalexchangeratedeclines,andpricesrisefasterabroadthanintheUnitedStates,therealexchangeratedeclines.9.Threegoodsforwhichthelawofonepriceislikelytoholdarefarmgoodslikewheat,whicharenearlyidenticalnomatterwheretheyareproduced,technologicalgoodslike

computersoftware,whichhavelowshippingcostsbecausetheyarelight,andclothing,whichalsohaslowshippingcosts.Threegoodsforwhichthelawofonepriceisnotlikelytoholdarerealestate,becauseyoucan"tmovelandorbuildingsfromonecountrytoanother;goodsthataremainlyconsumedinonecountryandsoarenottraded,likefroglegsinFrance;andserviceslikehaircuts,whichcannotbearbitragedevenifthepriceisverydifferentindifferentcountries.10.Ifpurchasing-powerparityholds,then12pesospersodadividedby$0.75persodaequalstheexchangerateof16pesosperdollar.IfpricesinMexicodoubled,theexchangeratewilldoubleto32pesosperdollar.11.a.Tomakeaprofit,youwouldwanttobuyricewhereitischeapandsellitwhereitisexpensive.SinceAmericanricecosts100dollarsperbushel,andtheexchangerateis80yenperdollar,Americanricecosts100x80equals8,000yenperbushel.SoAmericanriceat8,000yenperbushelischeaperthanJapanesericeat16,000yenperbushel.Soyoucouldtake8,000yen,exchangethemfor100dollars,buyabushelofAmericanrice,thensellitinJapanfor16,000yen,makingaprofitof8,000yen.Aspeopledidthis,thedemandforAmericanricewouldrise,increasingthepriceinAmerica,andthesupplyofJapanesericewouldrise,reducingthepriceinJapan.Theprocesswouldcontinueuntilthepricesinthetwocountrieswerethesame.b.Ifriceweretheonlycommodityintheworld,therealexchangeratebetweentheUnitedStatesandJapanwouldstartouttoolow,thenriseaspeopleboughtriceinAmericaandsolditinJapan,untiltherealexchangebecameoneinlong-runequilibrium.12.IfyoutakeXunitsofforeigncurrencyperBigMacdividedby2.49dollarsperBigMac,yougetX/2.49unitsoftheforeigncurrencyperdollar;that’sthepredictedexchangerate.a.Indonesia:16,000/2.49=6,426rupiah/$Hungary:459/2.49=184forint/$CzechRepublic:56.28/2.49=22.6koruna/$Israel:12/2.49=4.82shekel/$Canada:3.33/2.49=1.34C$/$b.Underpurchasing-powerparity,theexchangerateoftheIsraelishekeltotheCanadiandollaris12shekelsperBigMacdividedby3.33CanadiandollarsperBigMacequals3.6shekelsperCanadiandollar.Theactualexchangerateis4.79shekelsperdollardividedby1.34Canadiandollarsperdollarequals3.57shekelsperCanadiandollar.Thatisprettyclose!

32章OLUTIONSTOTEXTPROBLEMS:QuickQuizzes1.Thesupplyofloanablefundscomesfromnationalsaving.Thedemandforloanablefundscomesfromdomesticinvestmentandnetcapitaloutflow.Supplyinthemarketforforeign-currencyexchangecomesfromnetcapitaloutflow.Demandinthemarketforforeign-currencyexchangecomesfromnetexports.2.Thetwomarketsinthemodeloftheopeneconomyarethemarketforloanablefundsandthemarketforforeign-currencyexchange.Thesemarketsdeterminetworelativeprices:(1)themarketforloanablefundsdeterminestherealinterestrate;and(2)themarketforforeign-currencyexchangedeterminestherealexchangerate.3.IfAmericansdecidedtospendasmallerfractionoftheirincomes,theincreaseinsavingwouldshiftthesupplycurveforloanablefundstotheright,asshowninFigure1.Thedeclineintherealinterestrateincreasesnetcapitaloutflowandshiftsthesupplyofdollarstotherightinthemarketforforeign-currencyexchange.Theresultisadeclineintherealexchangerate.Sincetherealinterestrateislower,domesticinvestmentincreases.Sincenetcapitaloutflowincreases,thetradebalancealsoincreases.Overall,savinganddomesticinvestmentincrease,therealinterestrateandrealexchangeratedecrease,andthetradebalanceincreases.