- 1.21 MB

- 2022-04-22 11:34:35 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

'课后答案网您最真诚的朋友www.hackshp.cn网团队竭诚为学生服务,免费提供各门课后答案,不用积分,甚至不用注册,旨在为广大学生提供自主学习的平台!课后答案网:www.hackshp.cn视频教程网:www.efanjy.comPPT课件网:www.ppthouse.com

课后答案网,用心为你服务!大学答案---中学答案---考研答案---考试答案最全最多的课后习题参考答案,尽在课后答案网(www.khdaw.com)!Khdaw团队一直秉承用心为大家服务的宗旨,以关注学生的学习生活为出发点,旨在为广大学生朋友的自主学习提供一个分享和交流的平台。爱校园(www.aixiaoyuan.com)课后答案网(www.khdaw.com)淘答案(www.taodaan.com)课后答案网www.hackshp.cn

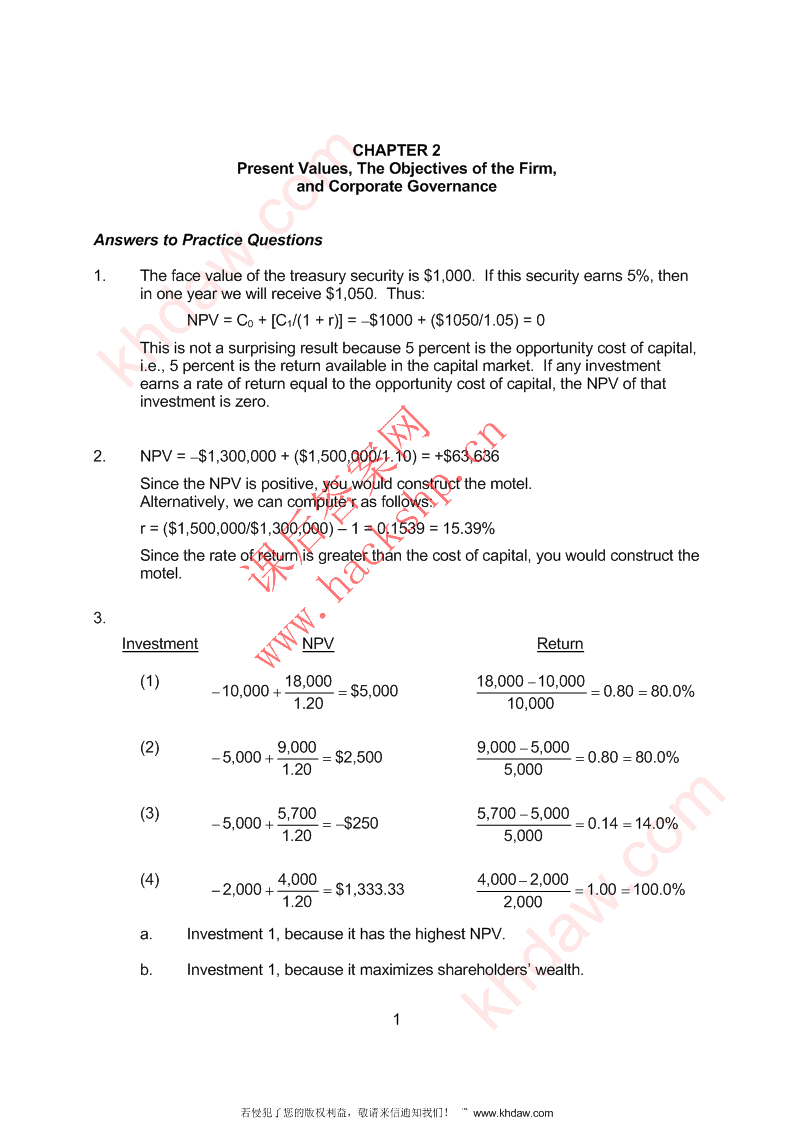

CHAPTER2PresentValues,TheObjectivesoftheFirm,andCorporateGovernanceAnswerstoPracticeQuestions1.Thefacevalueofthetreasurysecurityis$1,000.Ifthissecurityearns5%,theninoneyearwewillreceive$1,050.Thus:NPV=C0+[C1/(1+r)]=−$1000+($1050/1.05)=0Thisisnotasurprisingresultbecause5percentistheopportunitycostofcapital,i.e.,5percentisthereturnavailableinthecapitalmarket.Ifanyinvestmentkhdaw.comearnsarateofreturnequaltotheopportunitycostofcapital,theNPVofthatinvestmentiszero.2.NPV=−$1,300,000+($1,500,000/1.10)=+$63,636SincetheNPVispositive,youwouldconstructthemotel.Alternatively,wecancomputerasfollows:r=($1,500,000/$1,300,000)–1=0.1539=15.39%Sincetherateofreturnisgreaterthanthecostofcapital,youwouldconstructthemotel.课后答案网3.InvestmentNPVReturnwww.hackshp.cn(1)18,00018,000−10,000−10,000+=$5,000=0.80=80.0%1.2010,000(2)9,0009,000−5,000−5,000+=$2,500=0.80=80.0%1.205,000(3)5,7005,700−5,000−5,000+=−$250=0.14=14.0%1.205,000(4)4,0004,000−2,000−2,000+=$1,333.33=1.00=100.0%1.202,000a.Investment1,becauseithasthehighestNPV.b.Investment1,becauseitmaximizesshareholders’wealth.1khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

4.a.NPV=(−$50,000+$20,000)+($38,000/1.05)=$6,190.48b.NPV=(−$50,000+$20,000)+($38,000/1.10)=$4,545.45InPart(a),theNPVishigherthantheNPVoftheofficebuilding($5,000);therefore,weshouldacceptE.Coli’soffer.InPart(b),theNPVislessthantheNPVoftheofficebuilding,soweshouldnotaccepttheoffer.Youcanalsothinkofthisinanotherway.Thetrueopportunitycostofthelandiswhatyoucouldsellitfor,i.e.,$56,190(or$54,545).At$56,190,theofficebuildinghasanegativeNPV.At$54,545,theofficebuildinghasapositiveNPV.5.a.NPV=−$2,000,000+[($2,000,000×1.05)/1.05]=$0khdaw.comb.NPV=−$900,000+[($900,000×1.07)/1.10]=−$24,545.45Thecorrectdiscountrateis10%becausethisistheappropriaterateforaninvestmentwiththelevelofriskinherentinNorman’snephew’srestaurant.TheNPVisnegativebecauseNormanwillnotearnenoughtocompensatefortherisk.c.NPV=−$2,000,000+[($2,000,000×1.12)/1.12]=$0d.NPV=−$1,000,000+($1,100,000/1.12)=−$17,857.14Normanshouldinvestineithertherisk-freegovernmentsecuritiesorthe课后答案网riskystockmarket,dependingonhistoleranceforrisk.CorrectlypricedsecuritiesalwayshaveanNPV=0.6.a.Expectedrateofreturnonproject=www.hackshp.cn$2,100,000−$2,000,000=0.05=5.0%$2,000,000Thisisequaltothereturnonthegovernmentsecurities.b.Expectedrateofreturnonproject=$963,000−$900,000=0.07=7.0%$900,000Thisislessthanthecorrect10%rateofreturnforrestaurantswithsimilarrisk.c.Expectedrateofreturnonproject=$2,240,000−$2,000,000=0.12=12.0%$2,000,000Thisisequaltotherateofreturninthestockmarket.2khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

d.Expectedrateofreturnonproject=$1,100,000−$1,000,000=0.10=10.0%$1,000,000Thisislessthanthereturnintheequallyriskystockmarket.⎡$1,100,000+($1,600,000×1.12)⎤7.NPV=−$2,600,000+=−$17,857.14⎢⎥⎣1.12⎦TherateatwhichNormancanborrowdoesnotreflecttheopportunitycostoftheinvestments.Normanisstillinvesting$1,000,000at10%whiletheopportunitykhdaw.comcostofcapitalis12%.8.Theinvestment’spositiveNPVwillbereflectedinthepriceofScaledCompositesstock.Inordertoderiveacashflowfromherinvestmentthatwillallowhertospendmoretoday,Ms.Espinozacansellsomeofhersharesatthehigherpriceorshecanborrowagainsttheincreasedvalueofherholdings.9.DollarsNextYear课后答案网220,000216,000www.hackshp.cn203,704200,000DollarsNowa.Letx=theamountthatCaspershouldinvestnow.Then($200,000–x)istheamounthewillconsumenow,and(1.08x)istheamounthewillconsumenextyear.SinceCasperwantstoconsumeexactlythesameamounteachperiod:200,000–x=1.08x3khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Solving,wefindthatx=$96,153.85sothatCaspershouldinvest$96,153.85now,heshouldspend($200,000-$96,153.85)=$103,846.15now,andheshouldspend(1.08×$96,153.85)=$103,846.15nextyear.b.SinceCaspercaninvest$200,000at10%risk-free,hecanconsumeasmuchas($200,000×1.10)=$220,000nextyear.Thepresentvalueofthis$220,000is:($220,000/1.08)=$203,703.70ThereforeCaspercanconsumeasmuchas$203,703.70nowbyfirstinvesting$200,000at10%andthenborrowing,atthe8%rate,againstthe$220,000availablenextyear.Ifweusethe$203,703.70astheavailableconsumptionnow,andagainletx=theamountthatCaspershouldinvestnow,wecanthensolvethefollowingforx:khdaw.com$203,703.70–x=1.08xx=$97,934.47Therefore,Caspershouldinvest$97,934.47nowat8%,heshouldspend($203,703.70–$97,934.47)=$105,769.23now,andheshouldspend($97,934.47×1.08)=$105,769.23nextyear.[NotethatthisapproachleadstotheresultthatCasperborrows$203,703.70at8%andtheninvests$97,934.47at8%.Wecouldsimplysaythatheshouldborrow($203,703.70-$97,934.47)=$105,769.23at8%againstthe$220,000availablenextyear.Thisistheamountthathewillconsumenow.]课后答案网c.TheNPVoftheopportunityin(b)is:($203,703.70-$200,000)=$3,703.70www.hackshp.cn4khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ChallengeQuestions1.a.Expectedcashflow=($8million+$12million+$16million)/3=$12millionb.Expectedrateofreturn=($12million/$8million)–1=0.50=50%c.Expectedcashflow=($8+$12+$16)/3=$12Expectedrateofreturn=($12/$10)–1=0.20=20%ThenetcashflowfromsellingthetankerloadisthesameasthepayofffromonemillionsharesofStockZineachstateoftheworldeconomy.Therefore,theriskofeachofthesecashflowsisthesame.khdaw.comd.NPV=−$8,000,000+($12,000,000/1.20)=+$2,000,000TheprojectisagoodinvestmentbecausetheNPVispositive.Investorswouldbepreparedtopayasmuchas$10,000,000fortheproject,whichcosts$8,000,000.2.a.Expectedcashflow(ProjectB)=($4million+$6million+$8million)/3Expectedcashflow(ProjectB)=$6millionExpectedcashflow(ProjectC)=($5million+$5.5million+$6million)/3课后答案网Expectedcashflow(ProjectC)=$5.5millionb.Expectedrateofreturn(StockX)=($110/$95.65)–1=0.15=15.0%Expectedrateofreturn(StockY)=($44/$40)–1=0.10=10.0%www.hackshp.cnExpectedrateofreturn(StockZ)=($12/$10)–1=0.20=20.0%c.PercentageDifferencesSlumpv.NormalBoomv.NormalProjectB4/6=66.67%8/6=133.33%ProjectC5/5.5=90.91%6/5.5=109.09%StockX80/110=72.73%140/110=127.27%StockY40/44=90.91%48/44=109.09%StockZ8/12=66.67%16/12=133.33%ProjectBhasthesameriskasStockZ,sothecostofcapitalforProjectBis20%.ProjectChasthesameriskasStockY,sothecostofcapitalforProjectCis10%.5khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

d.NPV(ProjectB)=−$5,000,000+($6,000,000/1.20)=0NPV(ProjectC)=−$5,000,000+($5,500,000/1.10)=0e.Thetwoprojectswilladdnothingtothetotalmarketvalueofthecompany’sshares.khdaw.com课后答案网www.hackshp.cn6khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

CHAPTER3HowtoCalculatePresentValuesAnswerstoPracticeQuestions1.10a.PV=$100/1.01=$90.5310b.PV=$100/1.13=$29.4615c.PV=$100/1.25=$3.5223khdaw.comd.PV=$100/1.12+$100/1.12+$100/1.12=$240.1812.a.DF==0.905⇒r1=0.1050=10.50%11+r111b.DF===0.819222(1+r)(1.105)2c.AF2=DF1+DF2=0.905+0.819=1.724d.PVofanannuity=C课后答案网×[Annuityfactoratr%fortyears]Here:$24.65=$10×[AF3]AF3=2.465www.hackshp.cne.AF3=DF1+DF2+DF3=AF2+DF32.465=1.724+DF3DF3=0.7413.Thepresentvalueofthe10-yearstreamofcashinflowsis:⎡11⎤PV=$170,000×⎢−10⎥=$886,739.66⎣0.140.14×(1.14)⎦Thus:NPV=–$800,000+$886,739.66=+$86,739.667khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Attheendoffiveyears,thefactory’svaluewillbethepresentvalueofthefiveremaining$170,000cashflows:⎡11⎤PV=$170,000×⎢−5⎥=$583,623.76⎣0.140.14×(1.14)⎦4.10Ct$50,000$57,000$75,000$80,000$85,000NPV=∑=−$380,000+++++t2345t=0(1.12)1.121.121.121.121.12$92,000$92,000$80,000$68,000$50,000+++++=$23,696.15khdaw.com1.1261.1271.1281.1291.12105.a.LetSt=salaryinyeart30S3040,000(1.05)t−13030t(40,000/1.05)38,095.24PV=∑t=∑t=∑t=∑tt=1(1.08)t=1(1.08)t=1(1.08/1.05)t=1(1.0286)⎡11⎤=38,095.24×⎢−30⎥=$760,379.21⎣0.02860.0286×(1.0286)⎦课后答案网b.PV(salary)x0.05=$38,018.96Futurevalue=$38,018.96x(1.08)30=$382,571.75c.www.hackshp.cn⎡11⎤PV=C×⎢−t⎥⎣rr×(1+r)⎦⎡11⎤$382,571.75=C×⎢−20⎥⎣0.080.08×(1.08)⎦⎡⎤11C=$382,571.75⎢−⎥=$38,965.78⎢0.080.08×(1.08)20⎥⎣⎦8khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

6.PresentPeriodValue0−400,000.001+100,000/1.12=+89,285.7122+200,000/1.12=+159,438.7833+300,000/1.12=+213,534.07Total=NPV=$62,258.567.Wecanbreakthisdownintoseveraldifferentcashflows,suchthatthesumoftheseseparatecashflowsisthetotalcashflow.Then,thesumofthepresentkhdaw.comvaluesoftheseparatecashflowsisthepresentvalueoftheentireproject.(Alldollarfiguresareinmillions.)°Costoftheshipis$8millionPV=−$8million°Revenueis$5millionperyear,operatingexpensesare$4million.Thus,operatingcashflowis$1millionperyearfor15years.⎡11⎤PV=$1million×⎢−15⎥=$8.559million⎣0.080.08×(1.08)⎦°Majorrefitscost$2millioneach,andwilloccurattimest=5andt=10.510PV=(−$2million)/1.08课后答案网+(−$2million)/1.08=−$2.288million°Saleforscrapbringsinrevenueof$1.5millionatt=15.15PV=$1.5million/1.08=$0.473millionAddingthesepresentvaluesgivesthepresentvalueoftheentireproject:www.hackshp.cnNPV=−$8million+$8.559million−$2.288million+$0.473millionNPV=−$1.256million8.a.PV=$100,0005b.PV=$180,000/1.12=$102,137c.PV=$11,400/0.12=$95,000⎡11⎤d.PV=$1,9000×⎢−10⎥=$107,354⎣0.120.12×(1.12)⎦e.PV=$6,500/(0.12−0.05)=$92,857Prize(d)isthemostvaluablebecauseithasthehighestpresentvalue.9khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

9.Mr.Bassetisbuyingasecurityworth$20,000now.Thatisitspresentvalue.Theunknownistheannualpayment.Usingthepresentvalueofanannuityformula,wehave:⎡11⎤PV=C×⎢−t⎥⎣rr×(1+r)⎦⎡11⎤$20,000=C×⎢−12⎥⎣0.080.08×(1.08)⎦⎡⎤11khdaw.comC=$20,000⎢−⎥=$2,653.90⎢0.080.08×(1.08)12⎥⎣⎦10.AssumetheZhangswillputasidethesameamounteachyear.Oneapproachtosolvingthisproblemistofindthepresentvalueofthecostoftheboatandthenequatethattothepresentvalueofthemoneysaved.Fromthisequation,wecansolvefortheamounttobeputasideeachyear.5PV(boat)=$20,000/(1.10)=$12,418⎡11⎤PV(savings)=Annualsavings×⎢−5⎥课后答案网⎣0.100.10×(1.10)⎦BecausePV(savings)mustequalPV(boat):⎡11⎤Annualsavingswww.hackshp.cn×⎢−5⎥=$12,418⎣0.100.10×(1.10)⎦⎡11⎤Annualsavings=$12,418⎢−5⎥=$3,276⎣0.100.10×(1.10)⎦Anotherapproachistofindthevalueofthesavingsatthetimetheboatispurchased.Becausetheamountinthesavingsaccountattheendoffiveyearsmustbethepriceoftheboat,or$20,000,wecansolvefortheamounttobeputasideeachyear.Ifxistheamounttobeputasideeachyear,then:4321x(1.10)+x(1.10)+x(1.10)+x(1.10)+x=$20,000x(1.464+1.331+1.210+1.10+1)=$20,000x(6.105)=$20,000x=$3,27610khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

11.ThefactthatKangarooAutosisoffering“freecredit”tellsuswhatthecashpaymentsare;itdoesnotchangethefactthatmoneyhastimevalue.A10percentannualrateofinterestisequivalenttoamonthlyrateof0.83percent:rmonthly=rannual/12=0.10/12=0.0083=0.83%ThepresentvalueofthepaymentstoKangarooAutosis:⎡11⎤$1,000+$300×⎢−⎥=$8,93830⎣0.00830.0083×(1.0083)⎦AcarfromTurtleMotorscosts$9,000cash.Therefore,KangarooAutosoffersthebetterdeal,i.e.,thelowerpresentvalueofcost.khdaw.com12.TheNPVsare:$100,000$320,000at5percent⇒NPV=−$170,000−+=$25,01121.05(1.05)$100,000320,000at10percent⇒NPV=−$170,000−+=$3,55421.10(1.10)$100,000320,000at15percent⇒NPV=−$170,000−+=−$14,99121.15(1.15)ThefigurebelowshowsthattheprojecthaszeroNPVatabout11percent.课后答案网Asacheck,NPVat11percentis:$100,000320,000NPV=−$170,000−+=−$37121.11(1.11)www.hackshp.cn302010NPVNPV0-10-200.050.100.15RateofInterest11khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

13.a.Thisistheusualperpetuity,andhence:C$100PV===$1,428.57r0.07b.ThisisworththePVofstream(a)plustheimmediatepaymentof$100:PV=$100+$1,428.57=$1,528.57c.Thecontinuouslycompoundedequivalenttoa7percentannuallycompoundedrateisapproximately6.77percent,because:0.0677e=1.0700khdaw.comThus:C$100PV===$1,477.10r0.0677Notethatthepatternofpaymentsinpart(b)ismorevaluablethanthepatternofpaymentsinpart(c).Itispreferabletoreceivecashflowsatthestartofeveryyearthantospreadthereceiptofcashevenlyovertheyear;withtheformerpatternofpayment,youreceivethecashmorequickly.14.a.PV=$100,000/0.08=$1,250,000b.PV=$100,000/(0.08–0.04)=$2,500,000课后答案网⎡11⎤c.PV=$100,000×⎢−20⎥=$981,815⎣0.080.08×(1.08)⎦www.hackshp.cnd.Thecontinuouslycompoundedequivalenttoan8percentannuallycompoundedrateisapproximately7.7percent,because:0.0770e=1.0800Thus:⎡11⎤PV=$100,000×−=$1,020,284⎢(0.077)(20)⎥⎣0.0770.077×e⎦ThisresultisgreaterthantheanswerinPart(c)becausetheendowmentisnowearninginterestduringtheentireyear.2015.Withannualcompounding:FV=$100×(1.15)=$1,636.65(0.15×20)Withcontinuouscompounding:FV=$100×e=$2,008.5512khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

16.Onewaytoapproachthisproblemistosolveforthepresentvalueof:(1)$100peryearfor10years,and(2)$100peryearinperpetuity,withthefirstcashflowatyear11.Ifthisisafairdeal,thesepresentvaluesmustbeequal,andthuswecansolvefortheinterestrate(r).Thepresentvalueof$100peryearfor10yearsis:⎡11⎤PV=$100×⎢−10⎥⎣r(r)×(1+r)⎦Thepresentvalue,asofyear10,of$100peryearforever,withthefirstpaymentinyear11,is:PV10=$100/rkhdaw.comAtt=0,thepresentvalueofPV10is:⎡1⎤⎡$100⎤PV=⎢10⎥×⎢⎥⎣(1+r)⎦⎣r⎦Equatingthesetwoexpressionsforpresentvalue,wehave:⎡11⎤⎡1⎤⎡$100⎤$100×⎢−10⎥=⎢10⎥×⎢⎥⎣r(r)×(1+r)⎦⎣(1+r)⎦⎣r⎦Usingtrialanderrororalgebraicsolution,wefindthatr=7.18%.课后答案网17.Assumetheamountinvestedisonedollar.LetArepresenttheinvestmentat12percent,compoundedannually.LetBrepresenttheinvestmentat11.7percent,compoundedsemiannually.LetCrepresenttheinvestmentat11.5percent,compoundedcontinuously.www.hackshp.cnAfteroneyear:1FVA=$1×(1+0.12)=$1.12002FVB=$1×(1+0.0585)=$1.1204(0.115×1)FVC=$1×e=$1.1219Afterfiveyears:5FVA=$1×(1+0.12)=$1.762310FVB=$1×(1+0.0585)=$1.7657(0.115×5)FVC=$1×e=$1.777113khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Aftertwentyyears:20FVA=$1×(1+0.12)=$9.646340FVB=$1×(1+0.0585)=$9.7193(0.115×20)FVC=$1×e=$9.9742ThepreferredinvestmentisC.18.1+rnominal=(1+rreal)×(1+inflationrate)NominalRealInterestInflationRatekhdaw.comInterestRateRate6.00%1.00%4.95%23.20%10.00%12.00%9.00%5.83%3.00%19.Thetotalelapsedtimeis113years.113At5%:FV=$100×(1+0.05)=$24,797113At10%:FV=$100×(1+0.10)=$4,757,44120.Becausethecashflowsoccureverysixmonths,weuseasix-monthdiscount课后答案网rate,here8%/2,or4%.Thus:⎡11⎤PV=$100,000+$100,000×⎢−9⎥=$843,533www.hackshp.cn⎣0.040.04×(1.04)⎦21.a.Eachinstallmentis:$9,420,713/19=$495,827⎡11⎤PV=$495,827×⎢−19⎥=$4,761,724⎣0.080.08×(1.08)⎦b.IfERCiswillingtopay$4.2million,then:⎡11⎤$4,200,000=$495,827×⎢−19⎥⎣rr×(1+r)⎦UsingExcelorafinancialcalculator,wefindthatr=9.81%.14khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

⎡11⎤22.a.PV=$70,000×⎢−8⎥=$402,264.73⎣0.080.08×(1.08)⎦b.Beginning-Year-endTotalAmortizationEnd-of-YearYearof-YearInterestonYear-endofLoanBalanceBalanceBalancePayment1402,264.7332,181.1870,000.0037,818.82364,445.912364,445.9129,155.6770,000.0040,844.33323,601.583323,601.5825,888.1370,000.0044,111.87279,489.714279,489.7122,359.1870,000.0047,640.82231,848.885231,848.8818,547.9170,000.0051,452.09180,396.796180,396.7914,431.7470,000.0055,568.26124,828.54khdaw.com7124,828.549,986.2870,000.0060,013.7264,814.82864,814.825,185.1970,000.0064,814.810.0123.Thisisanannuityproblemwiththepresentvalueoftheannuityequalto$2million(asofyourretirementdate),andtheinterestrateequalto8percent,with15timeperiods.Thus,yourannuallevelofexpenditure(C)isdeterminedasfollows:⎡11⎤PV=C×⎢−t⎥⎣rr×(1+r)⎦课后答案网⎡11⎤$2,000,000=C×⎢−15⎥⎣0.080.08×(1.08)⎦www.hackshp.cn⎡⎤11C=$2,000,000⎢−⎥=$233,659⎢0.080.08×(1.08)15⎥⎣⎦Withaninflationrateof4percentperyear,wewillstillaccumulate$2millionasofourretirementdate.However,becausewewanttospendaconstantamountperyearinrealterms(R,constantforallt),thenominalamount(Ct)mustincreaseeachyear.Foreachyeart:tR=Ct/(1+inflationrate)15khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Therefore:tPV[allCt]=PV[allR×(1+inflationrate)]=$2,000,0001215⎡(1+0.04)(1+0.04)(1+0.04)⎤R×⎢1+2+...+15⎥=$2,000,000⎣(1+0.08)(1+0.08)(1+0.08)⎦R×[0.9630+0.9273+...+0.5677]=$2,000,000R×11.2390=$2,000,000R=$177,952ThusC1=($177,952×1.04)=$185,070,C2=$192,473,etc.khdaw.com24.First,withnominalcashflows:a.Thenominalcashflowsformagrowingperpetuityattherateofinflation,4%.Thus,thecashflowinoneyearwillbe$416,000and:PV=$416,000/(0.10–0.04)=$6,933,333b.Thenominalcashflowsformagrowingannuityfor20years,withanadditionalpaymentof$5millionatyear20:t⎡11(1+g)⎤$5,000,000PV=C−×⎥+=1⎢tt⎣(r课后答案网-g)(r−g)(1+r)⎦(1+r)⎡11(1.04)20⎤$5,000,000$416,000⎢−×20⎥+20=⎣(0.10www.hackshp.cn-0.04)(0.10-0.04)(1.10)⎦(1.10)$5,418,389Second,withrealcashflows:a.Here,therealcashflowsare$400,000peryearinperpetuity,andwecanfindtherealrate(r)bysolvingthefollowingequation:(1+0.10)=(1+r)×(1+0.04)⇒r=0.05769=5.769%PV=$400,000/(0.05769)=$6,933,61116khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

b.Now,therealcashflowsare$400,000peryearfor20yearsand$5million(nominal)in20years.Inrealterms,the$5milliondollarpaymentis:20$5,000,000/(1.04)=$2,281,935Thus,thepresentvalueoftheprojectis:⎡11⎤$2,281,935PV=$400,000×⎢−20⎥+20=$5,418,510⎣(0.05769)(0.05769)(1.05769)⎦(1.05769)[Asnotedinthestatementoftheproblem,theanswersagree,towithinroundingerrors.]25.khdaw.comLetxbethefractionofMs.Pool’ssalarytobesetasideeachyear.Atanypointinthefuture,t,herrealincomewillbe:t($40,000)(1+0.02)Therealamountsavedeachyearwillbe:t(x)($40,000)(1+0.02)Thepresentvalueofthisamountis:t(x)($40,000)(1+0.02)t(1+0.05)Ms.Poolwantstohave$500,000,inrealterms,30yearsfromnow.Thepresent课后答案网valueofthisamount(atarealrateof5percent)is:30$500,000/(1+0.05)Thus:www.hackshp.cn30t$500,000(x)($40,000)(1.02)30=∑t(1.05)t=1(1.05)30t$500,000($40,000)(1.02)30=(x)∑t(1.05)t=1(1.05)$115,688.72=(x)($790,012.82)x=0.14617khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ChallengeQuestions1.a.UsingtheRuleof72,thetimeformoneytodoubleat12percentis72/12,or6years.Moreprecisely,ifxisthenumberofyearsformoneytodouble,then:x(1.12)=2Usinglogarithms,wefind:x(ln1.12)=ln2x=6.12yearskhdaw.comb.Withcontinuouscompoundingforinterestraterandtimeperiodx:rxe=2Takingthenaturallogarithmofeachside:rx=ln(2)=0.693Thus,ifrisexpressedasapercent,thenx(thetimeformoneytodouble)is:x=69.3/(interestrate,inpercent).2.Spreadsheetexercise.课后答案网3.a.Thiscallsforthegrowingperpetuityformulawithanegativegrowthrate(g=–0.04):www.hackshp.cn$2million$2millionPV===$14.29million0.10−(−0.04)0.14b.Thepipeline’svalueatyear20(i.e.,att=20),assumingitscashflowslastforever,is:20CC(1+g)211PV==20r−gr−gWithC1=$2million,g=–0.04,andr=0.10:20($2million)×(1−0.04)$0.884millionPV===$6.314million200.140.14Next,weconvertthisamounttoPVtoday,andsubtractitfromtheanswertoPart(a):$6.314millionPV=$14.29million−=$13.35million20(1.10)18khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

CHAPTER4TheValueofBondsandCommonStocksAnswerstoPracticeQuestions1.Withannualcouponpayments:⎡11⎤1,000PV=60×⎢−5⎥+5=1,089.04⎣0.040.04×(1.04)⎦(1.04)Withsemi-annualcouponpayments:⎡11⎤1,000khdaw.comPV=30×⎢−10⎥+10=1,089.83⎣0.020.02×(1.02)⎦(1.02)2.Withannualcouponpayments:⎡11⎤1,000PV=60×⎢−5⎥+5=1,137.39⎣0.030.03×(1.03)⎦(1.03)Withsemi-annualcouponpayments:⎡11⎤1,000PV=30×⎢课后答案网−10⎥+10=1,138.33⎣0.0150.015×(1.015)⎦(1.015)3.Purchasepricefora6-yeargoverwww.hackshp.cnnmentbondwith5percentannualcoupon:⎡11⎤1,000PV=50×⎢−6⎥+6=1,108.34⎣0.030.03×(1.03)⎦(1.03)Priceoneyearlater(yield=3%):⎡11⎤1,000PV=50×⎢−5⎥+5=1,091.59⎣0.030.03×(1.03)⎦(1.03)Rateofreturn=[$50+($1,091.59–$1,108.34)]/$1,108.34=3.00%Priceoneyearlater(yield=2%):⎡11⎤1,000PV=50×⎢−5⎥+5=1,141.40⎣0.020.02×(1.02)⎦(1.02)Rateofreturn=[$50+($1,141.40–$1,108.34)]/$1,108.34=7.49%4.Newspaperexercise,answerswillvary19khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

5.ExpectedFutureValuesPresentValuesHorizonDividendPriceCumulativeFutureTotalPeriod(H)(DIVt)(Pt)DividendsPrice0100.00100.00100.00110.00105.008.7091.30100.00210.50110.2516.6483.36100.00311.03115.7623.8976.11100.00411.58121.5530.5169.50100.001015.51162.8959.7440.26100.002025.27265.3383.7916.21100.0050109.211,146.7498.941.06100.00khdaw.com1001,252.3913,150.1399.990.01100.00Assumptions1.Dividendsincreaseat5%peryearcompounded.2.Capitalizationrateis15%.6.a.Usingthegrowingperpetuityformula,wehave:P0=Div1/(r–g)73=1.68/(r-0.085)r=0.108=10.8%课后答案网b.Weknowthat:Plowbackratio=1.0–payoutratio=1.0–0.5=0.5And,wealsoknowthat:www.hackshp.cndividendgrowthrate=g=plowbackratio×ROEg=0.5×0.12=0.06=6.0%Usingthisestimateofg,wehave:P0=Div1/(r–g)73=1.68/(r–0.06)r=0.0830=8.30%20khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

DIV$1017.P===$100.00Ar0.10DIV$51P===$83.33Br−g0.10−0.04DIV1DIV2DIV3DIV4DIV5DIV6⎛DIV71⎞PC=1+2+3+4+5+6+⎜×6⎟1.101.101.101.101.101.10⎝0.101.10⎠5.006.007.208.6410.3712.44⎛12.441⎞P=++++++⎜×⎟=$104.50C12345661.101.101.101.101.101.10⎝0.101.10⎠khdaw.comAtacapitalizationrateof10percent,StockCisthemostvaluable.Foracapitalizationrateof7percent,thecalculationsaresimilar.Theresultsare:PA=$142.86PB=$166.67PC=$156.48Therefore,StockBisthemostvaluable.8.a.Weknowthatg,thegrowthrateofdividendsandearnings,isgivenby:g=plowbackratio×ROE=0.40×0.20=0.08=8.0%课后答案网Weknowthat:r=(DIV1/P0)+g=dividendyield+growthrateTherefore:www.hackshp.cnr=0.04+0.08=0.12=12.0%b.Dividendyield=4%.Therefore:DIV1/P0=0.04DIV1=0.04×P0Aplowbackratioof0.4impliesapayoutratioof0.6,andhence:DIV1/EPS1=0.6DIV1=0.6×EPS1EquatingthesetwoexpressionsforDIV1givesarelationshipbetweenpriceandearningspershare:0.04×P0=0.6×EPS1P0/EPS1=1521khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Also,weknowthat:EPS⎡PVGO⎤1=r×⎢1−⎥PP0⎣0⎦With(P0/EPS1)=15andr=0.12,theratioofthepresentvalueofgrowthopportunitiestopriceis44.4percent.Thus,iftherearesuddenlynofutureinvestmentopportunities,thestockpricewilldecreaseby44.4percent.c.InPart(b),allfutureinvestmentopportunitiesareassumedtohaveanetpresentvalueofzero.Ifallfutureinvestmentopportunitieshavearateofreturnequaltothecapitalizationrate,thisisequivalenttothestatementkhdaw.comthatthenetpresentvalueoftheseinvestmentopportunitiesiszero.Hence,theimpactonsharepriceisthesameasinPart(b).9.Internetexercise;answerswillvarydependingontimeperiod.10.Internetexercise;answerswillvarydependingontimeperiod.11.Usingtheconceptthatthepriceofashareofcommonstockisequaltothepresentvalueofthefuturedividends,wehave:DIVDIVDIV⎡1DIV⎤1234P=+课后答案网2+3+⎢3×⎥(1+r)(1+r)(1+r)⎣(1+r)(r−g)⎦123⎡1(3×1.06)⎤50=+2+3+⎢3×⎥(1+r)www.hackshp.cn(1+r)(1+r)⎣(1+r)(r−0.06)⎦Usingtrialanderror,wefindthatrisapproximately11.12percent.12.a.AnIncorrectApplication.HotshotSemiconductor’searningsanddividendshavegrownby30percentperyearsincethefirm’sfoundingtenyearsago.Currentstockpriceis$100,andnextyear’sdividendisprojectedat$1.25.Thus:DIV11.25r=+g=+0.30=0.3125=31.25%P1000Thisiswrongbecausetheformulaassumesperpetualgrowth;itisnotpossibleforHotshottogrowat30percentperyearforever.22khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ACorrectApplication.TheformulamightbecorrectlyappliedtotheOldFaithfulRailroad,whichhasbeengrowingatasteady5percentratefordecades.ItsEPS1=$10,DIV1=$5,andP0=$100.Thus:DIV51r=+g=+0.05=0.10=10.0%P1000Evenhere,youshouldbecarefulnottoblindlyprojectpastgrowthintothefuture.IfOldFaithfulhaulscoal,anenergycrisiscouldturnitintoagrowthstock.b.AnIncorrectApplication.Hotshothascurrentearningsof$5.00pershare.Thus:EPS5khdaw.comr=1==0.05=5.0%P1000Thisistoolowtoberealistic.ThereasonP0issohighrelativetoearningsisnotthatrislow,butratherthatHotshotisendowedwithvaluablegrowthopportunities.SupposePVGO=$60:EPS1P=+PVGO0r5100=+60rTherefore,r=12.5%课后答案网ACorrectApplication.Unfortunately,OldFaithfulhasrunoutofvaluablegrowthopportunities.SincePVGO=0:EPSwww.hackshp.cn1PVGOP=+0r10100=+0rTherefore,r=10.0%EPSNPV113.Shareprice=+rr−gTherefore:EPSα1NPVαΡ=+αr(r−0.15)ααEPSNPVβ1βΡ=+βr(r−0.08)ββ23khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Thestatementinthequestionimpliesthefollowing:NPVβ⎛⎜EPSβ1NPVβ⎞⎟NPVα⎛⎜EPSα1NPVα⎞⎟+>+(r−0.08)⎜r(r−0.08)⎟(r−0.15)⎜r(r−0.15)⎟β⎝ββ⎠α⎝αα⎠Rearranging,wehave:NPVαrαNPVβrβ×<×(r−0.15)EPS(r−0.08)EPSαα1ββ1a.NPVα(rβ-0.08),everythingelseequal.khdaw.comNPVαNPVβc.<,everythingelseequal.(r−0.15)(r−0.08)αβrαrβd.<,everythingelseequal.EPSEPSα1β114.a.Growth-Tech’sstockpriceshouldbe:$0.50$0.60$1.15⎛1$1.24⎞P=+++⎜×⎟=$23.8123⎜3⎟(1.12)(1.12)(1.12)⎝(1.12)(0.12−0.08)⎠课后答案网b.Thehorizonvaluecontributes:1$1.24PV(P)=×=$22.07H3www.hackshp.cn(1.12)(0.12−0.08)c.WithoutPVGO,P3wouldequalearningsforyear4capitalizedat12percent:$2.49=$20.750.12Therefore:PVGO=$31.00–$20.75=$10.25d.ThePVGOof$10.25islostatyear3.Therefore,thecurrentstockpriceof$23.81willdecreaseby:$10.25=$7.303(1.12)Thenewstockpricewillbe:$23.81–$7.30=$16.5124khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

15.Internetexercise;answerswillvarydependingontimeperiod.16.a.HerewecanapplythestandardgrowingperpetuityformulawithDIV1=$4,g=0.04andP0=$100:DIV1$4r=+g=+0.04=0.08=8.0%P$1000The$4dividendis60percentofearnings.Thus:EPS1=4/0.6=$6.67Also:EPS1khdaw.comP0=+PVGOr$6.67$100=+PVGO0.08PVGO=$16.63b.DIV1willdecreaseto:0.20×6.67=$1.33However,byplowingback80percentofearnings,CSIwillgrowby8percentperyearforfiveyears.Thus:Year1234567,课后答案网8...DIVt1.331.441.551.681.815.88ContinuedgrowthatEPSt6.677.207.788.409.079.804percentNotethatDIVwww.hackshp.cn6increasessharplyasthefirmswitchesbacktoa60percentpayoutpolicy.Forecastedstockpriceinyear5is:DIV5.88P=6==$1475r−g0.08−0.04Therefore,CSI’sstockpricewillincreaseto:1.331.441.551.681.81+147P=++++=$106.21023451.081.081.081.081.0825khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

17.ExpectedFutureValuesPresentValuesHorizonDividendPriceCumulativeFuturePeriod(H)(DIVt)(Pt)DividendsPriceTotal0100.00100.00100.00115.00100.0013.0486.96100.0025.00110.0016.8283.18100.0035.50121.0020.4479.56100.0046.05133.1023.9076.10100.001010.72235.7941.7258.28100.002027.80611.5962.6337.37100.0050485.0910,671.9090.159.85100.00khdaw.com10056,944.681,252,782.9498.931.07100.00Inordertopaytheextradividend,thecompanyneedstoraiseanextra$10pershareinyear1.Thenewshareholderswhoprovidethiscashwilldemandadividendof$0.50pershareinyear2,$0.55inyear3,andsoon.Thus,eacholdsharewillreceivedividendsof$15inyear1,($5.50–$0.50)=$5inyear2,($6.05–$0.55)=$5.50inyear3,andsoon.Thepresentvalueofashareatyear1iscomputedasfollows:$15⎛$51⎞PV=+⎜×⎟=$100.001.15⎝0.15-0.101.15⎠课后答案网www.hackshp.cn26khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ChallengeQuestions1.Spreadsheetexercise2.Fromtheequationgivenintheproblem,itfollowsthat:PROE×(1−b)1−b0==BVPSr−(b×ROE)(r/ROE)−bConsiderthreecases:khdaw.comROEr⇒(P0/BVPS)>1Thus,asROEincreases,theprice-to-bookratioalsoincreases,and,whenROE=r,price-to-bookequalsone.3.Assumetheportfoliovaluegiven,$100million,isthevalueasoftheendofthefirstyear.Then,assumingconstantgrowth,thevalueofthecontractisgivenbythefirstpayment(0.5percentofportfoliovalue)dividedby(r–g).Also:r=dividendyield+growthrate课后答案网Hence:r–growthrate=dividendyield=0.05=5.0%Thus,thevalueofthecontract,V,is:www.hackshp.cn0.005×$100millionV==$10million0.05Forstockswitha4percentyield:r–growthrate=dividendyield=0.04=4.0%Thus,thevalueofthecontract,V,is:0.005×$100millionV==$12.5million0.0427khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

CHAPTER5WhyNetPresentValueLeadstoBetterInvestmentDecisionsThanOtherCriteriaAnswerstoPracticeQuestions$10001.a.NPV=−$1000+=−$90.91A(1.10)$1000$1000$4000$1000$1000NPV=−$2000+++++=+$4,044.73B2345(1.10)(1.10)(1.10)(1.10)(1.10)khdaw.com$1000$1000$1000$1000NPV=−$3000++++=+$39.47C245(1.10)(1.10)(1.10)(1.10)b.PaybackA=1yearPaybackB=2yearsPaybackC=4yearsc.AandB2.a.WhenusingtheIRRrule,thefirmmuststillcomparetheIRRwiththeopportunitycostofcapital.Thus,evenwiththeIRRmethod,onemust课后答案网specifytheappropriatediscountrate.b.Riskycashflowsshouldbediscountedatahigherratethantherateusedtodiscountlessriskycashflows.Usingthepaybackruleisequivalenttowww.hackshp.cnusingtheNPVrulewithazerodiscountrateforcashflowsbeforethepaybackperiodandaninfinitediscountrateforcashflowsthereafter.3.r=-17.44%0.00%10.00%15.00%20.00%25.00%45.27%Year0-3,000.00-3,000.00-3,000.00-3,000.00-3,000.00-3,000.00-3,000.00-3,000.00Year13,500.004,239.343,500.003,181.823,043.482,916.672,800.002,409.31Year24,000.005,868.414,000.003,305.793,024.572,777.782,560.001,895.43Year3-4,000.00-7,108.06-4,000.00-3,005.26-2,630.06-2,314.81-2,048.00-1,304.76PV=-0.31500.00482.35437.99379.64312.00-0.02ThetwoIRRsforthisprojectare(approximately):–17.44%and45.27%Betweenthesetwodiscountrates,theNPVispositive.28khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

4.a.Thefigureonthenextpagewasdrawnfromthefollowingpoints:DiscountRate0%10%20%NPVA+20.00+4.13-8.33NPVB+40.00+5.18-18.98b.Fromthegraph,wecanestimatetheIRRofeachprojectfromthepointwhereitslinecrossesthehorizontalaxis:IRRA=13.1%andIRRB=11.9%c.ThecompanyshouldacceptProjectAifitsNPVispositiveandhigherkhdaw.comthanthatofProjectB;thatis,thecompanyshouldacceptProjectAifthediscountrateisgreaterthan10.7%(theintersectionofNPVAandNPVBonthegraphbelow)andlessthan13.1%.d.Thecashflowsfor(B–A)are:C0=$0C1=–$60C2=–$60C3=+$140Therefore:Discount课后答案网Rate0%10%20%NPVB-A+20.00+1.05-10.65IRRB-A=10.7%ThecompanyshouldacceptProjectAifthediscountrateisgreaterthanwww.hackshp.cn10.7%andlessthan13.1%.Asshowninthegraph,forthesediscountrates,theIRRfortheincrementalinvestmentislessthantheopportunitycostofcapital.29khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

50.0040.0030.0020.00ProjectA10.00ProjectBNPV0.00Increment-10.00khdaw.com-20.00-30.000%10%20%RateofInterest5.a.BecauseProjectArequiresalargercapitaloutlay,itispossiblethatProjectAhasbothalowerIRRandahigherNPVthanProjectB.(Infact,NPVAisgreaterthanNPVBforalldiscountrateslessthan10percent.)Becausethegoalistomaximizeshareholderwealth,NPVisthecorrectcriterion.课后答案网b.TousetheIRRcriterionformutuallyexclusiveprojects,calculatetheIRRfortheincrementalcashflows:Cwww.hackshp.cn0C1C2IRRA-B-200+110+12110%BecausetheIRRfortheincrementalcashflowsexceedsthecostofcapital,theadditionalinvestmentinAisworthwhile.$250$300c.NPV=−$400++=$81.86A21.09(1.09)$140$179NPV=−$200++=$79.10B21.09(1.09)30khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

6.Useincrementalanalysis:C1C2C3Currentarrangement-250,000-250,000+650,000Extrashift-550,000+650,0000Incrementalflows-300,000+900,000-650,000TheIRRsfortheincrementalflowsare(approximately):21.13%and78.87%Ifthecostofcapitalisbetweentheserates,Titanicshouldworktheextrashift.20,000−10,000+1.108,1827.a.PI===0.82D−(−10,000)10,000khdaw.com35,000−20,000+1.1011,818PI===0.59E−(−20,000)20,000b.EachprojecthasaProfitabilityIndexgreaterthanzero,andsobothareacceptableprojects.Inordertochoosebetweentheseprojects,wemustuseincrementalanalysis.Fortheincrementalcashflows:15,000−10,000+1.103,636PI===0.36E−D−(−10,000)10,000课后答案网Theincrementisthusanacceptableproject,andsothelargerprojectshouldbeaccepted,i.e.,acceptProjectE.(Notethat,inthiscase,thebetterprojecthasthelowerprofitabilityindex.)www.hackshp.cn8.UsingthefactthatProfitabilityIndex=(NetPresentValue/Investment),wefind:ProjectProfitabilityIndex10.222-0.0230.1740.1450.0760.1870.12Thus,giventhebudgetof$1million,thebestthecompanycandoistoacceptProjects1,3,4,and6.IfthecompanyacceptedallpositiveNPVprojects,themarketvalue(comparedtothemarketvalueunderthebudgetlimitation)wouldincreasebytheNPVofProject5plustheNPVofProject7:$7,000+$48,000=$55,000Thus,thebudgetlimitcoststhecompany$55,000intermsofitsmarketvalue.31khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ChallengeQuestions1.TheIRRisthediscountratewhich,whenappliedtoaproject’scashflows,yieldsNPV=0.Thus,itdoesnotrepresentanopportunitycost.However,ifeachproject’scashflowscouldbeinvestedatthatproject’sIRR,thentheNPVofeachprojectwouldbezerobecausetheIRRwouldthenbetheopportunitycostofcapitalforeachproject.ThediscountrateusedinanNPVcalculationistheopportunitycostofcapital.Therefore,itistruethattheNPVruledoesassumethatcashflowsarereinvestedattheopportunitycostofcapital.2.a.khdaw.comC0=–3,000C0=–3,000C1=+3,500C1=+3,500C2=+4,000C2+PV(C3)=+4,000–3,571.43=428.57C3=–4,000MIRR=27.84%xCC23b.xC+=−121.121.122(1.12)(xC1)+(1.12)(xC2)=–C32(x)[(1.12)(C1)+(1.12C2)]=–C3-Cx=课后答案网32(1.12)(C)+(1.12C)124,000x==0.452(1.12www.hackshp.cn)(3,500)+(1.12)(4,000)(1-x)C(1-x)C12C++=002(1+IRR)(1+IRR)(1-0.45)(3,500)(1-0.45)(4,000)−3,000++=02(1+IRR)(1+IRR)Now,findMIRRusingeithertrialanderrorortheIRRfunction(onafinancialcalculatororExcel).WefindthatMIRR=23.53%.ItisnotclearthateitherofthesemodifiedIRRsisatallmeaningful.Rather,thesecalculationsseemtohighlightthefactthatMIRRreallyhasnoeconomicmeaning.32khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

3.Maximize:NPV=6,700xW+9,000xX+0XY–1,500xZsubjectto:10,000xW+0xX+10,000xY+15,000xZ≤20,00010,000xW+20,000xX–5,000xY–5,000xZ≤20,0000xW-5,000xX–5,000xY–4,000xZ≤20,0000≤xW≤10≤xX≤10≤xZ≤1UsingExcelSpreadsheetAdd-inLinearProgrammingModule:khdaw.comOptimizedNPV=$13,450withxW=1;xX=0.75;xY=1andxZ=0Iffinancingavailableatt=0is$21,000:OptimizedNPV=$13,500withxW=1;xX=(23/30);xY=1andxZ=(2/30)Here,theshadowpricefortheconstraintatt=0is$50,theincreaseinNPVfora$1,000increaseinfinancingavailableatt=0.Inthiscase,theprogramviewedxZasaviablechoiceeventhoughtheNPVofProjectZisnegative.ThereasonforthisresultisthatProjectZprovidesapositivecashflowinperiods1and2.课后答案网Ifthefinancingavailableatt=1is$21,000:OptimizedNPV=$13,900withxW=1;www.hackshp.cnxX=0.8;xY=1andxZ=0Hence,theshadowpriceofanadditional$1,000int=1financingis$450.33khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

CHAPTER6MakingInvestmentDecisionswithTheNetPresentValueRuleAnswerstoPracticeQuestions1.Seethetablebelow.Webeginwiththecashflowsgiveninthetext,Table6.6,line8,andutilizethefollowingrelationshipfromChapter3:tRealcashflow=nominalcashflow/(1+inflationrate)Here,thenominalrateis20percent,theexpectedinflationrateis10percent,khdaw.comandtherealrateisgivenbythefollowing:(1+rnominal)=(1+rreal)×(1+inflationrate)1.20=(1+rreal)×(1.10)rreal=0.0909=9.09%Ascanbeseeninthetable,theNPVisunchanged(towithinaroundingerror).Year0Year1Year2Year3Year4Year5Year6Year7NetCashFlows(Nominal)-12,600-1,4842,9476,32310,5349,9855,7573,269NetCashFlows(Real)-12,600-1,3492,4364,7517,1956,2003,2501,678NPVofRealCashFlows(at9.09%)=$3,804课后答案网2.No,thisisnotthecorrectprocedure.Theopportunitycostofthelandisitsvalueinitsbestuse,soMr.Northshouldconsiderthe$45,000valueofthelandasanoutlayinhisNPVanalysisofthefuneralhome.www.hackshp.cn3.Investmentinworkingcapitalarisesasaforecastingissueonlybecauseaccrualaccountingrecognizessaleswhenmade,notwhencashisreceived(andcostswhenincurred,notwhencashpaymentismade).Ifcashflowforecastsrecognizetheexacttimingofthecashflows,thenthereisnoneedtoalsoincludeinvestmentinworkingcapital.34khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

4.Ifthe$50,000isexpensedattheendofyear1,thevalueofthetaxshieldis:0.35×$50,000=$16,6671.05Ifthe$50,000expenditureiscapitalizedandthendepreciatedusingafive-yearMACRSdepreciationschedule,thevalueofthetaxshieldis:⎛0.200.320.1920.11520.11520.0576⎞[0.35×$50,000]×⎜+++++⎟=$15,30623456⎝1.051.051.051.051.051.05⎠Ifthecostcanbeexpensed,thenthetaxshieldislarger,sothattheafter-taxcostissmaller.khdaw.com5$26,0005.a.NPV=−$100,000+∑=$3,810Att=11.08NPVB=–Investment+PV(after-taxcashflow)+PV(depreciationtaxshield)5$26,000×(1−0.35)NPVB=−$100,000+∑t+t=11.08⎡0.200.320.1920.11520.11520.0576⎤[]0.35×$100,000×+++++⎢23456⎥⎣1.081.081.081.081.081.08⎦NPVB=–$4,127课后答案网Another,perhapsmoreintuitive,waytodotheCompanyBanalysisistofirstcalculatethecashflowsateachpointintime,andthencomputethepresentvalueofthesecashflows:t=0www.hackshp.cnt=1t=2t=3t=4t=5t=6Investment100,000CashInflow26,00026,00026,00026,00026,000Depreciation20,00032,00019,20011,52011,5205,760TaxableIncome6,000-6,0006,80014,48014,480-5,760Tax2,100-2,1002,3805,0685,068-2,016CashFlow-100,00023,90028,10023,62020,93220,9322,016NPV(at8%)=-$4,127b.IRRA=9.43%IRRB=6.39%0.0639Effectivetaxrate=1−=0.322=32.2%0.094335khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

6.a.TABLE6.5TaxpaymentsonIM&C’sguanoproject($thousands)No.ofyearsdepreciation7Taxrate(percent)35Period01234567MACRS%14.2924.4917.4912.498.938.920.00Taxdepreciation1,4292,4491,7491,2498938920(MACRS%xdepreciableinvestment)1.Sales052312,88732,61048,90135,83419,71702.Costofgoodssold08377,72919,55229,34521,49211,83003.Othercosts4,0002,2001,2101,3311,4641,6111,77204.khdaw.comTaxdepreciation01,4292,4491,7491,24989389205.Pretaxprofits-4,000-3,9431,4999,97816,84311,8385,2236106.Tax-1,400-1,3805253,4925,8954,1431,828214TABLE6.6IM&C’sguanoproject–revisedcashflowanalysiswithMACRSdepreciation($thousands)Period012345671.Sales052312,88732,61048,90135,83419,71702.Costofgoodssold08377,72919,55229,34521,49211,83003.Othercosts4,0002,2001,2101,3311,4641,6111,77204.Tax课后答案网-1,400-1,3805253,4925,8954,1431,8282145.Cashflowfromoperations-2,600-1,1343,4238,23512,1978,5884,287-2146.Changeinworkingcapital-550-739-1,972-1,6291,3071,5812,0027.Capitalinvestmentanddisposal-10,0000000001,9498.Netcashflow(5+6+7)-12,600-1,6842,6846,26310,5689,8955,8683,7379.Presentvaluewww.hackshp.cn-12,600-1,4031,8643,6245,0963,9771,9651,043Netpresentvalue=3,566Costofcapital(percent)2036khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

b.TABLE6.1IM&C’sguanoproject–projections($thousands)reflectinginflationandstraightlinedepreciationPeriod012345671.Capitalinvestment15,000-1,9492.Accumulateddepn.2,4174,8337,2509,66712,08314,50003.Year-endbookvalue15,00012,58310,1677,7505,3332,91750004.Workingcapital5501,2893,2614,8903,5832,00205.Totalbookvalue(3+4)13,13311,45611,01110,2236,5002,50206.Sales52312,88732,61048,90135,83419,7177.Costofgoodssold8377,72919,55229,34521,49211,8308.Othercosts4,0002,2001,2101,3311,4641,6111,7729.Depreciationkhdaw.com2,4172,4172,4172,4172,4172,417010.Pretaxprofit-4,000-4,9311,5319,31015,67510,3143,6981,44911.Tax-1,400-1,7265363,2595,4863,6101,29450712.Profitaftertax(10–11)-2,600-3,2059956,05210,1896,7042,404942Notes:No.ofyearsdepreciation6Assumedsalvagevalueindepreciationcalculation500Taxrate(percent)35TABLE6.2IM&C’sguanoproject–initialcashflowanalysiswithstraight-linedepreciation($thousands)课后答案网Period012345671Sales052312,88732,61048,90135,83419,71702Costofgoodssoldwww.hackshp.cn08377,72919,55229,34521,49211,83003Othercosts4,0002,2001,2101,3311,4641,6111,77204Tax-1,400-1,7265363,2595,4863,6101,2945075Cashflowfromoperations-2,600-7883,4128,46912,6069,1214,821-5076Changeinworkingcapital-550-739-1,972-1,6291,3071,5812,0027Capitalinvestmentanddisposal-15,0000000001,9498Netcashflow(5+6+7)-17,600-1,3382,6736,49710,97710,4286,4023,4449Presentvalue-17,600-1,2062,1704,7507,2316,1893,4231,659Netpresentvalue=6,615Costofcapital(percent)1137khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

c.TABLE6.1IM&C’sguanoproject–projections($thousands)reflectinginflationandstraightlinedepreciationPeriod012345671.Capitalinvestment15,000-1,9492.Accumulateddepn.2,4174,8337,2509,66712,08314,50003.Year-endbookvalue15,00012,58310,1677,7505,3332,91750004.Workingcapital6051,4183,5875,3793,9412,20205.Totalbookvalue(3+4)13,18811,58511,33710,7126,8582,70206.Sales57514,17635,87153,79139,41721,6897.Costofgoodssold9218,50221,50732,28023,64113,0138.Othercosts4,0002,2001,2101,3311,4641,6111,7729.Depreciationkhdaw.com2,4172,4172,4172,4172,4172,417010.Pretaxprofit-4,000-4,9622,04710,61617,63111,7484,4871,44911.Tax-1,400-1,7377163,7166,1714,1121,57050712.Profitaftertax(10–11)-2,600-3,2261,3306,90011,4607,6362,916942Notes:No.ofyearsdepreciation6Assumedsalvagevalueindepreciationcalculation500Taxrate(percent)35TABLE6.2IM&C’sguanoproject–initialcashflowanalysiswithstraight-linedepreciation($thousands)课后答案网Period012345671Sales057514,17635,87153,79139,41721,68902Costofgoodssoldwww.hackshp.cn09218,50221,50732,28023,64113,01303Othercosts4,0002,2001,2101,3311,4641,6111,77204Tax-1,400-1,7377163,7166,1714,1121,5705075Cashflowfromoperations-2,600-8093,7479,31713,87710,0535,333-5076Changeinworkingcapital-605-813-2,169-1,7921,4381,7392,2027Capitalinvestmentanddisposal-15,0000000001,9498Netcashflow(5+6+7)-17,600-1,4142,9357,14812,08511,4917,0723,6449Presentvalue-17,600-1,2732,3825,2277,9616,8193,7811,755Netpresentvalue=9,051Costofcapital(percent)1138khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

7.Assumethefollowing:a.Thefirmwillmanufacturewidgetsforatleast10years.b.Therewillbenoinflationortechnologicalchange.c.The15percentcostofcapitalisappropriateforallcashflowsandisareal,after-taxrateofreturn.d.Alloperatingcashflowsoccurattheendoftheyear.Note:Sincepurchasingthelidscanbeconsideredaone-year‘project,’thetwoprojectshaveacommonchainlifeof10years.ComputeNPVforeachprojectasfollows:10($2×200,000)×(1−0.35)NPV(purchase)=−∑=−$1,304,880tkhdaw.comt=11.1510($1.50×200,000)×(1−0.35)NPV(make)=−$150,000−$30,000−∑tt=11.15⎡0.14290.24490.17490.1249+[]0.35×$150,000×++++⎢1234⎣1.151.151.151.150.08930.08930.08930.0445⎤$30,000++++=−$1,118,3285678⎥101.151.151.151.15⎦1.15Thus,thewidgetmanufacturershouldmakethelids.8.a.CapitalExpenditure课后答案网1.Ifthesparewarehousespacewillbeusednoworinthefuture,thentheprojectshouldbecreditedwiththesebenefits.2.Chargeopportunitycostofthelandandbuilding.3.Thesalvagevalueattheendoftheprojectshouldbeincluded.www.hackshp.cnResearchandDevelopment1.Researchanddevelopmentisasunkcost.WorkingCapital1.Willadditionalinventoriesberequiredasvolumeincreases?2.Recoveryofinventoriesattheendoftheprojectshouldbeincluded.3.Isadditionalworkingcapitalrequiredduetochangesinreceivables,payables,etc.?Revenue1.Revenueforecastsassumeprices(andquantities)willbeunaffectedbycompetition,acommonandcriticalmistake.OperatingCosts1.Arepercentagelaborcostsunaffectedbyincreaseinvolumeintheearlyyears?2.Wagesgenerallyincreasefasterthaninflation.DoesReliableexpectcontinuingproductivitygainstooffsetthis?39khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Overhead1.Is“overhead”trulyincremental?Depreciation1.Depreciationisnotacashflow,buttheACRSdeprecationdoesaffecttaxpayments.2.ACRSdepreciationisfixedinnominalterms.Therealvalueofthedepreciationtaxshieldisreducedbyinflation.Interest1.Itisbadpracticetodeductinterestcharges(orotherpaymentstosecurityholders).Valuetheprojectasifitisallequity-financed.Tax1.SeecommentsonACRSdepreciationandinterest.2.IfReliablehasprofitsonitsremainingbusiness,thetaxlossshouldkhdaw.comnotbecarriedforward.NetCashFlow1.SeecommentsonACRSdepreciationandinterest.2.Discountrateshouldreflectprojectcharacteristics;ingeneral,itisnotequivalenttothecompany’sborrowingrate.b.1.Potentialuseofwarehouse.2Opportunitycostofbuilding.3.Otherworkingcapitalitems.4.Morerealisticforecastsofrevenuesandcosts.5.Company’sabilitytousetaxshields.6.Opportunitycostofcapital.课后答案网c.ThetableonthenextpageshowsasampleNPVanalysisfortheproject.Theanalysisisbasedonthefollowingassumptions:1.Inflation:10percentperyear.2.CapitalExpenditure:www.hackshp.cn$8millionformachinery;$5millionformarketvalueoffactory;$2.4millionforwarehouseextension(weassumethatitiseventuallyneededorthatelectricmotorprojectandsurpluscapacitycannotbeusedintheinterim).Weassumesalvagevalueof$3millioninrealtermslesstaxat35percent.3.WorkingCapital:Weassumeinventoryinyeartis9.1percentofexpectedrevenuesinyear(t+1).Wealsoassumethatreceivableslesspayables,inyeart,isequalto5percentofrevenuesinyeart.4.DepreciationTaxShield:Basedon35percenttaxrateand5-yearACRSclass.Thisisasimplifyingandprobablyinaccurateassumption;i.e.,notalltheinvestmentwouldfallinthe5-yearclass.Also,thefactoryiscurrentlyownedbythecompanyandmayalreadybepartiallydepreciated.Weassumethecompanycanusetaxshieldsastheyarise.40khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

5.Revenues:Salesof2,000motorsin2004,4,000motorsin2005,and10,000motorsthereafter.Theunitpriceisassumedtodeclinefrom$4,000(real)to$2,850whencompetitionentersin2006.Thelatteristhefigureatwhichnewentrants’investmentintheprojectwouldhaveNPV=0.6.OperatingCosts:Weassumedirectlaborcostsdeclineprogressivelyfrom$2,500perunitin2004,to$2,250in2005andto$2,000inrealtermsin2006andafter.7.OtherCosts:Weassumetrueincrementalcostsare10percentofrevenue.8.Tax:35percentofrevenuelesscosts.9.OpportunityCostofCapital:Assumed20percent.khdaw.com200320042005200620072008CapitalExpenditure-15,400ChangesinWorkingCapitalInventories-801-961-1,690-345380-418Receivables–Payables-440-528-929-190-209DepreciationTaxShield1,0781,7251,035621621Revenues8,80019,36037,93441,72745,900OperatingCosts-5,500-10,890-26,620-29,282-32,210Othercosts-880-1,936-3,793-4,173-4,590Tax课后答案网-847-2,287-2,632-2,895-3,185NetCashFlow-16,2011,2503,7544,6505,4285,909200920102011201220132014CapitalExpenditurewww.hackshp.cn5,058ChangesinWorkingCapitalInventories-459-505-556-6126,727Receivables–Payables-229-252-278-306-3363,696DepreciationTaxShield310Revenues50,48955,53861,09267,20273,922OperatingCosts-35,431-38,974-42,872-47,159-51,875Othercosts-5,049-5,554-6,109-6,720-7,392Tax-3,503-3,854-4,239-4,663-5,129NetCashFlow6,1286,3997,0387,74220,9753,696NPV(at20%)=$5,99141khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

9.Thetablebelowshowstherealcashflows.TheNPViscomputedusingtherealrate,whichiscomputedasfollows:(1+rnominal)=(1+rreal)×(1+inflationrate)1.09=(1+rreal)×(1.03)rreal=0.0583=5.83%t=0t=1t=2t=3t=4t=5t=6t=7t=8Investment-35,000.015,000.0Savings7,410.07,410.07,410.07,410.07,410.07,410.07,410.07,410.0Insurance-1,200.0-1,200.0-1,200.0-1,200.0-1,200.0-1,200.0-1,200.0-1,200.0Fuel-526.5-526.5-526.5-526.5-526.5-526.5-526.5-526.5NetCashFlow-35,000.05,683.55,683.55,683.55,683.55,683.55,683.55,683.520,683.5NPV(at5.83%)=$10,064.9khdaw.com10.t=0t=1t=2t=3t=4t=5t=6t=7t=8Sales4,200.04,410.04,630.54,862.05,105.15,360.45,628.45,909.8ManufacturingCosts3,780.03,969.04,167.54,375.84,594.64,824.45,065.65,318.8Depreciation120.0120.0120.0120.0120.0120.0120.0120.0Rent100.0104.0108.2112.5117.0121.7126.5131.6EarningsBeforeTaxes200.0217.0234.8253.7273.5294.3316.3339.4Taxes70.076.082.288.895.7103.0110.7118.8CashFlow-Operations250.0261.1272.6284.9297.8311.3325.6340.6WorkingCapital350.0420.0441.0463.1486.2510.5536.0562.80.0IncreaseinW.C.350.070.021.022.123.124.325.526.8-562.8InitialInvestment1,200.0课后答案网SaleofPlant400.0TaxonSale56.0NetCashFlow-1,550.0180.0240.1250.5261.8273.5285.8298.81,247.4NPV(at12%)=$85.7www.hackshp.cn11.[Note:Section6.2providesseveraldifferentcalculationsofpre-taxprofitandtaxes,basedondifferentassumptions;thesolutionbelowisbasedonTable6.6inthetext.]Seethetablebelow.Withfullusageofthetaxlosses,theNPVofthetaxpaymentsis$4,779.Withtaxlossescarriedforward,theNPVofthetaxpaymentsis$5,741.Thus,withtaxlossescarriedforward,theproject’sNPVdecreasesby$962,sothatthevaluetothecompanyofusingthedeductionsimmediatelyis$962.42khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

t=0t=1t=2t=3t=4t=5t=6t=7PretaxProfit-4,000-4,5147489,80716,94011,5795,5391,949Fullusageoftaxlossesimmediately(Table6.6)-1,400-1,5802623,4325,9294,0531,939682NPV(at20%)=$4,779Taxlosscarry-forward0007145,9294,0531,939682NPV(at20%)=$5,74112.(Note:RownumbersinthetablebelowrefertotherowsinTable6.8.)t=0t=1t=2t=3t=4t=5t=6t=7t=81.Capitalinvestment83.5-12.04.Workingkhdaw.comcapital2.34.47.66.95.33.22.50.00.0ChangeinW.C.2.32.13.2-0.7-1.6-2.1-0.7-2.50.09.Depreciation11.911.911.911.911.911.911.90.012.Profitaftertax-6.24.226.923.515.45.01.6-7.8CashFlow-85.83.612.939.537.029.417.616.04.2NPV(at11.0%)=$17.5513.Inordertosolvethisproblem,wecalculatetheequivalentannualcostforeachofthetwoalternatives.(Allcashflowsareinthousands.)Alternative1–Sellthenewmachine:Ifwesellthenewmachine,wereceivethecashflowfromthesale,paytaxesonthegain,andpaythecostsassociatedwithkeepingtheoldmachine.Thepresentvalueofthisalternativeis:课后答案网3030303030PV=50−[0.35(50−0)]−20−−−−−123451.121.121.121.121.125www.hackshp.cn0.35(5−0)+−=−$93.80551.121.12Theequivalentannualcostforthefive-yearperiodiscomputedasfollows:PV1=EAC1×[annuityfactor,5timeperiods,12%]–93.80=EAC1×[3.605]EAC1=–26.02,oranequivalentannualcostof$26,02043khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Alternative2–Selltheoldmachine:Ifweselltheoldmachine,wereceivethecashflowfromthesale,paytaxesonthegain,andpaythecostsassociatedwithkeepingthenewmachine.Thepresentvalueofthisalternativeis:2020202020PV=25−[0.35(25−0)]−−−−−223451.121.121.121.121.12203030303030−−−−−−56789101.121.121.121.121.121.1250.35(5−0)+−=−$127.5110101.121.12Theequivalentannualcostfortheten-yearperiodiscomputedasfollows:PVkhdaw.com2=EAC2×[annuityfactor,10timeperiods,12%]–127.51=EAC2×[5.650]EAC2=–22.57,oranequivalentannualcostof$22,570Thus,theleastexpensivealternativeistoselltheoldmachinebecausethisalternativehasthelowestequivalentannualcost.Onekeyassumptionunderlyingthisresultisthat,wheneverthemachineshavetobereplaced,thereplacementwillbeamachinethatisasefficienttooperateasthenewmachinebeingreplaced.14.Thecurrentcopiershavenetcostcashflowsasfollows:课后答案网Before-TaxNetCashYearCashFlowAfter-TaxCashFlowFlow1-2,000www.hackshp.cn(-2,000×.65)+(.35×.0893×20,000)-674.92-2,000(-2,000×.65)+(.35×.0893×20,000)-674.93-8,000(-8,000×.65)+(.35×.0893×20,000)-4,574.94-8,000(-8,000×.65)+(.35×.0445×20,000)-4,888.55-8,000(-8,000×.65)-5,200.06-8,000(-8,000×.65)-5,200.0Thesecashflowshaveapresentvalue,discountedat7percent,of–$15,857.Usingtheannuityfactorfor6timeperiodsat7percent(4.767),wefindanequivalentannualcostof$3,327.Therefore,thecopiersshouldbereplacedonlywhentheequivalentannualcostofthereplacementsislessthan$3,327.44khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Whenpurchased,thenewcopierswillhavenetcostcashflowsasfollows:Before-TaxNetCashYearCashFlowAfter-TaxCashFlowFlow0-25,000-25,000-25,000.01-1,000(-1,000×.65)+(.35×.1429×25,000)600.42-1,000(-1,000×.65)+(.35×.2449×25,000)1,492.93-1,000(-1,000×.65)+(.35×.1749×25,000)880.44-1,000(-1,000×.65)+(.35×.1249×25,000)442.95-1,000(-1,000×.65)+(.35×.0893×25,000)131.46-1,000(-1,000×.65)+(.35×.0893×25,000)131.47-1,000(-1,000×.65)+(.35×.0893×25,000)131.4khdaw.com8-1,000(-1,000×.65)+(.35×.0445×25,000)-260.6Thesecashflowshaveapresentvalue,discountedat7percent,of–$21,967.Thedecisiontoreplacemustalsotakeintoaccounttheresalevalueofthemachine,aswellastheassociatedtaxontheresultinggain(orloss).Considerthreecases:a.Thebook(depreciated)valueoftheexistingcopiersisnow$6,248.Iftheexistingcopiersarereplacednow,thenthepresentvalueofthecashflowsis:–21,967+8,000–[0.35×(8,000–6,248)]=–$14,580Usingtheannuityfactorfor8timeperiodsat7percent(5.971),wefindthattheequivalentannualcostis$2,442.课后答案网b.Twoyearsfromnow,thebook(depreciated)valueoftheexistingcopierswillbe$2,676.Iftheexistingcopiersarereplacedtwoyearsfromnow,thenthepresentvalueofthecashflowsis:(–674.9/1.07www.hackshp.cn1)+(–674.9/1.072)+(–21,967/1.072)+2{3,500–[0.35×(3,500–2,676)]}/1.07=–$17,602Usingtheannuityfactorfor10timeperiodsat7percent(7.024),wefindthattheequivalentannualcostis$2,506.c.Sixyearsfromnow,boththebookvalueandtheresalevalueoftheexistingcopierswillbezero.Iftheexistingcopiersarereplacedsixyearsfromnow,thenthepresentvalueofthecashflowsis:6–15,857+(–21,967/1.07)=–$30,495Usingtheannuityfactorfor14timeperiodsat7percent(8.745),wefindthattheequivalentannualcostis$3,487.Thecopiersshouldbereplacedimmediately.45khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

15.a.Year1Year2Year3Year4Year5Year6Year7Year8Year9Year10Year11MACRS10.00%18.00%14.40%11.52%9.22%7.37%6.55%6.55%6.55%6.55%3.29%PercentMACRS40.0072.0057.6046.0836.8829.4826.2026.2026.2026.2013.16Depr.Tax15.6028.0822.4617.9714.3811.5010.2210.2210.2210.225.13ShieldPresentValue(at7%)=$114.57millionTheequivalentannualcostofthedepreciationtaxshieldiscomputedbydividingthepresentvalueofthetaxshieldbytheannuityfactorfor25yearsat7%:khdaw.comEquivalentannualcost=$114.57million/11.654=$9.83millionTheequivalentannualcostofthecapitalinvestmentis:$34.3million–$9.83million=$24.47millionb.Theextracostpergallon(aftertax)is:$24.47million/900milliongallons=$0.0272pergallonThepre-taxcharge=$0.0272/0.65=$0.0418pergallon16.Sincethegrowthinvalueof课后答案网bothtimberandlandislessthanthecostofcapitalafteryear8,itmustpaytocutbythattime.ThetablebelowshowsthatPVismaximizedifyoucutinyear8.Therefore,ifwecutinyear8,theNPVoftheofferis:$140,000–$109,900=$30,100www.hackshp.cnYear1Year2Year3Year4Year5FutureValue:Timber48.358.270.284.797.8Land52.054.156.258.560.8Total100.3112.3126.4143.2158.6PresentValue:92.094.597.6101.4103.1Year6Year7Year8Year9FutureValue:Timber112.9130.3150.5162.7Land63.365.868.471.2Total176.2196.1218.9233.9PresentValue:105.1107.3109.9107.746khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

10,00010,00010,00017.a.PV=40,000+++A231.061.061.06PVA=$66,730(Notethatthisisacost.)8,0008,0008,0008,000PV=50,000++++B2341.061.061.061.06PVB=$77,721(Notethatthisisacost.)Equivalentannualcost(EAC)isfoundby:PVA=EACA×[annuityfactor,6%,3timeperiods]khdaw.com66,730=EACA×2.673EACA=$24,964peryearrentalPVB=EACB×[annuityfactor,6%,4timeperiods]77,721=EACB×3.465EACB=$22,430peryearrentalb.Annualrentalis$24,964forMachineAand$22,430forMachineB.BorstalshouldbuyMachineB.c.Thepaymentswouldincreaseby8percentperyear.Forexample,forMachineA,rentforthefirstyearwouldbe$24,964;rentforthesecond课后答案网yearwouldbe($24,964×1.08)=$26,961;etc.18.Becausethecostofanewmachinenowdecreasesby10percentperyear,thewww.hackshp.cnrentonsuchamachinealsodecreasesby10percentperyear.Therefore:9,0008,1007,290PV=40,000+++A231.061.061.06PVA=$61,820(Notethatthisisacost.)7,2006,4805,8325,249PV=50,000++++B2341.061.061.061.06PVB=$71,614(Notethatthisisacost.)47khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Equivalentannualcost(EAC)isfoundasfollows:PVA=EACA×[annuityfactor,6%,3timeperiods]61,820=EACA×2.673EACA=$23,128,areductionof7.35%PVB=EACB×[annuityfactor,6%,4timeperiods]71,614=EACB×3.465EACB=$20,668,areductionof7.86%19.khdaw.comWitha6-yearlife,theequivalentannualcost(at8percent)ofanewjetis:$1,100,000/4.623=$237,941Ifthejetisreplacedattheendofyear3ratherthanyear4,thecompanywillincuranincrementalcostof$237,941inyear4.Thepresentvalueofthiscostis:4$237,941/1.08=$174,894380,000Thepresentvalueofthesavingsis:∑t=$206,168t=11.08Thepresidentshouldallowwideruseofthepresentjetbecausethepresentvalueofthesavingsisgreaterthanthepresentvalueofthecost.课后答案网www.hackshp.cn48khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ChallengeQuestions1.a.Year0Year1Year2Year3Year4Year5Year6Year7Pre-TaxFlows-14,000-3,0643,2099,75516,46314,0387,6963,951IRR=33.5%Post-TaxFlows-12,600-1,6302,3816,20510,68510,1366,1103,444IRR=26.8%EffectiveTaxRate=20.0%b.Ifthedepreciationrateisaccelerated,thishasnoeffectonthepretaxIRR,butitincreasestheafter-taxIRR.Therefore,thenumeratordecreaseskhdaw.comandtheeffectivetaxratedecreases.Iftheinflationrateincreases,wewouldexpectpretaxcashflowstoincreaseattheinflationrate,whileafter-taxcashflowsincreaseataslowerrate.After-taxcashflowsincreaseataslowerratethantheinflationratebecausedepreciationexpensedoesnotincreasewithinflation.Therefore,thenumeratorofTEbecomesproportionatelylargerthanthedenominatorandtheeffectivetaxrateincreases.CC(1−T)C−I(1−TC)I(1−TC)⎡CC⎤⎡I(1−TC)⎤c.T==−=1−(1−T)=TEC⎢⎥⎢⎥CC课后答案网⎣I(1−TC)I⎦⎣C⎦I(1−T)CHence,iftheup-frontinvestmentisdeductiblefortaxpurposes,thentheeffectivetaxrateisequaltothestatutorytaxrate.www.hackshp.cn2.a.Witharealrateof6percentandaninflationrateof5percent,thenominalrate,r,isdeterminedasfollows:(1+r)=(1+0.06)×(1+0.05)r=0.113=11.3%Forathree-yearannuityat11.3%,theannuityfactoris:2.4310Foratwo-yearannuity,theannuityfactoris:1.7057Forathree-yearannuitywithapresentvalueof$28.37,thenominalannuityis:($28.37/2.4310)=$11.67Foratwo-yearannuitywithapresentvalueof$21.00,thenominalannuityis:($21.00/1.7057)=$12.31Thesenominalannuitiesarenotrealisticestimatesofequivalentannualcostsbecausetheappropriaterentalcost(i.e.,theequivalentannualcost)musttakeintoaccounttheeffectsofinflation.49khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

b.Witharealrateof6percentandaninflationrateof25percent,thenominalrate,r,isdeterminedasfollows:(1+r)=(1+0.06)×(1+0.25)r=0.325=32.5%Forathree-yearannuityat32.5%,theannuityfactoris:1.7542Foratwo-yearannuity,theannuityfactoris:1.3243Forathree-yearannuitywithapresentvalueof$28.37,thenominalannuityis:($28.37/1.7542)=$16.17Foratwo-yearannuitywithapresentvalueof$21.00,thenominalannuityis:($21.00/1.3243)=$15.86khdaw.comWithaninflationrateof5percent,MachineAhasthelowernominalannualcost($11.67comparedto$12.31).Withinflationat25percent,MachineBhasthelowernominalannualcost($15.86comparedto$16.17).Thusitisclearthatinflationhasasignificantimpactonthecalculationofequivalentannualcost,andhence,thewarninginthetexttodothesecalculationsinrealterms.Therankingschangebecause,atthehigherinflationrate,themachinewiththelongerlife(here,MachineA)isaffectedmore.课后答案网www.hackshp.cn50khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

CHAPTER7IntroductiontoRisk,Return,andTheOpportunityCostofCapitalAnswerstoPracticeQuestions1.RecallfromChapter3that:(1+rnominal)=(1+rreal)×(1+inflationrate)Therefore:rreal=[(1+rnominal)/(1+inflationrate)]–1khdaw.coma.Therealreturnonthestockmarketineachyearwas:1999:20.4%2000:-13.8%2001:-12.4%2002:-22.82003:29.1%b.FromtheresultsforPart(a),theaveragerealreturnwas:0.10%c.Theriskpremiumforeachyearwas:1999:18.9%课后答案网2000:-16.8%2001:-14.8%2002:-22.6%2003:30.6%www.hackshp.cnd.FromtheresultsforPart(c),theaverageriskpremiumwas:–0.94%e.Thestandarddeviation(σ)oftheriskpremiumiscalculatedasfollows:2⎛1⎞222σ=⎜⎟×[(0.189−(−0.0094))+(−0.168−(−0.0094))+(−0.148−(−0.0094))⎜⎟⎝5−1⎠22+(−0.226−(−0.0094))+(0.306−(−0.0094))]=0.057530σ=0.057530=0.2399=23.99%2.Internetexercise;answerswillvary.51khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

3.a.Along-termUnitedStatesgovernmentbondisalwaysabsolutelysafeintermsofthedollarsreceived.However,thepriceofthebondfluctuatesasinterestrateschangeandtherateatwhichcouponpaymentsreceivedcanbeinvestedalsochangesasinterestrateschange.And,ofcourse,thepaymentsareallinnominaldollars,soinflationriskmustalsobeconsidered.b.Itistruethatstocksofferhigherlong-runratesofreturnthandobonds,butitisalsotruethatstockshaveahigherstandarddeviationofreturn.So,whichinvestmentispreferabledependsontheamountofriskoneiswillingtotolerate.Thisisacomplicatedissueanddependsonnumerousfactors,oneofwhichistheinvestmenttimehorizon.Iftheinvestorhasashorttimehorizon,thenstocksaregenerallynotpreferred.khdaw.comc.Unfortunately,10yearsisnotgenerallyconsideredasufficientamountoftimeforestimatingaverageratesofreturn.Thus,usinga10-yearaverageislikelytobemisleading.4.TherisktoHippiqueshareholdersdependsonthemarketrisk,orbeta,oftheinvestmentintheblackstallion.Theinformationgivenintheproblemsuggeststhatthehorsehasveryhighuniquerisk,butwehavenoinformationregardingthehorse’smarketrisk.So,thebestestimateisthatthishorsehasamarketriskaboutequaltothatofotherracehorses,andthusthisinvestmentisnotaparticularlyriskyoneforHippiqueshareholders.课后答案网5.Inthecontextofawell-diversifiedportfolio,theonlyriskcharacteristicofasinglesecuritythatmattersisthesecurity’scontributiontotheoverallportfoliorisk.Thiswww.hackshp.cncontributionismeasuredbybeta.LonesomeGulchisthesaferinvestmentforadiversifiedinvestorbecauseitsbeta(+0.10)islowerthanthebetaofAmalgamatedCopper(+0.66).Foradiversifiedinvestor,thestandarddeviationsareirrelevant.6.xI=0.60σI=0.10xJ=0.40σJ=0.20a.ρ=1IJ22222σ=x[σ+xσ+2(xxρσσ)]pIIJJIJIJIJ2222=[(0.60)(0.10)+(0.40)(0.20)+2(0.60)(0.40)(1)(0.10)(0.20)]=0.019652khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

b.ρ=0.50IJ22222σ=x[σ+xσ+2(xxρσσ)]pIIJJIJIJIJ2222=[(0.60)(0.10)+(0.40)(0.20)+2(0.60)(0.40)(0.50)(0.10)(0.20])=0.0148c.ρ=0ij22222σ=x[σ+xσ+2(xxρσσ)]pIIJJIJIJIJ2222=[(0.60)(0.10)+(0.40)(0.20)+2(0.60)(0.40)(0)(0.10)(0.20)]=0.01007.khdaw.coma.RefertoFigure7.11inthetext.With100securities,theboxis100by100.Thevariancetermsarethediagonalterms,andthusthereare100varianceterms.Therestarethecovarianceterms.Becausetheboxhas(100times100)termsaltogether,thenumberofcovariancetermsis:2100–100=9,900Halfoftheseterms(i.e.,4,950)aredifferent.b.Onceagain,itiseasiesttothinkofthisintermsofFigure7.11.With50stocks,allwiththesamestandarddeviation(0.30),thesameweightintheportfolio(0.02),andallpairshavingthesamecorrelationcoefficient(0.40),theportfoliovarianceis:课后答案网222222σ=50(0.02)(0.30)+[(50)–50](0.02)(0.40)(0.30)=0.03708σ=0.193=19.3%c.Forafullydiversifiedportfolio,portfoliovarianceequalstheaveragewww.hackshp.cncovariance:2σ=(0.30)(0.30)(0.40)=0.036σ=0.190=19.0%8.a.RefertoFigure7.11inthetext.Foreachdifferentportfolio,therelativeweightofeachshareis[onedividedbythenumberofshares(n)intheportfolio],thestandarddeviationofeachshareis0.40,andthecorrelationbetweenpairsis0.30.Thus,foreachportfolio,thediagonaltermsarethesame,andtheoff-diagonaltermsarethesame.Therearendiagonal2termsand(n–n)off-diagonalterms.Ingeneral,wehave:2222Variance=n(1/n)(0.4)+(n–n)(1/n)(0.3)(0.4)(0.4)53khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

22Foroneshare:Variance=1(1)(0.4)+0=0.160000Fortwoshares:222Variance=2(0.5)(0.4)+2(0.5)(0.3)(0.4)(0.4)=0.104000Theresultsaresummarizedinthesecondandthirdcolumnsofthetablebelow.b.(Graphsareonthenextpage.)Theunderlyingmarketriskthatcannotbediversifiedawayisthesecondtermintheformulaforvarianceabove:22Underlyingmarketrisk=(n-n)(1/n)(0.3)(0.4)(0.4)22Asnincreases,[(n-n)(1/n)]=[(n-1)/n]becomescloseto1,sothatthekhdaw.comunderlyingmarketriskis:[(0.3)(0.4)(0.4)]=0.048c.ThisisthesameasPart(a),exceptthatalloftheoff-diagonaltermsarenowequaltozero.Theresultsaresummarizedinthefourthandfifthcolumnsofthetablebelow.(Parta)(Parta)(Partc)(Partc)No.ofStandardStandardSharesVarianceDeviationVarianceDeviation1.160000.400.160000.4002.104000.322.080000.2833.085333.292.053333.2314.076000.276.040000.200课后答案网5.070400.265.032000.1796.066667.258.026667.1637.064000.253.022857.1518.062000.249.020000.1419.060444.246.017778.133www.hackshp.cn10.059200.243.016000.12654khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

GraphsforPart(a):PortfolioVariancePortfolioStandardDeviation0.20.50.40.150.30.10.2Variance0.050.1StandardDeviation00024681012024681012NumberofSecuritiesNumberofSecuritiesGraphsforPart(c):khdaw.comPortfolioVariancePortfolioStandardDeviation0.20.50.40.150.30.10.2Variance0.050.1StandardDeviation00024681012024681012NumberofSecuritiesNumberofSecurities课后答案网www.hackshp.cn55khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

9.Internetexercise;answerswillvarydependingontimeperiod.10.ThetablebelowusestheformatofTable7.11inthetextinordertocalculatetheportfoliovariance.Theportfoliovarianceisthesumofalltheentriesinthematrix.Portfoliovarianceequals:0.0598355AlcanBPDeutscheKLMLVMHNestleSonyAlcan0.00186130.00057450.00129150.00181380.00157900.00024840.0010539BP0.00057450.00116570.00042740.00077090.00045070.00022680.0003244Deutsche0.00129150.00042740.00296250.00152560.00156750.00019280.0014404KLM0.00181380.00077090.00152560.00606170.00228900.00055170.0010038LVMH0.00157900.00045070.00156750.00228900.00360000.00002660.0020357Nestle0.00024840.00022680.00019280.00055170.00002660.00049030.0001503Sony0.00105390.00032440.00144040.00100380.00203570.00015030.0046046khdaw.com11.Internetexercise;answerswillvarydependingontimeperiod.12.“Safest”meanslowestrisk;inaportfoliocontext,thismeanslowestvarianceofreturn.HalfoftheportfolioisinvestedinAlcanstock,andhalfoftheportfoliomustbeinvestedinoneoftheothersecuritieslisted.Thus,wecalculatetheportfoliovarianceforsixdifferentportfoliostoseewhichisthelowest.ThesafestattainableportfolioiscomprisedofAlcanandNestle.StocksPortfolioVarianceAlcan&BP0.051156Alcan&Deutsche课后答案网0.090733Alcan&KLM0.141497Alcan&LVMH0.105587Alcan&Nestle0.034893Alcan&Sonywww.hackshp.cn0.10502813.a.Ingeneral,weexpectastock’spricetochangebyanamountequalto(beta×changeinthemarket).Betaequalto–0.25impliesthat,ifthemarketrisesbyanextra5percent,theexpectedchangeinthestock’srateofreturnis–1.25percent.Ifthemarketdeclinesanextra5percent,thentheexpectedchangeis+1.25percent.b.“Safest”implieslowestrisk.Assumingthewell-diversifiedportfolioisinvestedintypicalsecurities,theportfoliobetaisapproximatelyone.Thelargestreductioninbetaisachievedbyinvestingthe$20,000inastockwithanegativebeta.Answer(iii)iscorrect.14.Internetexercise;answerswillvarydependingontimeperiod.15.Internetexercise;answerswillvarydependingontimeperiod.56khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ChallengeQuestions1.a.Ingeneral:22222Portfoliovariance=σP=x1σ1+x2σ2+2x1x2ρ12σ1σ2Thus:22222σP=(0.5)(0.530)+(0.5)(0.475)+2(0.5)(0.5)(0.72)(0.530)(0.475)2σP=0.21726Standarddeviation=σP=0.466=46.6%khdaw.comb.WecanthinkofthisintermsofFigure7.11inthetext,withthreesecurities.Oneofthesesecurities,T-bills,haszeroriskand,hence,zerostandarddeviation.Thus:22222σP=(1/3)(0.530)+(1/3)(0.475)+2(1/3)(1/3)(0.72)(0.530)(0.475)2σP=0.09656Standarddeviation=σP=0.311=31.1%Anotherwaytothinkofthisportfolioisthatitiscomprisedofone-thirdT-Billsandtwo-thirdsaportfoliowhichishalfDellandhalfMicrosoft.BecausetheriskofT-billsiszero,theportfoliostandarddeviationistwo-thirdsofthestandarddeviationcomputedinPart(a)above:课后答案网Standarddeviation=(2/3)(0.466)=0.311=31.1%c.With50percentmargin,theinvestorinveststwiceasmuchmoneyintheportfolioashehadtobeginwith.Thus,theriskistwicethatfoundinPartwww.hackshp.cn(a)whentheinvestorisinvestingonlyhisownmoney:Standarddeviation=2×46.6%=93.2%d.With100stocks,theportfolioiswelldiversified,andhencetheportfoliostandarddeviationdependsalmostentirelyontheaveragecovarianceofthesecuritiesintheportfolio(measuredbybeta)andonthestandarddeviationofthemarketportfolio.Thus,foraportfoliomadeupof100stocks,eachwithbeta=1.77,theportfoliostandarddeviationisapproximately:(1.77×15%)=26.55%.ForstockslikeMicrosoft,itis:(1.70×15%)=25.50%.57khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

2.Foratwo-securityportfolio,theformulaforportfolioriskis:2222Portfoliovariance=x1σ1+x2σ2+2x1x2ρρ12σ1σ2IfsecurityoneisTreasurybillsandsecuritytwoisthemarketportfolio,thenσ1iszero,σ2is20percent.Therefore:2222Portfoliovariance=x2σ2=x2(0.20)Standarddeviation=0.20x2Portfolioexpectedreturn=x1(0.06)+x2(0.06+0.85)Portfolioexpectedreturn=0.06x1+0.145x2ExpectedStandardkhdaw.comPortfolioX1X2ReturnDeviation11.00.00.0600.00020.80.20.0770.04030.60.40.0940.08040.40.60.1110.12050.20.80.1280.16060.01.00.1450.200PortfolioReturn&RiskPortfolioReturn&Risk课后答案网0.2www.hackshp.cnn0.15nn0.1nnnExpectedReturn0.05000.050.10.150.20.25StandardDeviation58khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

3.Internetexercise;answerswillvary.4.Thematrixbelowdisplaysthevarianceforeachofthesevenstocksalongthediagonalandeachofthecovariancesintheoff-diagonalcells:AlcanBPDeutscheKLMLVMHNestleSonyAlcan0.09120400.02814940.06328410.08887860.07737240.01217060.0516420BP0.02814940.05712100.02094360.03777400.02208360.01111350.0158935Deutsche0.06328410.02094360.14516100.07475220.07680960.00944880.0705803KLM0.08887860.03777400.07475220.29702500.11216100.02703200.0491863LVMH0.07737240.02208360.07680960.11216100.17640000.00130200.0997500Nestle0.01217060.01111350.00944880.02703200.00130200.02402500.0073625Sony0.05164200.01589350.07058030.04918630.09975000.00736250.2256250khdaw.comThecovarianceofAlcanwiththemarketportfolio(σAlcan,Market)isthemeanofthesevenrespectivecovariancesbetweenAlcanandeachofthesevenstocksintheportfolio.(ThecovarianceofAlcanwithitselfisthevarianceofAlcan.)Therefore,σAlcan,Marketisequaltotheaverageofthesevencovariancesinthefirstrowor,equivalently,theaverageofthesevencovariancesinthefirstcolumn.BetaforAlcanisequaltothecovariancedividedbythemarketvariance(seePracticeQuestion10).Thecovariancesandbetasaredisplayedinthetablebelow:CovarianceBetaAlcan0.05895730.9853BP0.02758260.4610Deutsche0.06585421.1006KLM0.09811561.6398LVMH0.08083981.3510课后答案网Nestle0.01320780.2207Sony0.07429141.2416www.hackshp.cn59khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

CHAPTER8RiskandReturnAnswerstoPracticeQuestions1.a.False–investorsdemandhigherexpectedratesofreturnonstockswithmorenondiversifiablerisk.b.False–asecuritywithabetaofzerowilloffertherisk-freerateofreturn.c.False–thebetawillbe:(1/3×0)+(2/3×1)=0.67d.True.khdaw.come.True.2.Inthefollowingsolution,securityoneisExxonMobilandsecuritytwoisCoca-Cola.Then:r1=0.10σ1=0.182r2=0.15σ2=0.273Further,weknowthatforatwo-securityportfolio:rp=x1r1+x2r222222σp=x1σ1课后答案网+2x1x2σ1σ2ρ12+x2σ2Therefore,wehavethefollowingresults:σpσpσpx1x2rpwww.hackshp.cnwhenρ=0whenρ=1whenρ=-11.00.00.1000.1820.1820.1820.90.10.1050.1660.1910.1370.80.20.1100.1560.2000.0910.70.30.1150.1510.2090.0460.60.40.1200.1540.2180.0000.50.50.1250.1640.2280.0460.40.60.1300.1790.2370.0910.30.70.1350.1990.2460.1370.20.80.1400.2210.2550.1820.10.90.1450.2460.2640.2280.01.00.1500.2730.2730.27360khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Correlation=016.00%14.00%12.00%10.00%8.00%6.00%ExpectedReturn4.00%2.00%0.00%khdaw.com0.00%10.00%20.00%30.00%StandardDeviationCorrelation=116.00%14.00%12.00%10.00%8.00%6.00%课后答案网4.00%ExpectedReturn2.00%0.00%0.00%10.00%www.hackshp.cn20.00%30.00%StandardDeviation61khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Correlation=-116.00%14.00%12.00%10.00%8.00%6.00%4.00%ExpectedReturn2.00%0.00%khdaw.com0.00%10.00%20.00%30.00%StandardDeviation3.a.Portfoliorσ110.0%5.1%29.04.6311.06.4b.Seethefigurebelow.Thesetofportfoliosisrepresentedbythecurved课后答案网line.ThefivepointsarethethreeportfoliosfromPart(a)plusthefollowingtwoportfolios:oneconsistsof100%investedinXandtheotherconsistsof100%investedinY.c.Seethefigurebelow.Thebestopportunitiesliealongthestraightline.www.hackshp.cnFromthediagram,theoptimalportfolioofriskyassetsisportfolio1,andsoMr.Harrywitzshouldinvest50percentinXand50percentinY.62khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

0.15ExpectedReturngg0.1ggg0.05khdaw.com000.020.040.060.080.1StandardDeviation4.a.Expectedreturn=(0.6×15)+(0.4×20)=17%2222Variance=(0.6×20)+(0.4×22)+2(0.6)(0.4)(0.5)(20)(22)=327.04(1/2)Standarddeviation=327.04=18.08%b.Correlationcoefficient=0课后答案网⇒Standarddeviation=14.88%Correlationcoefficient=–0.5⇒Standarddeviation=10.76%c.Hisportfolioisbetter.Theportfoliohasahigherexpectedreturnandalowerstandarddeviation.www.hackshp.cn5.Internetexercise;answerswillvarydependingontimeperiod.6.Internetexercise;answerswillvarydependingontimeperiod.7.Internetexercise;answerswillvarydependingontimeperiod.63khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

8.a.2015105000.511.52khdaw.comBetab.Marketriskpremium=rm–rf=0.12–0.04=0.08=8.0%c.Usethesecuritymarketline:r=rf+β(rm–rf)r=0.04+[1.5×(0.12–0.04)]=0.16=16.0%d.Foranyinvestment,wecanfindtheopportunitycostofcapitalusingthesecuritymarketline.Withβ=0.8,theopportunitycostofcapitalis:r=rf课后答案网+β(rm–rf)r=0.04+[0.8×(0.12–0.04)]=0.104=10.4%Theopportunitycostofcapitalis10.4%andtheinvestmentisexpectedtoearn9.8%.Therefore,theinvestmenthasanegativeNPV.www.hackshp.cne.Again,weusethesecuritymarketline:r=rf+β(rm–rf)0.112=0.04+β(0.12–0.04)⇒β=0.99.Internetexercise;answerswillvarydependingontimeperiod.10.Internetexercise;answerswillvary.64khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

11.a.Percival’scurrentportfolioprovidesanexpectedreturnof9%withanannualstandarddeviationof10%.FirstwefindtheportfolioweightsforacombinationofTreasurybills(security1:standarddeviation=0%)andtheindexfund(security2:standarddeviation=16%)suchthatportfoliostandarddeviationis10%.Ingeneral,foratwosecurityportfolio:22222σP=x1σ1+2x1x2σ1σ2ρ12+x2σ2222(0.10)=0+0+x2(0.16)x2=0.625⇒x1=0.375Further:rkhdaw.comp=x1r1+x2r2rp=(0.375×0.06)+(0.625×0.14)=0.11=11.0%Therefore,hecanimprovehisexpectedrateofreturnwithoutchangingtheriskofhisportfolio.b.Withequalamountsinthecorporatebondportfolio(security1)andtheindexfund(security2),theexpectedreturnis:rp=x1r1+x2r2rp=(0.5×0.09)+(0.5×0.14)=0.115=11.5%22222σP=x1σ1+2x1x2σ1σ2ρ12+x2σ22课后答案网2222σP=(0.5)(0.10)+2(0.5)(0.5)(0.10)(0.16)(0.10)+(0.5)(0.16)σ2P=0.0097σP=0.985=9.85%www.hackshp.cnTherefore,hecandoevenbetterbyinvestingequalamountsinthecorporatebondportfolioandtheindexfund.Hisexpectedreturnincreasesto11.5%andthestandarddeviationofhisportfoliodecreasesto9.85%.12.a.True.Bydefinition,thefactorsrepresentmacro-economicrisksthatcannotbeeliminatedbydiversification.b.False.TheAPTdoesnotspecifythefactors.c.True.Differentresearchershaveproposedandempiricallyinvestigateddifferentfactors,butthereisnowidelyacceptedtheoryastowhatthesefactorsshouldbe.d.True.Tobeuseful,wemustbeabletoestimatetherelevantparameters.Ifthisisimpossible,forwhateverreason,themodelitselfwillbeoftheoreticalinterestonly.65khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

13.StockP:r=5%+(1.0×6.4%)+[(–2.0)×(–0.6%)]+[(–0.2)×5.1%]=11.58%2StockP:r=5%+(1.2×6.4%)+[0×(–0.6%)]+(0.3×5.1%)=14.21%3StockP:r=5%+(0.3×6.4%)+[0.5×(–0.6%)]+(1.0×5.1%)=11.72%14.a.Factorriskexposures:b1(Market)=[(1/3)×1.0]+[(1/3)×1.2]+[(1/3)×0.3]=0.83b2(Interestrate)=[(1/3)×(–2.0)]+[(1/3)×0]+[(1/3)×0.5]=–0.50b3(Yieldspread)=[(1/3)×(–0.2)]+[(1/3)×0.3]+[(1/3)×1.0]=0.37khdaw.comb.rP=5%+(0.83×6.4%)+[(–0.50)×(–0.6%)]+[0.37×5.1%]=12.50%15.rC=1.0%+(0.30×7.6%)+(–0.09×3.9%)+(0.35×4.4%)=4.47%rF=1.0%+(1.38×7.6%)+(–0.01×3.9%)+(1.11×4.4%)=16.33%rP=1.0%+(0.36×7.6%)+(–0.69×3.9%)+(–0.03×4.4%)=0.91%rM=1.0%+(1.54×7.6%)+(0.13×3.9%)+(–0.24×4.4%)=12.16%课后答案网www.hackshp.cn66khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

ChallengeQuestions1.Ingeneral,foratwo-securityportfolio:22222σp=x1σ1+2x1x2σ1σ2ρ12+x2σ2and:x1+x2=1Substitutingforx2intermsofx1andrearranging:222222σp=σ1x1+2σ1σ2ρ12(x1–x1)+σ2(1–x1)2khdaw.comTakingthederivativeofσpwithrespecttox1,settingthederivativeequaltozeroandrearranging:222x1(σ1–2σ1σ2ρ12+σ2)+(σ1σ2ρ12–σ2)=0LetExxonMobilbesecurityone(σ1=0.182)andCoca-Colabesecuritytwo(σ2=0.273).Substitutingthesenumbers,alongwithρ12=0.4,wehave:x1=0.8049Therefore:x2=0.1951课后答案网2.a.Theratio(expectedriskpremium/standarddeviation)foreachofthefourportfoliosisasfollows:PortfolioA:(28.0–10.0)/72.9=0.247PortfolioB:(18.9–10.0)/21.2=0.420www.hackshp.cnPortfolioC:(15.4–10.0)/15.6=0.346PortfolioD:(11.3–10.0)/13.0=0.100Therefore,aninvestorshouldholdPortfolioB.b.ThebetaforAmazonrelativetoPortfolioBisequaltotheratiooftheriskpremiumofAmazontotheriskpremiumoftheportfoliotimesthebetaoftheportfolio:[(28.0%-10.0%)/(18.9%-10%)]×1.0=2.02267khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

Similarly,thebetasfortheremainderoftheholdingsareasfollows:βAmazon=2.022βDell=1.461βReebok=0.899βMicro=1.348βFord=1.124βGE=0.337βCC=0.562βPfizer=0.225khdaw.comβHeinz=-0.225βEx-M=0.000c.Iftheinterestrateis5%,thenPortfolioCbecomestheoptimalportfolio,asindicatedbythefollowingcalculations:PortfolioA:(28.0–5.0)/72.9=0.316PortfolioB:(18.9–5.0)/21.2=0.656PortfolioC:(15.4–5.0)/15.6=0.667PortfolioD:(11.3–5.0)/13.0=0.485ThebetasfortheholdingsinPortfolioCare:课后答案网βAmazon=2.212βDell=1.731βReebokwww.hackshp.cn=1.250βMicro=1.635βFord=1.442βGE=0.769βCC=0.962βPfizer=0.673βHeinz=0.288βEx-M=0.48168khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

3.LetrxbetheriskpremiumoninvestmentX,letxxbetheportfolioweightofX(andsimilarlyforInvestmentsYandZ,respectively).a.rx=(1.75×0.04)+(0.25×0.08)=0.09=9.0%ry=[(–1.00)×0.04]+(2.00×0.08)=0.12=12.0%rz=(2.00×0.04)+(1.00×0.08)=0.16=16.0%b.Thisportfoliohasthefollowingportfolioweights:xx=200/(200+50–150)=2.0xy=50/(200+50–150)=0.5khdaw.comxz=–150/(200+50–150)=–1.5Theportfolio’ssensitivitiestothefactorsare:Factor1:(2.0×1.75)+[0.5×(–1.00)]–(1.5×2.00)=0Factor2:(2.0×0.25)+(0.5×2.00)–(1.5×1.00)=0Becausethesensitivitiesarebothzero,theexpectedriskpremiumiszero.c.Thisportfoliohasthefollowingportfolioweights:xx=80/(80+60–40)=0.8xy=60/(80+60–40)=0.6课后答案网xz=–40/(80+60–40)=–0.4Thesensitivitiesofthisportfoliotothefactorsare:Factor1:(0.8www.hackshp.cn×1.75)+[0.6×(–1.00)]–(0.4×2.00)=0Factor2:(0.8×0.25)+(0.6×2.00)–(0.4×1.00)=1.0Theexpectedriskpremiumforthisportfolioisequaltotheexpectedriskpremiumforthesecondfactor,or8percent.69khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

d.Thisportfoliohasthefollowingportfolioweights:xx=160/(160+20–80)=1.6xy=20/(160+20–80)=0.2xz=–80/(160+20–80)=–0.8Thesensitivitiesofthisportfoliotothefactorsare:Factor1:(1.6×1.75)+[0.2×(–1.00)]–(0.8×2.00)=1.0Factor2:(1.6×0.25)+(0.2×2.00)–(0.8×1.00)=0Theexpectedriskpremiumforthisportfolioisequaltotheexpectedriskpremiumforthefirstfactor,or4percent.khdaw.come.Thesensitivityrequirementcanbeexpressedas:Factor1:(xx)(1.75)+(xy)(–1.00)+(xz)(2.00)=0.5Inaddition,weknowthat:xx+xy+xz=1Withtwolinearequationsinthreevariables,thereisaninfinitenumberofsolutions.Twooftheseare:1.xx=0xy=0.5xz=0.52.xx=6/11课后答案网xy=5/11xz=0Theriskpremiumsforthesetwofundsare:r1=0×[(1.75×0.04)+(0.25×0.08)]+(0.5)×www.hackshp.cn[(–1.00×0.04)+(2.00×0.08)]+(0.5)×[(2.00×0.04)+(1.00×0.08)]=0.14=14.0%r2=(6/11)×[(1.75×0.04)+(0.25×0.08)]+(5/11)×[(–1.00×0.04)+(2.00×0.08)]+0×[(2.00×0.04)+(1.00×0.08)]=0.104=10.4%Theseriskpremiumsdifferbecause,whileeachfundhasasensitivityof0.5tofactor1,theydifferintheirsensitivitiestofactor2.70khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

f.BecausethesensitivitiestothetwofactorsarethesameasinPart(b),oneportfoliowithzerosensitivitytoeachfactorisgivenby:xx=2.0xy=0.5xz=–1.5Theriskpremiumforthisportfoliois:(2.0×0.08)+(0.5×0.14)–(1.5×0.16)=–0.01Becausethisisanexampleofaportfoliowithzerosensitivitytoeachfactorandanonzeroriskpremium,itisclearthattheArbitragePricingTheorydoesnotholdinthiscase.Aportfoliowithapositiveriskpremiumis:xkhdaw.comx=–2.0xy=–0.5xz=1.5课后答案网www.hackshp.cn71khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

CHAPTER9CapitalBudgetingandRiskAnswerstoPracticeQuestions1.a.requity=rf+β×(rm–rf)=0.04+(1.5×0.06)=0.13=13%DE⎛$4million⎞⎛$6million⎞b.rassets=rdebt+requity=⎜×0.04⎟+⎜×0.13⎟VV⎝$10million⎠⎝$10million⎠rassets=0.094=9.4%khdaw.comc.Thecostofcapitaldependsontheriskoftheprojectbeingevaluated.Iftheriskoftheprojectissimilartotheriskoftheotherassetsofthecompany,thentheappropriaterateofreturnisthecompanycostofcapital.Here,theappropriatediscountrateis9.4%.d.requity=rf+β×(rm–rf)=0.04+(1.2×0.06)=0.112=11.2%DE⎛$4million⎞⎛$6million⎞rassets=rdebt+requity=⎜×0.04⎟+⎜×0.112⎟VV⎝$10million⎠⎝$10million⎠rassets=0.0832=8.32%课后答案网2.a.⎛D⎞⎛P⎞⎛C⎞βassets=⎜βdebtwww.hackshp.cn×⎟+⎜βpreferred×⎟+⎜βcommon×⎟=⎝V⎠⎝V⎠⎝V⎠⎛$100million⎞⎛$40million⎞⎛$200million⎞⎜0×⎟+⎜0.20×⎟×⎜1.20×⎟=0.729⎝$340million⎠⎝$340million⎠⎝$340million⎠b.r=rf+β×(rm–rf)=0.05+(0.729×0.06)=0.09374=9.374%3.Internetexercise;answerswillvary.4.Internetexercise;answerswillvary.72khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

25.a.TheRvalueforAlcanwas0.15,whichmeansthat15%oftotalriskcomesfrommovementsinthemarket(i.e.,marketrisk).Therefore,85%oftotalriskisuniquerisk.2TheRvalueforIncowas0.22,whichmeansthat22%oftotalriskcomesfrommovementsinthemarket(i.e.,marketrisk).Therefore,78%oftotalriskisuniquerisk.2b.ThevarianceofAlcanis:(24)=576MarketriskforAlcan:0.15×576=86.4UniqueriskforAlcan:0.85×576=489.62ThevarianceofIncois:(29)=841khdaw.comMarketriskforInco:0.22×841=185.02UniqueriskforInco:0.78×841=655.98c.Thet-statisticforβINCOis:1.04/0.26=4.09Thisissignificantatthe1%level,sothattheconfidencelevelis99%.d.rAL=rf+βAL×(rm–rf)=0.05+[0.69×(0.12–0.05)]=0.0983=9.83%e.rIN=rf+βIN×(rm–rf)=0.05+[0.69×(0–0.05)]=0.0155=1.55%6.Internetexercise;answerswillvary.课后答案网7.Thetotalmarketvalueofoutstandingdebtis$300,000.Thecostofdebtcapitalis8percent.Forthecommonstock,theoutstandingmarketvalueis:$50×10,000=$500,000.Thecostofequitycapitalis15percent.Thus,www.hackshp.cnLorelei’sweighted-averagecostofcapitalis:⎛300,000⎞⎛500,000⎞r=⎜⎟×0.08+⎜⎟×(0.15)assets⎜300,000+500,000⎟⎜300,000+500,000⎟⎝⎠⎝⎠rassets=0.124=12.4%8.a.rBN=rf+βBN×(rm–rf)=0.035+(0.53×0.08)=0.0774=7.74%rIND=rf+βIND×(rm–rf)=0.035+(0.49×0.08)=0.0742=7.42%b.No,wecannotbeconfidentthatBurlington’struebetaisnottheindustryaverage.ThedifferencebetweenβBNandβIND(0.04)islessthanonestandarderror(0.20),sowecannotrejectthehypothesisthatβBN=βIND.73khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com

c.Burlington’sbetamightbedifferentfromtheindustrybetaforavarietyofreasons.Forexample,Burlington’sbusinessmightbemorecyclicalthanisthecaseforthetypicalfirmintheindustry.OrBurlingtonmighthavemorefixedoperatingcosts,sothatoperatingleverageishigher.AnotherpossibilityisthatBurlingtonhasmoredebtthanistypicalfortheindustrysothatithashigherfinancialleverage.9.a.Ifyouagreetothefixedpricecontract,operatingleverageincreases.Changesinrevenueresultingreaterthanproportionatechangesinprofit.Ifallcostsarevariable,thenchangesinrevenueresultinproportionatechangesinprofit.Businessrisk,measuredbyβassets,alsoincreasesasakhdaw.comresultofthefixedpricecontract.Iffixedcostsequalzero,then:βassets=βrevenue.However,asPV(fixedcost)increases,βassetsincreases.b.Withthefixedpricecontract:PV(assets)=PV(revenue)–PV(fixedcost)–PV(variablecost)$20million$10millionPV(assets)=−($10million)×(annuityfactor6%,10years-)90.09(0.09)×(1.09)PV(assets)=$97,462,710Withoutthefixedpricecontract:PV(assets)=PV(revenue)–PV(variablecost)课后答案网$20million$10millionPV(assets)=−0.090.09PV(assets)=$111,111,111www.hackshp.cn10.a.Thethreatofacoupd’étatmeansthattheexpectedcashflowislessthan$250,000.Thethreatcouldalsoincreasethediscountrate,butonlyifitincreasesmarketrisk.b.Theexpectedcashflowis:(0.25×0)+(0.75×250,000)=$187,500Assumingthatthecashflowisaboutasriskyastherestofthecompany’sbusiness:PV=$187,500/1.12=$167,41174khdaw.com若侵犯了您的版权利益,敬请来信通知我们!℡www.khdaw.com