- 160.00 KB

- 2022-04-22 11:34:57 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

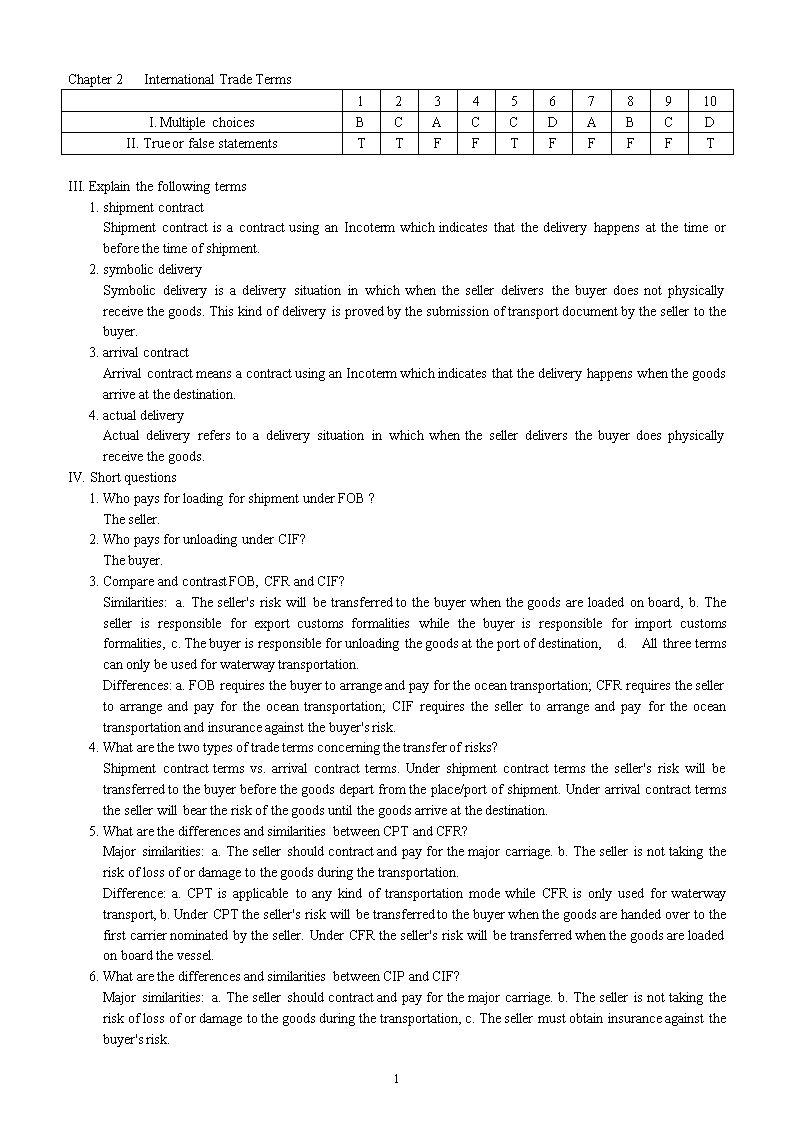

'Chapter2InternationalTradeTerms12345678910I.MultiplechoicesBCACCDABCDII.TrueorfalsestatementsTTFFTFFFFTIII.Explainthefollowingterms1.shipmentcontractShipmentcontractisacontractusinganIncotermwhichindicatesthatthedeliveryhappensatthetimeorbeforethetimeofshipment.2.symbolicdeliverySymbolicdeliveryisadeliverysituationinwhichwhenthesellerdeliversthebuyerdoesnotphysicallyreceivethegoods.Thiskindofdeliveryisprovedbythesubmissionoftransportdocumentbythesellertothebuyer.3.arrivalcontractArrivalcontractmeansacontractusinganIncotermwhichindicatesthatthedeliveryhappenswhenthegoodsarriveatthedestination.4.actualdeliveryActualdeliveryreferstoadeliverysituationinwhichwhenthesellerdeliversthebuyerdoesphysicallyreceivethegoods.IV.Shortquestions1.WhopaysforloadingforshipmentunderFOB?Theseller.2.WhopaysforunloadingunderCIF?Thebuyer.3.CompareandcontrastFOB,CFRandCIF?Similarities:a.Theseller"sriskwillbetransferredtothebuyerwhenthegoodsareloadedonboard,b.Thesellerisresponsibleforexportcustomsformalitieswhilethebuyerisresponsibleforimportcustomsformalities,c.Thebuyerisresponsibleforunloadingthegoodsattheportofdestination,d.Allthreetermscanonlybeusedforwaterwaytransportation.Differences:a.FOBrequiresthebuyertoarrangeandpayfortheoceantransportation;CFRrequiresthesellertoarrangeandpayfortheoceantransportation;CIFrequiresthesellertoarrangeandpayfortheoceantransportationandinsuranceagainstthebuyer"srisk.4.Whatarethetwotypesoftradetermsconcerningthetransferofrisks?Shipmentcontracttermsvs.arrivalcontractterms.Undershipmentcontracttermstheseller"sriskwillbetransferredtothebuyerbeforethegoodsdepartfromtheplace/portofshipment.Underarrivalcontracttermsthesellerwillbeartheriskofthegoodsuntilthegoodsarriveatthedestination.5.WhatarethedifferencesandsimilaritiesbetweenCPTandCFR?Majorsimilarities:a.Thesellershouldcontractandpayforthemajorcarriage.b.Thesellerisnottakingtheriskoflossofordamagetothegoodsduringthetransportation.Difference:a.CPTisapplicabletoanykindoftransportationmodewhileCFRisonlyusedforwaterwaytransport,b.UnderCPTtheseller"sriskwillbetransferredtothebuyerwhenthegoodsarehandedovertothefirstcarriernominatedbytheseller.UnderCFRtheseller"sriskwillbetransferredwhenthegoodsareloadedonboardthevessel.6.WhatarethedifferencesandsimilaritiesbetweenCIPandCIF?Majorsimilarities:a.Thesellershouldcontractandpayforthemajorcarriage.b.Thesellerisnottakingtheriskoflossofordamagetothegoodsduringthetransportation,c.Thesellermustobtaininsuranceagainstthebuyer"srisk.21

Difference:a.CPTisapplicabletoanykindoftransportationmodewhileCFRisonlyusedforseawayorinlandwaterwaytransport,b.UnderCPTtheseller"sriskwillbetransferredtothebuyerwhenthegoodsarehandedovertothefirstcarriernominatedbytheseller.UnderCFRtheseller"sriskwillbetransferredwhenthegoodsareloadedonboardthevessel.7.IfyoutradewithanAmerican,isthesalescontractsubjecttoIncotermswithoutanydoubt?Whatshouldyoudo?No.TheRevisedAmericanForeignTradeDefinitions1941isstillinuse,especiallyintheNorthAmericanarea.Ithasdifferentinterpretationaboutsometradeterms.Thetradersshouldclarifythechoiceofrulesbeforeanyfurtherdiscussion.8.Whatarethemostcommonlyusedtradeterms?FOB,CFR&CIF.9.WhoisresponsibleforcarryingoutcustomsformalitiesforexportsunderanFOBcontract?Theseller.AccordingtoIncoterms2010,exceptEXWandDDPthesetwoterms,alltheothereleventermsrequirethesellertohandletheexportcustomsformalities,whilethebuyertheimportcustomsformalities.10.IfaChinesetradersignsanFOBHamburgcontract,isheexportingorimporting?Importing.FOBshouldbeusedwitha"namedportofshipment",ifHamburgistheportofshipment,fromtheChinesetrader"sperspective,heisimporting.V.Casestudies1.AnFOBcontractstipulated"TheshipmentwillbeeffectedinMarch2011."Whenthegoodswerereadyon10March201l,thesellercontactedthebuyerforshipmentdetails.Thebuyerfaxed"Pleasesendthegoodstotheportforloadingon21March.Thevesselwilldeparton22March."Thesellersentthegoodstotheportaccordingly.Howeverthenominatedvesseldidnotturnupandthegoodshadtobestoredinthewarehouseattheport.Onthenightof21Marchafirehappenedinthewarehouseareaandpartofthegoodswasdamaged.Whenthevesselarrivedtwodayslaterthesellerandthebuyerhadanargumentaboutthesettlementoftheloss.Thesellerrequiredthebuyertobearthelosscausedbythefire,butthebuyerbelievedthatthevesselarrivedwithintheshipmentperiodandthelossoccurredbeforethesellerdeliveredthegoodsthereforethesellershouldbeartheloss.Pleaseprovideyoursolution.析:1)首先案例中提到货物发生了损失是由于货物存放在码头仓库期间发生火灾造成的。2)卖方之所以会把货物存放在码头仓库是因为买方指定的船只在约定时间没有出现。3)Incoterms2010有规定,买方有向卖方提供准确、及时的装船通知的义务,如果买方没有履行该义务而导致了货物受损,即使双方没有完成交货,买方也要承担相关损失。答案:买方应该承担损失。答题切入点:1)分析货物受损原因。2)根据《2010年国际贸易术语解释通则》买方在提供装运通知方面的义务。3)解释提供装运通知与完成交货风险转移之间的关系。2.AcontracttosellgrainusedaCFRterm.ThegrainwasofficiallycertifiedasGradeOneatthetimeofbeingdeliveredonboardattheportofshipment.Aftermakingtheshipment,thesellergavethebuyertimelynotice.However,duetothelongvoyage,somegrainwentbad.Atthedestination,thegraincouldonlybesoldas"Grade3".Consequently,thebuyerclaimedcompensationforthedamage.Shouldthesellerpay?析:1)货物在装运港已经“officiallycertifiedasGradeOne"’,这就说明货物的质量是合格的,而且是经官方确认的。2)文中提到“duetolongvoyage"这说明货物变质的原因是由于运输时间长。答案:No。答题切入点:a.货物变质的原因.b.CFR术语下风险转移的情况。3.UnderaCIFcontract,thegoodshadbeenloadedonboardthevesselaccordingtothetermsofthecontract.Thenthevesseldeparted.Anhourlater,thevesselstruckarockandsank.Thenextdaytheseller"sbankpresentedtheshippingdocuments,insurancepolicyandinvoicestothebuyer,anddemandedpayment.(1)Knowingthathewillnotreceivethegoods,shouldthebuyerpay?(2)Whichpartywouldhavetotaketheloss?21

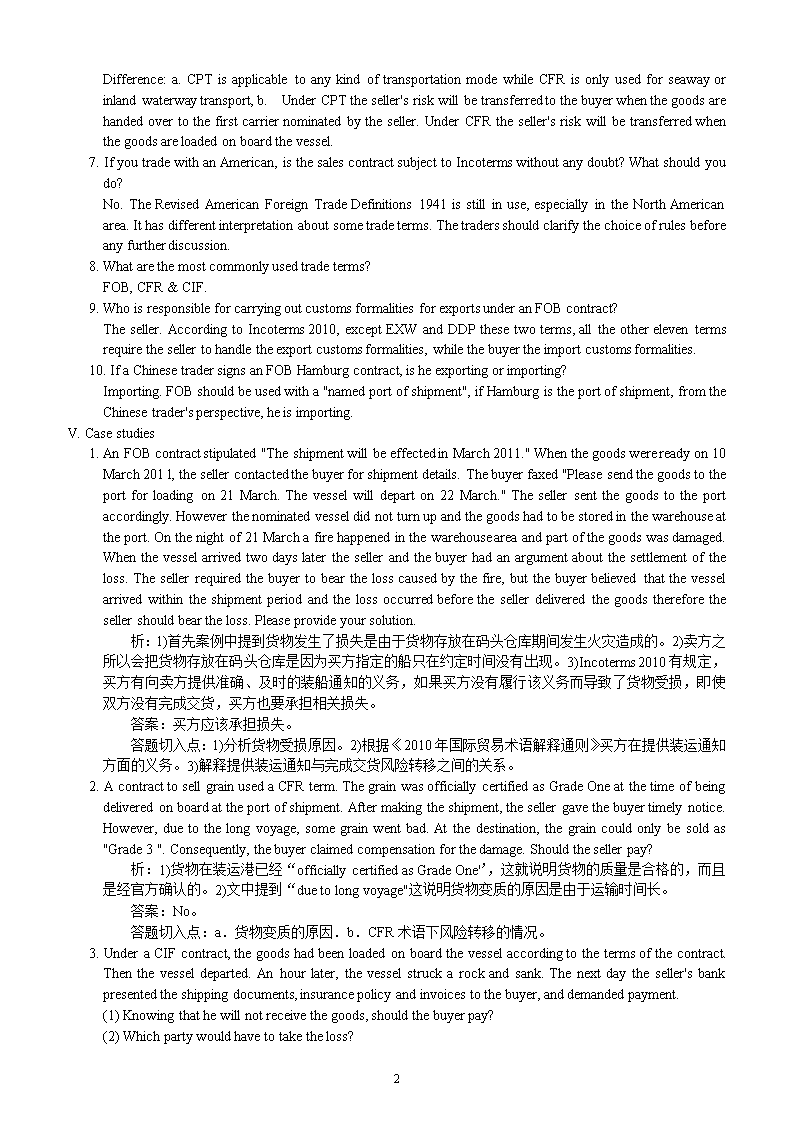

析:本题的关键疑问在于买方明知货物已全部损失,不可能再收到货物,是否还应支付货款。这是考察对“symbolicdelivery”这个概念的理解。在CIF术语下,卖方交货时买方并没有真正收到货物,卖方的交货是通过货交承运人并获得相关单据(尤其是物权凭证)来实现的。而相应的,买方必须接受交货,也就是买方必须接受卖方提供的相应单据并履行相关支付的义务。(1)答案:Yes.答题切入点:1)卖方履行其义务的情况;2)CIF术语对双方交货、领受货物的规定;3)解释“symbolicdelivery”在这里的应用。(2)答案:Thebuyer.答题切入点:CIF术语下风险转移的情况。由于本章主要讨论贸易术语的应用,关注的主要是买、卖双方。如果答案是保险公司,则要求说明损失的风险首先是由买方承担的,在风险属于保险公司承保范围内的情况下,保险公司会对买方进行部分或全部的赔偿。4.AShanghaicompanysignedaCIFcontracttosellChristmasgoodstoaBritishcompany.TheUSD1millioncontractstipulated,"ThesellerguaranteesthatthegoodsarriveattheportofdestinationbyDecember1,2010.Ifthecarriageislate,thebuyercancancelthepurchase,andgettherefundforthepayment."Sotheshipmentwasmade.Unfortunately,duetomechanicalproblems,thevesselarrivedatthedestinationafewhourslate.Thebuyerrefusedtoacceptthegoods.Asaresult,thegoodshadtobesoldonthespot,andthesellerlostUSD700000.Commentonthiscase.析:卖方受损的原因是货物达到目的港的时间晚于合同规定的时间,因此买方拒收货物。从表面上看,似乎问题就是出在卖方违约上,但如果仔细分析就会发现,该合同本身的内容就存在自相矛盾的问题。合同用的是CIF术语,卖方在货装上船时风险就转移。卖方既不承担运输途中的风险,也不保证货物是否能抵达目的港。CIF合同本质上是一个“shipmentcontract”。但加上一条保证到岸时间的条款后,合同的性质发生了变化:它变成了一个“arrivalcontract”。也就是说,在货物按时抵达目的港之前的一切风险都由卖方承担,否则卖方就是违约。答题切入点:1)CIF术语对双方风险及义务的划分,点出“shipmentcontract”这一概念;2)解释“arrivaldate”clause对合同性质的改变。5.AChinesecompanyfinalizedatransactionwithaGermancompanyunderCIFpriceandL/Cpayment.BothsalescontractandL/Creceivedstipulatedthattransshipmentwasnotallowed.TheChinesecompanymadetheshipmentonadirectvesselwithinthevalidityperiodoftheL/CandnegotiatedthepaymentwithadirectBillofLadingsuccessfully.AfterdepartingfromtheChineseport,inordertotakeanothershipment,theshippingcompanyunloadedthegoodsfromtheoriginalvesselandreloadedthemontoanother.Duetothedelayandthepoorconditionofthesecondvessel,thegoodsarrived2monthslaterthantheexpectedtime.TheGermancompanysufferedandclaimedcompensationfromtheChinesecompanywiththereasonthattheChinesesidecheatedthemwithadirectB/L.TheChinesecompanybelievedthatsincetheysignedthecontractundera"到岸价"andtheybookedtheshippingcompany,theywouldberesponsibleforwhathappened.AsaresulttheChinesesidecompensated.Commentonthiscase.析:1)卖方按照合同规定履行了各项义务,造成货物到港延误的原因是船公司擅自改变运输安排,卖方对此并不知情。2)卖方把CIF理解成“到岸价格”存在错误,混淆了承担风险与承担费用的区别。如果把CIF理解成“到岸价格”,那么CIF就变成了一个到岸合同术语(arrivalcontractterm)了,而实际上它应该是个装运合同术语(shipmentcontractterm)。3)因此,卖方在此情况下不应进行赔偿,而是应该协助买方向船方进行索赔。答题切入点:1)分析买方受损的真正原因及责任方:2)解释卖方错误赔偿的原因;3)给出本案例正确的处理方法,尤其是卖方应该如何应对买方的要求。Chapter3ExportPrice12345678910I.MultiplechoicesBDDACDABDBII.TrueorfalsestatementsFTFFFTTFFF21

III.Explainthefollowingterms1.inquiryAninquiryistheactofapotentialclientaskingforinformationfromthecounterparttohisintentioninbuyingorsellingacertaincommodity.2.offerAnofferisasufficientlydefiniteproposaladdressedtooneormorespecificpersonsforconcludingacontract,necessarilyindicatingtheintentionoftheofferortobeboundincaseofacceptance.3.counterofferAcounterofferisareplytoanofferwhichcontainsadditions,limitationsorothermodifications.4.acceptanceAnacceptanceisastatementmadebyorotherconductoftheoffereeindicatingassenttoanoffer.IV.Shortquestions1.Whatarethefourcomponentsofthestandardformofaprice?Acodeofcurrency,anumber,aunitandatradeterm.2.Whilemakingpricingdecision,whatmajorfactorsshouldbeconsidered?Whenasellerissettinghisexportprices,themajorfactorshehastoconsiderincludecost,anticipatedprofit,capabilityofhistargetmarket,termsofpayment,competitionandrelationshipbetweentheexporterandtheimporter.3.Whatarethedifferencesandsimilaritiesbetweencommissionanddiscount?Similarities:Bothcommissionanddiscountareusedasincentivetopromotetransactions.Differences:a.Commissionpaymentisanadd-upontopoftheoriginalprice,whilediscountareduction;b.Commissionmainlyappliestotransactionswhichinvolvemiddlepersonoragent.Discountcanbeusedwithoutparticularprerequisites.4.Whenwillanofferbeterminated?Anofferwillbeterminatedwhen:a.itislegallyterminated(beingwithdrawnorrevoked);b.itisnotacceptedbytheoffereewithinthevalidityperiodorareasonableperiodoftime;c.itisrejectedbytheofferee;andd.someuncontrollableeventshappen,preventingtheofferorfromfulfillinghisobligations.5.Whatarethepossiblemodificationsacounteroffermaymaketoanoffer?Ifareplytoanoffermakesmodificationsinthefollowingaspects,thereplywillbeconsideredasacounteroffer:~_priceandpayment;b.qualityandquantityofgoods;c.placeandtimeofdelivery;d.extentofoneparty"sliabilitytotheother;e.settlementofdispute.V.Casestudies1.UnderthepriceofUSD25.5/dozenCFRRotterdamBBCompanysignedacontracttosell1000dozensofT-shirt.TheT-shirtwaspurchasedfromfactorybyRMB135/dozen.BBCompanycalculated3%ofitsproductpurchasingpriceasitsoverheadcosts.ThelocaltransportandcustomsformalitiestookRMB2500andthecontaineroceanfreightwasUSD1500.Ifthebankexchangeratewas1USD/6.5RMB,whatwouldbetheexportprofitmarginforthisdeal?Andwhataboutitsexportcostforforeignexchange?exportprofitmargin:9.26%;exportcostforforeignexchange:5.897Exportprofitmargin=[Exportrevenue(FOB)-Exportcost(FOB)]/Exportrevenue(FOB)ExportCostforForeignExchange=[ExportCostinLocalCurrency]/[ExportRevenueinForeignCurrency]2.ThepricequotedbyaShanghaiexporterwas"USD1200perM/TCFRLiverpool"ThebuyerrequestedarevisedFOBpriceincluding2%commission.ThefreightforShanghai-LiverpoolwasUSD200perM/T.Tokeeptheexportrevenueconstant,whatwouldFOBC2%pricebe?FOBC2%ShanghaiUSD1020.41/M/TFOBC%=FOB/(1-Commission)3.ACCompanyofferedtosellgoodsat"USD100percaseCIFNewYork".Theimporterrequestedarevised21

quoteforCFRC5%.Thepremiumrateforinsurancewas1.05%andmark-upforinsurancewas10%.Togetthesameexportrevenue,whatwouldAC"snewofferbe?CFRC5%NewYorkUSD104.5/caseI=CIFx110%xRCFRC%=CFR/(1-Commission)4.DDCompanyofferedtosellgoodsat"USD2000perM/TCWTorontowith"allrisks"and"warrisk"for110%ofthevalue".TheimporterrequestedarevisedquoteforFOBGuangzhou.ThefreightforGuangzhou-TorontowasUSD50perM/T,andthepremiumratesfor"allrisks"and"warrisk"were1%and0.2%respectively.Togetthesameexportrevenue,whatFOBpriceshouldtheexporteroffer?FOBGuangzhouUSD1923.6/M/TI=CIFx110%xRCIF=FOB+Freight+Insurance5.Thepricequotedbyanexporterwas"USD450percaseFOBShanghai".TheimporterrequestedarevisedquoteforCIFAuckland.IfthefreightwasUSD50percase,110%ofthevaluewastobeinsured,andthepremiumrateforinsurancewas0.8%,whatwouldthenewpricebe?CIFAucklandUSD504.44/caseCIF=CFR/(1-110%xR)CFR=FOB+Freight6.XCompanysignedacontracttoexporttwomachinesataninitialprice(P0)ofUSD5millioneach.AtthetimeofsettingP0,thematerialpriceindex(M0)was110,thewageindex(W0)was120.Thecontractcontainedapricerevisionclausethatallowedthefinalpricetobesetondelivery.Atthetimeofdelivery,thematerialpriceindex(M)was112,andthewageindex(W)became125.Ifthefollowingratiosremainedconstant:A(themanagementfeeandprofitasapercentageoftheprice)=15%B(thematerialcostasapercentageoftheprice)=30%C(thewagecostasapercentageoftheprice)=55%Whatisthefinalprice(P)?USD5.14millionP=P0.(A+B.M/M0+C.W/W0)7.OnNov.20th,LeeCo.offeredtosellgoodstoDeeInc.atUSD500percaseCIFLondon,"Offervalidifreplyhere11/27."OnNov.22ndDeecabledback,"OfferacceptedifUSD480percase."AsLeewasconsideringthebid,themarketpricewentoverUSD500.OnNov.25th,DeecabledanunconditionalacceptanceofLee"sinitialoffer.CouldLeerejectDee"sacceptance?析:1)11月22日DeeInc.的回复对价格进行了更改,因此这是一个还盘。当DeeInc.对报盘进行还盘,原来的报盘就自动中止了。在这个前提下,LeeCo.可以采取任何行动而不须顾虑先前的报价。2)尽管DeeInc.在原报盘的有效期内又发出了一个无条件接受报盘的回复,但由于之前他们已经进行了还盘,所以此时的接受无效。答案:Yes.答题切入点:1)还盘的定义;2)报盘中止的因素。8.XofferedtosellgoodstoY,"Shipmentwithin2monthsafterreceiptofL/C,offervalidifreplyhere5days."Twodayslater,Ycabledback,"Acceptyouroffershipmentimmediately."Xdidn"treply.Twomoredayslater,XreceivedY"sL/Crequiringimmediateshipment.Atthistime,themarketpriceofthegoodswentupby20%.WhatoptionsdidXhavetodealwithY?析:1)Y在两天后的回复中虽然声明接受报盘,但同时要求“shipmentimmediately”,这是对原报盘的船期“shipmentwithin2months”进行了修改,因此构成了一个还盘,原报盘则被中止。2)在这个前提下,再来考虑x都有哪些选择以及哪个是最可能或最好的。21

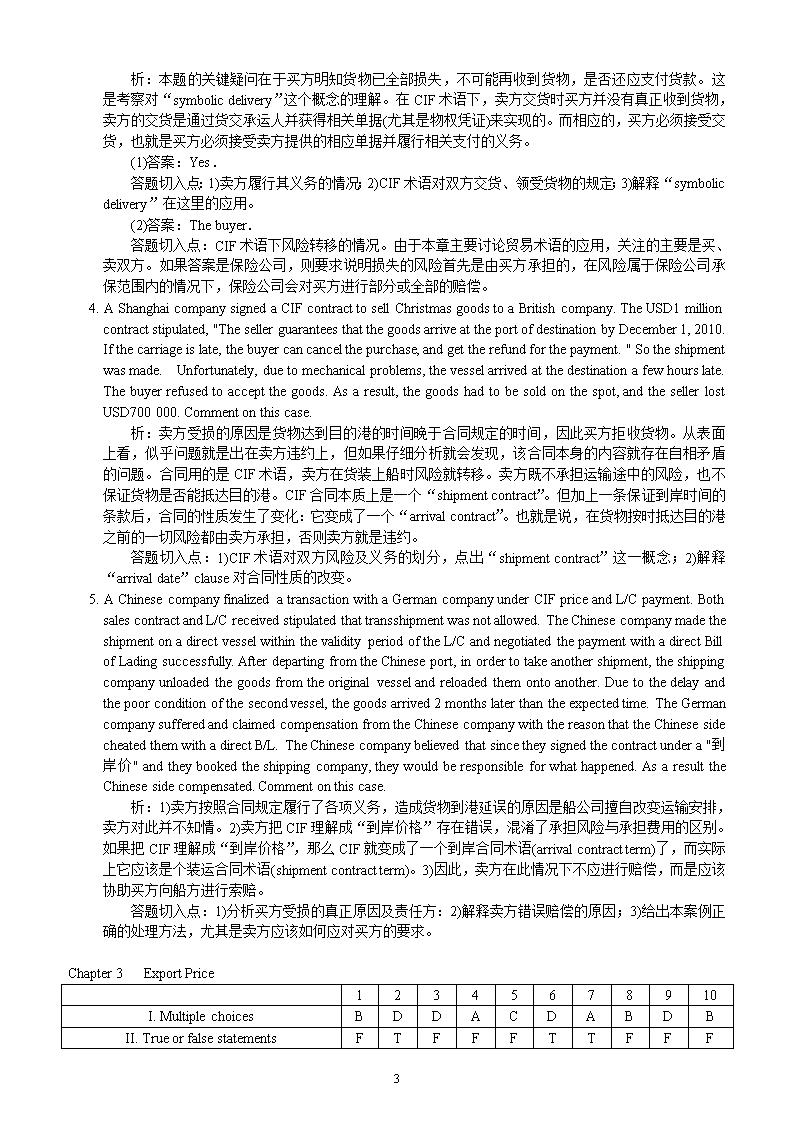

答题切入点:1)还盘的定义;2)报盘中止的因素;3)X可能有的各项选择;4)X最可能选择的做法及原因。Chapter4TermsofCommodity12345678910I.MultiplechoicesCCDDBCCBDBII.TrueorfalsestatementsFFFTFFTFFFIII.CalculationCompanyChasacontracttoexport10metrictonsofSeafood,tobepackedincartonseachof40lb.(lib=0.45358kg),witha5%moreorlessallowedbothinquantityandinamount.1.HowmanycartonsofSeafoodcanCompanyCdeliveratmost?2.HowmanycartonsofSeafoodshouldCompanyCdeliveratleast?1lib=0.45358kg,so40lb=18.144kgMaximum:[10xl000kgx(1+5%)]/18.144=578.7(Attention:0.7shouldbedeletedhere)=578cartonsMinimum:[10xl000kgx(1-5%)]/18.144=523.6(Attention:0,6shouldbeaddedhere)=524cartonsAnswer:1)Atmost,CompanyCcandeliver578cartonsofSeafood.2)Atleast,CompanyCshoulddeliver524cartons.IV.Explainthefollowingterms1.qualitylatitudeQualitylatitudemeansthepermissiblerangewithinwhichthequalityofthegoodsdeliveredbythesellermaybeflexiblycontrolled.2.qualitytoleranceQualitytolerancereferstothequalitydeviationrecognized(e.g.bysomeindustry),whichallowsthequalityofthegoodsdeliveredtohavecertaindifferencewithinarange.3.salebycountersampleAcountersampleisareplicamadebythesellerofthesampleprovided,normallybythebuyer.Inasalebycountersample,thecountersamplewillreplacetheoriginalsampleandbecomethefinalstandardofqualityofthetransaction.Bymeansofacountersample,thesellerwouldbemorecomfortabletopreparethemassproductsaccordingtoasampleprovidedbyhimself.Evenintheworstscenariothatthebuyerlaterfindsthecountersampledoesnotmatchwiththeoriginal,thesellerwillnotcarryanyresponsibilityasthecountersamplehasbeenconfirmedbythebuyer.4.grossfornetInthecaseof"grossfornet",thegoodsarepricedbytheirgrossweightinsteadofthenet.The"grossfornet"practicewillbeadoptedwhenthepackingmaybecomeanindivisiblepartoftheproduct,suchastobaccoflakes;orthepackingmaterialisalmostofthesamevalueasthatofthegoods,likegrainandfodder.5.standardregainStandardregain(rate)referstotheratiobetweenthewatercontentandthedryweightofthegoodswhichisacceptedintheworldmarketoragreeduponbythesellerandthebuyer.6.conditionedweightConditionedweightisadoptedforsomecommoditieslikewoolwhichisnotusuallypackedinavacuumcontainerandtendstoabsorbmoisture,astheweightofthesecommoditiesislikelytobeunstableduetothefluctuationoftheiractualmoisturecontentandvariesgreatlyfromtimetotime,andfromplacestoplaces.Inaddition,theseproductsareofhighvalue,itbecomesimportantforthebuyerandsellertoreachanagreementontheconceptofweight.7.moreorlessclause"Moreorlessclause"referstothestipulationconstitutingpartofthequantityclauseinthecontractthatallows21

thesellertodeliverthegoodswithacertainpercentageofmoreorlessinquantityaccordingly.Theuseof"moreorlessclause"isforthesakeofefficientshipmentandlesscomplexityincontractexecutionbecauseinpracticeitisnotthateasytocontrolthequantityofgoodssuppliedstrictlyandexactly.Amoreorlessclauseusuallyconcernsthreeissues:1)howmuchmoreorlessshouldbeallowed;2)whichpartyisentitledtomakethedecision;and3)howshouldthemoreorlessportionofthegoodsbepriced.8.shippingmarksShippingmarksareatypeofmarkingontheshippingpacking.Itquickenstheidentificationandtransportationofthegoodsandhelpsavoidshippingerrors.Internationalstandardshippingmarksareusuallymadeupoffourparts:1)Consignee"scode;2)Destination;3)ReferenceNo.and4)Numberofpackages.9.F.A.Q.F.A.Q.istheabbreviationof"fairaveragequality".F.A.Q.isakindofstandardusedtoindicatethatthequalityoftheproductofferedisaboutequaltotheaveragequalitylevelofthesamecropwithinacertainperiodoftime(e.g.ayear.).10.neutralpackingNeutralpackingisaspecialtypeofmarkingratherthanatypeofpackingasitsnamemayindicate.Whileneutralpackingisrequired,nomarkingoforiginornameofthemanufacturershouldappearontheproduct,ontheshippingpackingorsalespackaging.V.Shortquestions1.Whatarethetwocommonwaysofindicatingqualityofgoodsforexport?Salebydescriptionandsalebysamplearethetwocommonwaysofindicatingqualityofgoodsforexport.Salebydescriptionisawaytospecifythequalityofmostcommoditiesininternationaltrade.Salebydescriptionmaytaketheformofsalebyspecification,salebygrade,salebystandard,salebybrandnameortrademark,salebyoriginandsalebydescriptionsorillustrations.Asaleismadebysamplewhenthesellerandbuyeragreethatsamplesareusedasreferenceofqualityandconditionofthegoodstobedelivered.Thismethodisusedwhenitisdifficulttodescribequalityofthecommoditybywords.Accordingtothesupplierofthesample,therearethreecasesundersalebysample:salebyseller"ssample,salebybuyer"ssampleandsalebycountersample.2.Whataretheissuestobeconcernedwhenspecifyingqualityclauseinasalescontract?Whenstipulatingaqualityclauseinasalescontract,thefollowingaretobeconcerned:~adoptingtherightwaytostipulatethequality:Salebydescriptionisapplicabletocommoditiesofwhichqualitycanbeexpressedbysomescientificindices.Whilesalebysampleisadoptedwhenitisdifficulttodescribequalityofthecommoditybywords.~avoidingdoublestandard,eitherbydescriptionorbysample:Whensamplesarerequiredunderasalebydescription,itisessentialtoindicatethatthesampleisforreferenceonly.~makinguseofthequalitylatitudewhichallowsthesellertohaveflexibilityincontrollingthequalitybecauseabsolutequalityisdifficultorevenimpossibletohandle.~incaseofasampleprovidedbythebuyer,makinguseofprotectingclause.3.Whatarethecommonwaystomeasuretheweightofexportgoods."?Thecommonwaystomeasuretheweightofexportgoodsincludegrossweight,netweight,conditionedweight,theoreticalweightandlegalweight.~Grossweightreferstotheweightofthecommodityplustheweightofthepacking.Grossweightisapplicabletocommoditiesofcomparativelylowvalue.~Netweightmeanstheactualweightofacommodityitselfexcludingtheweightofthepacking.AccordingtoCISGArticle56,theweightofacommodityiscalculatedbyitsnetweightunlessotherwisestatedinthecontract.~Conditionedweightisadoptedformoistureunstablecommoditieswithhighvalue,suchaswool.~Theweightisatheoreticalweightwhenthetotalweightoftheproductiscalculatedbymultiplyingthetotal21

quantityandtheunitweight,ratherthanmeasuredactually.Theoreticalweightisapplicabletocommoditiesofstandardizedsizesandspecifications.~Legalweightistheweightofthegoodsincludingtheimmediate,inner,ordirectpackingofthegoods.Accordingtothecustomslawsandregulationsinsomecountries,legalweightisusuallyusedasthebasisfortariffcalculation.4.Whatarethedifferentwaysofcalculatingthetarewhennetweightisused?Ininternationaltrade,tarecanbecalculatedbyactual/realtare,byaveragetare,bycustomarytareorbycomputedtarewhennetweightisusedandtheweightofpacking,i.e.thetare,mustbededucted.~Actual/realtarereferstotheactualweightofthepackingofthecommodities.Inordertogettheactualtareofthegoods,eachpackingofagoodhastobeweighedinordertogetatotal.~Byaveragetare,theweightofthepackingiscalculatedonthebasisoftheaverage.Theaveragetarecanbecalculatedbyweighingapartofthepackingofthecommoditiesandworkingouttheaveragewhenthepackingmaterialsareuniformandthespecificationsofgoodsarestandardized.~Thepackingofsomecommoditiesareunifiedandstandardizedandtheweightofthepackingisknownandacceptedbyeveryone.Inthiscase,therecognizedweightofthepacking,whichiscalledthecustomarytare,canbeusedincalculatingthenetweight.~Computedtareistheweightofthepackingagreeduponbythepartiesconcerned.Inthiscase,thenetweightiscalculatedbydeductingthetarepreviouslyagreeduponfromthegrossweightofthecommodity.5.Whataretheissuestobeconcernedwhenspecifyingquantityclauseinasalescontract?Whenstipulatingaquantityclauseinasalescontract,thefollowingaretobeconcerned:~adoptingtherightunitmeasurementsIninternationaltrade,thequantityofcommoditiesisalwaysshownasaspecificamountindifferentmeasurementunitssuchasweight,number,length,areaandvolume,etc.Sincedifferentcommoditieshavedifferentnaturesandcharacteristics,theadoptionofmeasurementunitsvaries.Therefore,thequantityofthecontractcommoditymustbemeasuredintherightmeasurementunit.~beingawareofdifferentmeasurementunitsDuetotheexistenceofdifferentmeasurementsystemsintheworld,tradersneedtobeawareoftheconsistencyofsystem.Anotablefactisthatsomeunitsindifferentsystemscarrythesamenamethough;theyareindicatingstandardsofmeasurementwithsignificantdifference.Inaddition,itistruethatduetothelocalbackgroundandcustomarypractice,differentcountriesadoptdifferentsystemsofmeasurement.Therefore,tradersneedtoclarifytheuseofunitandmeasurementsystemtoavoidunnecessarydisputes.~makinguseofthemoreorlessclausewhichallowsthesellertohaveflexibilityinmakingshipmentbecauseabsolutequantityisdifficultorevenimpossibletohandle."Moreorlessclause"referstothestipulationconstitutingpartofthequantityclauseinthecontractthatallowsthesellertodeliverthegoodswithacertainpercentageofmoreorlessinquantityaccordingly.Theuseof"moreorlessclause"isforthesakeofefficientshipmentandlesscomplexityincontractexecutionbecauseinpracticeitisnotthateasytocontrolthequantityofgoodssuppliedstrictlyandexactly.VI.CaseStudies1.XYZCompanysignedacontracttoexportRedDates.Thecontractspecifiedthatthedatesshouldbe"Grade3".Butatthetimeofshipment,therewerenotenoughthird-gradedatesonhandfordelivery.Asaresult,datesofhigherquality,Grade2,wereusedassubstitutes.Thesellerproudlymarkedtheinvoice,"DatesofGrade2soldatthepriceofGrade3".(1)Couldthebuyerrefusetoacceptthegoods?Whyorwhynot?(2)Wouldyoudodifferentlyifyouweretheseller?How?析:本题的解题要点:1)联合国国际货物销售合同公约第三十五条(1)卖方交付的货物必须与合同所规定的数量、质量和规格相符,并须按照合同所规定的方式装箱或包装;2)合同本身的品质规定是“Grade3”;3)实际所交货物的品质是“Grade2”。21

(1)答案:Yes,买方可以拒收货物。不论品质比规定的好或差,只要实际所交货物的品质与合同本身的品质规定不同,就是不符。在此情况下,买方有权利拒收货物。答题切入点:品质不符的理解。(2)答案:Yes,如果我是卖方,我会与买方磋商,寻求买卖双方都能接受的处理方法。答题切入点:与买方磋商解决。2.ABXCompanysentasampleofexportinggoodstoaGermanbuyerduringnegotiation.Later,acontractwassigned,andtheprovisionofthegoodswas,"Moisture:14%;Impurity:4%."Beforeshipment,theselleragaincabledthebuyer,"Qualityaspersample".Aftertakingthedelivery,thebuyerhadthegoodsinspected.Althoughthequalityconformedtothetermsofthecontract,itwaslowerthanthatofthesampleby7%.Asaresult,thebuyerfiledaclaimforcompensation.Didthesellermakeanymistake?Whyorwhynot?析:答案:Yes,买方可以向卖方提出索赔,因为卖方交付的货物的品质与样品不符;在这笔交易中,卖方犯了起码两个错误:错误1):品质条款没有品质机动某些产品(如农副产品等)的质量具一定的不稳定性,为了交易的顺利进行,在规定其品质指标的同时,应制定一定的品质机动幅度,允许卖方所交的货物的品质指标在一定的幅度内有灵活性。否则单一的品质指标难以达到,往往给卖方履行合同带来困难。答题的切入点:品质机动条款错误2):品质规定用了双重标准,既凭合同规格买卖,又凭样品买卖。表示品质的方法很多,品质条款应视商品的特性而定,采取合理的品质规定。凡是能用一种方法表示某种品质的,一般就不宜用两种或两种以上的方法来表示。根据联合国国际货物销售合同公约,如同时采用既凭样品又凭规格买卖,则要求卖方交付的货物的品质必须既与样品一致,又要符合合同所规定规格,要做到两全其美,难以办到,往往给卖方履行合同带来困难。答题的切入点:品质规定的双重标准,既凭合同规格又凭样品买卖。3.ABCCompanysignedacontracttoexportrice.Thequantitywas10000tons.Aftertakingthedelivery,theforeignbuyerdemandedanadditional160metrictonsofrice.Whatwentwrong?析:本题的解题要点:合约中的数量为“吨”,是不明确的规定。“吨”,在实行公制的国家一般理解为公吨,每吨为1000公斤;在实行英制的国家一般理解为长吨,每吨为1016公斤;在实行美制的国家一般理解为短吨,每吨为907公斤。所以,当卖方理解为公吨,每吨为1000公斤;而买方理解为长吨,每吨为1016公斤是,这份合约下卖方实际交货的数量与买方预期收货数量的差别为160公吨[(1016kg-1000kg)×100000=160000kg=160metrictons]。答案:是买卖双方对合约数量规定的“吨”有不同的理解。答题的切入点:1)数量规定不明确;2)不同度量衡制度下的“吨”表示的实际数量不同。4.ABeijingcompanysignedacontracttoimportwoolfromAustralia.Thequantitywasspecifiedas"20M/T".Whenthewoolwasdelivered,ithadaregainof33%.(1)Whatisaregainrate?(2)Whydidthebuyergetabaddeal?(3)Ifthestandardregainis10%,andactualregainis33%,whatistheconditionedweight?析:本题的解题要点:1)文中提到合同约定的数量是“20MT”,应理解为净重。因为计算重量的方法有毛重,净重,公量等,而根据联合国国际货物销售合同公约第五十六条,如果价格是按货物的重量规定的,如有疑问,应按净重确定。2)合同商品的羊毛,具有较强的吸湿性,其所含的水分受客观环境的影响较大,故其重量很不稳定。为了准确计算这类商品的重量,国际贸易中买卖双方通常会约定标准(公定)回潮率,采用按公量计算的办法。(1)答案:回潮是指货物(纤维材料)在环境温度下吸湿含水的现象。回潮率则是指货物(纤维材料)含水重量占货物(纤维材料)干重的百分比。答题的切入点:回潮(率)的概念。21

(2)答案:买方这笔交易不划算。因为合同中没有明确规定计算重量的方法,只能按净重计算。因此当卖方实际交货的羊毛,因具有较强的吸湿性而其所含的水分高达33%是,买方也别无他法,只得按净重(连带33%的水分)计算付款。答题的切入点:合同约定计算重量的方法不明确。(3)答案:如按公量计算,这批货只有16.54公吨。计算:ConditionedWeight=ActualWeight×[(1+StandardRegainRate)/(1+ActualRegainRate)]=20×[(1+10%)/(1+33%)]=16.54答题的切入点:公量的计算。5.KHCompanywasexportingbicyclestotheUS.Thecontractstipulated,"Packedinwoodencase."Althoughtheletterofcreditstated,"PackedinwoodencaseC.K.D.",theexporterpackedthebicyclesasusual(SKD).Theinvoiceandshippingdocumentsweremarked"C.K.D.".Butattheportofdestination,thecustomsimposedaseverepenaltyonthegoods,andthebuyerdemandedcompensationfromtheseller.Wasthebuyerentitledtothecompensation?(C.K.D.:CompletelyKnockedDown,S.K.D.:SemiKnockedDown)析:本题的解题要点:导致买方被海关罚款的原因是单货不符。单货不符的原因是卖方实际交货的包装与信用证规定不符;导致实际交货的包装与信用证规定不符的原因是信用证规定的包装与合同不符(或合同规定不够详细明确)。答案:Yes,买方应得到赔偿。答题的切入点:导致买方被海关罚款的直接原因;单货不符的责任方。Chapter5CargoTransportation12345678910I.MultiplechoicesDBCDBAACBAII.TrueorfalsestatementsTFTFTFFFTTIII.Calculation1.Thepricequotedbyanexporterwas"USD38percaseFOBShanghai".TheimporterrequestedarevisedCFRLiverpoolprice.Ifthesizeofeachcasewas50cmx40cmx30cm,grossweightpercasewas40kg,freightbasiswasW/MandthequotationforLiverpoolisUSD100pertonofcarriage,plus20%bunkeradjustmentfactor(BAF)and10%currencyadjustmentfactor(CAF),whatwouldbetheCFRprice?W=40kg=0.04m/tM=50cmx40cmx30cm=0.5x0.4x0.3=0.06cm3M>W,MwillbeusedasfreightbasisforfreightcalculationFreightpercase=Mxbasicfreightratex(1+BAFrate+CAFrate)=0.06x100x(l+20%+10%)=USD7.8CFR=FOB+Freight=38+7.8=USD45.80Answer:TheCFRpricewouldbeUSD45.80percaseCFRLiverpool.2.Oneconsignmentof10cartonsofleathershoes,measurementofeachcartonis50x50x50cm,grossweightofeachis15KG.TheairfreightratequotedfortheflightrequiredisUSD1.3/KG.Howmuchairfreightshouldbepaidtothecarrier?W=15kgM=(50x50x50)/6000cm3=20.83kgM>WFreight=USD1.3/kgx20.83x10cartons=USD270.79Answer:TheairfreightisUSD270.79.3.CompanyAistodeliverasmallconsignmentofHardware(Total:120ctn/3cbm/6.5mt)fromShenzhen,ChinatoBerlin,Germany.TheLCLoceanfreightrateisUSD45.00perrateton(lcbm:lmt).Howmuchisthefreight?TotalWeight=6.5m/t21

TotalMeasurement=3cbmM>W,soMisusedascalculationbasis.Totalfreight=BasicFreightRatexTotalQuantity=45.00x6.5=USD292.50Answer:ThetotalfreightwouldbeUSD292.50.4.CompanyBistoexporttheirgoodsbythree1x20"FCLContainersfromGuangzhou,ChinatoFelixstow,UK.ThequotationforFCLoceanfreightrateisasfollows:O/F(Oceanfreight)rate:USD750.00/20";BAF:USD500.00/20";CAF:12%onthebasisfreightISPS(Internationalshipandportfacilitysecurity)USD10.00/20"Howmuchisthetotalfreight?Totalfreight=[O/Fx(1+CAF)+BAF+ISPS]xQuantity=[750x(1+12%)+500+10]x3=1350x3=USD4050.00Answer:ThetotalfreightwouldbeUSD4050.00.5.CompanyCistodeliverbyair10setsofHi-fiEquipmentstoParis,France.Thetotalweightis550kgandthemeasurementis2.5cbm.TheAirfreightquotedbyalogisticscompanyisasfollows:A/F(Airfreight)rate:CNY10.00/kgFSC(Fuelsurcharge):CNY11.00/kgSCC(Securitysurcharge):CNY1.20/kgHowmuchisthetotalairfreight?TotalWeight=550kgTotalMeasurement:2.5m3/6000cm3=2.5x1000000cm3/6000cm3=2.5x167≈417kgW>M,soWisusedasthecalculationbasis.Totalairfreight=(A/F+FSC+SCC)xQuantity=(10.00+11.00+1.20)x550=CNY12210.00Answer:ThetotalairfreightwouldbeCNY12210.00.IV.Explainthefollowingterms1.linerserviceLinerserviceprovidesregularsailingsandarrivalsandsailsonafixed(regular)sailingrouteandcallsatfixed(regular)baseportswithacomparativelyfixedtimetableandchargesatcomparativelyfixedfreightrates.Normally,thefreightoffinerserviceismadeupoftwoparts.Oneisthebasicfreight;theotheristhesurchargesandadditionals.2.F.I.O.F.I.O.istheinitialorabbreviationsfor"FreeInandOut"."FreeInandOut"isoneofthefourmethodsusuallyusedtodividetheexpensesofloadingandunloadingbetweentheshipownerandthechartererinacharterparty.UnderF.I.O.,theship-ownerdoesnotbearanyloadingandunloadingcost.3.demurrageDemurrageistheamountofmoneypaidasapenaltyatanagreedratebythecharterertocompensatetheship-ownerforhislossesincasethechartererfailstohaveloadingandunloadingcompletedwithinthelaytime.Inasalescontract,demurrageispaidtothecharterer(buyerorseller)bytheotherparty(sellerorbuyer)incasetheloadingorunloadingcompletesbeyondthestipulatedlaytime.4.dispatchmoneyDispatchistheamountofmoneypaidasabonusbytheship-ownertothechartereriftheygetloadingandunloadingdoneaheadofschedule.Normallydispatchmoneyishalfthedemurrageasthebenefitfromtheexpediteloadingorunloadingissupposedtobesharedbyboththeship-ownerandthecharterer.Inthecaseofasalescontract,dispatchispaidbythecharterer(buyerorseller)totheotherparty(sellerorbuyer)incasetheloadingorunloadingcompletesaheadofthestipulatedlaytime.5.containerization21

Containerizationisamethodofdistributingmerchandiseinaunitizedformadoptinganinter-modalsystemwhichprovidesapossiblecombinationofsea,roadandothermodesoftransportation,Forthesakeofcontainerization,containers,asaveryspecialformoftransportation,arewidelyusedindifferentmodesoftransportation.6.FCLFCL,ashortforFullContainerLoad,isonetypeofthetwocontainertransportationservices.Ifthegoodsareofacontainerload,FCLserviceshallbeadopted.UnderFCLservice,thefreightiscalculatedbasedoncontainercapacityandtheoriginanddestinationofthegoods,notonthequantityofthegoodsinvolvedasinthecaseofLCL,theothertypeofthecontainertransportationservices.7.timeofdeliveryTimeofdeliveryreferstothetimelimitduringwhichthesellershallderiverthegoodstothebuyerattheagreedplace.Forallshipmentcontracts,timeofshipmentistimeofdeliveryandtheycanbeusedinterchangeablyinthecontract.Forallarrivalcontracts,timeofshipmentandtimeofdeliverythetwocompletelydifferentconceptsandtimeofdeliveryshouldbestipulatedinthecontract.8.optionalportsOptionalportsrefertotwoormoreportsofdestinationratherthanadefinite.Theyarespecifiedinthecontract.Thesellermayaccepttwoormoreoptionalportstomeetthebuyer"sspecialrequirements,whenabuyercannot,atthetimeofcontracting,makethedecisionastowhichmarketshouldthegoodsbedeliveredto.V.Shortquestions1.Underwhatcircumstancesdoestimeofshipmentequaltothetimeofdelivery?Timeofshipmentreferstothetimelimitforloadingthegoodsonboardthevesselattheportofshipmentwhiletimeofdeliveryreferstothetimelimitduringwhichthesellershalldeliverthegoodstothebuyerattheagreedplace.Forallshipmentcontracts,timeofshipmentequalstotimeofdeliveryandtheycanbeusedinterchangeablyinthecontract.AccordingtoIncoterms2010,contractsconcludedonthebasisoftermslikeFOB,CFR,CIF,FCA,CPT,CIPareshipmentcontracts.Undertheshipmentcontract,thesellerfulfillshisobligationofdeliverywhenthegoodsareshippedonboardthevesselordeliveredtothecarderandtheselleronlybearsallriskspriortoshipment.2.Whatarethefunctionsofabilloflading?Abillofladinghasthreemajorfunctions:First,itisacargoreceipt.Second,itisevidenceofacontractofcarriage.Finally,itisadocumentoftitletothegoods.3.Whatarethemaintypesofbillsoflading?Billsofladingcanbeclassifiedintovariousformsaccordingtodifferentstandards.~Accordingtowhetherthegoodshavebeenloadedonboardthecarryingvessel,billsofladingcanbeclassifiedintoshipped(oronboard)B/Landreceivedforshipment(orreceived)B/L.~Accordingtotheapparentconditionofthereceivedcargo,billsofladingcanbeclassifiedintocleanB/LanduncleanB/L.~Accordingtotheaddressoftheconsignee,billsofladingcanbedividedintostraightB/L,orderB/LandopenB/L.~Accordingtowhethertransshipmentisinvolvedintransit,billsofladingcanbeclassifiedintodirectB/LandtransshipmentB/L.~Accordingtotheperplexityorsimplicityofthebillcontent,billsofladingcanbeclassifiedintolongformB/LandshortformB/L.~Accordingtothepaymentconditionoffreight,billsofladingcanbeclassifiedintofreightprepaidB/LandfreighttobecollectedB/L.~Accordingtothevalidity,billsofladingareclassifiedintooriginalB/LandcopyB/L.~Otherformsofbillofladingalsoexistaccordingtodifferentcircumstances.TheyarestaleB/L,ante-dated21

B/L,advanceB/Landon-deckB/L.4.Whatarethewaysofdividingchargesofloadingandunloadinginacharterparty?Fourmethodsareusuallyusedtodividetheexpensesofloadingandunloadingbetweentheship-ownerandthecharterer:~LinerTerms/GrossTermsorInandOut(I.&O.):Theship-ownerbearsloadingandunloadingcost.~FreeIn(F.I.):Theship-ownerisonlyresponsibleforunloadingcost.~FreeOut(F.O.):Theship-ownerisonlyresponsibleforloadingcost.~FreeInandOut(F.I.O.):Theship-ownerdoesnotbearloadingandunloadingcost.OrF.I.O.S.T.(freeinandout,stowedandtrimmed):Theship-ownerdoesnotbearloadingandunloadingcost,notevenbeartheexpensesofstowingandtrimming.5.Whatfactorsaretobeconcernedinstipulatingclauseofdeliveryinacontract?Theshipmentclauseinasalescontractusuallyincludesstipulationsconcerningtimeofdelivery(timeofshipment),port(place)ofshipmentandport(place)ofdestination,partialshipments,transshipment,orlaydays,demurrageanddispatchmoney.VI.Casestudies1.ABCco.signedacontracttoexport200M/Tofbeans.Theletterofcreditstipulated,"Partialshipmentnotallowed".Whentheshipmentwasbeingmade,theexporterloaded100M/TeachonboardthesamevesselforthesamevoyageattheportofShanghaiandtheportofDalian.Theshipmentdocumentwasclearlymarkedwiththeportsofshipmentandthedatesofshipment.DidtheexporterviolatethetermsoftheL/C?析:本题的解题要点:ucP600第三十一条:b.表明使用同一运输工具并经由同次航程运输的数套运输单据在同一次提交时,只要显示相同目的地,将不视为部分发运,即使运输单据上表明的发运日期不同或装货港、接管地或发运地点不同。案例虽然没有说明货物是否在同一目的港卸货,但如果没有强调说明,一般认为是同一个目的地。答案:No。卖方没有违反信用证“不允许分批装船”的规定。答题切入点:对转船的定义和相关规定的理解。2.Deeco.signedalargeexportcontractstipulating,"ShipmentwillbemadeduringAugustof2012".Butduetotheproblemswiththevessel,theshipmentwasnotmadeuntilSeptember13.UponDee"srequest,thecarrierante-datedtheB/LtoAugust31.(1)Whatcouldbetheconsequenceofante-dating?(2)Whatwouldbethefightthingtodoincaseofapossibleshipmentdelay?析:本题的解题要点:对于倒签提单,各国法律和海运行规都是不允许的。倒签提单是指承运人在货物装船完毕,签发提单时,应托运人的请求将提单签发日期提前到信用证规定的日期。倒签提单是一种非常严重的行为,托运人的目的都是为了使提单签发日期符合信用证的规定,顺利结汇,但对收货人来说则构成合谋欺诈,可能使收货人蒙受重大损失。1)答案:倒签提单是一种严重的合谋欺诈行为,托运人和承运都有可能被追究法律责任。如使收货人蒙受重大损失,还会被追讨经济方面的赔偿。答题切入点:对倒签提单及其相关规定的理解。2)答案:与买方磋商,寻求买卖双方都能接受的解决办法;如1)延期信用证的有效期和船期;2)买方同意向银行(开证行)和卖方开出保函,保证接受签发日期迟于信用证规定日期的提单。答题切入点:与买方磋商解决。3.CompanyEinthemainlandofChinareachedanFOBcontractwithCompanyFinChina"sHongKong,exportingSteelSheets.Toresellthegoods,CompanyFsignedanotherCFRcontractwithCompanyGinSouthKorea.Later,CompanyEreceivedfromcompanyFtherelevantL/Cforthetransaction.ThepriceshowedintheL/CwasFOBascontracted.TheL/CalsostipulatedthatBusan(inSouthKorea)shouldbetheportofdestination.What"smore,theL/CstipulatedthattheB/Lshouldbemarkedwith"FreightPrepaid".(1)WhydidCompanyFhavesuchrequests?(2)ShouldCompanyEaccepttheseL/Cclauses?21

析:本题的关键是1)理解中国香港公司作为中间商是要把从E公司购买的钢板转卖给韩国的G公司。为免周折,中间商往往会安排货物直接从出口装运港运往韩国G公司所指定的目的港(地)。2)FOB合同下,买方虽然既无义务租船订舱,也无须承担出货物自出口装运港之后的一切运输费,但通常会接受买家的委托安排货物运往买家指定的目的港(地),只是“运费到付”,即由承运人向目的港(地)的收货人收取。(1)答案:因为港商为了简化向韩商的交货手续,或者是企图将运费转嫁给出口商。答题的切入点:FOB和CFR术语下出口货物运输义务以及主运费的买方和卖方之间划分。(2)答案:可以,只要运至釜山的运费由中国香港公司承担。具体做法可由FOB合同下的卖方E公司和买家G公司磋商决定,如可采取a.中国香港公司先将运费汇交E公司;或者b.由中国香港公司先将运费交付船公司,经从船公司得到确认后E公司可照办;或者C.要求修改信用证,加入允许收益人超支运费条款。答题的切入点:在FOB合同下,货物自在出口装运港之后的运费由买方承担。Chapter6TransportInsurance12345678910I.MultiplechoicesDBCDCCBABCII.TrueorfalsestatementsFFTFTFTTFFIII.Explainthefollowingterms1.insurableinterestInsurableinterestistheinterestininsurancesubjectmatter(cargoorpropertyacceptedforinsurance)heldbytheinsurantandrecognizedbylaws,indicatingthattheinsurantwillsuffersomefinanciallossesifanymaritimerisksmaterialize.2.utmostgoodfaithprincipleTheutmostgoodfaithprincipleorbonafideprinciplemeansthatbothpartiesshallbehonestandfaithfulwhenenteringintotheinsurancecontract,thatis,theinsurantshallexposetotheinsureralltheimportantfactsthatwillinfluencethejudgmentandevaluationbytheinsurertotheperils.3.indemnityprincipleTheindemnityprinciplemeansthatintheeventoflossofordamagetothesubjectmatterresultingfromaninsuredperil,theinsurershallcompensatetheclaimantexactlywhatthelatterhaslostintheoccurrenceoftheperil.Inpractice,thisisalmostalwayscompensatedbypayinganamountofmoneyequaltothevalueofthegoodslostordamaged.4.proximatecauseprincipleTheproximatecausereferstothemajorand/oreffectivereasonthathascausedtheaccidentandtheproximatecauseprincipleisemployedinthejudgmentofcausationbetweenaccidentsandlosses.5.cargotransportationinsuranceCargotransportationinsurancemeansthattheinsurant,referredtoaseithertheexporterorimporter,enterswithaninsurancecompanyand/oranunderwriterintoacontractofinsuranceinwhichtheinsurantundertakesthepaymentofaninsurancepremiumandtheinsurancecompanywill,accordingtothetermsindicatedintheinsurancecontract,indemnifytheinsurantofanylossthatoccurswithinthescopeofcoverage.6.marinecargoinsurancecontractMarinecargoinsurancecontractreferstoacontractwherebytheinsurerundertakestoindemnifytheassuredinamannerandtotheextenttherebyagreed,againstmarinelosses,thatistosay,thelossesincidentaltomarineadventure.7.generalaveragecontribution21

Wherethereisageneralaverageloss,thepartyonwhomitfallsisentitled,subjecttotheconditionsimposedbymaritimelaw,toaratablecontributionfromtheotherpartiesinterested,andsuchcontributioniscalledageneralaveragecontribution.8.inherentviceInherentvicereferstotheinherenttendencyofthecargotodeteriorateduetotheessentialinstabilityofthecomponentsnotresultedfromexternalcause.9.warehousetowarehouseclauseWarehousetowarehouseclausereferstothedurationofinsurancethroughoutwhichtheinsurancecompanyundertakesaninsuranceliability.Accordingtoit,theinsurancecompanyundertakesaninsuranceliabilityovertheinsuredcargofromthewarehouseorplaceofstorageoftheshippernamedinthepolicyuntilthecargohasarrivedatthewarehouseorplaceofstorageofthereceivernamedinthepolicy,limitedtosixty(60)daysaftercompletionofdischargeoftheinsuredgoodsfromtheseagoingvesselatthefinalportofdischargebeforetheyreachtheabovementionedwarehouseorplaceofstorage.10.franchiseFranchiseininsurancereferstothepracticethatthelossordamagebelowacertainspecifiedpercentagevalueisnon-recoverable.Franchisecanbeclassifiedintotwocategories:deductiblefranchiseandnon-deductiblefranchise.Underadeductiblefranchise,wherethelossordamageexceedsthepercentageallowed,theinsurancecompanyneedsmerelyindemnifytheexceedingparttotheinsuredwhereasunderanon-deductiblefranchise,aslongasthelossordamageexceedsthefranchisepercentage,theinsurancecompanyshallindemnifyfullamounttotheinsured.IV.Shortquestions1.WhatarethefourinsuranceprinciplesguidinginsurancepracticeinChina?ThefourprinciplesguidinginsurancepracticeinChinaaretheInsurableInterestPrinciple,theUtmostGoodFaithPrinciple,theIndemnityPrincipleandtheProximateCausePrinciple.2.Whatarethedifferencesbetweengeneralaverageandparticularaverage?Althoughbothgeneralaverageandparticularaveragebelongtothecategoryofpartialloss,thereisstillsomedifferencesbetweenthem:~Causes:Particularaverageisakindofcargolossusuallycauseddirectlybyseaperils,whilegeneralaverageiscausedbyintentionalmeasurestakentosavethecommoninterest.~Indemnification:Particularaverageisoftenbornebythepartywhosecargoisdamaged,whilegeneralaverageshouldbeproportionallycontributedamongallpartiesbenefitedfromtheintentionalmeasures.3.Whataretheconditionsforgeneralaverage?Apartiallosscanbetreatedasgeneralaverageifitisformeduponthefollowingconditions:~Thedangerthatthreatsthecommonsafetyofcargoand/orvesselshallbemateriallyexistentandisnotforeseen.~Themeasurestakenbythemastershallbeaimedtoremovethecommondangerofbothvesselandcargoandshallbeundertakendeliberatelyandreasonablyforcommonsafety.~Thesacrificeshallbespecializedandnotcausedbyperilsdirectlyandtheexpenseincurredshallbeadditionalexpensewhichisnotwithintheoperationbudget.~Theactionsoftheship"smastershallbesuccessfulinsavingthevoyage.4.WhatarethedifferencesbetweenthescopeofI.C.C.(B)andI.C.C.(C)?ThescopeofI.C.C.(C)coverslossofordamagetothecargoattributabletofireorexplosion;vesselofcraftbeingstranded,grounded,sunkorcapsized;overturningorderailmentoflandconveyance;collisionorcontactofvessel,craftorconveyancewithanyexternalobjectotherthanwater;ordischargeofcargoataportofdistress;generalaveragesacrifice;orjettison.ApartfromthosecoveredunderI.C.C.(C),thescopeofI.C.C.(B)alsocoverslossofordamagetothesubjectmatterinsuredattributabletoearthquake,volcaniceruptionorlightning;washingoverboard;entryof21

sea,lakeorriverwaterintovessel,craft,conveyance,container,liftvanorplaceofstorage;ortotallossofanypackagelostoverboardordroppedwhilstloadingontoorunloadingfrom,vesselorcraft.5.Listtherisksthatareknownasgeneraladditionalcoverage.Generaladditionalinsurancecoveragemainlycovers11typesofrisks:~T.P.N.D(Theft,PilferageandNon-delivery)~FreshWaterRainDamage~RiskofShortage~RiskofIntermixtureandContamination~RiskofLeakage~RiskofClashandBreakage~RiskofOdor~HeatingandSweatingRisk~HookDamage~RiskofRust~BreakageofPackingDamage6.Whataremainexpensesinvolvedinoceanmarineinsurance?Howtodefinethem?Marinecargoinsurancealsocoverstheexpensesincurredtoavoidorreducethedamagetoorlossofthesubjectmatterinsured.Therearemainlytwotypesofexpenses.Oneissueandlaborexpenses,theotherissalvagecharges.Sueorlaborexpensesareextraordinaryexpensesmadeinatimeofperilbytheinsuredtoacttoavert,orminimizeanylossofordamagetothesubjectmatterinsured.Salvagechargesareexpensesresultingfrommeasuresproperlytakenbyathirdpartyotherthantheinsured,hisagents,oranypersonemployedbythemtopreservemaritimepropertyfromperilsatsea.7.Whatdocumentsareneededwhenaninsuranceclaimismade?Whenmakinganinsuranceclaim,theclaimantusuallyisrequiredtosubmitthefollowingdocuments:~Originalinsurancepolicyorinsurancecertificate~Originalbillofladingorothertransportdocument~Commercialinvoice~Packinglist~CertificateofLoss(CertificateofSurvey)~Thelandingaccountorweightnotes(notesonweight)atdestination~Anycorrespondencewiththecarrieroranyotherpartywhocouldberesponsibleforthelossordamage~Master"sprotest8.Whataretheprerequisitesforaclaim?Theprerequisitesforaclaimare:~Therisksexposedtothegoodsinsuredshouldfallwithintheinsurancecoveragestipulatedintheinsurancepolicy.~Theclaimantshouldbeabletoevidencetheinsurableinteresthehasinthegoodsinsured.~Theriskscoveredshouldoccurwithinthedurationoftheinsuranceliability.V.Calculation1.AChinesecompanyofferedtoaBritishcounterpartatUSD500percaseFOBShanghai.TheBritishimporteraskedtheexportertoofferaCIFprice.SupposethefreightisUSD50percaseandpremiumrateis0.5%,whatwouldthenewofferbe?CIF=(FOB+F)/(1-110%xR)=(500+50)/(1-110%*0.5%)≈USD553Answer:ThenewofferisUSD553percaseCIFShanghai.2.CompanyAtransactedwithCompanyB,exportingfrozenfoodunderCIF.ThetotalamountoftheinvoicevaluewasUSD10000.Thepremiumratewas0.4%andthegoodswereinsuredagainstFPAwithamarkupof10%.Pleasecalculatetheinsuranceamountandinsurancepremiumrespectively?21

Insuranceamount=CIFx(1+markuprate)=10000x110%=USD11000Insurancepremium=CIFinsuranceamountxinsurancerate=11000x0.4%=USD44Answer:TheinsuranceamountandinsurancepremiumareUSD11000andUSD44respectively.3.OurexportingcompanyofferedlightindustrialproductstoaBritishimporteratGBP10000permetrictonCIFLondon(insurancecoveringAllRiskswith10%markupand1%premiumrate).However,theimporterintendedtoeffectinsurancebyhimself,asaresult,hecounter-offeredCFRprice.WhatistheCFRprice?HowmuchpremiumshouldtheexporterneedtodeductfromtheCIFprice?CFR=CIFx(1-110%xR)=10000x(1-110%x1%)=GBP9890Insurancepremium=CIF-CFR=10000-9890=GBP110Answer:TheCFRpriceisGBP9890permetrictonCFRLondonandtheexportershoulddeductGBPll0fromtheCIFpriceasthepremium.VI.Casestudies1.XCompanysignedaCIFcontracttoexportcandies.Thecargowasinsuredfor"allrisks".Duetothelongvoyage,candiesabsorbedsweatingintheship"shold,andthussoftenedanddegraded.Wastheinsurancecompanyliableforthedamage?Whyorwhynot?析:答案:No。案例中提到“duetothelongvoyage,candiesabsorbedsweatingintheship"sholdandthussoftenedanddegraded”,这说明candies变软的原因在于长时间海上运输,吸收了船舱的热气所致。保险公司不应给予赔偿原因有三:1)在货物运输保险中没有“长时间运输”这一风险;2)candy变软是由于其本身的货物特性决定的,糖果即使在常温下摆放一段时间都会变软,因此可认为是糖果的内在瑕疵(inherentvice)所导致的;3)虽然一般附加险中包含了“heatingandsweating"’这一险种,但此险种是指由于某种意外的原因(如船上的制冷设备坏了)导致船舱内温度、湿度突然变化,造成货物品质变化的情况,本案例不属于此情况。答题的切入点:1)货物inherentvice属于保险公司的除外责任;2)“heatingandsweatingrisk”的适用范围。2.AnexportersignedanFOBcontractwithaFrenchcompany,andaCIFcontractwithaBritishcompany.Bothcargoeswereinsuredformarinecargoinsurance.Butintransitfromtheexporter"sfactorytotheportofshipment,thegoodsweredamaged.Undereachdeal,whoshouldobtaininsurance?Whoshouldtaketheloss?析:本题的解题要点:1)理解FOB和CIF合同中买卖双方中哪一方应该投保,虽然这两个合同都是“shipmentcontract”,买方负责主要路程的风险,如在FOB项下,风险在船舷转移,买方承担主要航程的风险,因此通常是买方会去投保;但在CIF项下,卖方有购买保险的责任,卖方是投保人。2)决定哪一方是货物的受损方,要看货物受损是发生在风险转移之前还是之后,发生在之前,卖方是受损方,之后,则买方是受损方。此外,在买了保险的情况下,受损方通常会提起索赔,但索赔要满足三个条件,如果投保人或受益人投了保,且风险在承保范围内,又对受损货物有可保利益,同时又能满足仓至仓条款,索赔人就可以向保险公司索赔。1)答案:FOB下,进口商法国公司投保;CIF下出口商投保。答题切入点:术语的理解。2)答案:FOB下,出口商承担损失;CIF下出口商承担损失,但如果风险在承保范围内,出口商可以向保险公司索赔。答题切入点:满足索赔的条件:保险范围、可保利益和保险起讫期限。3.Onavoyagethecargoshiphadanaccidentalfire.Tosavetheship,thecaptainorderedtohavewaterpouredintothecompartment.Thefirewasputout.(1)ForpartyX,hergoodsburntamountedto10%ofUSD0.5millioncargo;(2)ForpartyY,hisgoodsdamagedduetowaterpouredaccountedfor20%ofUSD1millioncargo;(3)Forthecarrier,enginedamagesduetothefireequaled10%ofUSD50millionship;(4)ExtrawagesfortheseamentotaledUSD50000.Basedontheinformationabove,indicate1)WhichisPA?21

2)WhichisGA?3)WhatistheGAcontributionforeachparty?解:本题的关键在于对共同海损和单独海损的区别和共同海损分摊的计算。单独海损是承保风险所直接导致的船货损失。共同海损不是承保风险所直接导致的损失,而是指载货的船舶在海上遇到灾害或者意外事故,威胁到船货各方的共同安全,为解除这种危险,维护船货安全,由船方有意识地、合理地采取措施,所作出的某些特殊牺牲或支出的某些额外的费用。1)答案:PartyX和carrier的损失。2)答案:PartyY的损失和海员的拯救费用。答题切入点:共同海损和单独海损的区别,及满足共同海损的条件。3)GATotalloss=20%×1+0.05=USD0.25mGATotalBenefit=0.5×90%+50×90%+1=USD46.45mGAcontributionrate=[GAtotalloss/GATotalBenefit]×100%=(0.25/46.45)×100%=0.0054×100%=0.54%G.A.ContributionbyX=0.5×90%×0.54%=0.00243m≈USD2430G.A.ContributionbyY=1×0.54%=0.0054m≈USD5400G.A.ContributionbyCarrier=50×90%×0.54%=0.243m≈USD243000答题切入点:共同海损计算的步骤。4.AnimportersignedanFOBcontractwithanAustraliancompany,importingabatchofwoolenblanket.Thecontractrequiredthatgoodsbecardedbycontainers.Thegoodswerepackedasfollows:eachblanketinaplasticbag,fourblanketstoalargepolyethylenebag.TheimportereffectedinsuranceagainstWPAandWarRisk.Whengoodsarrivedatthedestination,thegoodswerefoundwettodifferentextents.Uponcarefulinvestigation,finallytheimporterfoundthattherewereseveralholesonthetopofthecontainer,thebiggestofwhichwasasbigas4cmindiameter.Theimporterfaxedtheexporter,askingforcompensation.However,theexportersuggestedtheimportershouldlodgeaclaimagainsttheinsurerforcompensation.Commentonthiscaseandworkoutthesolution.析:本题的关键在于分析损失应该由谁来负责。1)卖方的损失?这里要理解FOB术语中,出口方的交货的责任范围。本案例中卖方已经按合同和术语要求完成了交货,货物受损是在风险转移之后,因此损失应该由买方负责。此部分的答题切入点:FOB术语中出口方责任的理解,风险转移点的理解。2)保险公司负责理赔?案例中“theexportersuggestedtheimporterlodgeaclaimagainsttheinsurerforcompensation”一说不正确。进口商虽然投保了WPA和战争险,但损失是由于集装箱的问题造成的,属于第三方的责任,买方没有理由向保险公司索赔。此部分的答题切入点:保险险别的承保范围,点出货物受损的直接原因。3)谁是第三责任方?货物受损是由于承运人提供的集装箱出问题而导致的,因此,承运人应该负担责任,买方应该向承运人索赔。此部分的答题切入点:承运人的责任。5.AnAfricansellersignedaCIFcontractexportinggoodstoanAmericanbuyer.ThesellerinsuredthegoodsagainstAllRisksattherequestofthebuyerandtransferredtheinsurancepolicyandthebillofladingtothebuyerafterwards.Intransitfromtheseller"swarehousetotheportofshipment,thegoodssufferedlosseswhichwerewithintheinsurancecoverage.Whenthebuyeraskedtheinsurerforcompensationwiththeinsurancepolicy,theinsurerrefusedtomakecompensationonthegroundthatthebuyerheldnoinsurableinterestinthegoodswhenthelossoccurred.Commentonthecase.析:本题的解题要点:保险单转让之后,保险单的权益就有效地转让给了买方,买方就承受了保险单项下的全部权益。卖方在货物受损时对货物具有可保利益,但卖方把他的权益转让给买方之后,买方由权利向保险公司索赔本来属于卖方的权益。保险公司根据保险单承保范围和保险条款中的“仓至仓”条款,应该赔偿买方的损失。答题切入点:1)保单转让后权益的变化;2)索赔的条件。21

Unit7InternationalPayments12345678910I.MultiplechoicesBDBCDACABBII.TrueorfalsestatementsFTTFFTTFTFIII.Shortquestions1.AfterBankXadvisedexporterYoftheL/C,theshipmentwasmade.Whenthecargowasontheway,theimporterfiledforbankruptcy.IsYoutofluckofcollectingthepayment?Cantheopeningbankrefusetomakereimbursementtothenegotiatingbank?Whyorwhynot?No,exporterYdoesnotneedtoworryaboutthepayment.BecausethepaymentisbyL/C,theissuingbankisresponsibleformakingpaymentregardlessoftheimporter"ssituation.ButtheconditionisthatexporterYcanfulfillalltherequirementslistedontheL/C.AccordingtoUCP600,acreditconstitutesadefiniteundertakingoftheopeningbanktopayortopayatmaturityincaseofacceptance.Thereforeoncethestipulateddocumentsarepresentedtotheopeningbankandthetermsandconditionsofthecreditarecompliedwith,theopeningbankcannotrefusetomakereimbursementtothenegotiatingbank.2.AnL/CdoesnotindicatewhetheritisrevocableOrnot,isitrevocable?Canarevocablecreditbetransferable?AccordingtoUCP600,ifanL/Cdoesnotindicatewhetheritisirrevocableornot,itwillbeconsideredasirrevocable.AndatransferableL/Cmustbeirrevocable.3.AfteragullibleimporterpaidBankCagainsttheseeminglycorrectshippingdocuments,hewenttotakethedelivery,butfoundoutthatthegoodswereinferiorcounterfeits.IsBankCliableunderUCP600?Cantheimporterdoanythinginordertorecovertheloss?BankCisnotliableinthiscasebecauseUCP600stipulatesthatincreditoperationsallpartiesconcerneddealwithdocuments,andnotwithgoods,servicesand/orotherperformancestowhichthedocumentsmayrelate.Inordertorecovertheloss,theimportershouldrelyonthesalescontractandseekforsolution.4.Anexporter,WuCo.,receivedanL/CissuedbyBankBandconfirmedbyBankK.AfterWushippedthegoods,BankBdeclaredbankruptcy.WillWuhavesleeplessnights?No,WuCo.doesnotneedtoworryaboutthepayment.WhentheL/Cisconfirmed,theconfirmingbankholdsthesamedefiniteundertakingastheissuingbanktopayortopayatmaturityincaseofacceptance.5.Doesapaymentcreditdifferfromasightcredit?Apaymentcreditcouldbesettledbysightpaymentordeferredpayment.In"bothcases,adraftdrawnontheissuingbankmaynotbenecessary.Whilewhenasightcreditisused,paymentwouldbemadeimmediatelyagainstasightdraftandrequiredcommercialdocuments.6.Arethefollowingcreditstransferable?(A)ThisL/Cisassignable;(B)ThisL/Cistransmissible;(C)ThisL/Cisfractionable;(D)ThisL/Cisdivisible.AccordingtoUCP600,acreditcanbetransferredonlyifitisexpresslydesignatedas"transferable"bytheissuingbank.Termssuchas"divisible","fractionable","assignable",and"transmissible"donotrendertheCredittransferable.7.Underananticipatorycredit,theexportermadeanadvance,butdisappearedwithoutpresentingthedocumentsasrequired.Whoisliableforrepaymentoftheadvance?Thespecialclauseisrequiredbytheapplicant,asaresulthehastomakerepaymentoftheadvancesifthebeneficiaryfailstopresentdocumentsforsettlement.8.Useanexampletoexplainwhyaback-to-backcreditisneeded.Abacktobackcreditisnormallyusedbymiddlepersonfortheprotectionofhisinterest.Forexample,agentA21

receivedadocumentarycreditfromtheendbuyerB,AcanusethiscreditasabackuptoapplyfortheopeningofanewcreditinfavoroftheendsupplierC.BydoingsoAcanbesurethatneitherBnorCwouldknoweachother,thereforewellprotectingA"sbusinessconfidentiality.9.Whatisthedifferencebetweenaback-to-backcreditandatransferablecredit?Whenaback-to-backcreditisused,thereactuallyinvolvetwocredits.Whenatransferablecreditisused,operationisbasedononlyonecredit.IV.Casestudies1.OnSeptember1,XCompanysignedacontracttoexportgoodstotheU.S.OnSeptember30,CityBanksentanirrevocableL/CwithanamountofUSD30,000.TheL/CstipulatedshipmentduringOctober,andBankofTokyotobethereimbursingbank.OnOctober2,BankofChinaadvisedXoftheL/C.Buttendayslater,Xlearntthattheimporterwasnearbankruptcy.HowshouldXdealwiththesituation?析:1)案例中X公司收到的是一份不可撤销的信用证(anirrevocableL/c),说明X公司在满足信用证所列条件的情况下,可以直接从开证行或开证行指定银行获得货款,而不需考虑进口商的状况。2)在这种情况下,X公司在做决策时,需要考虑的一是自身完成信用证所列条件的能力,二是与进口商的合作问题。答题切入点:1)信用证支付情况下各方的关系;2)X公司可选择的做法及注意事项。2.F,astate-ownedenterprise,signedacontracttoimport1000M/TofgalvanizedsteelsheetsfromaH.K.company.OnMarch1,aShanghaibankissuedtheL/CforUSD200,000.OnMarch24,containershipmentwasmade.OnMarch25,thenegotiatingbankinH.K.negotiatedthedraftalongwiththeshippingdocuments.OnMarch26,theopeningbankreceivedthe"cleanB/L"whilethesealedcontainerarrivedatShanghai.OnMarch30,itwasfoundthatinsidethecontainerwererustedirondrums,ratherthantheorderedsteelsheets.Theissuingbankwasimmediatelynotifiedofthefraud,butitcouldnotrefusetotakeupthedocuments.InApril5,Fco.uncoveredthatthecommodityspecifiedontheB/Lwas50mm,inconsistentwith50cmrequiredbytheL/C.OnApril14,theissuingbankrequestedtheHKbanktoexercisetherightofrecourse.(a)Wouldtherebeanyproblemwiththerecourse?(b)Whatwerethelessons?析:1)在3月30日进口方发现货不对板,通知开证行时开证行“couldnotrefusetotakeupthedocument”,这里说明开证行尽管知道货不对板,但如果它认为议付行所提交的单证与信用证相符,开证行必须依照信用证规定的义务行事,即对议付行进行偿付。因为,在信用证的运作下,各方只凭单据操作,而不涉及实际的货物。2)4月5日进口商发现单据有不符点,可以想象的结果就是进口商拒绝赎单付款。此时开证行已向议付行支付了货款,而又遭到进口商以正当理由拒绝赎单付款,它是遭受损失的一方,因此会向议付行提出行使追索权。3)但根据UCP600开证行进行的议付是“无追索权的议付”。(1)答案:Yes.答题切入点:UCP600对开证行责任的规定。(2)答题切入点:在分析所吸取教训的时候,要分步进行。1)首先要分析在这起事件中哪几方遭受损失;2)然后进一步说明各方遭受损失的原因;3)最后提出预防类似情况出现的方法。3.FFCompanysignedacontracttoexportgoodstoAAcompanyinAfrica.InSeptemberFFwasnotifiedoftheL/C,butthemoneyofaccountwasdifferentfromthatrequiredbythesalescontract.Besides,thegoodswerenotreadyforshipment.InNovember,AAurgedFFtodeliverthegoods.FFrequestedanL/Camendmentandanextensionoftheshipmentdate.Thenextday,AAcabledback,"L/Camended."FFshippedthegoods.However,theamendedL/Cneverarrived,andtheopeningbankrefusedtopayagainsttheshippingdocuments.Thegoodswerestoredinthewarehouseattheportofdestination.FFhadtopaymuchrentandinsurance.Atthistime,AArequestedD/A.ShouldFFacceptit?Isthereanylessontobelearntfromthiscase?析:案例中由于AA公司没有如约修改信用证,使得FF公司提交的单据不符合信用证的要求,这时作为银行付款承诺的信用证已经失效。买卖双方的支付关系又回到了依靠商业信用的情况。而这时AA公司要求使用承兑交单(D/A),即是要求卖方同意在买方只作出支付承诺(承兑)而未付款的情况下获得可以提取货物的单据。21

答题切入点:1)解释D/A的应用特点;2)对AA的过往行为进行判断,对其要求D/A的目的进行分析;3)FF如果同意采用D/A可能出现的后果;4)FF是受损一方,分析其在不同阶段所犯的错误及预防错误的方法。4.AChinesebankissuedstandbyLs/CtotalingmillionsofU.S.dollars,infavorofanU.S.company.Thesewereirrevocable,transferablestandbyLs/Cvalidforoneyear.Whenquestionedbythesupervisingagency,thebankstatedthattheseweremerelyevidenceofabsorbedforeigninvestment,"Ithasnoobligationtorepayprincipalandinterest,andbearsnoresponsibility,economicorlegal,forthefunds."Wasthereanyriskforthebank?析:1)本案例中各方的关系可能是:某中国公司要某美国公司投资某项目,作为完成项目的担保,向银行申请开出一份备用信用证,受益方是美国公司。中国公司在申请信用证的时候可能游说银行,使其相信这只是帮助吸引外资的一个文件,该公司会承担完成项目的责任,而美国公司则负责出资,所以银行不会承担任何风险。中方银行在对备用信用证没有了解的情况下同意该操作。2)备用信用证尽管是一种特殊的信用证,它为申请人提供担保,在申请人未能完成所规定义务的情况下向受益人支付约定的款项;但它的本质还是一份信用证,即在符合条件的情况下开证行对受益人承诺付款义务。3)案例中的开证行对备用信用证了解不透,误解了它所应承担的责任,因此也忽略了它可能承担的风险:当中国公司不能履行其义务时,开证行是要向美国公司支付相应款项的。答案:Yes.答题切入点:1)备用信用证的特点;2)信用证使用中开证行的义务;3)案例中如果申请人不能履行义务,开证行的责任。21'

您可能关注的文档

- 吴晓求 投资证券学课后习题答案.doc

- 周三多 第二版 课后习题答案.doc

- 四川大学《计算机软件技术基础》复习题2及答案.doc

- 四川省2014年12月教师招聘考试《教育公共基础》题本+答案解析.doc

- 四年级课外阅读练习精选30题(答案).doc

- 合作课后习题答案_催日明_李兵.doc

- 国际经济合作课后习题答案_赵永宁.doc

- 国际财务管理课后习题答案chapter 8.doc

- 国际贸易实务习题(含答案).doc

- 土木工程施工习题及答案(上海应用技术学院).doc

- 土木工程概论习题与答案.doc

- 地质学基础试题及答案.docx

- 基础会计参考答案.doc

- 国文学史课后习题答案__第一到第六单元.doc

- 大学体验英语综合教程4课文翻译及课后答案.doc

- 大学全部学科答案链接地址.doc

- 大学公共管理学考研真题资料与答案解析.doc

- 大学有机化学答案chapter9.doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明