- 131.50 KB

- 2022-04-22 11:41:20 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

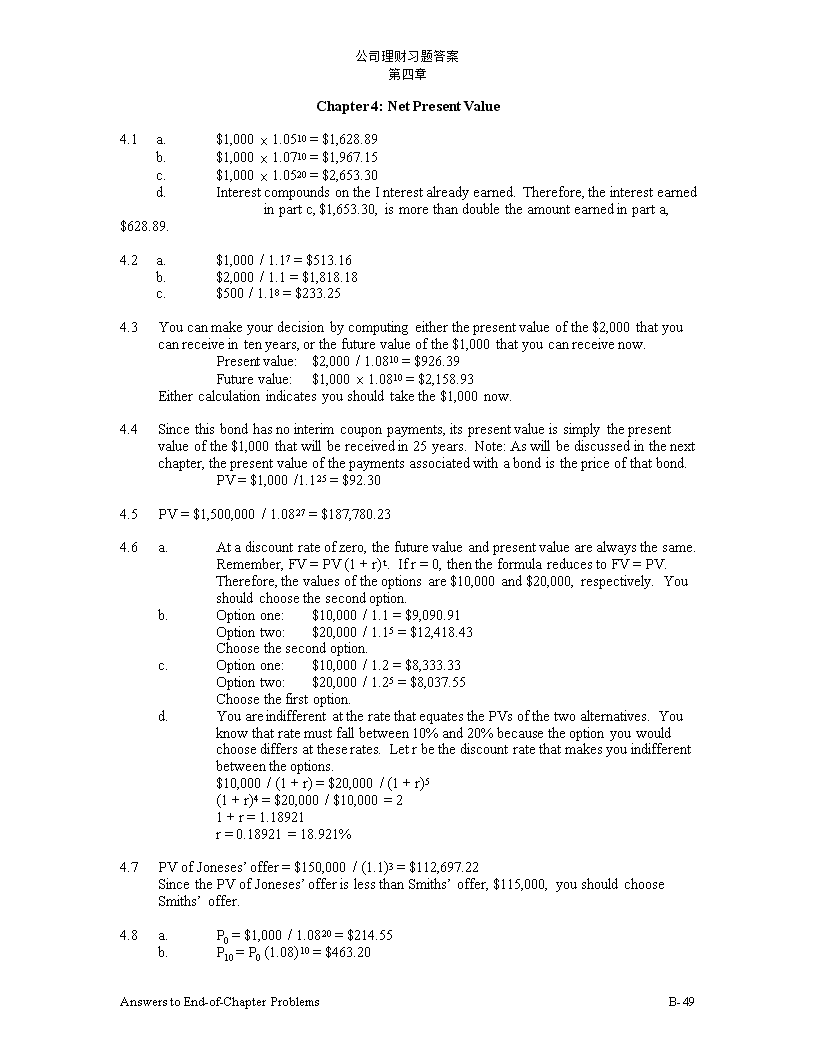

'公司理财习题答案第四章Chapter4:NetPresentValue4.1a.$1,000´1.0510=$1,628.89b.$1,000´1.0710=$1,967.15c.$1,000´1.0520=$2,653.30d.InterestcompoundsontheInterestalreadyearned.Therefore,theinterestearnedinpartc,$1,653.30,ismorethandoubletheamountearnedinparta,$628.89.4.2a.$1,000/1.17=$513.16b.$2,000/1.1=$1,818.18c.$500/1.18=$233.254.3Youcanmakeyourdecisionbycomputingeitherthepresentvalueofthe$2,000thatyoucanreceiveintenyears,orthefuturevalueofthe$1,000thatyoucanreceivenow.Presentvalue:$2,000/1.0810=$926.39Futurevalue:$1,000´1.0810=$2,158.93Eithercalculationindicatesyoushouldtakethe$1,000now.4.4Sincethisbondhasnointerimcouponpayments,itspresentvalueissimplythepresentvalueofthe$1,000thatwillbereceivedin25years.Note:Aswillbediscussedinthenextchapter,thepresentvalueofthepaymentsassociatedwithabondisthepriceofthatbond.PV=$1,000/1.125=$92.304.5PV=$1,500,000/1.0827=$187,780.234.6a.Atadiscountrateofzero,thefuturevalueandpresentvaluearealwaysthesame.Remember,FV=PV(1+r)t.Ifr=0,thentheformulareducestoFV=PV.Therefore,thevaluesoftheoptionsare$10,000and$20,000,respectively.Youshouldchoosethesecondoption.b.Optionone:$10,000/1.1=$9,090.91Optiontwo:$20,000/1.15=$12,418.43Choosethesecondoption.c.Optionone:$10,000/1.2=$8,333.33Optiontwo:$20,000/1.25=$8,037.55Choosethefirstoption.d.YouareindifferentattheratethatequatesthePVsofthetwoalternatives.Youknowthatratemustfallbetween10%and20%becausetheoptionyouwouldchoosediffersattheserates.Letrbethediscountratethatmakesyouindifferentbetweentheoptions.$10,000/(1+r)=$20,000/(1+r)5(1+r)4=$20,000/$10,000=21+r=1.18921r=0.18921=18.921%4.7PVofJoneses’offer=$150,000/(1.1)3=$112,697.22SincethePVofJoneses’offerislessthanSmiths’offer,$115,000,youshouldchooseSmiths’offer.4.8a.P0=$1,000/1.0820=$214.55b.P10=P0(1.08)10=$463.20B-57AnswerstoEnd-of-ChapterProblems

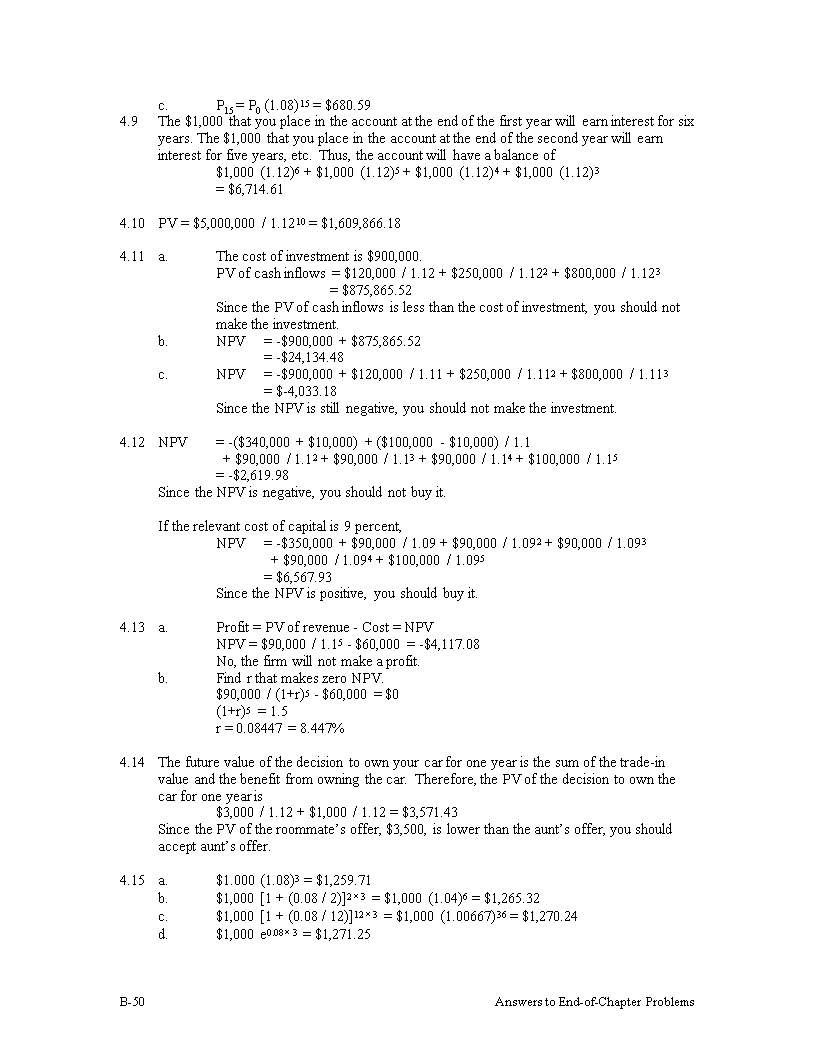

公司理财习题答案第四章c.P15=P0(1.08)15=$680.594.9The$1,000thatyouplaceintheaccountattheendofthefirstyearwillearninterestforsixyears.The$1,000thatyouplaceintheaccountattheendofthesecondyearwillearninterestforfiveyears,etc.Thus,theaccountwillhaveabalanceof$1,000(1.12)6+$1,000(1.12)5+$1,000(1.12)4+$1,000(1.12)3=$6,714.614.10PV=$5,000,000/1.1210=$1,609,866.184.11a.Thecostofinvestmentis$900,000.PVofcashinflows=$120,000/1.12+$250,000/1.122+$800,000/1.123=$875,865.52SincethePVofcashinflowsislessthanthecostofinvestment,youshouldnotmaketheinvestment.b.NPV=-$900,000+$875,865.52=-$24,134.48c.NPV=-$900,000+$120,000/1.11+$250,000/1.112+$800,000/1.113=$-4,033.18SincetheNPVisstillnegative,youshouldnotmaketheinvestment.4.12NPV=-($340,000+$10,000)+($100,000-$10,000)/1.1+$90,000/1.12+$90,000/1.13+$90,000/1.14+$100,000/1.15=-$2,619.98SincetheNPVisnegative,youshouldnotbuyit.Iftherelevantcostofcapitalis9percent,NPV=-$350,000+$90,000/1.09+$90,000/1.092+$90,000/1.093+$90,000/1.094+$100,000/1.095=$6,567.93SincetheNPVispositive,youshouldbuyit.4.13a.Profit=PVofrevenue-Cost=NPVNPV=$90,000/1.15-$60,000=-$4,117.08No,thefirmwillnotmakeaprofit.b.FindrthatmakeszeroNPV.$90,000/(1+r)5-$60,000=$0(1+r)5=1.5r=0.08447=8.447%4.14Thefuturevalueofthedecisiontoownyourcarforoneyearisthesumofthetrade-invalueandthebenefitfromowningthecar.Therefore,thePVofthedecisiontoownthecarforoneyearis$3,000/1.12+$1,000/1.12=$3,571.43SincethePVoftheroommate’soffer,$3,500,islowerthantheaunt’soffer,youshouldacceptaunt’soffer.4.15a.$1.000(1.08)3=$1,259.71b.$1,000[1+(0.08/2)]2´3=$1,000(1.04)6=$1,265.32c.$1,000[1+(0.08/12)]12´3=$1,000(1.00667)36=$1,270.24d.$1,000e0.08´3=$1,271.25B-57AnswerstoEnd-of-ChapterProblems

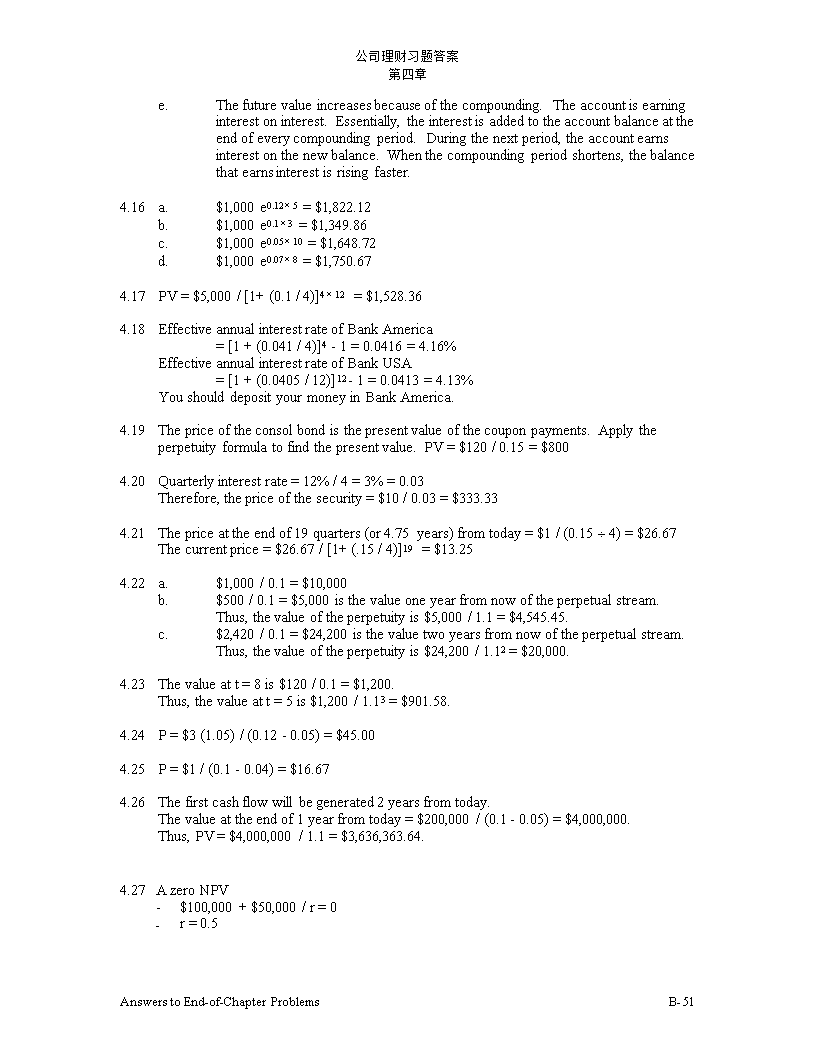

公司理财习题答案第四章e.Thefuturevalueincreasesbecauseofthecompounding.Theaccountisearninginterestoninterest.Essentially,theinterestisaddedtotheaccountbalanceattheendofeverycompoundingperiod.Duringthenextperiod,theaccountearnsinterestonthenewbalance.Whenthecompoundingperiodshortens,thebalancethatearnsinterestisrisingfaster.4.16a.$1,000e0.12´5=$1,822.12b.$1,000e0.1´3=$1,349.86c.$1,000e0.05´10=$1,648.72d.$1,000e0.07´8=$1,750.674.17PV=$5,000/[1+(0.1/4)]4´12=$1,528.364.18EffectiveannualinterestrateofBankAmerica=[1+(0.041/4)]4-1=0.0416=4.16%EffectiveannualinterestrateofBankUSA=[1+(0.0405/12)]12-1=0.0413=4.13%YoushoulddeposityourmoneyinBankAmerica.4.19Thepriceoftheconsolbondisthepresentvalueofthecouponpayments.Applytheperpetuityformulatofindthepresentvalue.PV=$120/0.15=$8004.20Quarterlyinterestrate=12%/4=3%=0.03Therefore,thepriceofthesecurity=$10/0.03=$333.334.21Thepriceattheendof19quarters(or4.75years)fromtoday=$1/(0.15¸4)=$26.67Thecurrentprice=$26.67/[1+(.15/4)]19=$13.254.22a.$1,000/0.1=$10,000b.$500/0.1=$5,000isthevalueoneyearfromnowoftheperpetualstream.Thus,thevalueoftheperpetuityis$5,000/1.1=$4,545.45.c.$2,420/0.1=$24,200isthevaluetwoyearsfromnowoftheperpetualstream.Thus,thevalueoftheperpetuityis$24,200/1.12=$20,000.4.23Thevalueatt=8is$120/0.1=$1,200.Thus,thevalueatt=5is$1,200/1.13=$901.58.4.24P=$3(1.05)/(0.12-0.05)=$45.004.25P=$1/(0.1-0.04)=$16.674.26Thefirstcashflowwillbegenerated2yearsfromtoday.Thevalueattheendof1yearfromtoday=$200,000/(0.1-0.05)=$4,000,000.Thus,PV=$4,000,000/1.1=$3,636,363.64.4.27AzeroNPV-$100,000+$50,000/r=0-r=0.5B-57AnswerstoEnd-of-ChapterProblems

公司理财习题答案第四章4.28ApplytheNPVtechnique.Sincetheinflowsareanannuityyoucanusethepresentvalueofanannuityfactor.NPV=-$6,200+$1,200=-$6,200+$1,200(5.3349)=$201.88Yes,youshouldbuytheasset.4.29Useanannuityfactortocomputethevaluetwoyearsfromtodayofthetwentypayments.Remember,theannuityformulagivesyouthevalueofthestreamoneyearbeforethefirstpayment.Hence,theannuityfactorwillgiveyouthevalueattheendofyeartwoofthestreamofpayments.Valueattheendofyeartwo=$2,000=$2,000(9.8181)=$19,636.20Thepresentvalueissimplythatamountdiscountedbacktwoyears.PV=$19,636.20/1.082=$16,834.884.30Thevalueofannuityattheendofyearfive=$500=$500(5.84737)=$2,923.69Thepresentvalue=$2,923.69/1.125=$1,658.984.31Theeasiestwaytodothisproblemistousetheannuityfactor.Theannuityfactormustbeequalto$12,800/$2,000=6.4;rememberPV=CAtr.Theannuityfactorsareintheappendixtothetext.Tousethefactortabletosolvethisproblem,scanacrosstherowlabeled10yearsuntilyoufind6.4.Itisclosetothefactorfor9%,6.4177.Thus,therateyouwillreceiveonthisnoteisslightlymorethan9%.Youcanfindamorepreciseanswerbyinterpolatingbetweennineandtenpercent.10%ù6.1446ùaérúbcé6.4ïdë9%ûë6.4177ûByinterpolating,youarepresumingthattheratioofatobisequaltotheratioofctod.(9-r)/(9-10)=(6.4177-6.4)/(6.4177-6.1446)r=9.0648%Theexactvaluecouldbeobtainedbysolvingtheannuityformulafortheinterestrate.Sophisticatedcalculatorscancomputetheratedirectlyas9.0626%.B-57AnswerstoEnd-of-ChapterProblems

公司理财习题答案第四章4.32a.TheannuityamountcanbecomputedbyfirstcalculatingthePVofthe$25,000whichyouneedinfiveyears.Thatamountis$17,824.65[=$25,000/1.075].Nextcomputetheannuitywhichhasthesamepresentvalue.$17,824.65=C$17,824.65=C(4.1002)C=$4,347.26Thus,putting$4,347.26intothe7%accounteachyearwillprovide$25,000fiveyearsfromtoday.b.Thelumpsumpaymentmustbethepresentvalueofthe$25,000,i.e.,$25,000/1.075=$17,824.65Theformulaforfuturevalueofanyannuitycanbeusedtosolvetheproblem(seefootnote14ofthetext).4.33Theamountofloanis$120,000´0.85=$102,000.=$102,000TheamountofequalinstallmentsisC=$102,000/=$102,000/8.513564=$11,980.884.34Thepresentvalueofsalaryis$5,000=$150,537.53Thepresentvalueofbonusis$10,000=$23,740.42(EAR=12.68%isusedsincebonusesarepaidannually.)Thepresentvalueofthecontract=$150,537.53+$23,740.42=$174,277.944.35Theamountofloanis$15,000´0.8=$12,000.C=$12,000TheamountofmonthlyinstallmentsisC=$12,000/=$12,000/40.96191=$292.964.36Optionone:Thiscashflowisanannuitydue.Tovalueit,youmustusetheafter-taxamounts.Theafter-taxpaymentis$160,000(1-0.28)=$115,200.Valueallexceptthefirstpaymentusingthestandardannuityformula,thenaddbackthefirstpaymentof$115,200toobtainthevalueofthisoption.Value=$115,200+$115,200=$115,200+$115,200(9.4269)=$1,201,178.88Optiontwo:Thisoptionisvaluedsimilarly.Youareabletohave$446,000now;thisisalreadyonanafter-taxbasis.Youwillreceiveanannuityof$101,055foreachofthenextthirtyyears.Thosepaymentsaretaxablewhenyoureceivethem,soyourafter-taxpaymentis$72,759.60[=$101,055(1-0.28)].Value=$446,000+$72,759.60=$446,000+$72,759.60(9.4269)=$1,131,897.47SinceoptiononehasahigherPV,youshouldchooseit.B-57AnswerstoEnd-of-ChapterProblems

公司理财习题答案第四章4.37Theamountofloanis$9,000.ThemonthlypaymentCisgivenbysolvingtheequation:C=$9,000C=$9,000/47.5042=$189.46InOctober2000,SusanChaohas35(=12´5-25)monthlypaymentsleft,includingtheonedueinOctober2000.Therefore,thebalanceoftheloanonNovember1,2000=$189.46+$189.46=$189.46+$189.46(29.6651)=$5,809.81Thus,thetotalamountofpayoff=1.01($5,809.81)=$5,867.914.38Letrbetherateofinterestyoumustearn.$10,000(1+r)12=$80,000(1+r)12=8r=0.18921=18.921%4.39Firstcomputethepresentvalueofallthepaymentsyoumustmakeforyourchildren’seducation.Thevalueasofoneyearbeforematriculationofonechild’seducationis$21,000=$21,000(2.8550)=$59,955.Thisisthevalueoftheelderchild’seducationfourteenyearsfromnow.Itisthevalueoftheyoungerchild’seducationsixteenyearsfromtoday.ThepresentvalueoftheseisPV=$59,955/1.1514+$59,955/1.1516=$14,880.44Youwanttomakefifteenequalpaymentsintoanaccountthatyields15%sothatthepresentvalueoftheequalpaymentsis$14,880.44.Payment=$14,880.44/=$14,880.44/5.8474=$2,544.804.40TheNPVofthepolicyisNPV=-$750-$800/1.063+$250,000/[(1.066)(1.0759)]=-$2,004.76-$1,795.45+$3,254.33=-$545.88Therefore,youshouldnotbuythepolicy.4.41TheNPVoftheleaseofferisNPV=$120,000-$15,000-$15,000-$25,000/1.0810=$105,000-$93,703.32-$11,579.84=-$283.16Therefore,youshouldnotaccepttheoffer.4.42Thisproblemappliesthegrowingannuityformula.Thefirstpaymentis$50,000(1.04)2(0.02)=$1,081.60.PV=$1,081.60[1/(0.08-0.04)-{1/(0.08-0.04)}{1.04/1.08}40]=$21,064.28Thisisthepresentvalueofthepayments,sothevaluefortyyearsfromtodayis$21,064.28(1.0840)=$457,611.46B-57AnswerstoEnd-of-ChapterProblems

公司理财习题答案第四章4.43Usethediscountfactorstodiscounttheindividualcashflows.ThencomputetheNPVoftheproject.Noticethatthefour$1,000cashflowsformanannuity.YoucanstillusethefactortablestocomputetheirPV.Essentially,theyformcashflowsthatareasixyearannuitylessatwoyearannuity.Thus,theappropriateannuityfactortousewiththemis2.6198(=4.3553-1.7355).YearCashFlowFactorPV1$7000.9091$636.3729000.8264743.7631,000ù41,000ú2.61982,619.8051,000ú61,000û71,2500.5132641.5081,3750.4665641.44Total$5,282.87NPV=-$5,000+$5,282.87=$282.87Purchasethemachine.4.44Weeklyinflationrate=0.039/52=0.00075Weeklyinterestrate=0.104/52=0.002PV=$5[1/(0.002-0.00075)]{1–[(1+0.00075)/(1+0.002)]52´30}=$3,429.384.45Engineer:NPV=-$12,000+$20,000/1.055+$25,000/1.056-$15,000/1.057-$15,000/1.058+$40,000/1.058=$352,533.35Accountant:NPV=-$13,000+$31,000/1.054=$345,958.81Becomeanengineer.Afteryourbrotherannouncesthattheappropriatediscountrateis6%,youcanrecalculatetheNPVs.Calculatethemthesamewayasaboveexceptusingthe6%discountrate.EngineerNPV=$292,419.47AccountantNPV=$292,947.04Yourbrothermadeapoordecision.Ata6%rate,heshouldstudyaccounting.4.46SinceGoosereceiveshisfirstpaymentonJuly1andallpaymentsinoneyearintervalsfromJuly1,theeasiestapproachtothisproblemistodiscountthecashflowstoJuly1thenusethesixmonthdiscountrate(0.044)todiscountthemtheadditionalsixmonths.PV=$875,000/(1.044)+$650,000/(1.044)(1.09)+$800,000/(1.044)(1.092)+$1,000,000/(1.044)(1.093)+$1,000,000/(1.044)(1.094)+$300,000/(1.044)(1.095)B-57AnswerstoEnd-of-ChapterProblems

公司理财习题答案第四章+$240,000/(1.044)(1.095)+$125,000/(1.044)(1.0922)=$5,051,150Rememberthattheuseofannuityfactorstodiscountthedeferredpaymentsyieldsthevalueoftheannuitystreamoneperiodpriortothefirstpayment.Thus,theannuityfactorappliedtothefirstsetofdeferredpaymentsgivesthevalueofthosepaymentsonJuly1of1989.Discountingby9%forfiveyearsbringsthevaluetoJuly1,1984.Theuseofthesixmonthdiscountrate(4.4%)bringsthevalueofthepaymentstoJanuary1,1984.Similarly,theannuityfactorappliedtothesecondsetofdeferredpaymentsyieldsthevalueofthosepaymentsin2006.Discountingfor22yearsat9%andforsixmonthsat4.4%providesthevalueatJanuary1,1984.Theequivalentfive-year,annualsalaryistheannuitythatsolves:$5,051,150=CC=$5,051,150/3.8897C=$1,298,596Thestudentmustbeawareofpossibleroundingerrorsinthisproblem.Thedifferencebetween4.4%semiannualand9.0%andforsixmonthsat4.4%providesthevalueatJanuary1,1984.4.47PV=$10,000+($35,000+$3,500)[1/(0.12-0.04)][1-(1.04/1.12)25]=$415,783.604.48NPV=-$40,000+$10,000[1/(0.10-0.07)][1-(1.07/1.10)5]=$3,041.91Revisethetextbook.4.49Theamountoftheloanis$400,000(0.8)=$320,000ThemonthlypaymentisC=$320,000/=$2,348.10Thirtyyearsofpayments$2,348.10(360)=$845,316.00Eightyearsofpayments$2,348.10(96)=$225,417.60Thedifferenceistheballoonpaymentof$619,898.404.50TheleasepaymentisanannuityinadvanceC+C=$4,000C(1+20.4558)=$4,000C=$186.424.51Theeffectiveannualinterestrateis[1+(0.08/4)]4–1=0.0824Thepresentvalueoftheten-yearannuityisPV=900=$5,974.24FourremainingdiscountperiodsPV=$5,974.24/(1.0824)4=$4,352.43B-57AnswerstoEnd-of-ChapterProblems

公司理财习题答案第四章4.49ThepresentvalueofErnie’sretirementincomePV=$300,000/(1.07)30=$417,511.54ThepresentvalueofthecabinPV=$350,000/(1.07)10=$177,922.25ThepresentvalueofhissavingsPV=$40,000=$280,943.26Inpresentvaluetermshemustsaveanadditional$313,490.53InfuturevaluetermsFV=$313,490.53(1.07)10=$616,683.32HemustsaveC=$616.683.32/=$58,210.54B-57AnswerstoEnd-of-ChapterProblems'

您可能关注的文档

- 管理学习题答案.doc

- 管理学原理与方法课后习题答案(第五版)(周三多编写_复旦出版社).doc

- 管理学实务课后答案.doc

- 线代第六章答案.doc

- 经济学原理习题与答案.doc

- 经济学说史名词解释及课后习题答案.doc

- 经济法概论_习题集(含答案).doc

- 经济管理概论部分练习题答案.doc

- 给水工程课后思考题答案.doc

- 考研《马克思主义基本原理概论》课后习题答案全(2015最新).doc

- 考试大论坛:2011一级建造师《建设工程经济》复习题及答案.doc

- 聚合物加工工程习题及答案.doc

- 胡裕树 《现在汉语》课后习题答案 武汉大学学生制作.doc

- 自然地理学习题和答案3.doc

- 自然辩证法复习题答案.doc

- 自考04741《计算机网络原理》课后习题答案.pdf

- 自考《日语教程》课文翻译与练习答案.doc

- 自考《网络操作系统》(2010版)课后题目(带答案).doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明