- 325.00 KB

- 2022-04-22 11:45:35 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

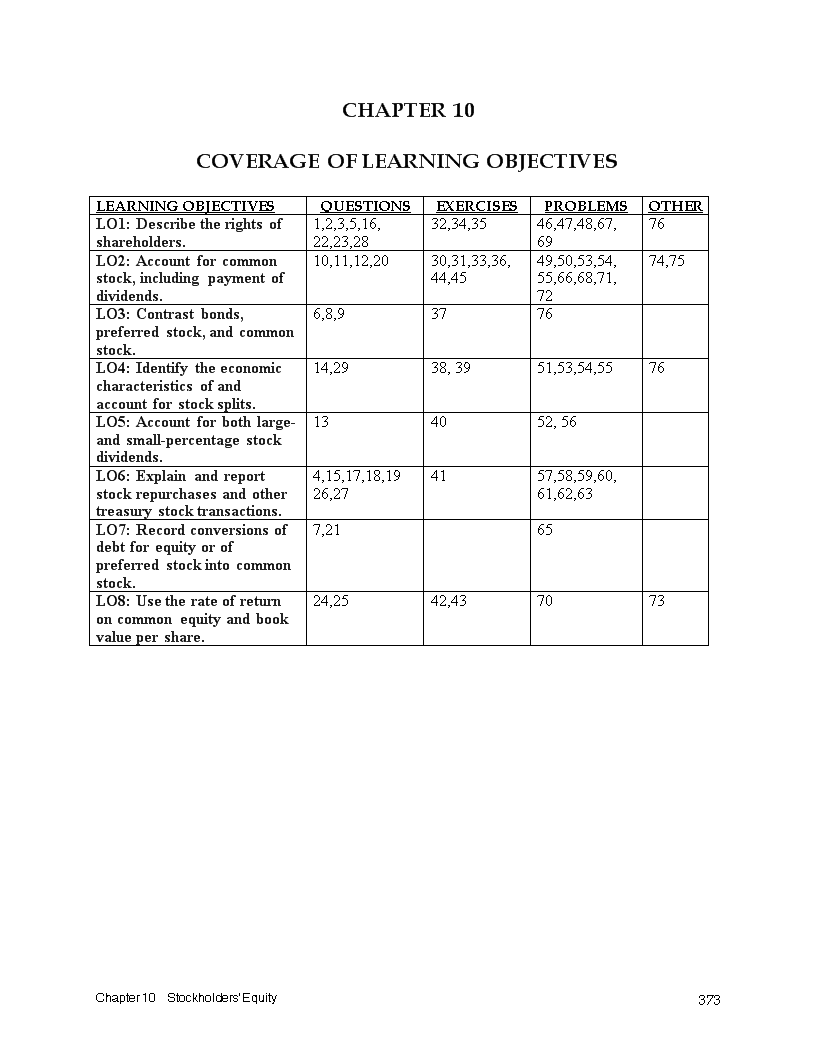

'CHAPTER10COVERAGEOFLEARNINGOBJECTIVESLEARNINGOBJECTIVESQUESTIONSEXERCISESPROBLEMSOTHERLO1:Describetherightsofshareholders.1,2,3,5,16,22,23,2832,34,3546,47,48,67,6976LO2:Accountforcommonstock,includingpaymentofdividends.10,11,12,2030,31,33,36,44,4549,50,53,54,55,66,68,71,7274,75LO3:Contrastbonds,preferredstock,andcommonstock.6,8,93776LO4:Identifytheeconomiccharacteristicsofandaccountforstocksplits.14,2938,3951,53,54,5576LO5:Accountforbothlarge-andsmall-percentagestockdividends.134052,56LO6:Explainandreportstockrepurchasesandothertreasurystocktransactions.4,15,17,18,1926,274157,58,59,60,61,62,63LO7:Recordconversionsofdebtforequityorofpreferredstockintocommonstock.7,2165LO8:Usetherateofreturnoncommonequityandbookvaluepershare.24,2542,437073419Chapter10Stockholders’Equity

CHAPTER1010-1Thepreemptiveprivilegegivespresentshareholderstheopportunitytopurchaseadditionalsharesdirectlyfromthecorporationbeforenewsharescanbesoldtothegeneralpublic.Inthisway,theshareholdersareabletomaintaintheirpercentageownership.10-2Unlikeindividualproprietorsorpartners,stockholders’personalassetscannotbeclaimedbycreditorstosatisfythedebtsofanincorporatedentity.10-3No.Beforeashareofcommonstockcanbeoutstanding,itmustbedulyauthorizedandissued.10-4No.Treasurystockisissuedstockthathasbeenrepurchasedbytheissuerandisnolongeroutstanding.10-5Dividendsareneverliabilitiesunlessdeclared.Hereliabilitiesisusedinthestrictaccountingsense.Cumulativedividendsareconditionalobligationsasthestatementimplies.10-6No.Liquidatingvalueisthedollarmeasurementofthepreferencetoreceiveassetsintheeventofcorporateliquidation.10-7Convertiblesecuritiesarebondsandstocksthatcanbetransformedintocommonsharesattheoptionoftheholder.10-8Preferredstockanddebtbothhavefixedpaymentrates.Apaymentonpreferredstockiscalledadividendwhilethepaymentondebtiscalledinterest.Whileinterestisalegalobligationontheperiodicpaymentdate,dividendsonpreferredandcommonstockarenotanobligationofthecompanyuntildeclaredbytheboardofdirectors.Interestisanexpenseandreducesnetincomewhilepreferredandcommondividendsdonotreducenetincome.Finallyinterestanddividendsareoftentaxeddifferentlyforboththeissuerandtheinvestor.10-9Bondsareriskierforthecorporationbecauseinterestandprincipalpaymentsarelegalresponsibilities.Preferredstockisriskierfortheinvestorbecausethecorporationhasnolegalobligationtopaydividendsandmostpreferredstockshaveaninfinitelife.10-10Whenacompanygrantsastockoptiontoanexecutive,itisgivingsomethingofvalueforservicesrendered.Existingfinancialmodelsallowustomeasurethevalueoftheseoptionswhentheyaregranted.Whenthecompanygrantsotheritemsofvaluetoemployees,theyrecordanexpense.10-11Stockoptionsrewardtheemployeesonlyifthestockappreciatesinvalue.Stockoptionscreateincentivesforemployeestoworkhardinthebestinterestsoftheshareholders.Therecanalsobetaxadvantagestooptions.419Chapter10Stockholders’Equity

10-12Cashdividendsarerealinthesensethattheyrequirethedisbursementofassets.Stockdividendsinvolvedisbursementofrealassetsonlywhenthedividendratepershareismaintainedandastockdividendresultsinanincreaseintotaldividends.10-13No.Itisimpossibletoincreaseeveryshareholders’fractionalportionofthecompanybecauseeveryshareholderreceivesthesameproportionaldistribution.10-14Theuseofhigh-percentagestockdividends(20%ormore)ismerelyanotherwayofobtainingastocksplit.Sometimessuchtransactionsarecalleda“stockspliteffectedintheformofastockdividend.”Whiletheeconomiceffectsarethesameforlargestockdividendsandforsplits,differentstockholders’equityaccountsmaybeinvolvedintheaccounting.10-15Yes,ifsharesarerepurchasedandpermanentlyretired,thepurchasepriceischargedagainstcommonstock,additionalpaid-incapital,andretainedearnings.Ifthesharesaretobeheldonlytemporarily,theyarelistedastreasurystockanddeductedfromstockholders’equityintotal,andindividualpartsofstockholders’equityarenotreduced.10-16No.Toretireshares,acompanymustpaythemarketpricepershare.10-17Therearemanyreasonsacompanymightbuybackitsownstock.Itmightbethemostefficientwaytodistributeexcesscashtoshareholders,especiallyafterconsideringtaxconsequences.Italsoallowsmoreflexibilityintimingandamountofpaymentthandoesthepaymentofdividends.Further,itmaynotcreateanexpectationofhigherdividendsinthefuture.Finally,itcandemonstratemanagement’sconfidenceintheprospectsforthecompany.10-18Treasurystockisnotanassetbecauseitisareductionofstockholders’equity.Treasurystockisacquiredbydistributingcashorotherassetstoshareholders.Itarisesfromareturnofassetspreviouslycontributedbyshareholders.10-19Althoughthespecificaccountingfortransactionsinthecompany’sownstockmayvaryfromcompanytocompany,oneruleisparamount.Anydifferencebetweentheacquisitionpriceandresalepriceoftreasurystockisneverreportedasaloss,expense,revenue,orgainintheincomestatement.Why?Acorporation’sowncapitalstockispartofitscapitalstructure.Itisnotanassetofthecorporation.Norisstockintendedtobetreatedlikemerchandiseforsaletocustomersataprofit.Therefore,changesinacorporation"scapitalizationshouldproducenoaccountinggainorloss,butshouldberecordedasdirectadjustmentstothestockholders’equity.10-20Theproperamountisthe“fairvalue”ofeithertheissuedsecuritiesortheincomingassets,whicheverismoreobjectivelydeterminable.Thatsameamountshouldbeusedbybothpartiestotheexchange.419Chapter10Stockholders’Equity

10-21Aconversionoptionallowsaninvestortoparticipateinacompany’ssuccessbyconvertingtocommonshares.Meanwhile,theinvestorcanreceivetheinterestonbondsordividendsonpreferredstock,andtheydonotbeartheriskofdeclinesinthepriceofthecommonstock.Theseoptionsarevaluable,sotheymakethebondorpreferredstockmorevaluabletoaninvestor.10-22Avoluntaryrestrictionondividend-declaringpowermaytaketheformofareserveforcontingencies(alsocalledanappropriationofretainedearningsforcontingencies).Thereservemaybeusedtorestrictdividendpaymentsinordertoretaincashforaparticularpurposesuchasplantexpansion.Completelyinvoluntaryarerestrictionsunderstatelawthatprohibitpaymentofdividendsifretainedearningsisnegativeordebtcovenantsrestrictsuchpayments.10-23Restrictionsondividend-declaringpowerprotecttherightsofcreditors.Suchrestrictionsmaybeanecessarytoborrowmoney.Theymayalsoreducetheinterestratelenderswouldrequire.Finally,restrictionsinforminvestorsabouttheintentionsoftheboard.10-24ROEprovidesinformationaboutthereturnsinvestorsingeneralgetfromthecumulativeinvestmentstheyhavemadeinthecompany.However,mostinvestorsdonotbuysharesdirectlyfromthecompany;theybuythemfromotherinvestorsinthemarket.Thus,whatashareholderpaysisoftenquitedifferentfromhisorhershareofstockholders’equity(bookvaluepershare).Anindividualinvestor’sreturnisbestmeasuredbydividendspluspriceincreasedividedbythepricepaidfortheshares.10-25Acommonstockwithamarketpriceoflessthanbookvaluemaynotnecessarilybeanattractiveinvestment.Theforecastedearningsofthecompanymaybetoolowtojustifyahighermarketprice.Thebookvaluemaynotrecognizealargecontingentliabilityfromalawsuit.Forexample,amajoruncertaintyfortobaccocompaniesrelatestothepossibilitythatlawsuitsbyformersmokerswillbesuccessful.Whiletheriskisreal,theoutcomeisfartoouncertaintorecordonthebooks.Further,bookvalueincludestheoriginalcostsofassets,whichmaybefarbeloworabovetheircurrentvalues.419Chapter10Stockholders’Equity

10-26Thisisareasonableargumentifcompanieswereallowedtorepurchaseshareswithoutinvestorsknowingwhattheyweredoing.However,intheUnitedStates,companiesmustannounceprogramstorepurchasesharesandarerestrictedfromtradingaroundthetimeofcertaininformationeventssuchasearningsreleases.So,aslongasthecompanyannouncesthattheywillberepurchasingbeforedoingso,itdoesnotseemthereismuchofaproblem.Aspointedoutinthetext,everyoneisbetteroffwithrepurchasesthanwithdividends.Repurchasesallowthosewhodesirecashtoobtainitatlowertaxcostthanifitwerereceivedasadividendandprotectsthosewhodonotwantcashfromreceivingadividend,payingtaxes,andhavingtoreinvesttheaftertaxproceedsfromthedividend.Further,noshareholderisforcedtosellsharesbacktothecompany.10-27Thenotionofgainsorlossesintheincomestatementthatarisefromtransactionsinthecompany’sownstockisproblematicfortworeasons.First,itsuggeststhatthecompanyisinthebusinessofbuyingandsellingitsownstock.Thisisfalse.Thecompanyshouldneverseektomakegainsorlossesintransactionswithitsshareholders.Soifitisnotanactivitythatispartoftheongoingprofit-makingintentionofthecompany,itshouldnotbeshownintheincomestatement.Moreover,companiesannouncetheirintentionstobuysharesoftheirstock.Itisbasicallyatransactionthatisanalternativetoissuingdividends.Ifthegoalistofacilitatestockholdersintheirdesirestoenhancetheircashpositionswithoutcommittingtocashdividendseveryquartergoingforward,itisnotasourceofoperatinggainsandlosses.10-28Yourfriendisontosomething.Parvalueandtherelatedconceptofstatedvaluebothhavesomelegalsignificanceinvariousstates.However,thetruthisthatthenumberofstatesandindividualcompaniesforwhomitmattersissmall.Forpracticalpurposes,thistextwouldprobablynotcoverthetopicifitwerenotsocommoninpublishedfinancialstatements.10-29Strictlyspeaking,thisplandoesnotmakesense.Ifastockissplitoralargestockdividendisissued(morethan25%),thepricepershareshouldusuallydeclineinproportionwiththenewissue.Thecompanyhasnomoreresourcesthanithadbeforeandifeachofoursharesrepresentsasmallerpercentageofownership,weshouldexpectthevalueofasharetodropproportionately.However,practicallyspeaking,overtherecentpast,thishasbeenareasonablysuccessfulstrategy.Itishardtoexplainwhy.Perhapsitsuggeststhatmanagement’sdecisionprovidesnewinformation.Ifmanagementdidnotexpectthingstokeepgoingwell,theywouldnotundertakethisstep.Thus,theactofissuingasplitordividendsays,“Iamrathersurethingswillkeepgoingwell,astheyhavebeen.”419Chapter10Stockholders’Equity

10-30(5min.)Therewere1,750,000sharesissuedandoutstanding,and1,000,000unissuedshares:Issuedandoutstanding:2,000,000–250,000=1,750,000Unissued:3,000,000–2,000,000=1,000,000Summary(notrequired)NumberofSharesAuthorized3,000,000Unissued(1,000,000)Issued2,000,000Deduct:Sharesheldintreasury(250,000)Issuedandoutstanding1,750,00010-31(5min.)(Amountsinmillions.)Issuedandoutstanding:2,097–758=1,339sharesUnissued:4,688–2,097=2,591sharesSummary(notrequired):(inmillions)NumberofSharesAuthorized4,688Unissued(2,591)Issued2,097Deduct:Sharesheldintreasury(758)Issuedandoutstanding1,33910-32(20min.)SeeExhibit10-32onthefollowingpage.419Chapter10Stockholders’Equity

EXHIBIT10-32LiquidationofClaimsUnderVariousAlternatives(InThousands)TotalCashProceedstobeDistributedAccountBalances$1,400$1,100$800$600$400$200Accountspayable$300$300$300$300$300$240*$120*Unsubordinateddebentures200200200200200160*80*Subordinateddebentures300300300300100Preferredstock($20parvalueand$24liquidatingvaluepershare)100120120Commonstockandretainedearnings300480180Totalliabilitiesandshareholders’equity$1,200Totalcashproceedsdistributed$1,400$1,100$800$600$400$200*Ratioof60:40becauseofclaimsof$300,000and$200,000,respectively.419Chapter10Stockholders’Equity

10-33(5–10min.)Amountsareinmillionsofyen.1.Issueprice=¥158,611÷1,669.629122shares=¥94.9977Cash158,611Commonstock103,517Capitalsurplus55,094Toaccountfor¥62parvaluesharesissuedat¥95pershare:¥62×1,669.629122=¥103,517And(¥94.9977–¥62)×1,669.629122=¥55,0942.IntheUnitedStates,parvalueisusuallysmallinrelationtotheissuepriceofcommonshares.ForKawasakiHeavyIndustries,theparvalueis¥62÷¥94.9977=65%oftheissueprice.10-34(15–20min.)1. PreferredDividends CommonDividendsNetIncomeDeclaredInArrearsDeclared20X1$(5,000,000)–$5,000,000–20X2(4,000,000)–10,000,000–20X315,000,000$6,000,000**9,000,000*–20X420,000,00014,000,000***–$6,000,000***20X514,000,0005,000,000–9,000,000Total$40,000,000$25,000,000$15,000,000*$5millionperyeartimes3years,less$6millionpaidin20X3.**Availabletodeclare=$(5)+$(4)+$15=$6million.Allgoestopreferred.***Availabletodeclare=$20million,preferredreceives$9millionarrearageplus$5millionfor20X4,balancetocommon.Theboardofdirectorsisnotlegallyobligatedtodeclaredividendsatanytime.Whethertheseamountswouldbedeclaredandpaidattheindicatedtimeswoulddependonthecashposition,liabilities,andgeneralfinancialplans.Indeed,thelikelihoodoftheselargedividendsbeingpaidsosoonissmall.Nonetheless,aslongasthebalanceofretainedearningsispositive,inmoststates,theboardcouldlegallydeclaredividendsthatwoulddecreasethebalancetozero.Holdersofcumulativestockwouldreceiveaccumulateddividendsbeforetheholdersofcommonsharesreceivedanydividends.Failuretopaydividendsatthespecificdatesresultsinarrearages,whichisawordcommonlyusedtodescribeaccumulatedunpaidpreferreddividends.Theamountofdividendsinarrearsisnotaliability.Why?Becausenodividendsareliabilitiesuntildeclared.419Chapter10Stockholders’Equity

2.NetIncomeDividendsDeclaredPreferredCommon19X1$(5,000,000)––19X2(4,000,000)––19X315,000,000$5,000,000$1,000,00019X420,000,0005,000,00015,000,00019X514,000,0005,000,0009,000,000$40,000,000$15,000,000$25,000,000Ifthepreferredisnotcumulative,preferredshareholdersgetonly$15,000,000comparedto$25,000,000otherwise.10-35(5–10min.)Thispreferredstockiscumulative,soallmissedpreferredstockdividendsmustbepaidbeforepayinganycommonstockdividends.Preferreddividendsfor20X1,20X2,and20X3are:.07×$3,000,000×3=$630,000Afterpaying$630,000inpreferreddividends,$370,000isleftforcommonstockdividends:$1,000,000–$630,000=$370,00010-36(10min.)Amountsareinmillionsofyen.Amountofdividends:1,814.6million×¥77=¥139,724millionDeclaration:Dividendsdeclared139,724Dividendspayable139,724Torecorddividendsof¥77pershare.Payment:Dividendspayable139,724Cash139,724Torecordpaymentofcashdividends.419Chapter10Stockholders’Equity

10-37(10min.)Cash80,000Commonstock8,000Additionalpaid-incapital72,000Torecordissueof4,000sharesuponexerciseofoptionstoacquirethem@$20pershare.Themanagershaveoptionsonstockthathasavalueof4,000×$40=$160,000.Thegainis$80,000,sincetheymustpay$80,000toacquiretheshares.Thissubstantialeconomicbenefitresultsfromasignificantriseinthestockpriceover3years.Proponentsofstockoptionswouldsaythatmanagershadworkedhardatthecompanyandbeingrewardedappropriatelyforthebenefitsthecompanyhadexperienced.Criticswouldaskwhetherthewholeeconomyandthestockmarkethaddoubledduringthese3yearsand,ifso,wouldarguethatmanagershadbenefitedfromthatgeneralimprovement.10-38(15min.)Becausetheparvalueofthestockincreasedby50%,from$8,802,000to$13,203,000,DeanFoodshada3-for-2stocksplitora50%stockdividend.Theclassicideaofastocksplithasbeentoissueanumberofsharesinexchangeforeachshareofstocknowoutstanding.Thusa3-for-2splitofa$30-parstockwouldmeanthatashareholderwouldreceivethree$20-parsharesforeachtwo$30-parsharesexchanged.Thisentailsnoformalchangeinthetotaldollarbalanceofcommonstock.Asapracticalmatter,companiesoftenaccomplishsuchasplitviaa50%“stockdividend.”DeanFoodsusedthe50%stockdividenddevice,therebyautomaticallyissuingoneadditionalshareforeachtwosharesoutstanding.Thisnecessitatedchargingretainedearningsatparforthetotaladditionalsharesissuedbecausetheparvaluewasnotreducedasitoftenisforastocksplit.Thiswayofobtainingasplithasagreatattractionbecauseitdoesnotinvolvethebotherandexpenseofexchangingcertificates.“Stockdividends”of25%ormoreareessentiallystocksplitsandshouldbeaccountedforassuch.However,eventhoughastockdividendrequiresareductionofthebalanceinRetainedEarningsandanincreaseinCommonStock,totalstockholders’equityisunaffected.Insubstance,thereisnoimportantdifferencebetweenthetwowaysofaccomplishingstocksplits.Thus,Dean’saccountingdoesnotconflictwiththedefinitionofastocksplit—allshareholdersreceiveadditionalshareswithoutpayinganyadditionalcashandtherebymaintaintheirpercentageownershipofthecompany.419Chapter10Stockholders’Equity

10-39(5–10min.)1.Areversestocksplit,likearegularstocksplit,doesnotaffectanyoftheaccountbalances.Onlythenumberofsharesandtheparvalue(whichisnotshownbyQED)arechanged.QEDEXPLORATION,INC.Stockholders’equity:Commonstock,3,000,000sharesauthorized,2,353,000sharesissued$287,637Additionalpaid-incapital3,437,547Retainedearnings2,220,895Lesstreasurystock,atcost,101,755shares(305,250)Totalstockholders’equity$5,640,8292.Sincethenumberofsharesisreducedbyafactoroften,thevalueofeachshareshouldbetentimeshigher.Thisisonemotivationforthereversesplit,toincreasethemarketvalueofeachshare.Theseissuesarenotdiscussedatlengthinthetext,butthesubsequentdiscussioncouldask,whyisthisdesirable?Tworeasonsmaybeworthdiscussing.Someinvestorsavoid,orareprohibitedfromtradinginsharesvaluedbelowsomethreshold,forexample,$1.Somestockexchanges,suchastheNYSE,requireminimumpricestoremainlistedfortrading.Amoresubtlepointrelatestothetransactionscostsinvestorsface.Brokers’commissionsmaybebasedonacombinationofnumberofsharesandpricepershares.Higherpricedsharesmayproducelowercommissionsforagivenpercentageownershipofthefirm.Inasimilarvein,thebid/askspreadisoftenaneighthoraquarterofapoint.Thiscostisincurredpershare.Areversesplitreducesthenumberofsharesinvolvedina$5,000or$10,000investmentandthusmayreducetransactioncosts.419Chapter10Stockholders’Equity

10-40(10min.)1.RetainedEarnings3,289,898DividendsPayable3,289,898Torecord$.34cashdividenddeclarationon10/28/2009.$.34×(9,755,480–79,310)=$3,289,8982.Retainedearnings33,176,718Commonstock73,726Additionalpaid-incapital33,102,992Torecord10%stockdividend.10%×(7,397,133–24,529)×$45.00=$33,176,7183.1995:1.1×100=1101998:1.5×110=1652003:1.1×165=181.52005:1.1×181.5=199.652006:1.1×199.65=219.62Normallypartialsharesarepaidincashsoanequallygoodansweris:2003:1812005:181×1.1=1992006:199×1.1=21810-41(5–10min.)1.Treasurystock58,005Cash58,005Purchasetreasurystockfor$38.67´1,500=58,0052.CommonStock,Paid-inCapital,andRetainedEarningswillbedecreasedby$.01×1,500=15;($25.00–$.01)×1,500=37,485;and($38.67–$25)×1,500=20,505;respectively.Commonstock15Paid-incapital37,485Retainedearnings20,505Cash58,005419Chapter10Stockholders’Equity

10-42(15min.)Amountsareinmillionsexceptpershareamountsandpercentage.1.Bookvaluepercommonshare=(Totalstockholders’equity–Bookvalueofpreferredstock)÷Numberofcommonsharesoutstanding=($118-$15)÷2=$51.502.Rateofreturnoncommonequity=(Netincome–Preferreddividends)÷Averagecommonequity=[$12–(8%×$15)]÷½×[($112–$15)+($118–$15)]=$10.8÷100=10.8%3.Beginningretainedearnings+Netincome–Preferreddividends–Commondividends=Endingretainedearnings$65.2+$12–$1.2–Commondividends=$69Commondividends=$7UsingaT-account,letX=CommondividendsRetainedEarnings1.2Balance65.2X12Balance69X=$7419Chapter10Stockholders’Equity

10-43(10min.)Dollaramounts(exceptpershareamount)areinthousands.Rateofreturnoncommonequity=(Netincome–Preferreddividends)Averageof(Totalstockholders’equity–Liquidatingvalueofpreferredstock)=($2,400–$400)÷½×[($18,400–$4,400)+($20,000–$4,400)]=$2,000÷½×($14,000+$15,600)=$2,000÷$14,800=13.5%Earningspershareofcommonstock=(Netincome–Preferreddividends)÷Averagenumberofsharesoutstanding=$2,000÷4,000=$.50Price-earningsratio=Marketpricepershareofcommonstock÷Earningspershareofcommonstock=$11.00÷$.50=22Dividend-payoutratio=Commondividendspershare÷Commonearningspershare=$.20÷$.50=40%Dividend-yieldratio=Commondividendspershare÷Marketpricepershareofcommonstock=$.20÷$11.00=1.8%Bookvaluepershareofcommonstock=(Stockholders’equity–Liquidatingvalueofpreferredstock)Numberofcommonsharesoutstanding=($20,000–$4,400)÷4,000=$3.90Notethatthebookvalueislowerthanthemarketvalue.Thisistypical.Theshareholdersarepayingforearningpowerratherthanforassets.419Chapter10Stockholders’Equity

10-44(15–25min.)Thedividendspayableitemisnotpartofstockholders’equity.ROSELLICORPORATIONStatementofStockholders’EquityDecember31,20X86%cumulativepreferredstock,$40parvalue,callableat$42,authorized100,000shares,issuedandoutstanding,100,000shares$4,000,000Commonstock,$2.50parvalue,authorized1.8millionshares,issued1.2millionsharesofwhich60,000sharesareinthetreasury3,000,000Additionalpaid-incapital:Preferred$1,000,000Common9,000,00010,000,000*Retainedearnings12,000,000Subtotal$29,000,000Deduct:Costof60,000sharesofcommonstockreacquiredandheldintreasury(4,000,000)Totalstockholders’equity$25,000,000*Manypresentationswouldnotshowthedetailedbreakdownofparvalueandadditionalpaid-incapitalforpreferredandcommonstocks.Preferredstockwouldbeshownasthesumofparandadditionalpaid-incapitalof$5,000,000.Similarly,commonwouldbe$12,000,000.419Chapter10Stockholders’Equity

10-45(10–15min.)Youmaywishtouseabalancesheetequationtoshowtheoveralleffectsofeachitem.1.05.08.–$1,0002.06.–$50,0009.+$1,2003.+$600,0007.010.+$8004.010-46(15min.)1.20X7and20X8preferreddividendsmustbepaidbeforeanycommondividendscanbepaid.Dividendsarenotpaidontreasurystock.Preferreddividends=.06×$10×(52,136–11,528)×2=$48,730Commondividends=$.04×(1,322,850–93,091)=$49,190Retainedearnings48,730Cash48,730Torecordthedeclarationandpaymentofpreferreddividendsfor20X7and20X8.Retainedearnings49,190Cash49,190Torecordthedeclarationandpaymentofcommondividendsof$.04pershare.2.Endingbalance=Beginningbalance+Netincome–Dividends=$2,463,951+$400,000–$48,730–$49,190=$2,766,031RetainedEarnings48,730Balance2,463,95149,190400,000Balance2,766,031419Chapter10Stockholders’Equity

10-47(15–20min.)1.Notethatadividendreinvestmentisnotthesameasatypicalstockdividend.Retainedearnings2,480,000,000Dividendspayable2,480,000,000Declarationofdividends,$.40×6,200,000,000shares.Dividendspayable2,480,000,000Cash2,232,000,000Commonstock248,000,000Torecordpaymentofcash(90%of$2,480,000,000)andissuanceof4,960,000additionalsharesunderautomaticdividendreinvestmentprogram.Amountofreinvestment:10%($2,480,000,000)$248,000,000Pricepershare÷$50Numberofshares4,960,0002.Theseautomaticplanssavebrokeragefeesandareaconvenientwayforacompanytoraiseadditionalcapital.Theletterwritermissesthepoint.Theshareholdercanhavecashifdesired(unlikestockdividends).Therefore,theamountisjustifiablysubjecttopersonalincometaxesbecausethecashis“constructivelyreceived.”Differentcorporationsareatdifferentstagesintheirgrowthcycles.Investorswhodonotdesiredividendsmayprefertoinvestingrowthstocksthatdonotpaydividends.Theseinvestorscanmeettheirperiodicneedsforcashbysellingshares.10-48(10min.)1.Thelogicalreasonswouldtypicallybehistorical,taxbased,orrelatedtoaccesstocapital.Sometimestheyarelinkedtovotingrights,aswithFordMotorCompanywherehistoricalfamilyholdingscarrysupervotingrights.ThatisnotthecasewithShell.Thedifferentclassesareanhistoricalresultofthe1907mergerofaDutchcompanywithaU.K.company.Ahistoricallycomplexstructurewassimplifiedin2004butthedifferentialpaymentcurrenciescontinue.TheU.S.ADRstructureisalong-standingU.S.mechanismforprovidingaccesstointernationalcompanies,butitisnotabouthowcompaniesissuestock.RatherisrepresentsamechanismformakinginternationalcompaniesavailabletoU.S.shareholdersviaatrustmechanismthatholdsclassAorBsharesandissuesADR’s.2.ShellpublishesitsfinancialstatementsinU.S.dollarsbecausethatistheinternationalcurrencyinwhichoiltransactionsarepriced.419Chapter10Stockholders’Equity

10-49(20–30min.)1.Cash10,000,000Commonstock1,600,000Additionalpaid-incapital8,400,000Torecordtheissuanceof400,000sharesof$4parvalueforanaveragepriceof$25pershare.2.Retainedearnings400,000Cash400,000Torecordthedeclarationandpaymentofcashdividendsof$1pershareonMarch31,20X2.3.Retainedearnings1,000,000Commonstock80,000Additionalpaid-incapital920,000Torecorda5%commonstockdividend,resultingintheissuanceof20,000shares.Retainedearningsisreducedattherateofthemarketvalueof$50pershareatdateofissuance.Before5%After5%StockStock Dividend Changes Dividend Commonstock,400,000$1,600,000+(20,000shares$1,680,000shares@$4par@$4par)=+80,000Additionalpaid-incapital8,400,000+[20,000shares9,320,000@($50–$4)]=+920,000Retainedearnings9,000,000–(20,000@$50)8,000,000=–1,000,000Stockholders’equity$19,000,000$19,000,000Overallmarketvalueofstock@assumed$50$20,000,000@assumed$47.62*$20,000,000*Totalsharesoutstanding400,000420,000Individualshareholder:Assumedownershipofshares5,0005,250Percentageownershipinterest1.25%Still1.25%*Manysimultaneouseventsaffectthelevelofstockprices,includingexpectationsregardingthegeneraleconomy,theindustry,andthespecificcompany.Thus,themarketpriceofastock419Chapter10Stockholders’Equity

maymoveineitherdirectionwhenastockdividendisdeclared.Theoryandcomplicatedcasestudiesindicatethatastockdividendshould,onaverage,havezeroeffectonthetotalmarketvalueofthefirm.Accordingly,thenewmarketpricepershareshouldbe$20,000,000÷420,000shares=$47.62.First,notethatindividualshareholdersreceivenoassetsfromthecorporation.Moreover,theirfractionalinterestsareunchanged;iftheyselltheirdividendshares,theirproportionateownershipinterestsinthecompanywilldecrease.Second,thecompanyrecordsthetransactionbytransferringthemarketvalueoftheadditionalsharesfromretainedearningstocommonstockand“paid-incapitalinexcessofpar.”Thisentryisoftenreferredtoasthe“capitalizationofretainedearnings.”4.InvestmentincommonstockofMinneapolisCo.125,000Cash125,000Torecordinvestmentin5,000sharesofanoriginalissueofMinneapolis"commonstockat$25pershare.Theparvalueis$4pershare.Cash5,000Dividendincome5,000Torecordreceiptofcashdividendsat$1pershare.Stockdividends:Nojournalentry,butamemorandumwouldbemadeintheinvestmentaccounttoshowthat5,250sharesarenowownedatanaveragecostof$125,000÷5,250or$23.81pershare.5.Cash*11,600Investmentincommonstock**4,762Gainonsaleofinvestment***6,838*(200×$58.00)=$11,600**(200×$23.81)=$4,762***[200×($58.00–$23.81)]=200×$34.19=$6,838419Chapter10Stockholders’Equity

10-50(20–30min.)1.Cash5,400,000Commonstock(atpar)600,000Additionalpaid-incapital4,800,000Torecordtheissuanceof600,000sharesof$1parvalueforanaveragepriceof$9pershare.2.Retainedearnings300,000Cash300,000Torecordthedeclarationandpaymentofcashdividendsof$.50pershareonDecember 31, 20X6.3.Retainedearnings360,000Commonstock12,000Additionalpaid-incapital348,000Torecorda2%commonstockdividend,resultingintheissuanceof12,000shares.Retainedearningsisreducedattherateofthemarketvalueof$30pershareatdateofissuance.Before2%After2%StockStock Dividend Changes Dividend Commonstock,600,000shares$600,000+(12,000shares$612,000@$1par(612,000after@$1par)dividend)=+12,000Additionalpaid-incapital4,800,000+[12,000shares5,148,000@($30–$1)]=+348,000Retainedearnings7,000,000–(12,000@$30)6,640,000=–360,000Stockholders’equity$12,400,000$12,400,000Overallmarketvalueofstock@assumed$30$18,000,000@$29.412*$18,000,000*Totalsharesoutstanding600,000612,000Individualshareholder:Assumedownershipofshares6,0006,120Percentageownershipinterest1%Still1%*Manysimultaneouseventsaffectthelevelofstockprices,includingexpectationsregardingthegeneraleconomy,theindustry,andthespecificcompany.Thus,themarketpriceofa419Chapter10Stockholders’Equity

stockmaymoveineitherdirectionwhenastockdividendisdeclared.Theoryandcomplicatedcasestudiesindicatethatastockdividendshould,onaverage,havezeroeffectonthetotalmarketvalueofthefirm.Accordingly,thenewmarketpricepershareshouldbe$18,000,000÷612,000shares=$29.412.First,notethatindividualshareholdersreceivenoassetsfromthecorporation.Moreover,theirfractionalinterestsareunchanged;iftheyselltheirdividendshares,theirproportionateownershipinterestsinthecompanywilldecrease.Second,thecompanyrecordsthetransactionbytransferringthemarketvalueoftheadditionalsharesfromretainedearningstocommonstockand“additionalpaid-incapital.”Thisentryisoftenreferredtoasthe“capitalizationofretainedearnings.”4.InvestmentincommonstockofGarciaCompany45,000Cash45,000Torecordinvestmentin5,000sharesofanoriginalissueofGarciaCompanycommonstockat$9pershare.Theparvalueis$1pershare.Cash2,500Dividendincome2,500Torecordreceiptofcashdividendsat$.50pershare.Stockdividends:Nojournalentry,butamemorandumwouldbemadeintheinvestmentaccounttoshowthat5,100sharesarenowownedatanaveragecostof$45,000÷5,100or$8.82pershare.5.Cash*6,600InvestmentincommonstockofGarciaCompany**1,764Gainonsaleofinvestment***4,836*(200×$33.00)=$6,600**(200×$8.82)=$1,764;$8.82=originalcost÷numberofshares($45,000÷5,100)***[(200×($33.00–$8.82)]=200×$24.18=$4,836419Chapter10Stockholders’Equity

10-51(15–20min.)1.Thelettershouldcontainthefollowingpoints:a)Astocksplitisachangeofformbutnotsubstance.Whyisitconsidered“goodnews”?b)A5-for-4stocksplitaccomplisheslittle.Ithasonlyasmalleffectonthetradingrangeofthestock"sprice.Forexample,a$40stockbecomesa$32stock.Itisunlikelythatsuchasmallchangewillaffectthemarketabilityofthestock.2.Thefirmisdoingwellfinanciallyandwearethereforeabletoincreasecashdividends.Weincreasedthenumberofsharesyouownandalsoincreasedthecashdividendratepershare.Asaresult,ashareholderowning100shareswillhavea12%increaseindividendpaymentspershareandhave25%moreshares.Thetotalcashdividendincreaseis40%.(1.12×1.25)–1.00=40%.TeachingNote:Somestudentsmayinterprettheincreaseof12%asappliedtototaldividends.Thefollowingillustratesthealternatives.Whatcashdividendspersharewillbepaidafterthesplit?Willthecurrentratepershare,includingthe12%increase,bemaintainedonthenewshares?Ifso,thestocksplitincreasesdividendsanother25%,foratotalcashdividendincreaseof(1.12×1.25)–1.00=40%.Ontheotherhand,tomaintainonlythe12%totaldividendincrease,thecashdividendspersharemustfallafterthesplit.Thecashdividendratepersharethatmaintainscashdividendsatthepre-splitlevel(thatis12%abovelastyear"slevel)is1.00÷1.25=80%ofthepre-splitcashdividendspershareand1.12÷1.25=89.6%oflastyear"scashdividendrate.Consideranexamplewherelastyear"scashdividendswere$10.00pershare.The12%increaseraisesthecashdividendrateto$11.20pershare.Anowneroffoursharesreceivesdividendsof$44.80comparedtothepreviousamountof$40.Ifthestocksplits5-for-4andthe$11.20rateismaintained,cashdividendsforthestockholderare5×$11.20=$56,anincreaseof($56÷40)–1=40%.Ifthecashdividendspersharefallto.8×11.20=$8.96pershare,theownerwouldreceive5×$8.96=$44.80,thesameamountasjustbeforethestocksplit.Youmaywishtousethisproblemtodiscussthebenefitsofasharerepurchaseplanratherthandividendincreases.Iftheadditionalcashpaymentswereusedtorepurchasesharesratherthantopaydividends,twobenefitsaccrue.Thefirm“buysout”itsleastenthusiasticowners.Furthermore,lessofthepaymentsgototaxes.Ifdividendsarepaid,theyare100%taxabletotherecipient.Inarepurchase,onlytheseller’sgainistaxed.3.Thestockholderwillstillreceive$4,200.Theofferpricepersharewaschangedinproportiontotheincreaseinthenumberofshares.Notethat100×$42=$4,200and125×$33.60=$4,200.Thechangeinform,thestocksplit,didnotaffectthesubstanceoftheoffer,thetotalpriceofferedforUnitedFinancial.419Chapter10Stockholders’Equity

10-52(15–20min.)1.Retainedearnings5,000,000Commonstock,$1par497,000Additionalpaid-incapital4,473,000Cash30,000Torecord5%stockdividend.Totaladditionalshareswere5%×10,000,000=500,000.Cashof$30,000waspaidinlieuof3,000shares;therefore497,000newshareswereissued.2.SODERSTROMCOMPANYStockholders’EquityCommonstock,10,497,000shares,$1par$10,497,000Additionalpaid-incapital*44,473,000Retainedearnings**45,000,000Totalstockholders’equity$99,970,000*40,000,000+4,473,000**50,000,000–5,000,0003.Thestockholders’equitydecreased$30,000,theamountofcashpaidinlieuoffractionalshares.Ifallnewshareshadbeenissued,totalstockholders’equitywouldhavebeenunaffectedbythestockdividend.Exceptfortheeffectoffractionalshares,eachshareholderownsthesameproportionofthecompanyasheorshedidbeforethestockdividend.Theeffectofpayingcashinlieuoffractionalsharesistoreduceby$30,000thesizeofthecompany.Shareholderswhoreceivednocashwouldhaveaslightlyincreasedproportionalownershipinterest.SupposeAowned1%ofthecompanybeforethestockdividendandreceivednocashinlieuoffractionalshares.A"sownershipshareafterthestockdividendwouldbe(1%×$100,000,000)÷$99,970,000=1.0003%.419Chapter10Stockholders’Equity

10-53(15min.)1.1/2/X1Cash200,000Commonstock20,000Additionalpaid-incapital180,000Torecordtheissuanceof20,000$1parcommonstockfor$10pershare.12/27/X1Retainedearnings2,000Dividendspayable2,000Torecordthedeclarationofdividendsof$.10pershare.1/15/X2Dividendspayable2,000Cash2,000Torecordthepaymentofdividends.1/30/X2Commonstock1,000Additionalpaid-incapital7,000Cash8,000Torecordtheretirementof1,000sharespurchasedfor$8.00pershare.419Chapter10Stockholders’Equity

2.CHIPPEWAINVESTMENTCOMPANYBalanceSheetAsofDecember31,20X1AssetsLiabilitiesandStockholders’EquityCash$210,000*Liabilities:Totalassets$210,000Dividendspayable$2,000Stockholders’equity:Commonstock$20,000Additionalpaid-incapital180,000Retainedearnings8,000TotalStockholders’Equity$208,000Totalliabilitiesandstock-holders’equity$210,000*$214,000–$4,000419Chapter10Stockholders’Equity

10-54(20–30min.)1.Cash3,500,000Commonstock500,000Additionalpaid-incapital3,000,000Torecordtheissuanceof100,000sharesof$5parvaluestockforanaveragepriceof$35pershare.Analternatejournalentryfollows:Cash3,500,000Paid-incapital,commonstock3,500,0002.BeforeAfter2-for-12-for-1SplitChangesSplit –100,000@$5parCommonstock,100,000shares+200,000@$5par$500,000@$2.50par$500,000Additionalpaid-incapital3,000,0003,000,000Totalpaid-incapital3,500,0003,500,000Retainedearnings4,000,0004,000,000Stockholders’equity$7,500,000$7,500,000Thereisnoeffectonthereportedamountofthetotalstockholders’equity.Althoughnoformaljournalentryisrequired,theunderlyingstockholderrecordswillbechangedtoindicatethenumberofsharesheldbyeachshareholder.419Chapter10Stockholders’Equity

3.BeforeAfter100%Stock100%StockDividendChangesDividendCommonstock,100,000+(100,000sharesshares@$5par$500,000@$5)=$500,000$1,000,000Additionalpaid-incapital3,000,0003,000,000Totalpaid-incapital$3,500,000$4,000,000Retainedearnings4,000,000–$500,000par3,500,000_________valueof“dividend”_________Stockholders’equity$7,500,000$7,500,000Thejournalentrywouldbe:Retainedearnings500,000Commonstock500,000Torecordstocksplitintheformofa100%stockdividend,necessitatingatransferfromRetainedEarningstoCommonStockoftheparvalueoftheadditionalsharesissued,100,000×$5=$500,000.4.InvestmentincommonstockofLopezCompany70,000Cash70,000Torecordinvestmentin2,000sharesofanoriginalissueofLopezCompanycommonstockat$35pershare.Theparvalueis$5pershare.Thestocksplitat2for1(orreceiptofa100%“dividend”)wouldcallfornojournalentry.Amemorandumwouldbemadetoshowthat4,000sharesarenowheldatacostof$17.50eachinsteadof2,000sharesatacostof$35each.419Chapter10Stockholders’Equity

10-55(20–30min.)Dollaramountsareinmillions.1.Cash2,800Commonstock200Additionalpaid-incapital2,600Torecordtheissuanceof200millionsharesof$1parvaluecommonstockforanaveragepriceof$14pershare.Analternatejournalentryfollows:Cash2,800Paid-incapital,commonstock2,8002.Before2-for-1SplitChanges After2-for-1SplitCommonstock,200millionshares@$1par$200–200@$1par+400@$.50par$200Additionalpaid-incapital2,6002,600Totalpaid-incapital2,8002,800Retainedearnings5,0005,000Stockholders’equity$7,800$7,800Thereisnoeffectonthereportedamountofthetotalstockholders’equity.Althoughnoformaljournalentryisrequired,theunderlyingstockholderrecordswillbechangedtoindicatethenumberofsharesheldbyeachshareholder.3.Before100%StockDividendChanges After100%StockDividendCommonstock,200millionshares@$1par$200+(200@$1)=200$400Additionalpaid-incapital2,6002,600Totalpaid-incapital2,8003,000Retainedearnings5,000–200parvalueof“dividend”4,800Stockholders’equity$7,800$7,800Thejournalentrywouldbe:Retainedearnings200Commonstock200Torecordstocksplitintheformofa100%stockdividend,necessitatingatransferfromRetainedEarningstoCommonstockoftheparvalueoftheadditional419Chapter10Stockholders’Equity

sharesissued,200million×$1=$200million.4.(Amountsnotinmillions)InvestmentincommonstockofAT&T14,000Cash14,000Torecordinvestmentin1,000sharesofanoriginalissueofAT&Tcommonstockat$14pershare.Thestocksplitat2for1(orifreceivedasa100%“dividend”)wouldcallfornojournalentry.Amemorandumwouldbemadetoshowthat2,000sharesarenowheldatacostof$7.00eachinsteadof1,000sharesatacostof$14each.10-56(10–15min.)1.Therearetwopossiblewaystoaccountforthestocksplit.Thefirstrequiresnojournalentry.Theparvaluepershareissimplychangedfrom$1to$.50,andthenumberofsharesoutstandingischangedfrom300,000to600,000.Physicallytheissuingcompanymustexchangeshareswithitsshareholders.Thesecondwaywouldentailnochangeinparvalueandthefollowingjournalentry:Additionalpaidincapital300,000Commonstock300,0002.Retainedearnings300,000Commonstock,$1par300,000Torecorda100%stockdividend.3.Thereisnodifferenceinsubstance.Inform,thestocksplitresultsinahalvingoftheparvaluepersharebutthe100%stockdividenddoesnotaffectparvaluepershare.The100%stockdividendrequiresadecreaseinretainedearningsandanincreaseincommonstockintheamountoftheparvalueofthenewshares,$300,000,butnoequitybalancesareaffectedbyastocksplit.10-57(15–20min.)Accountbalancesandentriesinmillions.1.Treasurystock1,603Cash1,603Toacquire21.4millionshares2.$10,520million+$1,603million–$11,676million=$447million.3.Treasurystock7.6Cash7.6Toacquire100,000treasuryshares@7.6pershareJanuary2,2009Stockholders’equity=$9,879–$7.6=$9,871.4419Chapter10Stockholders’Equity

4.Cash9.0Treasurystock7.6Additionalpaid-incapital1.43Mmightmaintainaninternalseparationofitspaid-in-capitalanddistinguishthisascapitalfromatreasurystocktransaction.Thejournalentryassumesthisisnottrue.ManycompaniesadoptaLIFOorFIFOcostflowassumptionfortreasuryshares,mostoftenFIFO.Theproblemcouldbereadtoimplyspecificidentification,butthisisrare.5.Cash5.0Additionalpaid-incapital2.6Treasurystock7.6SomecompaniesdivideAdditionalPaid-inCapitalintoseveralseparateaccountsthatidentifydifferentsourcesofcapital,forexample:Additionalpaid-incapital–preferredstockAdditionalpaid-incapital–commonstockAdditionalpaid-incapital–treasurystocktransactionsAconsistentaccountingtreatmentwouldcallfordebitingonlyAdditionalPaid-inCapital–TreasuryStockTransactions(andnootherpaid-incapitalaccount)fortheexcessofthecostovertheresalepriceoftreasuryshares.Ifthereisnobalanceinsuchapaid-incapitalaccount,thedebitshouldbemadetoRetainedEarnings.419Chapter10Stockholders’Equity

10-58(25min.)Dollaramounts(exceptpershareamounts)andnumbersofsharesareinmillions.1.Beginningbalance,treasuryshares$36,896Purchasesoftreasuryshares3,508DispositionsoftreasurysharesX=$3,707*Endingbalance,treasuryshares$36,697*X=$36,896+$3,508–$36,697=$3,7072.Numberoftreasurysharespurchased,$3,508÷$20175.4Numberoftreasurysharesdisposedof,$3,707÷$25148.3Totalincreaseinnumberoftreasureshares27.13.Therearetwomainwaystoreturnmoneytoshareholders,payingdividendsandbuyingbacksharesofstock.GeneralElectrichashistoricallyusedboth.In1999,forexample,GeneralElectricreturned$7,488toshareholdersbypurchasingitsownsharesandreturned$4,786bypayingcashdividends.In2008thesenumberswere$1,649and$3,508respectively.NotethatGEhasshiftedcashdistributionstoshareholderstobemoredividendbasedandlessrepurchasebased. Thefinancialcrisisin2008–2009leadtoabreakinthepriorpatternofconsistentdividendincreases. Changesindividendsareimportantsignalstothefinancialmarketsandreductionsareinterpretedbythefinancialmarketsasstatementsaboutthelongtermabilitytogeneratesteadyorincreasingcashflow. BecauseGEhadbeenmakinglargesharerepurchases,whentherecessionbegan,theydidnothavetoslashdividendpaymentsasmuchastheywouldhaveifalldistributionstoshareholdershadbeenviadividends. Theuseofsharerepurchasesincreasedflexibilityindividenddistributionsasconditionsworsened.10-59(15min.)1.$34,420,000,000÷$81.00=424,938,272shares2.Bookvalue=$112,965million÷4,976million*=$22.70*Outstandingshares=8,019million–3,043million=4,976million419Chapter10Stockholders’Equity

10-60(15–20min.)BeforeRepurchaseofOutstanding Shares ChangesBecauseof Retirement AfterRepurchaseofOutstanding Shares CommonStock,6,000,000$12,000,000–(200,000shares@$2)$11,600,000shares@$2par=–$400,000Paid-incapitalinexcessofpar48,000,000–(200,000shares@$8)46,400,000=–$1,600,000Totalpaid-incapital$60,000,000$58,000,000Retainedearnings10,000,000–(200,000shares@$20)=–$4,000,0006,000,000Stockholders’equity$70,000,000$64,000,000Averageinitialpaid-in-capitalis$8calculatedas$48,000,000÷6,000,000.Thejournalentrywouldreversetheoriginalaveragepaid-incapitalpershareandwouldchargeanyadditionalamounttoretainedearnings.Theadditional$20issometimesdescribedasbeingtantamounttoaspecialcashdividendpaidtothe200,000shares:Commonstock400,000Paid-incapitalinexcessofpar1,600,000Retainedearnings4,000,000Cash6,000,000Torecordretirementof200,000sharesofstockfor$30cashpershare.Theoriginalpaid-incapitalwas$10pershare,sotheadditional$20pershareisdebitedtoRetainedEarnings.419Chapter10Stockholders’Equity

10-61(15min.)1.Cash55,000Treasurystock50,000Additionalpaid-incapital5,000Torecordsaleof5,000sharesoftreasurystockfor$11pershare.Costwas$10pershare.2.Cash45,000Additionalpaid-incapital5,000Treasurystock50,000Torecordsaleof5,000sharesoftreasurystockfor$9pershare.Costwas$10pershare.3.Cash35,000Additionalpaid-incapital5,000Retainedearnings10,000Treasurystock50,000Torecordsaleof5,000sharesoftreasurystockfor$7pershare.Costwas$10pershare.Notethatthemaximumamountthatcouldbedeductedfromadditionalpaid-incapitalwasthe$5,000addedtoadditionalpaid-incapitalwhenthefirst5,000sharesoftreasurystockweresold.Theextra$10,000hadtobedeductedfromretainedearnings.4.No.Buyingorsellingtreasurystockneverresultsinrecognizinggainsorlossesontheincomestatement.Treasurystocktransactionsarechangesinacorporation"scapitalization,notpartofitsprofitgenerationactivities.419Chapter10Stockholders’Equity

10-62(10min.)1.(InMillionsofDollars)AfterDividendBefore Paymentsof Dividends$ 4$ 1 Paid-incapital$24$24$24Retainedearnings847Total322831Deduct:Costoftreasurystock666Stockholders’equity$26$22$252.Typicallystatesdonotpermitdividendsifretainedearningsdoesnotexceedthecostofanytreasurystockonhand.Alackofthisrestrictioncouldjeopardizethepositionofthecreditors.Withouta$6millionrestrictionofretainedearnings(thecostofthetreasuryshares),thecorporationcouldpayadividendof$4millionasspecifiedin1aandthusreducethestockholders’equitybelowthepaid-incapitalof$24million.Inourexample,thisrestrictionof$6millionwouldleaveunrestrictedretainedearnings(andmaximumlegalpaymentofdividends)of$8–$6,or$2million.Thus,thelargestdividendallowedwouldbe$2million.10-63(10–20min.)1.Thestockholders’equitysectionwouldbeaffectedasfollows:BeforeAfterRepurchaseChangesRepurchaseof100,000Becauseofof100,000OutstandingTreasuryOutstanding Shares Stock Shares Commonstock,2,000,000shares@R3parR6,000,000R6,000,000Paid-incapitalinexcessofpar34,000,00034,000,000Totalpaid-incapitalR40,000,000R40,000,000Retainedearnings18,000,00018,000,000TotalR58,000,000R58,000,000Deduct:Costoftreasurystock––4,000,0004,000,000Stockholders’equityR58,000,000R54,000,000Thejournalentrywouldbe:Treasurystock4,000,000Cash4,000,000Torecordacquisitionof100,000sharesofcommonstock@R40(to419Chapter10Stockholders’Equity

beheldastreasurystock).Notethatthetreasurystockaccountdoesnotrepresentanassetbutanegativeelementofstockholders’equity.2.Cash5,000,000Treasurystock4,000,000Paid-incapitalinexcessofpar1,000,000Torecordsaleoftreasurystock,100,000shares@R50.CostwasR40pershare.3.Cash3,000,000Paid-incapitalinexcessofpar1,000,000Treasurystock4,000,000Torecordsaleoftreasurystock,100,000shares@R30.CostwasR40pershare.Ifthetreasurysharesareresoldbelowtheircost,accountantstendtodebitAdditionalPaid-inCapitalforthedifference,$10pershareinthiscase.AdditionalPaid-inCapitalissometimesdividedintoseveralseparateaccountsthatidentifydifferentsourcesofcapital,forexample:Additionalpaid-incapital–preferredstockAdditionalpaid-incapital–commonstockAdditionalpaid-incapital–treasurystocktransactionsAconsistentaccountingtreatmentwouldcallfordebitingonlyAdditionalPaid-inCapital–TreasuryStockTransaction(andnootherpaid-incapitalaccount)fortheexcessofthecostovertheresalepriceoftreasuryshares.IfthereisnobalanceinsuchaPaid-inCapitalaccount,thedebitshouldbemadetoRetainedEarnings.Theaccountingillustratedhereassumesongoingtransactionsintreasurystock.Asillustratedinthetext,whensharesarepurchasedintheopenmarketandretired,paid-incapitalaccountsarereducedproportionatelyandretainedearningsisalsotypicallyreduced.4.Bookvalueiscalculatedbasedonoutstandingshares.TheoriginalbookvaluepersharewasR29.Thenewbookvalueswillbe:(1)R54,000,000/1,900,000shares=R28.42(2)R59,000,000/2,000,000shares=R29.50(3)R57,000,000/2,000,000shares=R28.50419Chapter10Stockholders’Equity

10-64(10–15min.)Sourcingofdividendpaymentsistypicallyimportantbecauseoftaxissuesorlocalrestrictionsonpayments.IntheUnitedStates,forexample,dividendsfromU.S.companiesaretaxedat15%butdividendsfrominternationalcompaniesaretaxedmore.Thatmaybeanissue.Parentcompaniesmayfacedifferentrestrictionsondividendpayments.IntheNetherlandscivilcodespermitdividendsonlytotheextentthatthenetequityexceedscontributedcapitalplusrequiredreserves.Belgianlawsrequireaccumulationof5%ofannualprofitinareserveuntilsuchreservereaches10%ofcapitalanddividendscannotcausecapitaltofallbelowpaid-incapitalplusthereserve.10-65(10–15min.)1.SeeExhibit10-65onthefollowingpage.419Chapter10Stockholders’Equity

EXHIBIT10-65Assets=Liabilities+Stockholders’Equity Cash Preferred Stock AdditionalPaid-inCapital, Preferred Common Stock AdditionalPaid-inCapital, Common HartfordCompanyBooksIssuanceofpreferred+150,000=+50,000+100,000Conversionofpreferred=–50,000–100,000+10,000+140,000 Cash InvestmentinHartford Preferred InvestmentinHartford Common BostonCompanyBooksAcquisitionofpreferred–150,000+150,000=Conversionofpreferred–150,000+150,000=419Chapter10Stockholders’Equity

2.Onissuer’sbooks(Hartford):Cash150,000Preferredstock,convertible50,000Additionalpaid-incapital,preferred100,000Torecordissuanceof10,000sharesof$5parpreferredstockconvertibleintoonecommonshareforonepreferredshare.Preferredstock,convertible50,000Additionalpaid-incapital,preferred100,000Commonstock10,000Additionalpaid-incapital,common140,000Torecordtheconversionof10,000preferredsharesto10,000commonshares.Oninvestor"sbooks(Boston):InvestmentinHartfordCompanyconvertiblepreferredstock150,000Cash150,000Torecordacquisitionof10,000sharesconvertibleintocommonattherateofonecommonshareforonepreferred.InvestmentinHartfordCompanycommonstock150,000InvestmentinHartfordCompanypreferredstock150,000Torecordconversionof10,000preferredsharesinto10,000commonshares.419Chapter10Stockholders’Equity

10-66(15min.)1.a.TreasuryStock100,000,000Cash100,000,000b.$516,000÷.15=$3,440,000$3,440,000÷$20=172,000sharesCompensationexpense516,000Cash2,924,000Commonstock1,720Additionalpaid-incapital3,438,280c.$4,362,000÷$15=290,800sharesCash4,362,000Commonstock2,908Additionalpaid-incapital4,359,0922.Totalearningsrequired:Toerasenegativeretainedearnings$162,402,000Togenerateearningsequaltodividends*61,766,000Total$224,168,000*$1.00×61,766,000shares=$61,766,000Yearsrequiredtogenerateearningsof$224,168,000:$224,168,000÷$35,686,000=6.28years419Chapter10Stockholders’Equity

10-67(10–15min)Carrefourwouldpreferthatshareholdersholdtheirsharesdirectlyasregisteredshares.Theygivemultiplebenefitstoencourageregisteredsharesanddirectholdings.Directholdersofregisteredsharesreceivefreemanagementoftheshareholdings.Theyalsoreceive:1)Easyinvitationandaccesstogeneralmeetings2)Doublevotingrightsafter2years3)PersonalizedinformationservicesShareholderswhoelectbearersharesmaybehavingalloftheirfinancialinterestsmanagedbyprofessionals.TheydonotvaluethebenefitsCarrefourprovidestoregisteredholders,andtheymayvaluethebenefitsofanonymity.10-68(10–15min.)1.Theproperamountisthe“fairvalue”ofeithertheissuedsecuritiesortheincomingassets,whicheverismoreobjectivelydeterminable.Thatamountshouldbeusedbyboththeinvestorandtheissuerofthesecurities.Inthiscase,themarketvalueofCartier’scommonstockwouldberegardedasamoreobjectivelydeterminablefairvaluethanthebookvalueofMarseilles’sequipment.Thus,thetransactionvaluewouldbe10,000shares×€50=€500,000.TheaccountswouldbeaffectedasshowninExhibit10-68onthefollowingpage.419Chapter10Stockholders’Equity

EXHIBIT10-68(Amountsareineuros)Assets=Liabilities+Stockholders’EquityEquipmentCommonStockAdditionalPaid-inCapitalIssuanceofstockbyCartier+500,000=+10,000+490,000InvestmentinCommonStockEquipmentAccumulatedDepreciation Retainedearnings Disposalofequipt.byMarseilles+500,000–530,000+100,000=+70,000[Gainondisposalofequipment]2.Onissuer’sbooks:Equipment500,000(Cartier)Commonstock10,000Additionalpaid-incapital490,000Oninvestor’sbooks:InvestmentinCartierstock500,000(Marseilles)Accumulateddepreciation,equipment100,000Equipment530,000Gainondisposalofequipment70,000419Chapter10Stockholders’Equity

10-69(10–15min.)1.Sinceonerestrictedratioistheassetvaluetodebtratio,enteringacapitalleasewouldincreaseboththenumeratoranddenominatorequallybuttheratiowouldbereducedbecausetotalassetsaregreaterthantotaldebt.Thus,Mitchellwouldbemorelikelytouseoperatingleasesifitisnearthecovenantlevels.Theleasingchoicewouldnotaffectconsolidatedshareholder"sequityexceptasitrelatedtothefutureeffectonearnings.2.Covenantsprovideassurancetoinvestors.Withoutcovenantsinvestorsfacemoreriskandrequirehigherreturnssotheissuepriceofthedebtwouldfallortheinterestratewouldrise.3.Cash$248millionCommonStock$248millionTorecordtheissueof4.68millionsharesat$53pershare.4.1,000shares@$53pershareis$53,000.Inthemergertheinvestorwillreceive1,000×$31=$31,000incash.Theinvestorwillreceive.585×1,000=585sharesofDevonvaluedat$50.76pershareor$29,695.Totalproceeds=$31,000+$29,695=$60,695.Withacostbasisof$53,000thisisaprofitof$7,695.419Chapter10Stockholders’Equity

10-70(15–20min.)1.Averagenumberofshares,Adobe:$871,000,000÷$1.59=547,798,742Averagenumberofshares,Empire:$39,000,000÷$1.17=33,333,333Bookvaluepershare,Adobe:($5,821million–$1,411million=$4,410million)÷547,798,742=$8.05Bookvaluepershare,Empire:($1,714million–$1,185million=$529million)÷33,333,333=$15.87Markettobookratio,Adobe:$37÷$8.05=4.60Markettobookratio,Empire:$19÷$15.87=1.20Price-earningsratio,Adobe:$37÷$1.59=23.27Price-earningsratio,Empire:$19÷$1.17=16.24Becausewedonothavebeginningstockholders’equity,wemustuseendingratherthanaveragestockholders’equitytocomputeROE.Returnonstockholders’equity,Adobe:$871million÷$4,410million=19.8%Returnonstockholders’equity,Empire:$39million÷$529million=7.4%2.Adobeisafaster-growingcompanyinadynamicindustry.ManyoftheassetsofacompanysuchasAdobeare“intellectualcapital”andthusdonotappearonthebalancesheet.Ontheotherhand,EmpireDistricthasprimarilytangiblefixedassets.Therefore,thedenominatorsforthemarkettobookratioandROEarelikelytobeunderstatedforAdobecomparedtoEmpireDistrict,makingbothratioslargerforAdobe.419Chapter10Stockholders’Equity

10-71(15–20min.)1.ENRONCORPORATIONShareholders’EquityDecember31,1999(Dollaramountsinmillions)Preferredstock,cumulative,noparvalue,1,370,000sharesauthorized,1,296,184sharesissued$130Commonstock,noparvalue,1,200,000,000sharesauthorized,716,865,081sharesissued6,637Retainedearnings2,698Commonstockheldintreasury,1,337,714shares(49)Accumulatedothercomprehensiveincome(loss)(741)Otherstockholders’equity895Totalstockholders’equity$9,5702.Increaseinretainedearnings($2,698,000,000-$2,226,000,000)$472,000,000Cashdividends($355,000,000+$66,000,000)421,000,000Netincome$893,000,0003.Thenumberoftreasurysharesdecreasedby,9,333,322-1,337,714=7,995,608shares.Theaveragecostofthesharessoldwas($195,000,000-$49,000,000)÷7,995,608=$18.26pershare.Theremainingshareshaveanaveragecostof$49,000,000÷1,337,714=$36.63pershare.4.($9,570,000,000–$130,000,000)÷715,527,367*=$13.19bookvaluepershare.Market-to-bookratiois$45÷$13.19=3.41.*(716,865,081sharesissues–1,337,714treasuryshares)5.$91×716,000,000=$65,156,000,000$.04×716,000,000=28,640,000Loss$65,127,360,000419Chapter10Stockholders’Equity

10-72(10–15min.)1.Noexpensewouldberecorded.Footnotesindicatedthatearningswoulddropfrom$2billionto$1.8billionifexpensed.In2009,theexpensingwouldhavebeenrequiredandareasonableestimateonapersharebasiswouldhavebeenthewarrantvalueof$12each,atotalof$481million,orsomethingslightlyless,whichwouldbespreadover3years.Thekeydifferencesbetweenthewarrantsandtheexecutivestockoptionsarethattheexecutiveslosttheoptionsiftheyleftthefirmandtheycouldnotexercisethemcontinuously.Theyonlyinvestedaftersomeyearsofemployment.2.Manyexecutiveswouldsaythattherewasnovaluebecausetheoptionpricewasequaltothemarketpriceonthedatetheoptionsweregranted.Nevertheless,holdingtheoptionallowstheexecutivetoparticipateinanyincreaseinstockpricewithoutmakinganinvestmentinthestockandwithoutbearingtheriskofdecreasesinstockprice.Independentinvestorswereapparentlywillingtopay$12pershareforaprivilegesimilar(thoughnotidentical)tothestockoptions.However,thewarrantholdershavefewerconstraintsonexercisingtheirwarrants,sotheygetmorevalueforthemthantheexecutivesreceivefromtheiroptions.Therefore,theoptionswereworthlessthan$12totheexecutives.Therearemathematicalmodelsthatpredictthevalueofsuchoptions,buteveryoneisnotconvincedoftheaccuracyofsuchmodels.FootnotesshowaBlack-Scholesvalueof$11.12fortheoptions.WhenwereviewtheactualhistoryoftheseoptionswelearnthatBristol–MyersSquibbstockfellsharplyduring2002andhasnotregainedpricelevelsatwhichtheoptionswouldhavebeenexercisedbytheexecutivesbecausethemarketpricepersharewaslessthantheoptionpricepershare.Themarketpricepersharewas$25.78inlate2009.3.Theamountthefirmgivesupinissuingtheoptionistheamountitcouldhavereceivedforawarrantwithidenticalrestrictions.Thiswouldalsobeslightlyunder$12.Thisisanopportunitycost,notacashoutlay.4.Anadvantageoftencitedforstockoptionsisthattheyaligntheinterestsofexecutivesandstockholders.Toagreatextentthisistrue;increasesinstockpricesprovidebenefitstoboth.Nevertheless,thereareincentivesregardingdividendsthatmaynotbealigned.Executiveswhoholdstockoptionswantthestockpricetogrow,andonewaytospeedthegrowthofstockpriceistopaynodividends.Ifthisdividendpolicyisnotinthestockholders’bestinterest,executivesmayfaceanethicaldilemma.Thismaybemitigatedbythefactthattheboardofdirectors,notmanagement,declaresdividends.Nevertheless,managementoftenhasalargeinfluenceontheboard"sdividenddecisions.419Chapter10Stockholders’Equity

10-73(50min.ormore)Thepurposeofthisexerciseistodevelopanunderstandingofhowmarket-to-bookandreturnonstockholders’equityratiosmightdifferacrosscompaniesindifferentindustries.Bothratioshavestockholders’equityinthedenominator,soindustrycharacteristicsthataffectstockholders’equitywillaffectbothratiossimilarly.Forexample,industrieswithlargeamountsofintellectualcapital(whichdoesnotappearonthebalancesheet)ratherthanphysicalcapital,willtendtohavelargevaluesforbothratios.Prospectsforearningsgrowthwillaffectmainlythemarket-to-bookratiobecausethemarketpricewillreflectsuchprospects.Theindividualresearchwilldevelopthestudents’understandingofthestockholders’equitysectionofthebalancesheetaswellastheirinterpretationoftheratios.Thegroupsessionwillpoolmoreinformationthananindividualstudenthastimetogatherinordertodevelopgeneralizationsabouttheratiosacrossindustriesandfirmcharacteristics.10-74(30–45min.)Eachsolutionwillbeuniqueandwillchangeeachyear.Thepurposeofthisproblemistoexaminetransactionsthataffectstockholders’equity.10-75(40–50min.)Amountsareinmillions.1.Starbuckspaidnodividends.Iftheyhad,theywouldbeshowninthefinancingactivitiessectionofthestatementofcashflowsandintheretainedearningscolumnofthestatementofshareholders’equity.2.Thecashflowstatementshows$57.3millionofcashwasgeneratedbycommonstockissuancesinfiscal2009.3.ReturnonEquity:2009:ROE=$390.8÷[(1/2)×($3,045.7+$2,490.9)]=14.1%2008:ROE=$315.5÷[(1/2)×($2,490.9+$2,284.1)]=13.2%BookValueperShare:2009:BookValue=$3,045.7÷742.9shares=$4.10pershare2008:BookValue=$2,490.9÷735.5shares=$3.39pershareROEhasincreasedbyalmostapercentagepoint,indicatingimprovingperformance.Bookvaluepersharehasincreasedbymorethan$.70,showinganincreasingclaimonnetassetsbyshareholders.419Chapter10Stockholders’Equity

10-76(30–60min.)NOTETOINSTRUCTOR:ThissolutionisbasedontheWebsiteasitwasinearly2010withthe2009annualreport.BesuretoexaminethecurrentWebsitebeforeassigningthisproblem,astheinformationtheremayhavechanged.1.Accordingtothe2009annualreport,UPShadthefollowingstockauthorized:(1)preferredstock,$.01parvalue,authorized200millionshares,noneissued(showninfootnote9butnotonthebalancesheet),(2)classAcommonstock,$0.01parvalue,authorized4,600millionshares,issued285millionshares,(3)classBcommonstock,$.01parvalue,authorized5,600millionshares,issued711millionshares.Onlythepreferredstockhasnotbeenissued.ThereisanAdditionalPaid-inCapitalaccount,whichindicatesthatthecommonstockwassoldformorethanparvalue.ThisisalsoevidentfromstockissueslistedontheStatementofStockholders’Equity.NotethatclassAshareshave10voteswhileclassBshareshaveonevote.ClassAsharesareheldbyemployeesandretireesandarefullyconvertibleintoclassBshareswhichtradeonpublicmarkets.Seenote9.2.NumberofsharesUPScanissue:200millionpreferredshares4,600million–285million=4,315millionclassAshares5,600million–711million=4,889millionclassBsharesIfalltheseshareswereissuedbothcashandstockholders’equitywouldincrease.UPSdoeshavetreasurystocklistedat$108million,whichisadeductionfromStockholders’Equity.3.Changesinthecommonstockaccountsaredueto:(1)commonstockpurchases,(2)stockawardplans,(3)commonstockissues,and(4)conversionofclassAstocktoclassBstock.ThisisseenmosteasilyintheStatementofConsolidatedShareowners’Equity.4.UPSdidnotdeclareanystocksplitsorstockdividendsduring2008or2009.IfUPSdeclaredastocksplititwouldlowerthemarketpriceofitsstock.5.UPShasastockoptionplan.Itisdescribedinfootnote10toUPS’sfinancialstatements.419Chapter10Stockholders’Equity

419Chapter10Stockholders’Equity'

您可能关注的文档

- 第五版《高级会计学》耿建新,戴德明课后习题答案.doc

- 第五版复习题基础护理学试题及答案.doc

- 第五版有机化学-华北师范大学-李景宁-全册-习题答案.doc

- 第五版混凝土与砌体工程12.13.15章答案.doc

- 第五版版《国际贸易》课后习题答案(薛荣久著).doc

- 第五章习题及答案.doc

- 第六章习题答案机械制造工艺学.pdf

- 第十九章《四边形》单元总复习题(含答案).doc

- 第十章习题答案.doc

- 第四版《高分子化学》思考题课后答案_潘祖仁.doc

- 第四章 习题解答和解析.doc

- 第四章习题与答案.doc

- 第四轮公修课《突发事件》练习题答案.doc

- 答案《审计学》习题.doc

- 简-201310补充财务管理复习题及答案.doc

- 管理会计(第二版)课后习题答案.docx

- 管理会计习题及答案.doc

- 管理会计习题集及答案(修改后).doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明