- 1.13 MB

- 2022-04-22 11:52:27 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

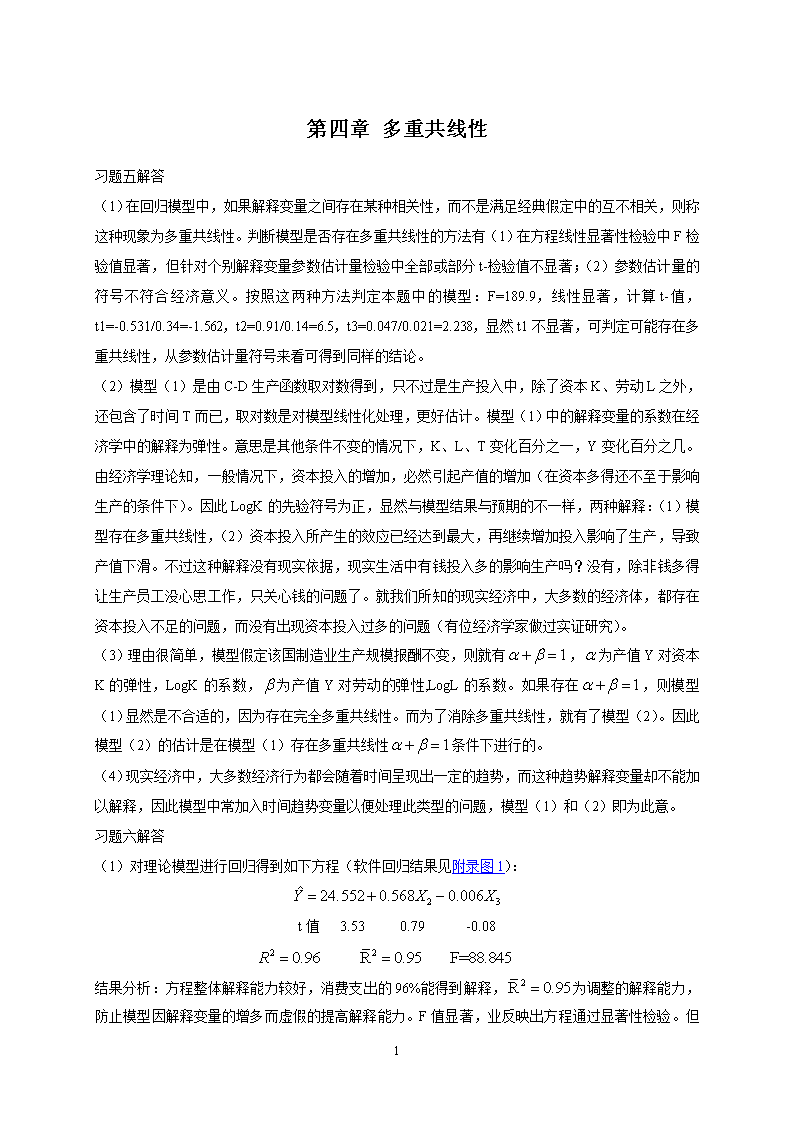

'第四章多重共线性习题五解答(1)在回归模型中,如果解释变量之间存在某种相关性,而不是满足经典假定中的互不相关,则称这种现象为多重共线性。判断模型是否存在多重共线性的方法有(1)在方程线性显著性检验中F检验值显著,但针对个别解释变量参数估计量检验中全部或部分t-检验值不显著;(2)参数估计量的符号不符合经济意义。按照这两种方法判定本题中的模型:F=189.9,线性显著,计算t-值,t1=-0.531/0.34=-1.562,t2=0.91/0.14=6.5,t3=0.047/0.021=2.238,显然t1不显著,可判定可能存在多重共线性,从参数估计量符号来看可得到同样的结论。(2)模型(1)是由C-D生产函数取对数得到,只不过是生产投入中,除了资本K、劳动L之外,还包含了时间T而已,取对数是对模型线性化处理,更好估计。模型(1)中的解释变量的系数在经济学中的解释为弹性。意思是其他条件不变的情况下,K、L、T变化百分之一,Y变化百分之几。由经济学理论知,一般情况下,资本投入的增加,必然引起产值的增加(在资本多得还不至于影响生产的条件下)。因此LogK的先验符号为正,显然与模型结果与预期的不一样,两种解释:(1)模型存在多重共线性,(2)资本投入所产生的效应已经达到最大,再继续增加投入影响了生产,导致产值下滑。不过这种解释没有现实依据,现实生活中有钱投入多的影响生产吗?没有,除非钱多得让生产员工没心思工作,只关心钱的问题了。就我们所知的现实经济中,大多数的经济体,都存在资本投入不足的问题,而没有出现资本投入过多的问题(有位经济学家做过实证研究)。(3)理由很简单,模型假定该国制造业生产规模报酬不变,则就有,为产值Y对资本K的弹性,LogK的系数,为产值Y对劳动的弹性,LogL的系数。如果存在,则模型(1)显然是不合适的,因为存在完全多重共线性。而为了消除多重共线性,就有了模型(2)。因此模型(2)的估计是在模型(1)存在多重共线性条件下进行的。(4)现实经济中,大多数经济行为都会随着时间呈现出一定的趋势,而这种趋势解释变量却不能加以解释,因此模型中常加入时间趋势变量以便处理此类型的问题,模型(1)和(2)即为此意。习题六解答(1)对理论模型进行回归得到如下方程(软件回归结果见附录图1):t值3.530.79-0.08结果分析:方程整体解释能力较好,消费支出的96%能得到解释,33

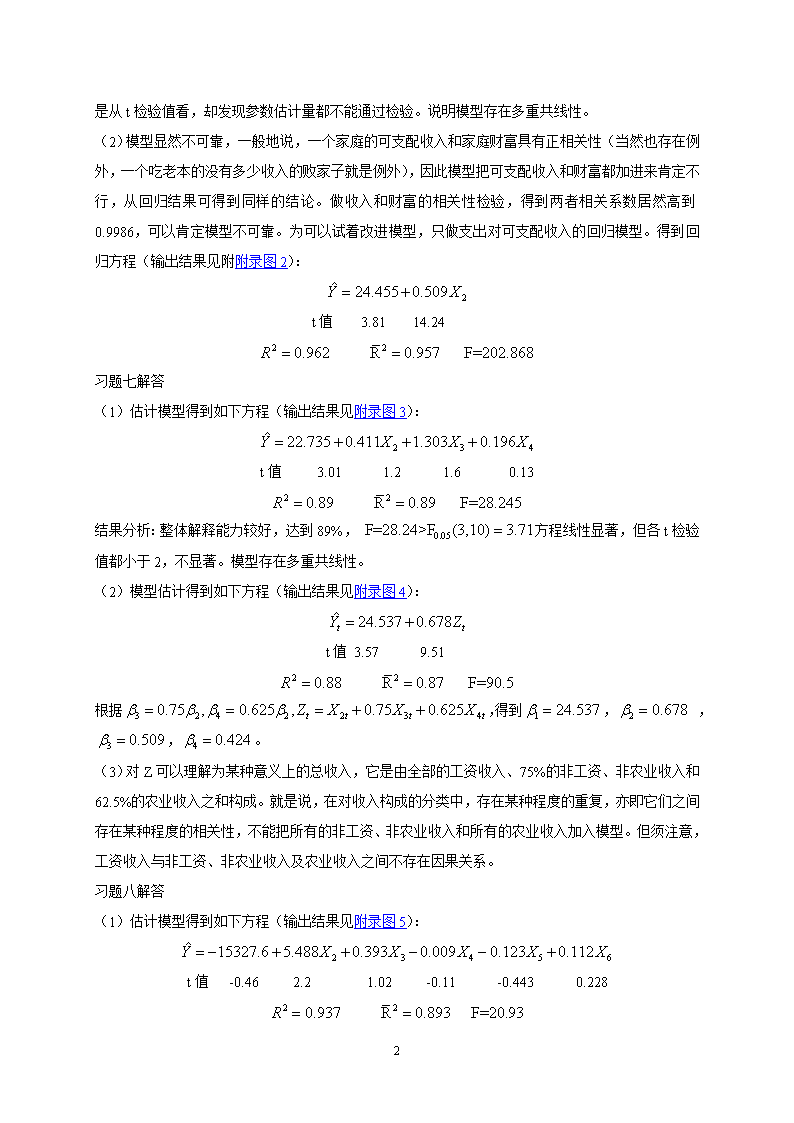

为调整的解释能力,防止模型因解释变量的增多而虚假的提高解释能力。F值显著,业反映出方程通过显著性检验。但是从t检验值看,却发现参数估计量都不能通过检验。说明模型存在多重共线性。(2)模型显然不可靠,一般地说,一个家庭的可支配收入和家庭财富具有正相关性(当然也存在例外,一个吃老本的没有多少收入的败家子就是例外),因此模型把可支配收入和财富都加进来肯定不行,从回归结果可得到同样的结论。做收入和财富的相关性检验,得到两者相关系数居然高到0.9986,可以肯定模型不可靠。为可以试着改进模型,只做支出对可支配收入的回归模型。得到回归方程(输出结果见附附录图2):t值3.8114.24习题七解答(1)估计模型得到如下方程(输出结果见附录图3):t值3.011.21.60.13结果分析:整体解释能力较好,达到89%,方程线性显著,但各t检验值都小于2,不显著。模型存在多重共线性。(2)模型估计得到如下方程(输出结果见附录图4):t值3.579.51根据,得到,,,。(3)对Z可以理解为某种意义上的总收入,它是由全部的工资收入、75%的非工资、非农业收入和62.5%的农业收入之和构成。就是说,在对收入构成的分类中,存在某种程度的重复,亦即它们之间存在某种程度的相关性,不能把所有的非工资、非农业收入和所有的农业收入加入模型。但须注意,工资收入与非工资、非农业收入及农业收入之间不存在因果关系。习题八解答(1)估计模型得到如下方程(输出结果见附录图5):t值-0.462.21.02-0.11-0.4430.22833

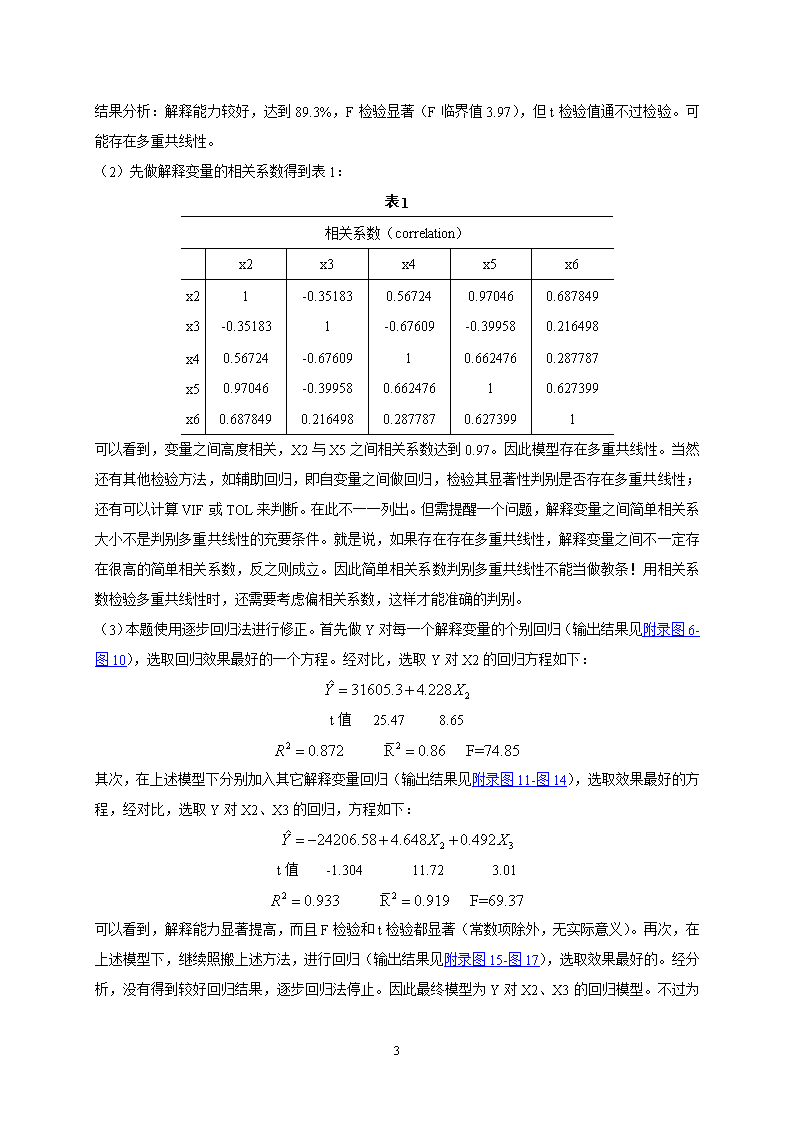

结果分析:解释能力较好,达到89.3%,F检验显著(F临界值3.97),但t检验值通不过检验。可能存在多重共线性。(2)先做解释变量的相关系数得到表1:表1相关系数(correlation)x2x3x4x5x6x2x31-0.35183-0.3518310.56724-0.676090.97046-0.399580.6878490.216498x4x5x60.567240.97046-0.67609-0.3995810.6624760.66247610.2877870.6273990.6878490.2164980.2877870.6273991可以看到,变量之间高度相关,X2与X5之间相关系数达到0.97。因此模型存在多重共线性。当然还有其他检验方法,如辅助回归,即自变量之间做回归,检验其显著性判别是否存在多重共线性;还有可以计算VIF或TOL来判断。在此不一一列出。但需提醒一个问题,解释变量之间简单相关系大小不是判别多重共线性的充要条件。就是说,如果存在存在多重共线性,解释变量之间不一定存在很高的简单相关系数,反之则成立。因此简单相关系数判别多重共线性不能当做教条!用相关系数检验多重共线性时,还需要考虑偏相关系数,这样才能准确的判别。(3)本题使用逐步回归法进行修正。首先做Y对每一个解释变量的个别回归(输出结果见附录图6-图10),选取回归效果最好的一个方程。经对比,选取Y对X2的回归方程如下:t值25.478.65其次,在上述模型下分别加入其它解释变量回归(输出结果见附录图11-图14),选取效果最好的方程,经对比,选取Y对X2、X3的回归,方程如下:t值-1.30411.723.01可以看到,解释能力显著提高,而且F检验和t检验都显著(常数项除外,无实际意义)。再次,在上述模型下,继续照搬上述方法,进行回归(输出结果见附录图15-图1733

),选取效果最好的。经分析,没有得到较好回归结果,逐步回归法停止。因此最终模型为Y对X2、X3的回归模型。不过为了模型得到跟好结果,采取无截距项的回归(输出见附录图18),回归方程如下:t值11.83532.613结果分析:对比有截距项和无截距项的回归,发现解释能力为发生显著的下降,因此无截距项回归,在方方程F检验和t检验全部显著的条件下获得了较好的效果。多重共线性的修正方法还有岭回归,数据结合等。最后说明:对于多重共线性的修正不能盲目进行,要考虑经济意义,多重共线性是一种样本现象,多数情况下的多重共线性,只要增大样本都会取得较好的效果,但不可奢求消除多重共线性,只能说可以减小其程度,使模型在误差项容许的范围下达到最好。第五章异方差性习题五解答(1)估计回归模型得到如下方程(输出结果见附录图19):t值2.56932结果分析:模型拟合较好,解释能力达到94.6%,显著性均通过。(2)检验异方差性的方法有多种,以下采取①图示法,②怀特检验。首先图示法检验得到:图1Y与X散点图图2误差项平方和R与X的散点图从图1可以看出,Y与X得散点图似乎看不出异方差性,但从残差项与X的散点图可以看出存在异方差。其次再用怀特检验得到:图3white检验输出结果33

HeteroskedasticityTest:WhiteF-statisticObs*R-squaredScaledexplainedSS6.30137310.864019.912825Prob.F(2,57)Prob.Chi-Square(2)Prob.Chi-Square(2)0.00340.00440.007TestEquationDependentVariable:RESID^2Method:LeastSquaresDate:12/21/09Time:00:41Sample:160Includedobservations:60 VariableCXX^2Coefficient-10.036140.1659770.0018Std.Error131.14241.6198560.004587t-Statistic-0.0765290.1024640.392469Prob.0.93930.91870.6962R-squaredAdjustedR-squaredS.E.ofregressionSumsquaredresidLoglikelihoodF-statisticProb(F-statistic)0.1810670.152332102.3231596790.5-361.28566.3013730.00337MeandependentvarS.D.dependentvarAkaikeinfocriterionSchwarzcriterionHannan-Quinncriter.Durbin-Watsonstat 78.86225111.137512.1428512.2475712.183811.442328 从表中的前四行可以看出,模型存在异方差,Obs*R-squared值为10.86,大于临界值。(3)对异方差性修正有多种方法,本题采取①WLS,②对数变换法两种方法。首先采用WLS法,取W=1/resid,得到如下方程(输出结果见附录图20):t值28.59372.51对比加权和为加权的两个回归结果,发现33

,结果大有改进,DW统计量都显著改善!接下来对数变换法进行修正,最后把钟方法的输出结果做对比。对数变换得到如下方程(输出结果见附录图21):t值1.0534.45结果分析:我们看到,对数变换并没有显著改善模型,解释能力提高不到1%。因此对数变换不适合本题的修正,我们最好采用WLS修正。当然这只是本题的结论。由凯恩斯消费理论知,消费和收入之间大致成线性关系。习题六解答(1)首先做散点图分析数据之间的关系,得到下图:图4Y与X、Z散点图我们看到,Y与利润Z、Y与销量X之间大致呈线性关系,但是,Y对销量X的回归明显存在异方差,这符合本题的出题目的。因此我们建立线性回归模型:,估计得到如下方程(输出结果见附录图22):t值0.1953.83结果分析:拟合效果不太好,解释能力才47.8%,不到50%,虽然显著性检验通过。在截面数据的回归中,异方差性一直是个萦绕心头的问题。本题抽取的不同部门的销售量和R&D费用的数据,因为不同部分用于R&D费用的比列不同,所以在销量中,R&D费用占有的比列就存在差异。(2)为了说明如何运用Glerjser方法检验异方差,下面以本题为例说明。其基本思想是用残差项的绝对值对解释变量的不同形式做回归,判断回归方程的显著性33

,以此来界定原回归模型是否存在异方差。依次做如下模型的回归估计(输出结果见附录图23-图27):,,,,。经估计得到,对解释变量平方根的回归最为显著,系数通过检验。必须说明,Glerjser检验只有在大样本情况下才会得到较好的拟合效果,在小样本情况下,则只能作为了解异方差性某种信息的一种手段。(3)采用WLS和对数变换法进行修正。WLS修正,W=1/X,得到如下方程(输出结果见附录图28):t值-1.85.525对比原回归结果,解释能力有显著改善。在用对数变换法做修正,得到如下方程(输出结果见附录图29):t值-3.9857.869可以看出,在本题的修正中,对数变换方法比加权得到得到了更好的效果。这就说明,不同的数据模型,其适应的修正方法也不同。习题七解答(1)首先做散点图分析,通过图示粗略地分析Y与X得关系,散点图如下:图5Y与X的散点图图6LOG(Y)与LOG(X)散点图从散点图分析我们发现,股票价格Y与X之间,线性关系相当微弱,其对数化后的线性关系33

也不见得好转,但这也只是粗略地分析而已,具体的需要回归估计。分别估计以下两模型:得到如下两方程(输出结果见附录图30-图31):t值4.255.05t值3.5971.91结果分析:由估计可以看出,Y对X的线性回归显著,但拟合效果不太好,对数化后的模型估计效果更次,不能通过检验。对残差进行分析:画出残差对解释变量的散点图,试着分析两者关系:图7残差项与X得散点图从散点图看不出残差与X得关系,因为存在异常点干扰整体关系。(2)重做回归得到如下方程(输出结果见附录图32):t值2.830.398结果分析:结果非常令人意想不到!剔除点后,居然模型回归由显著变为不显著!,可以说原模型是个伪回归。也即说明,Y与X之间的线性关系微弱,或者说消费者价格变化率会影响股票价格,但是影响股票价格的主要因素不是消费者价格变化率,而是其他因素。所以,本题找的两个数据没有实质意义,无非是锻炼我们掌握异方差性的相关内容。但是这样的工作可能会影响同学们的现实思考能力,以为回归模型可以利用在任何场合,也就是说方法能论!实事求是才是解决问题的前提33

和出发点。习题八解答(1)先验分析,12个样本,有五个解释变量,如把所有解释变量都纳入进来估计结果肯定不显著,存在多重共线性,为了更合理的分析,先做产值Y对所有解释变量的回归,得到如下方程(输出结果见附录图33):t值0.521.45-0.470.482.711.63结果分析:模型整体拟合效果较好,F检验显著,但是大部分t值却不显著,这是多重共线性的典型现象,为此运用逐步回归法得到如下较好的方程(简要输出结果见附录,步骤省略):t值3.462.62.5对比上述两方程,我们看到逐步回归法得到的方程,所有系数都显著,解释能力相比于原方程并没有显著下降。这可以作为最终建立的模型,下面的分析将基于上述模型进行。(2)运用Glejser检验和white检验分析异方差,得到如下结果(图8、图9):图8Glejser检验结果HeteroskedasticityTest:GlejserF-statistic1.671343 Prob.F(3,8)0.2494Obs*R-squared4.623345 Prob.Chi-Square(3)0.2015ScaledexplainedSS2.702259 Prob.Chi-Square(3)0.4398TestEquation:DependentVariable:ARESIDMethod:LeastSquaresDate:12/21/09Time:15:41Sample:112Includedobservations:12VariableCoefficientStd.Errort-StatisticProb. 33

C7.7598203.9188321.9801360.0830X3-0.1642620.121134-1.3560330.2121X4-0.0019300.001782-1.0829890.3104X50.0121510.0062191.9539690.0865R-squared0.385279 Meandependentvar11.94158AdjustedR-squared0.154758 S.D.dependentvar7.839495S.E.ofregression7.207399 Akaikeinfocriterion7.049295Sumsquaredresid415.5728 Schwarzcriterion7.210930Loglikelihood-38.29577 Hannan-Quinncriter.6.989452F-statistic1.671343 Durbin-Watsonstat1.985993Prob(F-statistic)0.249381图9white检验结果HeteroskedasticityTest:WhiteF-statistic9.463925 Prob.F(6,5)0.0130Obs*R-squared11.02887 Prob.Chi-Square(6)0.0875ScaledexplainedSS5.292628 Prob.Chi-Square(6)0.5069TestEquation:DependentVariable:RESID^2Method:LeastSquaresDate:12/21/09Time:15:47Sample:112Includedobservations:12VariableCoefficientStd.Errort-StatisticProb. C-29.0542156.72871-0.5121610.6304X3^20.6986110.2295393.0435420.0286X3*X4-0.0054540.008398-0.6494160.5447X3*X5-0.0626640.023860-2.6262930.046733

X4^25.25E-065.38E-050.0976760.9260X4*X50.0002900.0003020.9613910.3805X5^20.0013400.0005532.4255060.0597R-squared0.919072 Meandependentvar198.9376AdjustedR-squared0.821959 S.D.dependentvar271.4158S.E.ofregression114.5236 Akaikeinfocriterion12.61064Sumsquaredresid65578.31 Schwarzcriterion12.89350Loglikelihood-68.66382 Hannan-Quinncriter.12.50591F-statistic9.463925 Durbin-Watsonstat1.459409Prob(F-statistic)0.013029结果分析,两种检验,在0.05的显著性水平下(95%置信水平),均不能拒绝无异方差性的假设。因此逐步回归法得到的模型在0.05的显著性水平下不能拒绝无异方差性的假设。(3)如果把显著性水平降低到0.1,则white检验将得到异方差性的结果。这时如果要修正模型,可采用WLS法。下面以WLS作简要修正,W=1/resid,resid为Y对X3、X4、X5回归得到的残差。修正得到如下结果(输出结果见附录图34):t值5.54.32.62结果分析:虽然加权之后回归拟合效果提高了3%,但是,必须看到,这里做的修正是在降低显著性水平条件下进行的,即只是一个练习操作而已,没有实质意义。在实际研究中,当原模型可以很好的拟合数据时,我们再继续对它做些画蛇添足的行为时愚蠢的。33

附录图1DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:20:25Sample:110Includedobservations:10VariableCoefficientStd.Errort-StatisticProb. C24.551586.9523483.5314080.0096X20.5684250.7160980.7937810.4534X3-0.0058330.070294-0.0829750.9362R-squared0.962099 Meandependentvar111.0000AdjustedR-squared0.951270 S.D.dependentvar31.42893S.E.ofregression6.937901 Akaikeinfocriterion6.955201Sumsquaredresid336.9413 Schwarzcriterion7.045976Loglikelihood-31.77600 F-statistic88.84545Durbin-Watsonstat2.708154 Prob(F-statistic)0.000011图2DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:20:40Sample:110Includedobservations:10VariableCoefficientStd.Errort-StatisticProb. C24.454556.4138173.8127910.0051X20.5090910.03574314.243170.000033

R-squared0.962062 Meandependentvar111.0000AdjustedR-squared0.957319 S.D.dependentvar31.42893S.E.ofregression6.493003 Akaikeinfocriterion6.756184Sumsquaredresid337.2727 Schwarzcriterion6.816701Loglikelihood-31.78092 F-statistic202.8679Durbin-Watsonstat2.680127 Prob(F-statistic)0.000001图3DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:21:39Sample:114Includedobservations:14VariableCoefficientStd.Errort-StatisticProb. C22.734637.5505873.0109760.0131X20.4110800.3433391.1973030.2588X31.3028420.7929391.6430550.1314X40.1959431.5442240.1268880.9015R-squared0.894442 Meandependentvar87.76429AdjustedR-squared0.862774 S.D.dependentvar18.06057S.E.ofregression6.690349 Akaikeinfocriterion6.874166Sumsquaredresid447.6078 Schwarzcriterion7.056753Loglikelihood-44.11916 Hannan-Quinncriter.6.857264F-statistic28.24485 Durbin-Watsonstat1.439495Prob(F-statistic)0.000034图4DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:21:5233

Sample:114Includedobservations:14VariableCoefficientStd.Errort-StatisticProb. C24.537476.8642673.5746670.0038Z0.6784000.0713059.5141170.0000R-squared0.882948 Meandependentvar87.76429AdjustedR-squared0.873194 S.D.dependentvar18.06057S.E.ofregression6.431349 Akaikeinfocriterion6.691809Sumsquaredresid496.3470 Schwarzcriterion6.783103Loglikelihood-44.84266 Hannan-Quinncriter.6.683358F-statistic90.51842 Durbin-Watsonstat1.446036Prob(F-statistic)0.000001图5DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:22:28Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb. C-15327.6033512.84-0.4573650.6613X25.4876152.4948432.1995840.0638X30.3930320.3839941.0235370.3401X4-0.0093480.084285-0.1109100.9148X5-0.1230430.277870-0.4428060.6713X60.1122540.4931960.2276060.8265R-squared0.937310 Meandependentvar42010.15AdjustedR-squared0.892532 S.D.dependentvar2948.71433

S.E.ofregression966.6556 Akaikeinfocriterion16.88960Sumsquaredresid6540962. Schwarzcriterion17.15035Loglikelihood-103.7824 Hannan-Quinncriter.16.83600F-statistic20.93228 Durbin-Watsonstat2.807954Prob(F-statistic)0.000444图6DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:12Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb. C31605.331240.94225.468830.0000X24.2277540.4886818.6513610.0000R-squared0.871864 Meandependentvar42010.15AdjustedR-squared0.860215 S.D.dependentvar2948.714S.E.ofregression1102.461 Akaikeinfocriterion16.98912Sumsquaredresid13369621 Schwarzcriterion17.07603Loglikelihood-108.4293 Hannan-Quinncriter.16.97125F-statistic74.84604 Durbin-Watsonstat2.366188Prob(F-statistic)0.000003图7DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:13Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb. 33

C62268.0362353.060.9986360.3394X3-0.1820290.560228-0.3249200.7513R-squared0.009506 Meandependentvar42010.15AdjustedR-squared-0.080539 S.D.dependentvar2948.714S.E.ofregression3065.158 Akaikeinfocriterion19.03422Sumsquaredresid1.03E+08 Schwarzcriterion19.12114Loglikelihood-121.7225 Hannan-Quinncriter.19.01636F-statistic0.105573 Durbin-Watsonstat0.493997Prob(F-statistic)0.751337图8DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:13Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb. C38647.752569.91815.038510.0000X40.1559160.1134111.3747780.1966R-squared0.146626 Meandependentvar42010.15AdjustedR-squared0.069047 S.D.dependentvar2948.714S.E.ofregression2845.094 Akaikeinfocriterion18.88522Sumsquaredresid89040158 Schwarzcriterion18.97213Loglikelihood-120.7539 Hannan-Quinncriter.18.86735F-statistic1.890015 Durbin-Watsonstat0.865140Prob(F-statistic)0.196557图9DependentVariable:Y33

Method:LeastSquaresDate:12/20/09Time:23:13Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb. C29425.912129.91813.815510.0000X50.4660810.0773956.0221060.0001R-squared0.767273 Meandependentvar42010.15AdjustedR-squared0.746116 S.D.dependentvar2948.714S.E.ofregression1485.765 Akaikeinfocriterion17.58588Sumsquaredresid24282463 Schwarzcriterion17.67280Loglikelihood-112.3083 Hannan-Quinncriter.17.56802F-statistic36.26576 Durbin-Watsonstat1.551952Prob(F-statistic)0.000086图10DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:14Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb. C-16028.2414238.56-1.1256920.2843X61.8017820.4417154.0790640.0018R-squared0.602008 Meandependentvar42010.15AdjustedR-squared0.565827 S.D.dependentvar2948.714S.E.ofregression1942.961 Akaikeinfocriterion18.12245Sumsquaredresid41526060 Schwarzcriterion18.2093733

Loglikelihood-115.7959 Hannan-Quinncriter.18.10459F-statistic16.63876 Durbin-Watsonstat0.900150Prob(F-statistic)0.001823图11DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:23Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb.C-24206.5818567.18-1.3037300.2215X24.6477380.39661111.718640.0000X30.4922160.1635363.0098270.0131R-squared0.932769Meandependentvar42010.15AdjustedR-squared0.919323S.D.dependentvar2948.714S.E.ofregression837.5463Akaikeinfocriterion16.49800Sumsquaredresid7014837.Schwarzcriterion16.62838Loglikelihood-104.2370Hannan-Quinncriter.16.47121F-statistic69.37022Durbin-Watsonstat2.618267Prob(F-statistic)0.000001图12DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:24Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb.33

C32137.561166.30827.554960.0000X24.7834060.5397748.8618660.0000X4-0.0880910.048541-1.8147790.0996R-squared0.903609Meandependentvar42010.15AdjustedR-squared0.884331S.D.dependentvar2948.714S.E.ofregression1002.862Akaikeinfocriterion16.85828Sumsquaredresid10057321Schwarzcriterion16.98865Loglikelihood-106.5788Hannan-Quinncriter.16.83148F-statistic46.87216Durbin-Watsonstat2.303967Prob(F-statistic)0.000008图13DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:24Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb.C33449.241981.11216.884080.0000X26.5084731.9901493.2703450.0084X5-0.2761810.233876-1.1808880.2650R-squared0.887545Meandependentvar42010.15AdjustedR-squared0.865054S.D.dependentvar2948.714S.E.ofregression1083.208Akaikeinfocriterion17.01242Sumsquaredresid11733403Schwarzcriterion17.14279Loglikelihood-107.5807Hannan-Quinncriter.16.98562F-statistic39.46238Durbin-Watsonstat2.551133Prob(F-statistic)0.000018图1433

DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:24Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb.C14578.089048.5531.6110950.1382X23.4378780.6055795.6770090.0002X60.5889540.3105891.8962470.0872R-squared0.905753Meandependentvar42010.15AdjustedR-squared0.886903S.D.dependentvar2948.714S.E.ofregression991.6488Akaikeinfocriterion16.83579Sumsquaredresid9833673.Schwarzcriterion16.96616Loglikelihood-106.4326Hannan-Quinncriter.16.80899F-statistic48.05189Durbin-Watsonstat2.862048Prob(F-statistic)0.000007图15DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:32Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb.C-18285.7724890.72-0.7346420.4813X24.7334400.47205410.027330.0000X30.4410920.2175562.0274870.0732X4-0.0205030.053931-0.3801670.712633

R-squared0.933831Meandependentvar42010.15AdjustedR-squared0.911775S.D.dependentvar2948.714S.E.ofregression875.8469Akaikeinfocriterion16.63592Sumsquaredresid6903970.Schwarzcriterion16.80975Loglikelihood-104.1335Hannan-Quinncriter.16.60019F-statistic42.33870Durbin-Watsonstat2.551112Prob(F-statistic)0.000012图16DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:34Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb.C-19387.0119995.69-0.9695590.3576X25.8219831.5933053.6540300.0053X30.4582900.1729062.6505130.0265X5-0.1456990.191196-0.7620410.4655R-squared0.936844Meandependentvar42010.15AdjustedR-squared0.915792S.D.dependentvar2948.714S.E.ofregression855.6773Akaikeinfocriterion16.58932Sumsquaredresid6589653.Schwarzcriterion16.76315Loglikelihood-103.8306Hannan-Quinncriter.16.55359F-statistic44.50128Durbin-Watsonstat2.795472Prob(F-statistic)0.000010图17DependentVariable:YMethod:LeastSquares33

Date:12/20/09Time:23:34Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb.C-22269.1220711.67-1.0751970.3103X24.4724430.7587275.8946640.0002X30.4488400.2326001.9296660.0857X60.1031090.3731060.2763530.7885R-squared0.933334Meandependentvar42010.15AdjustedR-squared0.911113S.D.dependentvar2948.714S.E.ofregression879.1292Akaikeinfocriterion16.64340Sumsquaredresid6955813.Schwarzcriterion16.81723Loglikelihood-104.1821Hannan-Quinncriter.16.60767F-statistic42.00078Durbin-Watsonstat2.679392Prob(F-statistic)0.000013图18DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:17:42Sample:19831995Includedobservations:13VariableCoefficientStd.Errort-StatisticProb. X24.4422350.37533911.835260.0000X30.2792840.00856432.612900.0000R-squared0.921341 Meandependentvar42010.15AdjustedR-squared0.914191 S.D.dependentvar2948.714S.E.ofregression863.7738 Akaikeinfocriterion16.5011433

Sumsquaredresid8207158. Schwarzcriterion16.58805Loglikelihood-105.2574 Hannan-Quinncriter.16.48327Durbin-Watsonstat2.680964图19DependentVariable:YMethod:LeastSquaresDate:12/20/09Time:23:59Sample:160Includedobservations:60VariableCoefficientStd.Errort-StatisticProb.C9.3475223.6384372.5691040.0128X0.6370690.01990332.008810.0000R-squared0.946423Meandependentvar119.6667AdjustedR-squared0.945500S.D.dependentvar38.68984S.E.ofregression9.032255Akaikeinfocriterion7.272246Sumsquaredresid4731.735Schwarzcriterion7.342058Loglikelihood-216.1674Hannan-Quinncriter.7.299553F-statistic1024.564Durbin-Watsonstat1.790431Prob(F-statistic)0.000000图20DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:10:26Sample:160Includedobservations:60Weightingseries:1/RESIDVariableCoefficientStd.Errort-StatisticProb.33

C10.205070.35693328.591030.0000X0.6331700.001700372.51350.0000WeightedStatisticsR-squared0.999582Meandependentvar120.4524AdjustedR-squared0.999575S.D.dependentvar931.0901S.E.ofregression1.729654Akaikeinfocriterion3.966484Sumsquaredresid173.5187Schwarzcriterion4.036296Loglikelihood-116.9945Hannan-Quinncriter.3.993792F-statistic138766.3Durbin-Watsonstat0.192262Prob(F-statistic)0.000000UnweightedStatisticsR-squared0.946365Meandependentvar119.6667AdjustedR-squared0.945441S.D.dependentvar38.68984S.E.ofregression9.037146Sumsquaredresid4736.860Durbin-Watsonstat1.794290图21DependentVariable:LOG(Y)Method:LeastSquaresDate:12/21/09Time:10:41Sample:160Includedobservations:60VariableCoefficientStd.Errort-StatisticProb.C0.1401990.1335721.0496170.2982LOG(X)0.9015470.02616834.452160.0000R-squared0.953412Meandependentvar4.730314AdjustedR-squared0.952609S.D.dependentvar0.339103S.E.ofregression0.073821Akaikeinfocriterion-2.34157733

Sumsquaredresid0.316075Schwarzcriterion-2.271765Loglikelihood72.24731Hannan-Quinncriter.-2.314270F-statistic1186.951Durbin-Watsonstat1.947104Prob(F-statistic)0.000000图22DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:11:02Sample:118Includedobservations:18VariableCoefficientStd.Errort-StatisticProb.C192.9944990.98450.1947500.8480X0.0319000.0083293.8300440.0015R-squared0.478305Meandependentvar3056.861AdjustedR-squared0.445699S.D.dependentvar3705.973S.E.ofregression2759.150Akaikeinfocriterion18.78767Sumsquaredresid1.22E+08Schwarzcriterion18.88660Loglikelihood-167.0890Hannan-Quinncriter.18.80131F-statistic14.66924Durbin-Watsonstat3.015597Prob(F-statistic)0.001476图23DependentVariable:RMethod:LeastSquaresDate:12/21/09Time:11:23Sample:118Includedobservations:18VariableCoefficientStd.Errort-StatisticProb.33

C578.5686678.69490.8524720.4065X0.0119390.0057042.0930560.0526R-squared0.214951Meandependentvar1650.427AdjustedR-squared0.165885S.D.dependentvar2069.045S.E.ofregression1889.657Akaikeinfocriterion18.03062Sumsquaredresid57132855Schwarzcriterion18.12955Loglikelihood-160.2756Hannan-Quinncriter.18.04426F-statistic4.380883Durbin-Watsonstat1.743304Prob(F-statistic)0.052634图24DependentVariable:RMethod:LeastSquaresDate:12/21/09Time:12:02Sample:118Includedobservations:18VariableCoefficientStd.Errort-StatisticProb.SQRX6.4435141.4112684.5657620.0003R-squared0.248189Meandependentvar1650.427AdjustedR-squared0.248189S.D.dependentvar2069.045S.E.ofregression1794.007Akaikeinfocriterion17.87624Sumsquaredresid54713861Schwarzcriterion17.92571Loglikelihood-159.8862Hannan-Quinncriter.17.88306Durbin-Watsonstat1.742094图25DependentVariable:RMethod:LeastSquaresDate:12/21/09Time:12:06Sample:11833

Includedobservations:18VariableCoefficientStd.Errort-StatisticProb.X19589750.126400820.7586780.4584R-squared-0.618902Meandependentvar1650.427AdjustedR-squared-0.618902S.D.dependentvar2069.045S.E.ofregression2632.572Akaikeinfocriterion18.64326Sumsquaredresid1.18E+08Schwarzcriterion18.69273Loglikelihood-166.7894Hannan-Quinncriter.18.65008Durbin-Watsonstat0.794335图26DependentVariable:RMethod:LeastSquaresDate:12/21/09Time:11:26Sample:118Includedobservations:18VariableCoefficientStd.Errort-StatisticProb.X0.0156080.0037134.2034670.0006R-squared0.179294Meandependentvar1650.427AdjustedR-squared0.179294S.D.dependentvar2069.045S.E.ofregression1874.406Akaikeinfocriterion17.96392Sumsquaredresid59727790Schwarzcriterion18.01339Loglikelihood-160.6753Hannan-Quinncriter.17.97074Durbin-Watsonstat1.713357图27DependentVariable:RMethod:LeastSquaresDate:12/21/09Time:12:0133

Sample:118Includedobservations:18VariableCoefficientStd.Errort-StatisticProb.1/SQRX174610.9104554.51.6700470.1132R-squared-0.437823Meandependentvar1650.427AdjustedR-squared-0.437823S.D.dependentvar2069.045S.E.ofregression2480.977Akaikeinfocriterion18.52465Sumsquaredresid1.05E+08Schwarzcriterion18.57411Loglikelihood-165.7218Hannan-Quinncriter.18.53147Durbin-Watsonstat0.894315图28DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:12:38Sample:118Includedobservations:18Weightingseries:1/XVariableCoefficientStd.Errort-StatisticProb.C-243.4910135.2946-1.7997090.0908X0.0366980.0066425.5254750.0000WeightedStatisticsR-squared0.656142Meandependentvar929.6678AdjustedR-squared0.634651S.D.dependentvar738.5199S.E.ofregression694.2181Akaikeinfocriterion16.02789Sumsquaredresid7711020.Schwarzcriterion16.12682Loglikelihood-142.2510Hannan-Quinncriter.16.04153F-statistic30.53087Durbin-Watsonstat2.64308833

Prob(F-statistic)0.000046UnweightedStatisticsR-squared0.467483Meandependentvar3056.861AdjustedR-squared0.434201S.D.dependentvar3705.973S.E.ofregression2787.620Sumsquaredresid1.24E+08Durbin-Watsonstat2.963758图29DependentVariable:LOG(Y)Method:LeastSquaresDate:12/21/09Time:12:43Sample:118Includedobservations:18VariableCoefficientStd.Errort-StatisticProb.C-7.3646981.847999-3.9852290.0011LOG(X)1.3222400.1680377.8687330.0000R-squared0.794653Meandependentvar7.109988AdjustedR-squared0.781819S.D.dependentvar1.606121S.E.ofregression0.750216Akaikeinfocriterion2.367529Sumsquaredresid9.005196Schwarzcriterion2.466459Loglikelihood-19.30776Hannan-Quinncriter.2.381170F-statistic61.91696Durbin-Watsonstat2.398776Prob(F-statistic)0.000001图30DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:13:11Sample:12033

Includedobservations:20VariableCoefficientStd.Errort-StatisticProb.C4.6102821.0849064.2494780.0005X0.7574330.1499415.0515590.0001R-squared0.586380Meandependentvar8.530000AdjustedR-squared0.563402S.D.dependentvar5.131954S.E.ofregression3.390969Akaikeinfocriterion5.374748Sumsquaredresid206.9761Schwarzcriterion5.474321Loglikelihood-51.74748Hannan-Quinncriter.5.394186F-statistic25.51825Durbin-Watsonstat2.607212Prob(F-statistic)0.000083图31DependentVariable:LOG(Y)Method:LeastSquaresDate:12/21/09Time:13:12Sample:120Includedobservations:20VariableCoefficientStd.Errort-StatisticProb.C1.3226240.3676533.5974800.0021LOG(X)0.4578650.2393111.9132590.0718R-squared0.168997Meandependentvar1.982564AdjustedR-squared0.122830S.D.dependentvar0.607609S.E.ofregression0.569070Akaikeinfocriterion1.805014Sumsquaredresid5.829139Schwarzcriterion1.904587Loglikelihood-16.05014Hannan-Quinncriter.1.824452F-statistic3.660559Durbin-Watsonstat2.643006Prob(F-statistic)0.07175733

图32DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:13:35Sample:120IFX<=26Includedobservations:19VariableCoefficientStd.Errort-StatisticProb.C6.7380822.3848602.8253580.0117X0.2214840.5555680.3986630.6951R-squared0.009262Meandependentvar7.636842AdjustedR-squared-0.049016S.D.dependentvar3.310457S.E.ofregression3.390619Akaikeinfocriterion5.379203Sumsquaredresid195.4371Schwarzcriterion5.478618Loglikelihood-49.10243Hannan-Quinncriter.5.396028F-statistic0.158932Durbin-Watsonstat2.656146Prob(F-statistic)0.695105图33DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:15:10Sample:112Includedobservations:12VariableCoefficientStd.Errort-StatisticProb.C4.7171989.1257550.5169100.6237X10.0396150.0272701.4526970.1965X2-0.0368950.077705-0.4748130.6517X30.2632560.5494760.4791040.6488X40.0134630.0049632.7129970.035033

X50.0254690.0156631.6259930.1551R-squared0.974539Meandependentvar96.62750AdjustedR-squared0.953321S.D.dependentvar77.06446S.E.ofregression16.65001Akaikeinfocriterion8.769552Sumsquaredresid1663.338Schwarzcriterion9.012005Loglikelihood-46.61731Hannan-Quinncriter.8.679787F-statistic45.93047Durbin-Watsonstat1.969898Prob(F-statistic)0.000105图34DependentVariable:YMethod:LeastSquaresDate:12/21/09Time:15:59Sample:112Includedobservations:12Weightingseries:1/BVariableCoefficientStd.Errort-StatisticProb.X31.0374460.1885275.5029030.0004X40.0089590.0020874.2936450.0020X50.0211620.0080892.6162610.0280WeightedStatisticsR-squared0.992089Meandependentvar82.95636AdjustedR-squared0.990332S.D.dependentvar239.5237S.E.ofregression17.52356Akaikeinfocriterion8.777287Sumsquaredresid2763.675Schwarzcriterion8.898514Loglikelihood-49.66372Hannan-Quinncriter.8.732405Durbin-Watsonstat0.474622UnweightedStatistics33

R-squared0.959618Meandependentvar96.62750AdjustedR-squared0.950644S.D.dependentvar77.06446S.E.ofregression17.12075Sumsquaredresid2638.082Durbin-Watsonstat1.92369033'

您可能关注的文档

- 《计算机网络系统方法(第5版)》课后答案 中文.docx

- 《计算机英语(第3版)》练习参考答案.pdf

- 《计算机英语》习题答案.pdf

- 《计算机英语》原文译文和习题答案 刘艺.doc

- 《计算机软件技术基础》习题及参考答案.doc

- 《计算机软件技术基础》试题及答案.doc

- 《计算机软件技术基础》课后题答案.doc

- 《计算机通信与网络》习题答案.pdf

- 《计量经济学》 李子奈 第二版 课后习题答案.pdf

- 《证券市场基础知识》测试题及参考答案(二).doc

- 《证券投资模拟》习题及答案.doc

- 《诊断学》试题及答案(带解析).doc

- 《诊断学》试题及答案.doc

- 《语文课程与教学论》课后习题(学生整理1).doc

- 《财务与会计实务》教材第四版课后训练题参考答案.doc

- 《财务会计》习题及参考答案.doc

- 《财务会计》第3版练习答案.doc

- 《财务会计》课后习题答案.doc

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明