- 808.84 KB

- 2022-04-22 11:17:39 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

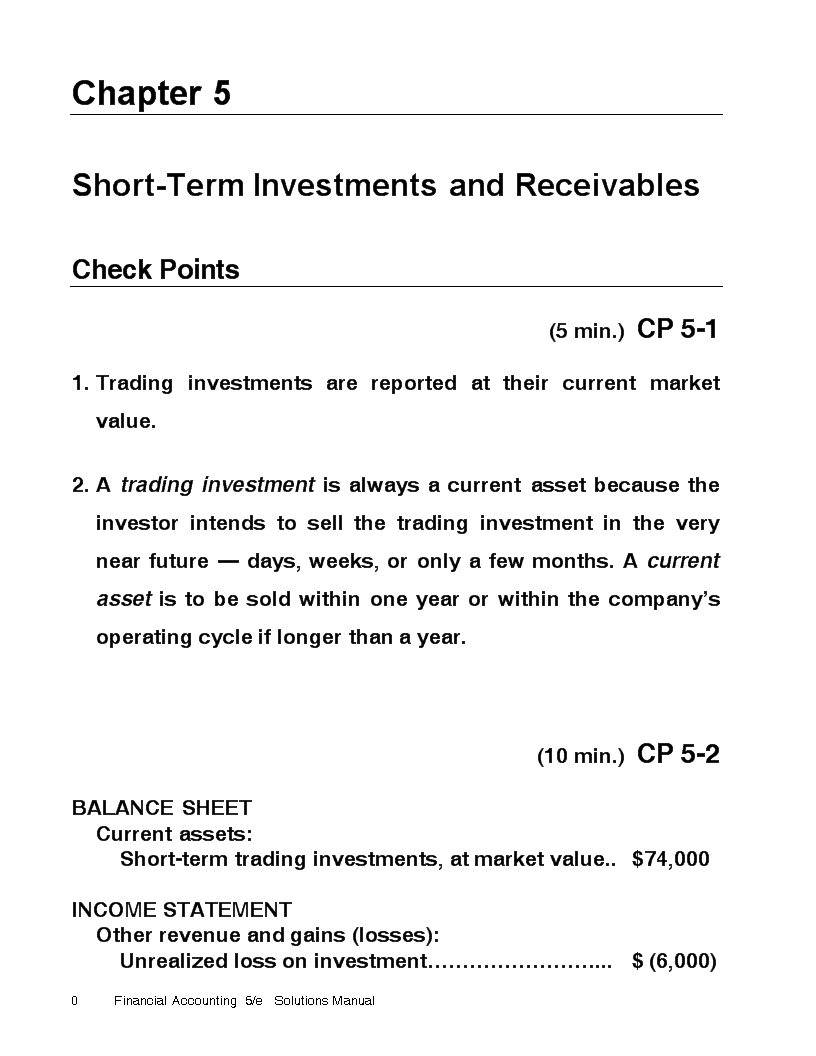

'Chapter5Short-TermInvestmentsandReceivablesCheckPoints(5min.)CP5-11.Tradinginvestmentsarereportedattheircurrentmarketvalue.2.Atradinginvestmentisalwaysacurrentassetbecausetheinvestorintendstosellthetradinginvestmentintheverynearfuture—days,weeks,oronlyafewmonths.Acurrentassetistobesoldwithinoneyearorwithinthecompany’soperatingcycleiflongerthanayear.(10min.)CP5-2BALANCESHEETCurrentassets:Short-termtradinginvestments,atmarketvalue..$74,000INCOMESTATEMENTOtherrevenueandgains(losses):Unrealizedlossoninvestment……………………...$(6,000)67Chapter5ReceivablesandShort-TermInvestments

67Chapter5ReceivablesandShort-TermInvestments

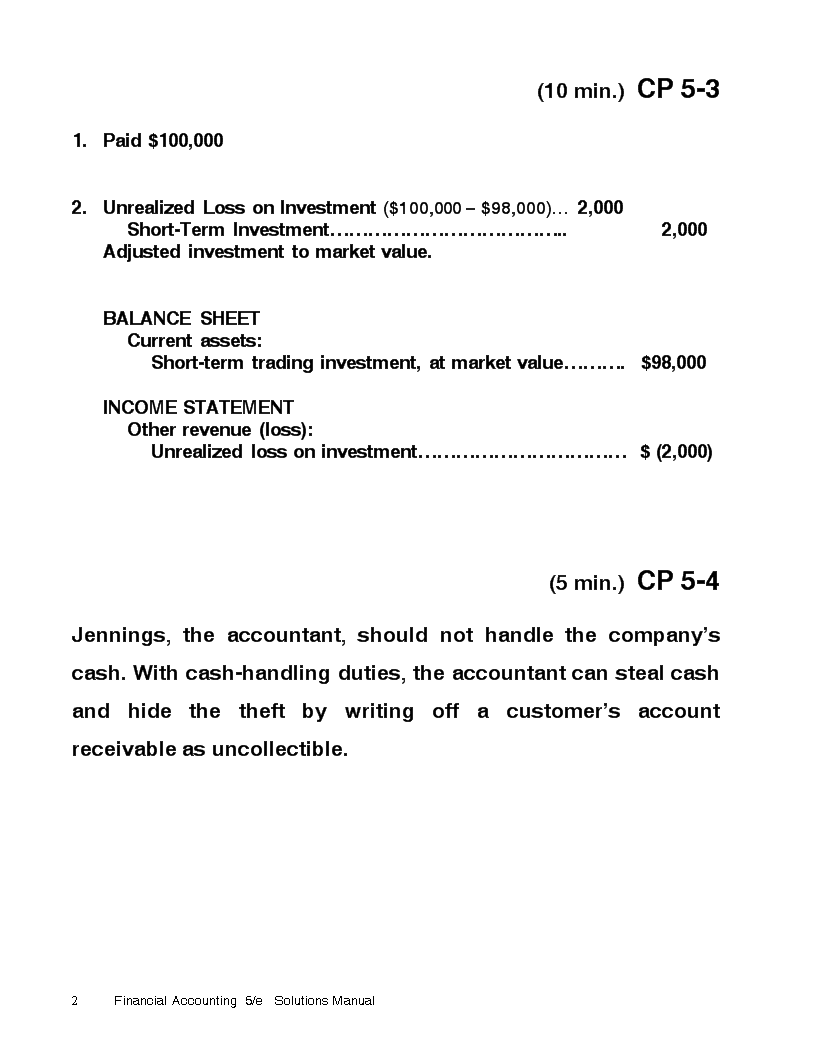

(10min.)CP5-31.Paid$100,0002.UnrealizedLossonInvestment($100,000–$98,000)…2,000Short-TermInvestment………………………………..2,000Adjustedinvestmenttomarketvalue.BALANCESHEETCurrentassets:Short-termtradinginvestment,atmarketvalue……….$98,000INCOMESTATEMENTOtherrevenue(loss):Unrealizedlossoninvestment……………………………$(2,000)(5min.)CP5-4Jennings,theaccountant,shouldnothandlethecompany’scash.Withcash-handlingduties,theaccountantcanstealcashandhidethetheftbywritingoffacustomer’saccountreceivableasuncollectible.67Chapter5ReceivablesandShort-TermInvestments

(5min.)CP5-51.Uncollectible-AccountExpense($900,000´.01)…..9,000AllowanceforUncollectibleAccounts……………9,0002.BalancesheetAccountsreceivable…………………………………$90,000LessAllowanceforuncollectibleaccounts……..(9,000)Accountsreceivable,net……………………………$81,000(5-10min.)CP5-61.AccountsReceivable………………………………….800,000SalesRevenue………………………………………800,0002.Cash………………………………………………………780,000AccountsReceivable………………………………780,0003.AllowanceforUncollectibleAccounts……………..5,000AccountsReceivable……………………………….5,0004.Uncollectible-AccountExpense($800,000´.01)…8,000AllowanceforUncollectibleAccounts………….8,00067Chapter5ReceivablesandShort-TermInvestments

(10min.)CP5-71.AccountsReceivableBeg.bal.90,000Netcreditsales800,000Collections780,000Write-offs5,000End.bal.105,000Amountcustomersowethecompany2.AllowanceforUncollectibleAccountsBeg.bal.9,000Write-offs5,000Uncollectible-accountexpense8,000End.bal.12,000AmountSpitzerexpectsnottocollect3.and4.BALANCESHEET:Accountsreceivable,net($105,000–$12,000)…………………………$93,000AmountSpitzerexpectstocollectINCOMESTATEMENT:Salesrevenue…………………………………...$800,000Uncollectible-accountexpense………………8,00067Chapter5ReceivablesandShort-TermInvestments

67Chapter5ReceivablesandShort-TermInvestments

(5-10min.)CP5-8(a)AccountsReceivable………………………..700,000SalesRevenue…………………………….700,000(b)Cash…………………………………………….720,000AccountsReceivable…………………….720,000(c)AllowanceforUncollectibleAccounts…..6,000AccountsReceivable…………………….6,000(d)Uncollectible-AccountExpense…………..7,000AllowanceforUncollectibleAccounts..7,000AllowanceforUncollectibleAccountsBeg.bal.8,000Write-offs6,000Uncollectible–accountexpenseX=7,000End.bal.9,00067Chapter5ReceivablesandShort-TermInvestments

(10min.)CP5-91.and2.AccountsReceivableBeg.bal.100,000Netcreditsales700,000Collections720,000Write-offs6,000End.bal.74,000AllowanceforUncollectibleAccountsBeg.bal.8,000Write-offs6,000Uncollectible–accountexpense7,000End.bal.9,0003.BALANCESHEETAccountsreceivable…………………………….$74,000LessAllowanceforuncollectibleaccounts…(9,000)Accountsreceivable,net……………………….$65,00067Chapter5ReceivablesandShort-TermInvestments

(5-10min.)CP5-10a.May19NoteReceivable—R.Kroll……..100,000Cash………………………………100,000b.Nov.19Cash…………………………………103,000NoteReceivable—R.Kroll…..100,000InterestRevenue($100,000´.06´6/12)………3,000(10min.)CP5-111.Interestfor:20X7($200,000´.09´8/12)……………….$12,00020X8($200,000´.09)……………………….18,00020X9($200,000´.09´4/12)……………….6,0002.TradewindsBankhasanotereceivableandinterestrevenue.MikeTobyhasanotepayableandinterestexpense.3.PayoffatNovember30,20X7:Principal………………………………………….$200,000Interest($200,000´.09´7/12)……………….10,500Total……………………………………………….$210,50067Chapter5ReceivablesandShort-TermInvestments

(10min.)CP5-1220X5a.Aug.31NoteReceivable—L.Holland……………1,000Cash………………………………….…….1,000Tolendmoney.20X6b.June30InterestReceivable($1,000´.09´10/12).75InterestRevenue………………………...75Toaccrueinterestrevenue.20X6c.Aug.31Cash($1,000+$90)………………………...1,090InterestReceivable……………………...75InterestRevenue($1,000´.09´2/12).15NoteReceivable…………………………1,000Tocollectonnotereceivable.67Chapter5ReceivablesandShort-TermInvestments

(5-10min.)CP5-13a.BALANCESHEETJune30,20X6Currentassets:Notereceivable……………………………………$1,000Interestreceivable…………………………….….75b.INCOMESTATEMENTYearendedJune30,20X6Revenues:Interestrevenue……………………………….….$75c.BALANCESHEETJune30,20X7NothingtoreportbecausethenotewascollectedonAugust31,20X6.d.INCOMESTATEMENTYearendedJune30,20X7Revenues:Interestrevenue……………………………….….$1567Chapter5ReceivablesandShort-TermInvestments

(10min.)CP5-14Req.120X6Cash+Short-terminvestments$4,000+$15,000Acid-testratio=+Netcurrentreceivables=+$73,000Totalcurrentliabilities$101,000=.91Thecompany’sacid-testratiocomparesfavorablytotheindustryaverageof.90.Req.2Oneday’ssales=$743,000=$2,036365Days’salesinaverageaccountsreceivableAveragenet=accountsreceivable=($73,000+$68,000)/2Oneday’ssales$2,036=35daysThecompany’sdays’-sales-in-receivablesratio(35)isokayrelativetothe30-dayperiodofthecreditterms.67Chapter5ReceivablesandShort-TermInvestments

(10-15min.)CP5-15IncomeStatementBalanceSheetDebitCreditDebitCredit1.ClassificationsBalanceBalanceBalanceBalanceServicerevenue………XOtherassets…………..XProperty,plant,andequipment…………..XCostofservicessold..XCash…………………….XNotespayable………...XUnearnedrevenues….XAllowancefordoubtfulaccounts...XOtherexpenses………XAccountsreceivable…XAccountspayable……XMillions2.Servicerevenue………………………………………$23,613Costofservicessold………………………………..(11,620)Otherexpenses……………………………………….(12,569)Netincome(netloss)………………………………..$(576)3.Currentratio=$239+$4,417–$389=1.48$607+$2,28567Chapter5ReceivablesandShort-TermInvestments

Exercises(10-15min.)E5-11.ThisisatradinginvestmentbecauseExxonintendstosellthestockwithinashorttime.2.Dec.20Short-TermInvestment(10,000´$60)….600,000Cash……………………………………….600,000Purchasedinvestment.Dec.31Short-TermInvestment[(10,000´$63)–$600,000]………………..30,000UnrealizedGainonInvestment………30,000Adjustedinvestmenttomarketvalue.3.BALANCESHEETCurrentassets:Short-termtradinginvestment,atmarketvalue……….$630,000INCOMESTATEMENTOtherrevenueandgains:Unrealizedgainoninvestment……………………………$30,00067Chapter5ReceivablesandShort-TermInvestments

(10-20min.)E5-2INCOMESTATEMENTOtherrevenueand(expense):Dividendrevenue………………………………………$500Unrealizedgainoninvestment($101,000–$98,000).3,000BALANCESHEETCurrentassets:Short-terminvestments,atmarketvalue………….$101,00067Chapter5ReceivablesandShort-TermInvestments

(15-30min.)E5-3Req.1CashShort-TermInvestmentDividendRevenue110,00067,00067,0002,0001,700*1,700*65,00072,000UnrealizedGain(Loss)OnInvestmentGainonSaleOfInvestment2,0007,000_____*2,000shares´$.85=$1,700Req.2December31BALANCESHEET20X320X4Currentassets:Short-terminvestments……………………$65,000$—YearEndedINCOMESTATEMENT20X320X4Otherrevenueandexpense:Dividendrevenue……………………………$1,700$—Unrealized(loss)oninvestment………….(2,000)—Gainonsaleofinvestment………………..—7,00067Chapter5ReceivablesandShort-TermInvestments

(5-10min.)E5-4MEMORANDUMDATE:TO:BobO’ReillyFROM:StudentNameRE:EssentialelementofinternalcontrolovercollectionfromcustomersSeparationofdutiesistheessentialelementinasystemtoensurethatcashreceivedbymailfromcustomersisproperlyhandledandaccountedfor.Itisveryimportanttoseparatecash-handlingdutiesfromaccountingduties.Otherwise,anemployeecanstealacashreceiptfromacustomerandcoverthetheftbywritingoffthecustomeraccountasuncollectible.Studentresponsesmayvary.67Chapter5ReceivablesandShort-TermInvestments

(15-20min.)E5-5JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X8Dec.31Year-endentry:Doubtful-AccountExpense($600,000´.01)………………………...6,000AllowanceforDoubtfulAccounts.6,000BALANCESHEETCurrentassets:Accountsreceivable,netofallowancefordoubtfulaccountsof$6,9001…………...$84,1002__________1$900+$6,000=$6,9002$91,000–$6,900=$84,10067Chapter5ReceivablesandShort-TermInvestments

(15min.)E5-6Req.1JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITOct.AccountsReceivable……………………...100,000SalesRevenue…………………………..100,000Oct.Cash…………………………………………..94,000AccountsReceivable…………………...94,000Oct.AllowanceforUncollectibleAccounts…1,700AccountsReceivable…………………...1,700Oct.Uncollectible-AccountExpense($100,000´.02)……………………………..2,000AllowanceforUncollectibleAccounts2,000Req.2AccountsReceivableAllowanceforUncollectibleAccounts28,00094,0001,600100,0001,7001,7002,00032,3001,900Netaccountsreceivable=$30,400($32,300–$1,900)Thestoreexpectstocollectanamountapproximatingthenetreceivable.Req.3BALANCESHEETCurrentassets:Accountsreceivable,netofallowanceforuncollectibleaccountsof$1,900…………………$30,40067Chapter5ReceivablesandShort-TermInvestments

(10-15min.)E5-7Req.1JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITOct.Uncollectible-AccountExpense…..1,700AccountsReceivable……………..1,700Req.2Netaccountsreceivableis$32,300,thebalanceinAccountsReceivable,computedasfollows:AccountsReceivableBeg.bal.28,000Cr.sales100,000Collections94,000Write-offs1,700End.bal.32,300Thestoredoesnotexpecttocollectthefull$32,300becausesomecreditcustomersarelikelynottopaytheiraccounts.67Chapter5ReceivablesandShort-TermInvestments

(15-30min.)E5-8Req.1ThecreditbalanceatDecember31inAllowanceforDoubtfulAccountsshouldbe$13,400.($106,000´.005)+($78,000´.015)+($70,000´.06)+($15,000´.50)=$13,400.Thecurrentbalanceis$7,400.Thus,thebalanceoftheallowanceaccountistoolow.Req.2JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITDoubtful-AccountExpense……………..6,000AllowanceforDoubtfulAccounts….6,000AllowanceforDoubtfulAccounts7,4006,00013,400Req.3BALANCESHEETCurrentassets:Cash…………………………………………..$XXShort-terminvestments…………………...XXAccountsreceivable,netofallowancefordoubtfulaccountsof$13,400……..255,600*_____*AnotherwaytoreportaccountsreceivableisAccountsreceivable……………………….$269,000LessAllowancefordoubtfulaccounts…(13,400)255,60067Chapter5ReceivablesandShort-TermInvestments

67Chapter5ReceivablesandShort-TermInvestments

(15-20min.)E5-9Req.12%isreasonablebecauseforeachyear’ssalesandfortheentirethree-yearperiod,theratiooftotalwrite-offstosalesisverycloseto2%.(Dollarsinthousands)20X420X520X6TotalWriteoffs=$139$138$144$421Sales$6,800$7,000$7,100$20,900=.0204=.0197=.0203=.0201Req.2Thousands20X6AccountsReceivable……………………7,100SalesRevenue………………………...7,100Recordedsalesonaccount.20X6Bad-DebtExpense($7,100´.02)……...142AllowanceforBadDebts……………142Recordedexpensefortheyear.20X6AllowanceforBadDebts……………….144AccountsReceivable………………...144Wroteoffuncollectiblereceivables.67Chapter5ReceivablesandShort-TermInvestments

(10-15min.)E5-10JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITNov.1NoteReceivable—AlSperry…………40,000Cash…………………………………….40,000Dec.3NoteReceivable—Acura,Inc………..5,000ServiceRevenue……………………..5,00016NoteReceivable—VanguardCo…….2,000AccountsReceivable—VanguardCo.2,00031InterestReceivable……………………..656*InterestRevenue……………………..656_____($40,000´.09´2/12)+($5,000´.12´28/365)+($2,000´.12´15/365**)=$645$600$46$10**Fractioncanalsobestatedas.5/12Harrisonearnedinterestrevenueof$656thisyear.67Chapter5ReceivablesandShort-TermInvestments

(15min.)E5-1120X820X9BALANCESHEETCurrentassets:Notereceivable…………………………….…$100,000$—Interestreceivable($100,000´.08´9/12).6,000—INCOMESTATEMENTInterestrevenue…………………………………6,0002,000*_____*$100,000´.08´3/12=$2,00067Chapter5ReceivablesandShort-TermInvestments

(10min.)E5-121.StocktonBankhasinterestreceivableandinterestrevenue.CaliforniaCompanyhasinterestpayableandinterestexpense.Interestforonemonth($100,000´.06´1/12)………$5002.StocktonBank:Assets=Liabilities+EquityAffectedBy0InterestrevenueCaliforniaCompany:0Interestexpense3.True4.Thenetamountofreceivables—theamountthecompanyexpectstocollect—ismoreinterestingbecausethecompanywillprobablycollectthisamountincash.5.Accountsreceivable…………………….$XXXLessAllowanceforuncollectibles……(X)Accountsreceivable,net……………….$XXBALANCESHEETCurrentassets:CashShort-terminvestmentsAccountsreceivable,net6.False.Thedirectwrite-offmethodoverstatesassetsbecauseitfailstoshowtheamountofthereceivablesthecompanyexpectstocollect.67Chapter5ReceivablesandShort-TermInvestments

(10-15min.)E5-13AmountsinmillionsofdollarsShort-termNetcurrent(a)Acid-test=Cash+investments+receivablesratioTotalcurrentliabilities=$137+$30+$37$40+$158=$204$198=1.03Anacid-testratioof1.03isnormal.(b)OneSalesandday"s=servicerevenue=$415=$1.137sales365365Days’salesAveragenetinaverage=accountsreceivable=($37+$42)/2receivablesOneday’ssales$1.137=35days35days’salesinaveragereceivablesisokayrelativetocredittermsofnet30days.67Chapter5ReceivablesandShort-TermInvestments

(10-15min.)E5-14Req.1Averagecollectionperiod:MillionsofdollarsOneday’ssales=$256,329=$702.3365Days’salesinaveragereceivables=($1,254+$1,569)/2=2days(averagecollectionperiod)$702.3Req.2Wal-Mart’scollectionperiodisshortbecauseWal-Martsellsforcashandoncreditcardsandbankcards.Receivablesareverylow.67Chapter5ReceivablesandShort-TermInvestments

(15-20min.)E5-15ActualwithoutBankCardsExpectedwithBankCardsSalesrevenue……………………...$400,000$440,000*Costofgoodssold……………….$210,000$231,000**Uncollectible-accountexpense…6,000—Bank-carddiscountexpense……4,800***Otherexpenses……………………68,00066,000****Totalexpenses…………………….284,000301,800Netincome………………………….$116,000$138,200Decision:Acceptbankcardsbecauseoftheexpectedincreaseinnetincome._____*$400,000´1.10=$440,000**$210,000´1.10=$231,000***$440,000–$200,000=$240,000´.02=$4,800Theswitchtobankcardsshouldproducebankcarddiscountexpenseononlytheportionofsalesthataremadeonbankcards.****$68,000–$2,000=$66,00067Chapter5ReceivablesandShort-TermInvestments

(15-20min.)E5-16AnalysisofT-accountsishelpful,asfollows(inmillions):AllowancesBeg.bal.68(a)Write-offs351Expense354End.bal.71(b)Totalrevenue=$35,400($354).01)TradeReceivablesBeg.bal.($2,269+$68)2,337Totalrevenue35,400Write-offs351Collections34,729(c)End.bal.($2,586+$71)2,65767Chapter5ReceivablesandShort-TermInvestments

(10-15min.)E5-17ReceivablesBeg.bal.80,000Salesonaccount950,000CollectionsmustbeX=$940,000Maximumacceptablebal.90,000Collections=$940,000=$940,000=.91Beg.bal.+Salesonaccount$80,000+$950,000$1,030,000Therefore,thepercentagediscountthatColumbiashouldbewillingtoabsorbis9%(100%–91%).67Chapter5ReceivablesandShort-TermInvestments

PracticeQuiz1.c2.d3.c4.b[($150,000´.02)+($60,000´.08)+($10,000´.20)–$3,200=$6,600]5.$210,200($220,000–$9,800)6.a($1,000,000´.03=$30,000)7.b($2,000+$30,000=$32,000)8.$7,000($2,000+$30,000–$25,000=$7,000)9.c($6,000´.07´5/12=$175)10.d11.b($6,000´.07´8/12=$280)12.d13.Cash………………………….NoteReceivable………...InterestReceivable……..InterestRevenue………..6,2806,00017510514.d15.a[($90,000+$110,000)/2])($730,000/365days)=50days16.a67Chapter5ReceivablesandShort-TermInvestments

ProblemsGroupA(20-30min.)P5-1AReqs.1and2CashShort-TermInvestment400,00025,500*25,500*900**5,500+31,000DividendRevenueUnrealizedGain(Loss)onInvestment900**5,500+_____*2,000´$12.75=$25,500**2,000´$.45=$900+$31,000–$25,500=$5,50067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-1AReq.2JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X4Dec.2Short-TermInvestment………………..25,500Cash(2,000´$12.75)………………..25,500Purchasedinvestment.21Cash(2,000´$0.45)……………………900DividendRevenue…………………..900Receivedcashdividend.31Short-TermInvestment($31,000–$25,500)……………………..5,500UnrealizedGain(Loss)onInvestment5,500Adjustedinvestmenttomarketvalue.Req.3BALANCESHEETCurrentassets:Short-terminvestment,atmarketvalue………$31,000Req.4INCOMESTATEMENTOtherrevenueandgain:Dividendrevenue……………………………………$900Unrealizedgainoninvestment……………………5,50067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-1AReq.5JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X5Jan.9Cash……………………………………….29,000LossonSaleofInvestment…………..2,000Short-TermInvestment……………..31,000Soldinvestmentataloss.67Chapter5ReceivablesandShort-TermInvestments

(10-15min.)P5-2AMEMORANDUMDATE: _________________TO:CompanyEmployeesFROM:AkbarKuwaja,PresidentRE:Procedurestoensurethatallcashreceiptsaredepositedinthebankandthateachday’stotalcashreceiptsarepostedtoaccountsreceivable.1.Someoneotherthantheaccountantopensthemail.Thispersonseparatescustomerchecksfromtheaccompanyingremittanceslips.2.Anemployeewithnoaccesstotheaccountingrecordsdepositsthecashinthebankimmediately.3.Theremittanceslipsgototheaccountant,whousesthemforpostingcreditstothecustomeraccounts.Theaccountantaddsupthetotalofthecreditsfortheday.4.Athirdperson,suchasthemanagerorthepresident,comparestheamountofthebankdeposittothetotalofthecustomercreditspostedbytheaccountant.Thisgivessomeassurancethattheday’scashreceiptswentintothebankandthatthesameamountwaspostedtocustomeraccounts.5.Someoneotherthantheaccountantshouldpreparethebankreconciliation.67Chapter5ReceivablesandShort-TermInvestments

Studentresponsesmayvary.67Chapter5ReceivablesandShort-TermInvestments

(15-20min.)P5-3A(Allamountsinmillions)Reqs.1,3,and4AccountsReceivableAllowanceforUncollectibles4437,316587,703269*269*30856197ThesebalancesagreewiththeactualAOLamounts._____*Mustsolveforwriteoffs,$269,throughtheAllowanceaccount.Req.2JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITa.AccountsReceivable……………….7,703ServiceRevenue………………….7,703b.Cash……………………………………7,316AccountsReceivable…………….7,316c.Uncollectible-AccountExpense….308AllowanceforUncollectibles($7,703´.04)………………………308d.AllowanceforUncollectibles……...269*AccountsReceivable…………….269*67Chapter5ReceivablesandShort-TermInvestments

(continued)P5-3AReq.5CustomersowedAOL$561.AOLexpectedtocollect$464($561–$97).Req.6INCOMESTATEMENTServicerevenue……………………….$7,703Uncollectible-accountexpense…….30867Chapter5ReceivablesandShort-TermInvestments

(25-35min.)P5-4AReq.1JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITNov.22AllowanceforDoubtfulAccounts………4,100AccountsReceivable—MonetCorp..1,300AccountsReceivable—Blocker,Inc..2,100AccountsReceivable—MStreetPlaza700Dec.31Doubtful-AccountExpense………………7,800AllowanceforDoubtfulAccounts……7,800*_____*Computation:RequiredcreditbalanceinAllowanceforDoubtfulAccountsbasedonagingofAccountsReceivable($160,000´.005)+($80,000´.01)+($34,000´.05)+($15,000´.50)……………………..$10,800CreditbalanceinAllowanceforDoubtfulAccountsbeforetheDecember31entry—(seetheT-acccountintheanswertoReq.2;$7,100–$4,100)………………………………………..3,000CreditentryneededtoproducetherequiredcreditbalanceinAllowanceforDoubtfulAccounts…….$7,80067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-4AReq.2AllowanceforDoubtfulAccountsNov.22Write-offs4,100Sept.30Balance7,100Dec.31Adjusting7,800Dec.31Balance10,800Req.3DodgeRamAutoSupplyComparativeBalanceSheetDecember31,20X8andDecember31,20X720X820X7Accountsreceivable………………………$289,000$271,000Less:Allowancefordoubtfulaccounts.(10,800)(8,700)Accountsreceivable,net…………………$278,200$262,30067Chapter5ReceivablesandShort-TermInvestments

(20-25min.)P5-5AReq.1Cash($18,000–$8,000)……………………..$10,000Short-termtradinginvestments,atmarketvalue…………………………….22,000Accountsreceivable…………………………$49,000Less:Allowanceforuncollectibles…….(4,000)45,000Inventory……………………………………….54,000Prepaidexpenses…………………………….5,000Totalcurrentassets……………………….$136,000Totalcurrentliabilities……………………$145,000Req.2AsreportedCorrectedCurrent=$202,000=1.39$136,000=0.94ratio$145,000$145,000($18,000+$34,000Acid-test=+$49,000+$42,000)=0.99$10,000+$22,000+$45,000=0.53ratio$145,000$145,00067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-5AReq.3Netincome,asreported…………………..$65,000–Unrealizedlossontradinginvestments($34,000–$22,000)……………………...(12,000)–Correctionforconversiontotheallowancemethod—Uncollectible-accountexpenseshouldbe($400,000´.03)……….…$12,000Uncollectible-accountexpensebythedirectwrite-offmethod…………7,000(5,000)Netincome,corrected…………………….$48,000Req.4KPMG’ssuggestionsmakeBzenskylookmuchlesssuccessful,decreasingthecurrentratio,theacid-testratio,andnetincome.67Chapter5ReceivablesandShort-TermInvestments

(20-30min.)P5-6AReq.1JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X4Nov.30NoteReceivable—KellyMoorePaintCo…..60,000SalesRevenue………………………………..60,000Dec.31InterestReceivable($60,000´.10´1/12)…...500InterestRevenue……………………………..50020X5Feb.18NoteReceivable—AltexCo…………………..5,000AccountsReceivable—AltexCo…………5,000Feb.20Cash………………………………………………..4,600FinancingExpense………………………………400NoteReceivable—AltexCo……………….5,000Feb.28Cash………………………………………………..61,500NoteReceivable—KellyMoorePaintCo..60,000InterestReceivable…………………………..500InterestRevenue($60,000´.10´2/12)…..1,00067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-6AJournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X5Nov.11NoteReceivable—Consolidated,Inc...50,000Cash……………………………………...50,000Dec.31InterestReceivable……………………….616InterestRevenue($50,000´.09´50/365)616Req.2December31BALANCESHEET20X520X4Currentassets:Notereceivable…………………………$50,000$60,000Interestreceivable……………………...61650067Chapter5ReceivablesandShort-TermInvestments

(30-40min.)P5-7AReq.1Dollaramountsinmillions20X620X5a.Current=Totalcurrentassets=$766=1.42$695=1.56ratioTotalcurrentliabilities$540$446Cash+Short-terminvestmentsb.Acid-testratio=+Netcurrentreceivables=$27+$93+$206$26+$101+$154Totalcurrentliabilities$540$446=.60=.63c.Oneday’ssales=Netsales=$2,671=$7.32$2,505=$6.86365365365Days’salesinaveragereceivables=Averagenetreceivables=($206+$154)/2($154+$127)/2Oneday’ssales$7.32$6.86=25days=20days67Chapter5ReceivablesandShort-TermInvestments

(continued)P5-7AReq.2MEMORANDUMDATE:_________________TO:TopmanagementofCrain’sStationeryCompanyFROM:StudentNameRE:Changesinratiovaluesfrom20X5to20X6Thecurrentratiodeterioratedfrom1.56to1.42.Theacid-testratiodroppedfrom.63to.60,anddays’salesinreceivablesroseto25days.Allthreeratiovaluesdeterioratedduringthecurrentyear.Thisisanunfavorabletrendbecauseitindicatesthatthecompanymayfinditmoredifficulttocollectitsreceivablesandpayitsbills.Studentresponsesmayvary.67Chapter5ReceivablesandShort-TermInvestments

ProblemsGroupB(20-30min.)P5-1BReqs.1and2CashShort-TermInvestment400,00046,250*46,250*9,250+1,600**37,000DividendRevenueUnrealizedGain(Loss)onInvestment1,600**9,250+_____*5,000´$9.25=$46,250**5,000´$.32=$1,600+$46,250–(5,000´$7.40)=$9,25067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-1BReq.2JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X8Nov.3Short-TermInvestment…………………46,250Cash(5,000´$9.25)………………….46,250Purchasedinvestment.14Cash(5,000´$0.32)……………………..1,600DividendRevenue…………………….1,600Receivedcashdividend.Dec.31UnrealizedGain(Loss)onInvestment.9,250Short-TermInvestment[$46,250–(5,000´$7.40)].…………..9,250Adjustedinvestmenttomarketvalue.Req.3BALANCESHEETCurrentassets:Short-terminvestment,atmarketvalue(5,000´$7.40)……………………………………..$37,000Req.4INCOMESTATEMENTOtherrevenueand(loss):Dividendrevenue……………………………………$1,600Unrealized(loss)oninvestment………………….(9,250)67Chapter5ReceivablesandShort-TermInvestments

(continued)P5-1BReq.5JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X9Jan.6Cash……………………………………….39,000Short-TermInvestment……………..37,000GainonSaleofInvestment………..2,000Soldinvestmentatagain.67Chapter5ReceivablesandShort-TermInvestments

(10-15min.)P5-2BMEMORANDUMDATE: _________________TO:ManagementofTonytheTiger,Inc.FROM:StudentNameRE:EvaluationofinternalcontrolovercashreceiptsfromcustomersByopeningthemail,theaccountanthasdirectaccesstocash.Thiscreatesaninternalcontrolweaknessbecausetheaccountantalsopostscreditstocustomeraccounts.Shecanstealacashreceiptfromacustomerandwriteoffthecustomeraccountasuncollectible.Thetheftishardtodetectbecausethecustomer’saccountgetszeroedout,andthecompanydoesnotpursuecollection.Tocorrectthisinternalcontrolweakness,theaccountantshouldbedeniedaccesstocash.Someoneelseintheorganizationshouldopenthemailandseparatecashreceiptsfromtheaccompanyingremittanceslips.Thecashshouldbedepositedinthebankimmediately,andonlytheremittanceslipsshouldgototheaccountant.Studentresponsesmayvary.67Chapter5ReceivablesandShort-TermInvestments

67Chapter5ReceivablesandShort-TermInvestments

(15-20min.)P5-3B(Allamountsinmillions)Reqs.1,3,and4AccountsReceivableAllowanceforUncollectibles1,6359,343659,48988*88*951,69372ThesebalancesagreewiththeactualNikeamounts._____*Mustsolveforwrite-offs,$88,throughtheAllowanceaccount.Req.2JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITa.AccountsReceivable………………9,489SalesRevenue……………………9,489b.Cash…………………………………..9,343AccountsReceivable……………9,343c.Uncollectible-AccountExpense…95AllowanceforUncollectibles($9,489´.01)……………………...95d.AllowanceforUncollectibles……..88*AccountsReceivable……………88*67Chapter5ReceivablesandShort-TermInvestments

(continued)P5-3BReq.5CustomersowedNike$1,693.Nikeexpectedtocollect$1,621($1,693–$72).Req.6INCOMESTATEMENTSalesrevenue………………………….$9,489Uncollectible-accountexpense…….9567Chapter5ReceivablesandShort-TermInvestments

(25-35min.)P5-4BReq.1JournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDITNov.18AllowanceforDoubtfulAccounts………1,100AccountsReceivable—BlissCo.…..700AccountsReceivable—MicroData...400Dec.31Doubtful-AccountExpense……………...1,600AllowanceforDoubtfulAccounts…...1,600*_____*Computation:RequiredcreditbalanceinAllowanceforDoubtfulAccountsbasedonagingofAccountsReceivable($100,000´.001)+($40,000´.005)+($14,000´.05)+($9,000´.30)………………………$3,700CreditbalanceinAllowanceforDoubtfulAccountsbeforetheDecember31adjustingentry—(seetheT-acccountintheanswertoReq.2;$3,200–$1,100)………………………………………..2,100CreditentryneededtoproducetherequiredcreditbalanceinAllowanceforDoubtfulAccounts…….$1,60067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-4BReq.2AllowanceforDoubtfulAccountsNov.18Write-offs1,100Sept.30Balance3,200Dec.31Adjusting1,600Dec.31Balance3,700Req.3PrecisionToolCompanyComparativeBalanceSheetDecember31,20X4andDecember31,20X320X420X3Accountsreceivable……………………...$163,000$112,000Less:Allowancefordoubtfulaccounts.(3,700)(2,200)Accountsreceivable,net…………………$159,300$109,80067Chapter5ReceivablesandShort-TermInvestments

(20-25min.)P5-5BReq.1Cash($21,000–$10,000)……………………$11,000Short-termtradinginvestments,atmarketvalue…………………………….7,000Accountsreceivable…………………………$37,000Less:Allowanceforuncollectibles…….(9,000)28,000Inventory……………………………………….61,000Prepaidexpenses…………………………….14,000Totalcurrentassets……………………….$121,000Totalcurrentliabilities……………………$103,000Req.2AsreportedCorrectedCurrent=$202,000=1.96$121,000=1.17ratio$103,000$103,000($21,000+$19,000Acid-test=+$37,000+$50,000)=1.23$11,000+$7,000+$28,000=0.45ratio$103,000$103,00067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-5BReq.3Netincome,asreported…………………..$72,000–Unrealizedlossontradinginvestments($19,000–$7,000)……………………….(12,000)–Correctionforconversiontotheallowancemethod—Uncollectible-accountexpenseshouldbe($600,000´.025)………...$15,000Uncollectible-accountexpensebythedirectwrite-offmethod…………6,000(9,000)Netincome,corrected…………………….$51,000Req.4PWC’ssuggestionsmakeCiliotta,Inc.,lookmuchlesssuccessful.Thecorrectionsdecreasedthecompany’scurrentratio,acid-testratio,andnetincome.67Chapter5ReceivablesandShort-TermInvestments

(20-30min.)P5-6BJournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X5Oct.31NoteReceivable—Kroger,Inc.………..30,000SalesRevenue………………………….30,000Dec.31InterestReceivable($30,000´.06´2/12)……………………..300InterestRevenue……………………….30020X6Jan.31Cash…………………………………………30,450NoteReceivable—Kroger,Inc……..30,000InterestReceivable……………………300InterestRevenue($30,000´.06´1/12)……………….150Mar.31NoteReceivable—BlissCo.…………...4,000AccountsReceivable—BlissCo…..4,000Mar.31Cash…………………………………………3,800FinancingExpense……………………….200NoteReceivable—BlissCo…………4,00067Chapter5ReceivablesandShort-TermInvestments

(continued)P5-6BJournalDATEACCOUNTTITLESANDEXPLANATIONDEBITCREDIT20X6Nov.16NoteReceivable—McNeil,Inc…………..45,000Cash……………………………………….45,000Dec.31InterestReceivable………………………...666InterestRevenue($45,000´.12´45/365)666Req.2December31,BALANCESHEET20X620X5Currentassets:Notereceivable…………………………$45,000$30,000Interestreceivable……………………...66630067Chapter5ReceivablesandShort-TermInvestments

(15-25min.)P5-7BReq.1Dollaramountsinmillions20X620X5a.Current=Totalcurrentassets=$813=1.35$887=1.68ratioTotalcurrentliabilities$603$528Cash+Short-terminvestmentsb.Acid-testratio=+Netcurrentreceivables=$36+$140+$297$80+$154+$285Totalcurrentliabilities$603$528=0.78=0.98c.Oneday’ssales=Netsales=$4,989=$13.67$5,295=$14.51365365365Days’salesinaveragereceivables=Averagenetreceivables=($297+$285)/2($285+$178)/2Oneday’ssales$13.67$14.51=21days=16days67Chapter5ReceivablesandShort-TermInvestments

(continued)P5-7BReq.2MEMORANDUMDATE:_________________TO:TopmanagementofBraswell-DavisOrganicGardeningSupplyCo.FROM:StudentNameRE:Changesinratiovaluesfrom20X5to20X6Thecurrentratiodeterioratedfrom1.68to1.35.Theacid-testratiodecreasedfrom0.98to0.78.Days’salesinreceivablesrosefrom16daysto21days.Allthreeratiovaluesdeterioratedduringthecurrentyear.Thisisanunfavorabletrendbecauseitindicatesthatthecompanymayfinditmoredifficulttocollectitsreceivablesandpayitsbills.Studentresponsesmayvary.67Chapter5ReceivablesandShort-TermInvestments

DecisionCases(15-20min.)DecisionCase1(Dollarsinthousands)20X720X6Days’salesinreceivables=($435*+$356*)/2($356*+$345*)/2$1,475/365days$1,589/365days=98days=81days_____*NetaccountsreceivableDays’salesinreceivablesincreaseddramaticallyduring20X7.Cashcollectionsfromcustomersfor20X7and20X6:20X720X6Beginningnetaccountsreceivable$356$345+Salesrevenue1,4751,589–Endingnetaccountsreceivable(435)(356)=Estimatedcashcollections$1,396$1,578Collectionsfromcustomersdroppedduring20X7.Basedonthefallingtrendofsalesandcollectionsfromcustomers,andthedramaticincreaseindays’salesinreceivables,wewouldnotlend$1milliontoTriadSalesCompany.67Chapter5ReceivablesandShort-TermInvestments

(20-25min.)DecisionCase2ProvidenceMedicalClinicSummaryIncomeStatementYearEndedDecember31,20X6Servicerevenue………………………………$1,100,000Totalexpenses,excludingbaddebts…….870,000Bad-debtexpense($1,100,000´.08)……..88,000Netincome…………………………………….$142,000Conclusion:Theclinicwasprofitableduring20X6.Computation:AccountsReceivable20X5Revenue800,00020X5Collections600,00020X5Write-offs30,000Dec.31,20X5Balance170,00020X6REVENUES1,100,00020X6Collections950,00020X6Write-offs60,000Dec.31,20X6Balance260,00067Chapter5ReceivablesandShort-TermInvestments

(30-40min.)DecisionCase3Req.1Nature’sBestHealthFoodsIncomeStatementYearsEndedDecember31,20X520X4Revenues:Salesrevenue………………..$180,000$170,000Interestrevenue……………..40,00020,000Totalrevenue……………..220,000190,000Expenses:Doubtful-accountexpense9,0008,500Otherexpense……………….128,000113,000Totalexpense……………..137,000121,500Netincome………………………$83,000$68,500_____Computations:Interestrevenue:20X5:$400,000´.10=$40,00020X4:200,000´.10=20,000Salesrevenue:20X5:$220,000–$40,000=$180,00020X4:190,000–20,000=170,000Doubtful-accountexpense:20X5:$180,000´.05=$9,00020X4:170,000´.05=8,500Otherexpense:20X5:$130,000–$2,000=$128,00020X4:115,000–2,000=113,00067Chapter5ReceivablesandShort-TermInvestments

(continued)DecisionCase3Req.2Nature’sBest’sfuturedoesnotlookaspromisingasEarley’sincomestatementmakesitappear.Salesrevenueincreasedbyonly$10,000from20X4to20X5.Earley’sincomestatementconcealsthatfactbyreportingonlytotalrevenues.Thereasonfortheincreaseinnetincomeduring20X5istheincreaseininterestrevenue,butthatincreaseresultsfromsalesthatweremadein20X4,notfromsalesmadein20X5.Also,netincomeisnotashighasreportedbyEarleybecausedoubtful-accountexpensewasunderstatedontheincomestatementheprovided.67Chapter5ReceivablesandShort-TermInvestments

EthicalIssueLaVegaCreditCompany’spracticeofsmoothingincomeisunethicalbecausetheownerdeliberatelyunderestimatesUncollectible-AccountExpenseinsomeperiodsandoverstatestheexpenseinotherperiods.Herpurposeistomanipulateincome.Instead,Cranstonshouldbeusingaccountinginformationtorepresentthebusinesstruthfullytoherbanklender.WecanbesurethebankexpectstruthfulfinancialstatementsfromLaVegaCreditCompany.Cranston’sreasoningisfaulty.Theincomeoverstatementsmayoffsettheincomeunderstatementsinsomeperiods,butthereisnoguaranteethatthiswillalwaysoccur.Theaccountingliteratureisfullofinstanceswheremisstatementsofincomehavedulledpeople’sperceptionofthetruthandresultedintragiclossesofresourcesandreputations.AnarticleinTheWallStreetJournalconcludedwiththisstatement,“Thedangerwithspinartistryinaccountingisthatthespinnermaybelievethespin.”67Chapter5ReceivablesandShort-TermInvestments

FocusonFinancials:YUM!Brands(30-40min.)Req.1MillionsCashreceivedfromsaleofinvestments(fromstatementofcashflows)……………………..$13Costofinvestmentssold($27–$15;frombalancesheet)…………………………………..12Gainonsaleofinvestments…………………………...$1Req.220032004(1)Accountsandnotesreceivable,net(frombalancesheet)……………………..$169$168(2)Allowance………………………………………….2842(3)Accountsandnotesreceivable—customers owedYUMthisamount………………………$197$210YUMexpectedtocollectaccountsandnotesreceivable,net…………………………$169$168Req.3AccountsandNotesReceivableBeg.bal.210Totalrevenue8,380Write-offs14CollectionsX=8,379End.bal.19767Chapter5ReceivablesandShort-TermInvestments

FocusonAnalysis:Pier1Imports(20min.)Req.1ThousandsCustomersowedPier1($14,226+$111)…………….$14,337Pier1expectedtocollect……………………………….14,226Pier1expectednottocollect………………………….111Req.2Otheraccountsreceivableattheendof2004wereofhigherqualitythanattheendof2003becausetheallowanceisasmallerpercentageofaccountsreceivable,asshownhere:20042003Allowancefordoubtfulaccounts…………$111$236Grossotheraccountsreceivable…………14,337*11,656**%doubtful…………………………………….0.77%***2.0%***_____*$14,226+$111=$14,337**$11,420+$236=$11,656***WhencomputedonOtheraccountsreceivable,net,thesepercentagesare0.78%attheendof2004and2.1%attheendof2003.Req.3Wewouldpredictthatdoubtful-accountexpensedecreasedin2004becausetheallowancefordoubtfulaccountsdecreasedduring2004whileaccountsreceivablewereincreasing.67Chapter5ReceivablesandShort-TermInvestments'

您可能关注的文档

- 西安交通大学17年3月课程考试《普通物理》作业考核试题及答案.doc

- 西政 中国法制史课后习题参考答案.doc

- 西政_中国法制史课后习题参考答案.doc

- 西方哲学智慧课后习题.docx

- 西方经济学(宏观部分)习题及参考答案.doc

- 西方经济学--习题答案修订(陈喜强版).pdf

- 西方经济学习题解答[[适用教材——尹伯成主编:《西方经济学简明教程》].pdf

- 西方经济学简明教程第七版习题答案.doc

- 西方经济学课后题答案.doc

- 西电《移动通信》第四版 李建东 郭梯云 习题答案.doc

- 观测保障5-《气象仪器与观测方法指南(第六版)》练习题答案-尤竞飞.doc

- 解析几何,吕林根,课后习题解答一到五.doc

- 计算方法习题集及答案.doc

- 计算方法的课后答案.doc

- 计算机二级《笔试宝典》习题答案与详解.doc

- 计算机图形学基础(第2版)课后习题答案 陆枫 何云峰.doc

- 计算机图形学答案.doc

- 计算机图形学课后题答案(第二版)--许长青、许志闻.pdf

相关文档

- 施工规范CECS140-2002给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程

- 施工规范CECS141-2002给水排水工程埋地钢管管道结构设计规程

- 施工规范CECS142-2002给水排水工程埋地铸铁管管道结构设计规程

- 施工规范CECS143-2002给水排水工程埋地预制混凝土圆形管管道结构设计规程

- 施工规范CECS145-2002给水排水工程埋地矩形管管道结构设计规程

- 施工规范CECS190-2005给水排水工程埋地玻璃纤维增强塑料夹砂管管道结构设计规程

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程(含条文说明)

- cecs 141:2002 给水排水工程埋地钢管管道结构设计规程 条文说明

- cecs 140:2002 给水排水工程埋地管芯缠丝预应力混凝土管和预应力钢筒混凝土管管道结构设计规程 条文说明

- cecs 142:2002 给水排水工程埋地铸铁管管道结构设计规程 条文说明